Ready to learn more?

Explore More

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Factor investing offers an intelligent, transparent, and rules-based alternative to both indexing and active management.

If you’re working with a financial advisor to build your financial plan, you know where you currently stand and where it is you want to go. Your financial plan is the roadmap for how to get there. The final remaining piece of the puzzle, how best to invest your savings, is a critical one. Your portfolio is the engine that will drive your financial plan.

Get it wrong and you could find yourself wildly off course, perhaps with your destination permanently out of reach. Get it right, and you arrive at your destination on time. So, what’s the best way to put your hard-earned savings to work? Mercer Advisors believes it is factor investing, a strategy we implement for our clients.

Factor investing offers a smart, transparent, and rules-based alternative to both indexing and active management. Borrowing from indexing and active management, factor investing takes a structured, process-driven approach to investing – embracing broad diversification and the theory of market efficiency.

Active management is best defined as an investment approach that relies on the use of a human element, typically a single manager or a team of managers, to actively manage a portfolio with the objective of outperforming a broad market index such as the S&P 500 Index. Active managers rely on in-house analytical research, forecasts, and their own judgment and experience in making investment decisions on what securities to buy, hold, and sell – and in what weights. Active managers believe markets are “inefficient” and that it’s possible to outperform the broad market by identifying and investing in mispriced stocks, bonds, and other securities. The opposite of active management is commonly referred to as “passive management” or “indexing.”

