Ready to learn more?

Explore More

How We Think About the Risks of Private Markets Investing: Insights From Our CIO

July 18, 2025

Home » Insights » Estate Planning » To Minimize Inheritance and Estate Tax, Make These Moves Now

Logan Baker, JD, LL.M., MBA

Lead, Sr. Wealth Strategist

When estate planning, learning the ins and outs of inheritance and estate tax – and how to possibly lessen their impact – is key.

While inheritance tax and estate tax are two different types of tax, both may earn the “death tax“ moniker. An inheritance tax is paid by the person receiving the inheritance. Since no federal inheritance tax exists, inheritance tax is imposed only by certain states.

In addition, inheritance tax rates vary according to kin and marital relationships. A surviving spouse is exempt from inheritance tax. As an example, depending on state law, a relative inheriting money may not pay as much tax as a friend unrelated to the deceased person.

Inheritance and estate taxes are calculated by adding up all the assets titled in the name of the decedent and applying the applicable tax rate. Such assets may include:

For tax purposes, the fair market value of these assets on the owner’s death date is the benchmark. For estates valued above the federal exemption level – currently $13,610,000 per person or $27,220,000 for a married couple – any estate tax due is paid by the estate administrator to the IRS within nine months of the death date. A six-month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. Without congressional intervention, these exemption amounts will continue to be in effect (with annual adjustments for inflation) until 2026. Only after all relevant estate taxes are paid can the personal representative of the estate distribute the remainder of the estate to beneficiaries.

States with inheritance tax: Who pays and how much?

The good news is that as of 2024, very few states impose inheritance tax. For those states, direct descendants of the deceased, such as their children and grandchildren, are usually exempt; however, those who are not related by blood or marriage will likely have to pay tax on their inheritance.

In 2024, states imposing inheritance tax include Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. Iowa will completely phase out its inheritance tax in 2025. Maryland is the only state with both inheritance and estate taxes. Some states exempt a certain portion of inheritance value before taxes kick in. As shown below, six states impose the highest rates applied to the fair market value of the inheritance.

| State | Highest Rate Applied to the Fair Market Value of the Inheritance |

| Iowa | 15% with an exemption amount of $25,000 |

| Kentucky | 16% with an exemption amount ranging from $500 to $1,000 |

| Maryland | 10% |

| Nebraska | 15% with an exemption amount ranging from $25,000 to $100,000 |

| New Jersey | 16% with an exemption amount of $25,000 |

| Pennsylvania | 15% |

Lineal descendants are not exempt in every state from inheritance tax. In Nebraska and Pennsylvania for example, children and grandchildren must pay inheritance taxes, although at lower rates ranging from 1% to 4.5%.

Some states do not impose inheritance taxes on smaller estates. For example, Iowa only imposes inheritance tax on estates valued at more than $25,000.

Other types of exemptions are common. In Pennsylvania, certain types of agricultural land are not subject to inheritance tax if the property is transferred to those eligible for the exemption. Laws such as these keep working farms in the same family without the fear of selling them to pay the tax.

Depending on the state, some heirs will pay more than others if they are not lineal descendants. Siblings will generally pay a lower tax rate than nieces and nephews for their inheritance. In other states, these relatives are not subject to inheritance taxes.

Since there is no standard rule for which relatives must pay inheritance tax and who is exempt; it really is a matter determined on a state-by-state basis. In New Jersey, grandchildren and stepchildren do not have to pay inheritance tax, but step-grandchildren do. An attorney will explain whether you owe tax based on the state’s law, the amount inherited, and the category of your relationship to the deceased.

Federal estate taxes only an issue for the extremely wealthy

Only the largest estates are subject to federal estate tax. The estate tax is not an inheritance tax, as it is paid to the federal government by the estate and not by the heirs. However, the imposition of an estate tax still means heirs receive less money.

For people who pass away in 2024, the federal estate tax exemption is $13.61 million for individuals. Married couples don’t have to pay federal estate tax if their estate is worth $27.22 million or less. This amount is inflation-adjusted by the Internal Revenue Service each year.

The Tax Cuts and Jobs Act (“TCJA”) keeps the exemption at that level, indexed for inflation, through 2025. Whether Congress will extend the TCJA remains to be seen. Should the TCJA sunset as scheduled, the exemption amount would revert to $5 million indexed for inflation, likely around $6 million to $7 million total beginning in 2026.

Under the TCJA, fewer than 1,000 estates are subject to federal estate tax each year. Estates that must pay federal estate tax will owe 40% on the amount above the exemption. For example, if the amount above the exemption is $1 million, the IRS receives $400,000.

