As college students prepare for the fall semester, a sweeping new law, The One Big Beautiful Bill Act (OBBBA), is reshaping the landscape of federal student loans. Signed into law by President Trump on July 4, 2025, OBBBA introduces significant changes to repayment plans, borrowing limits, and student loan forgiveness timelines. Here’s what students, parents, and graduates need to know.

Repayment plans are changing: Here’s what that means

The One Big Beautiful Bill sets a clear deadline: By July 1, 2028, most Income-Driven Repayment (IDR) plans will be retired. Only two plans will remain:

- The Repayment Assistance Plan (RAP), a new option still in development.

- The Income-Based Repayment (IBR) plan, which now has two versions depending on when you took out your first loan.

If your first loan was before July 1, 2014, you have the option to choose the old IBR, which calculates payments at 15% of discretionary income and offers forgiveness after 25 years. If your first loan was on or after July 1, 2014, you have the option to choose the new IBR, which uses 10% of discretionary income and forgives loans after 20 years. Current borrowers will also have the option to choose the new RAP plan.

SAVE plan borrowers: What you need to know

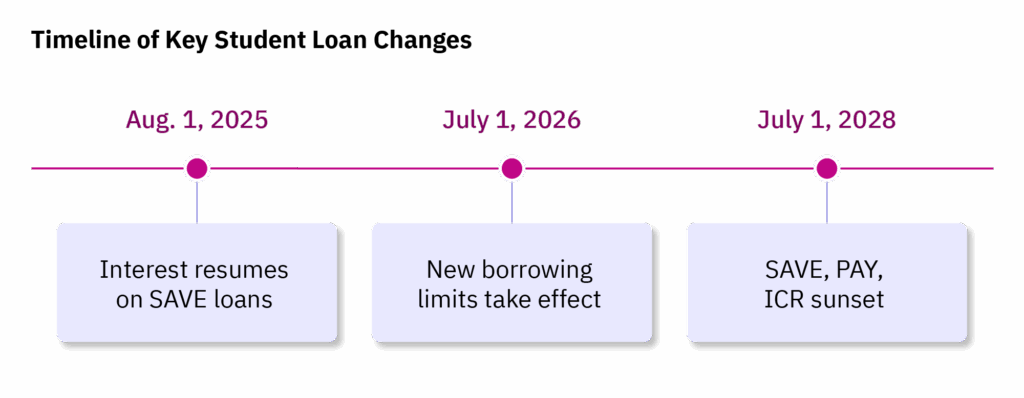

Student loan borrowers currently on the SAVE plan are in a unique position. While payments are paused, interest resumed on Aug. 1, 2025. To continue progressing toward forgiveness, borrowers who took out their first loan after July 1, 2014, will need to switch to the new IBR plan or RAP by July 1, 2028.

Borrowers who took out their first student loan before July 1, 2014, can switch to the old IBR plan to resume making progress towards student loan forgiveness.

There is a temporary opportunity for some borrowers to switch to the PAYE plan, which offers lower monthly payments. This applies if your first loan was taken out on or after Oct. 1, 2007, and you received a disbursement on or after Oct. 1, 2011. Both conditions must be met to qualify. However, this option may not last long, as both PAYE and SAVE are currently being challenged in the Eighth Circuit Court of Appeals.

Parent PLUS borrowers: Act before July 1, 2026

If you’re repaying Parent PLUS loans, timing is critical. You must consolidate your loans and enroll in the ICR plan before July 1, 2026, to qualify for income-based repayment. After that date, you will be placed on a standard repayment plan with fixed monthly payments for a term of 10 to 25 years with the length of the term dependent upon the amount borrowed. It is possible that these monthly payments could be quite high for some borrowers.

This step is also essential if you plan to pursue Public Student Loan Forgiveness.

OBBBA impact on future borrowers

The One Big Beautiful Bill Act introduces new repayment options and borrowing limits for students taking out loans after July 1, 2026.

Repayment options:

- Standard Plan: Offers borrowers a fixed monthly payment amount of 10 years for borrowers with less than $25,000 outstanding, 15 years for borrowers with between $25,000 and $49,999 outstanding, 20 years for borrowers with between $50,000 and $99,999 outstanding, and 25 years for borrowers with $100,000 or more outstanding.