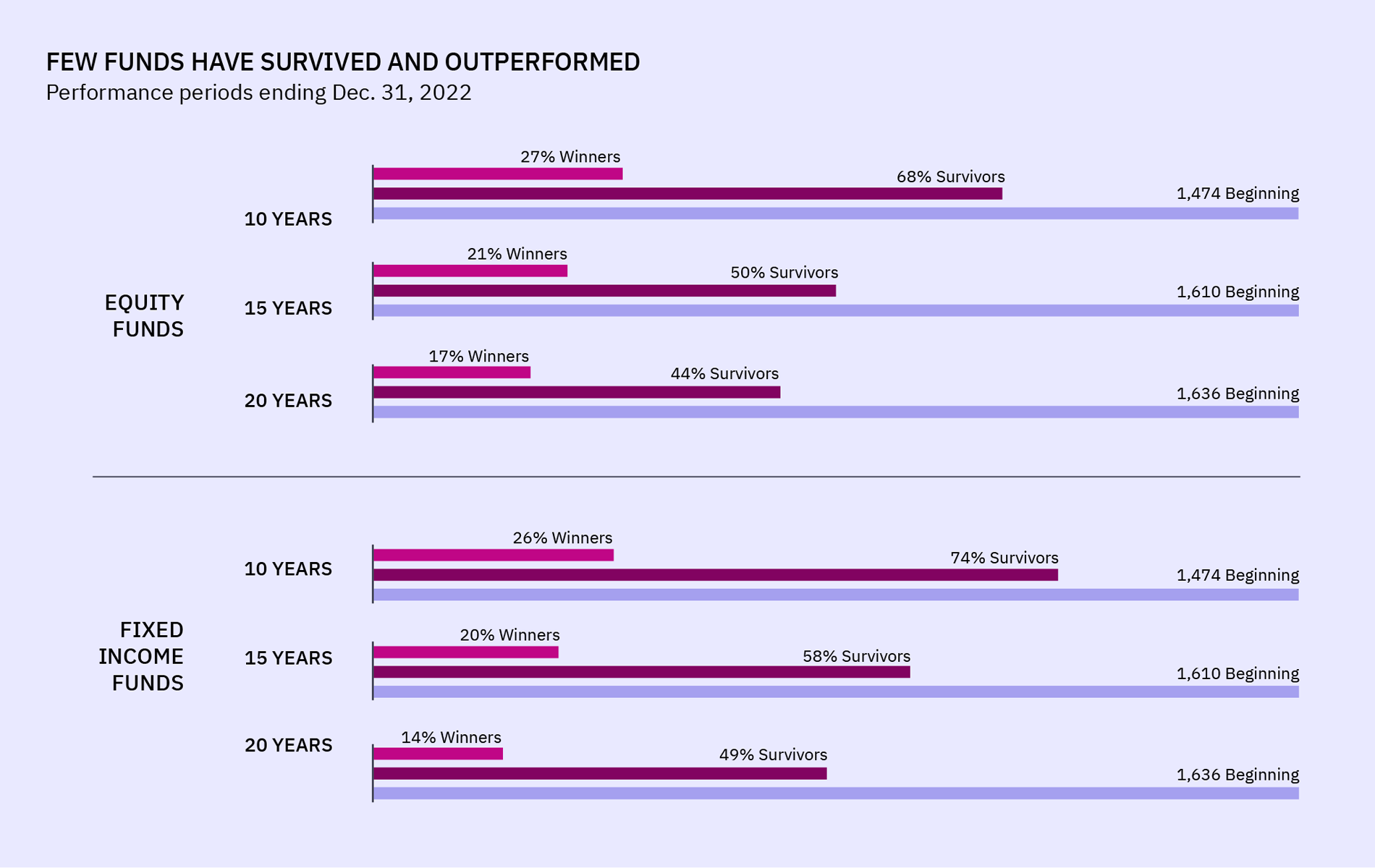

There is a certain romantic appeal to the notion that a financial guru can, against the odds, outperform the broad market through hard work, raw talent, or superior intellect. We see such outperformance in other areas of human endeavor, such as sports or standardized testing, where gifted individuals rise to the top to outperform their peers. However, outperformance in these areas doesn’t translate to financial markets where, in fact, many decades of real-world data conclusively show that nearly all active managers underperform a simple market index. Consider the below data that details mutual fund outperformance over the 20-year period ending Dec. 31, 2022.

The probability of an actively managed mutual fund surviving longer than 20 years is below 50%. Further, the odds of an actively managed fund outperforming its index are exceptionally low (17% for equity managers and 14% for bond managers).

1 Index Data Sources: Index data provided by Bloomberg, MSCI, Russell, FTSE Fixed Income LLC, and S&P Dow Jones Indices LLC. Bloomberg data provided by Bloomberg.

It’s precisely because of the poor results posted by active managers that indexing has become such a powerful force in investing. Firms such as Vanguard have grown tremendously over the past several decades due to the failure of active portfolio management to deliver value. Index investing has been shown to deliver superior returns, and at lower costs than active management, largely due to the high fees and poor diversification associated with active management –making it virtually impossible for such managers to beat their respective indexes.

The secret to indexing’s relative success rests on some very simple observations gleaned from financial theory. First, indexing embraces broad diversification within an asset class. For example, an S&P 500 Index fund purchases all 500 stocks in the index (or a statistically representative sample) rather than trying to divine which individual stocks out of all 500 will outperform in the quarter or year ahead. Both financial theory and mathematics tell us that there’s safety in numbers; more is better, both in terms of risk reduction and superior returns. Second, indexing embraces the efficient markets hypothesis (“EMH”), which postulates that the market “prices in” all publicly available information. If true, this means there are no arbitrage opportunities for active managers to capture risk-free returns. Finally, because indexing doesn’t rely on high-priced financial gurus or constant trading, index fund fees are significantly less expensive than their actively managed competitors, resulting in better returns.

The discussion, however, doesn’t stop at indexing. Walk into any graduate-level investing or portfolio management course at any leading business school in the world, and you’ll find factor investing constitutes the core of the curriculum. And for good reason: factor investing is the modern manifestation of more than nine decades of scientific inquiry into financial markets.

Factors are defined as those quantifiable characteristics that have been shown to be reliable predictors of future outperformance. In equities, the most popular factors include value, quality, momentum, and size. With respect to bonds, factors include term (the length of time until the lender is repaid) and credit (the credit quality of the borrower). All are transparent and quantifiable using data pulled from publicly available financial statements, such as a firm’s balance sheet, income statement, or statement of cash flows.

Factor investing borrows from both indexing and active management. It embraces broad diversification; it does not seek to outperform by way of market timing or concentrating holdings in a handful of stocks or bonds, nor does factor investing attempt to identify mispriced securities.

It embraces the theory of market efficiency and subsequently benefits from low fees. Like active management, factor investing’s objective is to outperform the market. However, unlike active managers, factor investing aims to do so by taking a structured, process-driven approach to investing—not one reliant upon human judgment or experience, both of which are arbitrary and anecdotal (read: not scientific).