State taxes are another story

While a federal estate tax is imposed only on large estates, some states impose taxes on estates with a lower value than the federal exemption. Perhaps you are left an inheritance by a person living in a state without an inheritance tax. Even if that estate is worth less than the federal exemption, your inheritance amount may diminish if the estate is also subject to a state estate tax. Such taxes can take a big chunk out of what you may have thought you would receive.

Currently, 12 states and the District of Columbia impose estate taxes. New York, for example, has a $5.74 million exemption for 2024 and imposes an estate tax of 16%. However, the New York estate tax law also stipulates that when an estate is worth more than 105% of the exemption threshold, the entire estate is subject to tax. Illinois has a similar “cliff” tax that taxes the entire estate back to dollar one if it exceeds the state exemption threshold. Other exemption amounts and top estate tax percentages are detailed below.

| State | Top Tax Rate | Estates Worth at or Over |

| Connecticut | 12% | $13,610,000 |

| Hawaii | 20% | $5,490,000 |

| Illinois | 16% | $4,000,000 (but the entire estate is taxed if over the exemption amount) |

| Maine | 12% | $6,410,000 |

| Maryland | 16% | $5,000,000 |

| Massachusetts | 16% | $2,000,000 |

| Minnesota | 16%

|

$3,000,000 |

| New York | 16% | $6,940,000 (but the entire estate is taxed if over the exemption amount) |

| Oregon | 16% | $1,000,000 |

| Rhode Island | 16% | $1,744,000 |

| Vermont | 16% | $5,000,000 |

| Washington | 20% | $2,193,000 |

| Washington, DC | 16% | $4,710,000 |

Keep in mind, these are the highest rates for each state for the estates subject to tax. There are other caveats, and the devil is in the details. For example, most states apply graduated rates depending on the value of the estate. Hawaii applies graduated rates of 10%, 11%, 12%, 13%, 14%, 15.7%, and 20% depending on the value of the estate.

Some states adjust their exemption amounts annually for inflation, while others do not. Oregon is one example. Because its exemption amount of $1 million has not been adjusted for inflation for years, simply owning a home and a retirement account could easily expose Oregon residents to state estate tax.

The federal estate tax allows married couples to combine their exemption amounts, through a provision known as portability. However, this provision only applies to the federal estate tax and is not available for purposes of most state estate taxes. Currently, only Hawaii and Maryland allow for exemption portability. For more information, speak with your wealth advisor. And if you’re not a client, let’s talk.