- Repayment Assistance Plan (RAP): Payments based on Adjusted Gross Income (AGI), with forgiveness after 30 years.

Under RAP, married borrowers will have the option of filing taxes as married filing jointly, or married filing separately. Monthly payments will be no lower than $10 per month. Borrowers who make at least $10,000 but not more than $19,999 annually, will see payments at 1% of AGI. Payments will increase by 1% for every $10,000 of AGI up to a maximum of 10% for borrowers making $100,000 or more annually. The monthly payments will also be reduced by $50 per dependent per month.

Borrowing limits are tightening

OBBA reinstates borrowing caps that were removed in 1992. Starting July 1, 2026:

- Parent borrowing will be capped at $20,000/year per child, with a lifetime limit of $65,000

- Undergraduate students may continue borrowing up to $31,000 in federal loans

- Graduate students face new limits:

- Academic programs: $20,000/year, $100,000 total

- Professional programs (law, medicine, etc.): $50,000/year, $200,000 total

- Lifetime cap for combined undergraduate and graduate borrowing: $257,500 (excluding Parent PLUS loans)

Borrowing limits will be changing for both graduate and undergraduate programs. These changes will impact both Parent PLUS loans that parents take out on behalf of their students, and Direct PLUS loans commonly referred to as Grad PLUS loans that graduate students take out for graduate school.

Private loans: A backup option

With federal student loan limits in place, some students, especially those in professional programs, may need to turn to private loans. These loans can cover the full cost of attendance, but come with trade-offs:

- Fixed and variable interest rates offered

- Requires good credit history to qualify

- May require a co-signer

- No income driven repayment plans, or student loan forgiveness.

If you go the private student loan route, look for fixed-rate loans from reputable lenders with no prepayment penalties

| For more information on the OBBBA, visit our library of articles. |

What you should do now

1. Review your current federal student loan repayment plan

If you’re on the SAVE plan, interest has now begun to accrue. To resume making progress towards student loan forgiveness, consider switching to IBR unless your income situation makes SAVE temporarily more favorable. For example, if you recently married and filed jointly, you may want to wait and file separately next year before switching.

If you are currently on a payment pause with SAVE, and making monthly payments would be difficult for you, consider staying on the SAVE program, at this time.

2. Use legacy borrowing rules if you’re still in school

If you’re currently enrolled, you can borrow under existing student loan limits for up to three academic years or until your program ends, whichever comes first. This legacy provision will apply for undergraduate, graduate, and parent borrowers.

Talk to your financial aid office and academic advisor to ensure you’re on track and have paperwork in place.

When to speak to your wealth advisor

Navigating the new student loan landscape under OBBBA can be complex, and making the right financial choices often depends on your individual circumstances. That’s where a wealth advisor can be an invaluable resource.

If you’re considering switching repayment plans, especially if you’re currently on SAVE, PAYE, ICR, or the standard repayment plan, it is important to be proactive. When you apply to change plans, you must specify which plan you want to switch to. If you don’t, the Department of Education may assign you to a plan that does not align with your financial goals. A wealth advisor can help you evaluate which repayment option best fits your income, career trajectory, and long-term financial strategy.

Tax filing decisions also play a critical role in student loan repayment. For married borrowers, choosing between filing jointly or separately can significantly impact monthly payments under income-driven plans. Your wealth advisor can run a comparative analysis to determine which filing status will minimize your adjusted gross income (AGI) and, in turn, reduce your loan payments. They can also advise on increasing pre-tax retirement contributions to further lower your AGI and optimize your repayment plan.

If you anticipate receiving student loan forgiveness after 2025, it’s essential to prepare for the tax implications. Starting Jan. 1, 2026, forgiven loan amounts under income-driven repayment plans will be considered taxable income. Your wealth advisor can help you forecast this liability and develop a strategy to manage the tax burden when the time comes.

Finally, if you have questions that go beyond the scope of this article, whether about niche loan scenarios, institutional policies, or broader financial planning, don’t hesitate to reach out. Your wealth advisor can provide tailored guidance to ensure you’re making informed decisions in this new era of student lending. Not a client? Let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

CHARTERED RETIREMENT PLANNING COUNSELOR℠ and CRPC® are trademarks or registered service marks of the College for Financial Planning in the United States and/or other countries.