In contrast to active management and indexing alike, proponents of factor investing argue that certain assets outperform others for risk-based reasons, not because they’re mispriced. The central premise behind factor investing is that riskier investments are required to pay higher returns for the privilege of putting an investor’s capital to work. Think of the market as a highly competitive global auction with the users of capital (corporations and governments) on one side and the providers of capital (investors like you) on the other. Riskier companies and governments are required to pay higher returns to investors for the privilege of using their capital. We see this in markets all the time. For example, those with lower credit scores are required to pay a higher interest rate for a home mortgage, and vice versa. Financial markets—those markets seeking to put your savings to work—aren’t any different.

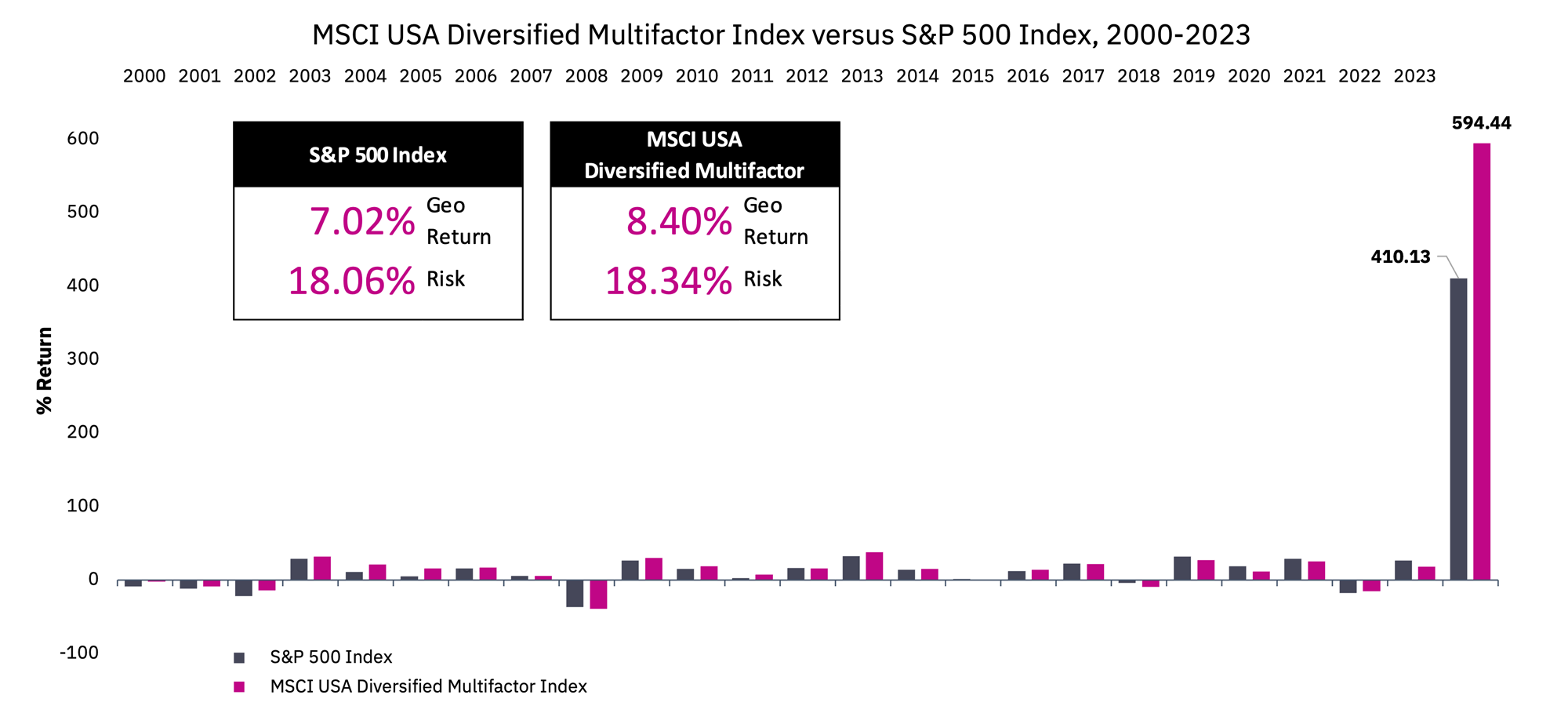

Does this mean factor investing is riskier than, say, indexing? Yes and no. While individual factors usually have higher risk than a typical index, by diversifying, these risks can be lowered without compromising returns. See the below data, from 2000 – 2023 the MSCI USA Diversified Multifactor Index—which invests in US stocks that exhibit the value, momentum, quality, and size factors—outperformed the S&P 500 Index by 1.38% annually with only 0.28% more risk.