Avoiding state inheritance and estate tax

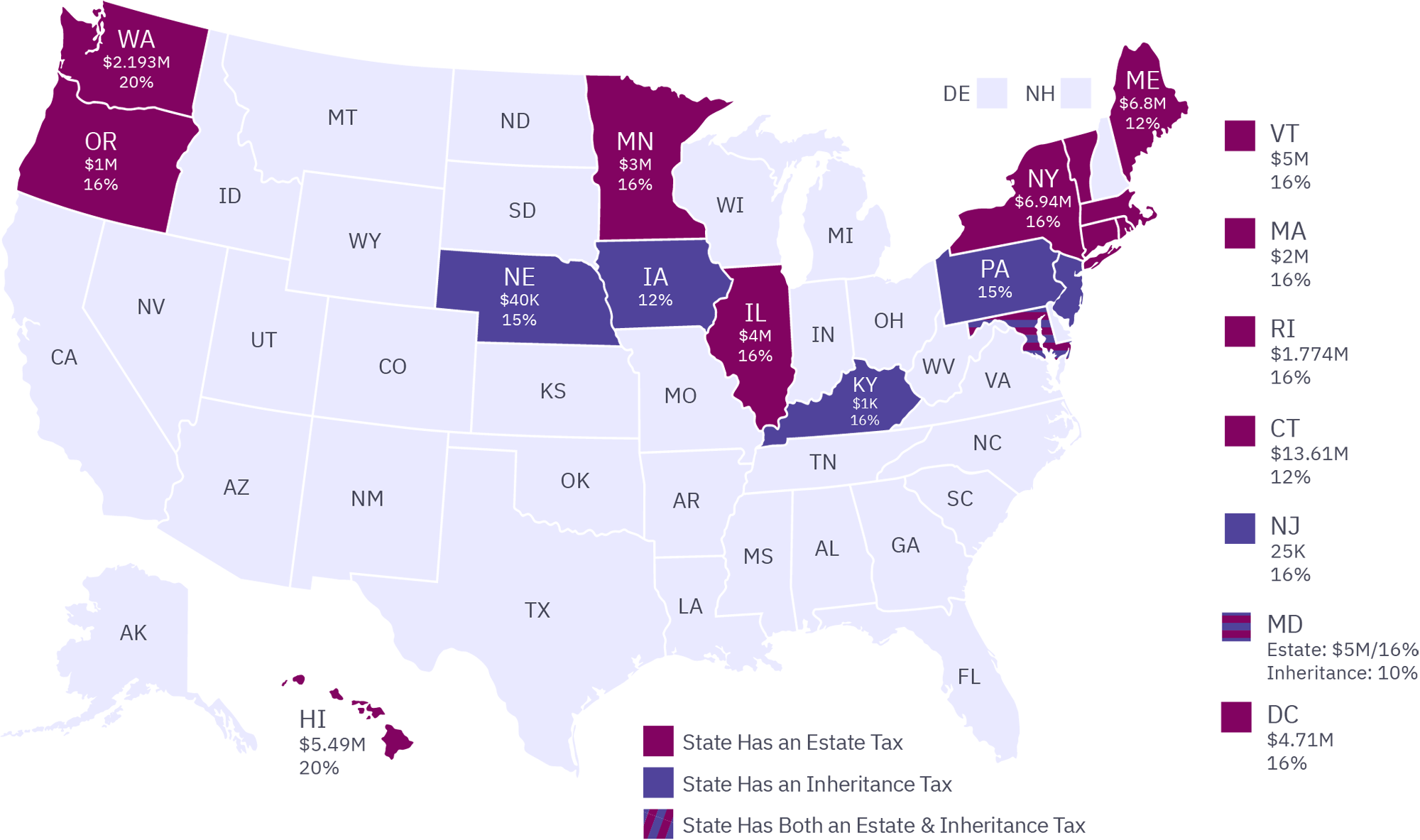

Perhaps you live in a state with no inheritance or estate tax, but your parents reside in a state that does. You may want to discuss ways to minimize or avoid these taxes with them, or with any other person from whom you expect to receive an inheritance. The map below showcases states that have the inheritance tax, estate tax, or both.

Maybe your parents are willing to relocate to a state without an inheritance or estate tax. If moving is out of the question, they may want to consider alternatives and plan their estates with the goal of wealth preservation and potential avoidance of future state estate or inheritance taxes. For these purposes, consult an estate planning professional. This is not something that even a reasonably sophisticated investor should try on their own.

The planning professional may recommend the establishment of an irrevocable life insurance trust (“ILIT”), intentionally defective grantor trust (“IDGT”), spousal lifetime access trust (“SLAT”), or other type of irrevocable trust for tax purposes. An irrevocable trust is one for which the grantor, or person establishing the trust, cannot change the terms but which keeps the trust assets out of the grantor’s estate for inheritance and estate tax purposes.

Even though the grantor is generally not permitted to manage or directly benefit from these trusts, the grantor will appoint a trustee for that purpose. Depending on the type of trust used, the trustee could be the grantor’s spouse, children, other family members, or an attorney, corporate trustee, or financial professional.

Does your state have an inheritance tax, estate tax, or both?

Protecting your estate from taxes

If you live in a state with an inheritance tax, sound estate planning can minimize some of its effects. For example, if you are healthy and expect to live more than two years, planned giving to individuals who are otherwise subject to the inheritance tax can reduce your taxable estate. That can mean avoiding inheritance taxes.

These measures require careful planning. In 2024, you cannot give away more than $18,000 per individual to reduce the size of your estate. If you want to give more than that, you must file a gift tax return. You can, however, give $18,000 to as many people as you like, and your spouse can give away the same amount without tax consequences.

In some states, that inheritance may be smaller than you think

While generally only high net-worth households worry about federal inheritance and estate taxes, state tax is a different story. Depending on the state, even a relatively modest inheritance can trigger a sizable tax. In some states, even close relatives will end up with a large tax burden after inheriting.

State inheritance and estate taxes are big considerations when making retirement plans. Perhaps moving to a more tax-friendly state is not an option due to family and community ties. After all, it is out of love and care for your family that you make estate-planning decisions. You want to leave your loved ones as comfortably provided for as possible. Consult an estate planning professional to develop a customized strategy and start minimizing your tax obligations.

Every family situation is different, and so is every estate plan. A financial advisor can explain the intricacies of state inheritance tax law, discuss the concerns you have about family members’ needs and with that information, design a well-crafted estate plan. Your advisor will inform you what each heir might owe given the current tax situation and your estate’s value. From there, you can devise ways to. If you are an existing client, contact your advisor to help ensure your beneficiaries are in the best situation possible. If you’re not a client and would like more information, contact us.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

July 18, 2025