2 Source: Bloomberg L.P.

There are three takeaways from this discussion. First, active management’s approach to investing is expensive, underperforms, and subjects your financial plan to unnecessary risk. Second, the low costs and diversification benefits associated with indexing have historically delivered better returns relative to active management. Finally, factor investing offers an intelligent, transparent, and rules-based alternative to both indexing and active management.

To learn more about factor investing, contact your advisor. If you’re not currently working with Mercer Advisors and would like more information on our investment management and planning services, let’s talk.

1 The sample includes funds at the beginning of the 20-year period ending December 31, 2022. Each fund is evaluated relative to its primary prospectus benchmark. Survivors are funds that had returns for every month in the sample period. Each fund is evaluated relative to its primary prospectus benchmark. Winners are funds that survived and outperformed their benchmark over the period. Where the full series of primary prospectus benchmark returns is unavailable, non-Dimensional funds are instead evaluated relative to their Morningstar category index. Data Sample: The sample includes US-domiciled, USD-denominated open-end and exchange-traded funds (ETFs) in the following Morningstar categories. Non-Dimensional fund data provided by Morningstar. Dimensional fund data is provided by the fund accountant. Dimensional funds or subadvised funds whose access is or previously was limited to certain investors are excluded. Index funds, load-waived funds, and funds of funds are excluded from the industry sample. Morningstar Categories (Equity): Equity fund sample includes the following Morningstar historical categories: Diversified Emerging Markets, Europe Stock, Foreign Large Blend, Foreign Large Growth, Foreign Large Value, Foreign Small/Mid Blend, Foreign Small/Mid Growth, Foreign Small/ Mid Value, Global Real Estate, Japan Stock, Large Blend, Large Growth, Large Value, Mid-Cap Blend, Mid-Cap Growth, Mid-Cap Value, Miscellaneous Region, Pacific/Asia ex-Japan Stock, Real Estate, Small Blend, Small Growth, Small Value, World Large-Stock Blend, World Large-Stock Growth, World Large-Stock Value, and World Small/Mid Stock. Morningstar Categories (Fixed Income): Fixed income fund sample includes the following Morningstar historical categories: Corporate Bond, High Yield Bond, Inflation-Protected Bond, Intermediate Core Bond, Intermediate Core-Plus Bond, Intermediate Government, Long Government, Muni California Intermediate, Muni California Long, Muni Massachusetts, Muni Minnesota, Muni National Intermediate, Muni National Long, Muni National Short, Muni New Jersey, Muni New York Intermediate, Muni New York Long, Muni Ohio, Muni Pennsylvania, Muni Single State Intermediate, Muni Single State Long, Muni Single State Short, Muni Target Maturity, Short Government, Short-Term Bond, Ultrashort Bond, World Bond, and World Bond-USD Hedged. Index Data Sources: Index data provided by Bloomberg, MSCI, Russell, FTSE Fixed Income LLC, and S&P Dow Jones Indices LLC. Bloomberg data provided by Bloomberg. MSCI data © MSCI 2023, all rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. FTSE fixed income indices © 2023 FTSE Fixed Income LLC. All rights reserved. S&P data © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment. Their performance does not reflect the expenses associated with management of an actual portfolio. US-domiciled mutual funds and US-domiciled ETFs are not generally available for distribution outside the US.

2 The MSCI USA Diversified Multiple-Factor Index is based on a traditional market cap weighted parent index, the MSCI USA Index, which includes US large and mid cap stocks. The index aims to maximize exposure to four factors – Value, Momentum, Quality and Low Size– while maintaining a risk profile similar to that of the underlying parent index. The MSCI USA Diversified Multiple-Factor Index was launched on Feb 17, 2015. Data prior to the launch date is back-tested test (i.e. calculations of how the index might have performed over that time period had the index existed). There are frequently material differences between back-tested performance and actual results. Past performance — whether actual or back-tested — is no indication or guarantee of future performance.

The S&P 500 Index is a widely accepted gauge of the US equity market. The index includes a representative sample of 500 leading companies in leading industries of the US economy. The S&P 500 Index focuses on the large-cap segment of the market; however, since it includes a significant portion of the total value of the market, it also represents the market.

Indices are not available for direct investment.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate, but is not guaranteed or warranted by Mercer Advisors. Content, research, tools, and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. All investment strategies have the potential for profit or loss. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.