Ready to learn more?

Explore More

Christopher Currin, CFP®, ChSNC®

Sr. Wealth Strategist

When caring for a dependent with special needs, it’s critical to have a financial and caregiving plan to ensure continuing care.

An old Wall Street adage is that the market “climbs a wall of worry,” which refers to stock prices rising despite negative economic or news factors. That rings true at a time when many markets are reaching historic highs, while our worries have expanded dramatically beyond investments. In recent years, many individuals have been hesitant about risking their hard-earned money in markets threatened by societal and political uncertainties. But successful investors can overcome their trepidation and, maybe more importantly, tap into the wisdom of those who best understand the market’s history and how it can be rewarding for participants in the long run.

It may also be true that parenting climbs a wall of worry. The first thing that can help you deal with a level of uncertainty when you have a disabled child is realizing that you are not alone. Other parents, along with teachers and interested professionals, like me, have been sorting out how to manage for decades. You don’t have to blaze your own trail.

Working with clients throughout a long career, I’ve learned that you can develop clarity and a sense of purpose by reviewing and revising your goals, and your plans for achieving them. This is especially true if you need to revise your plans when you receive a loved one’s special needs diagnosis. If you are currently caring for a dependent with a disability, it’s essential that you have a comprehensive plan in place for whomever might have to assume your duties.

Three key components of a special needs financial plan

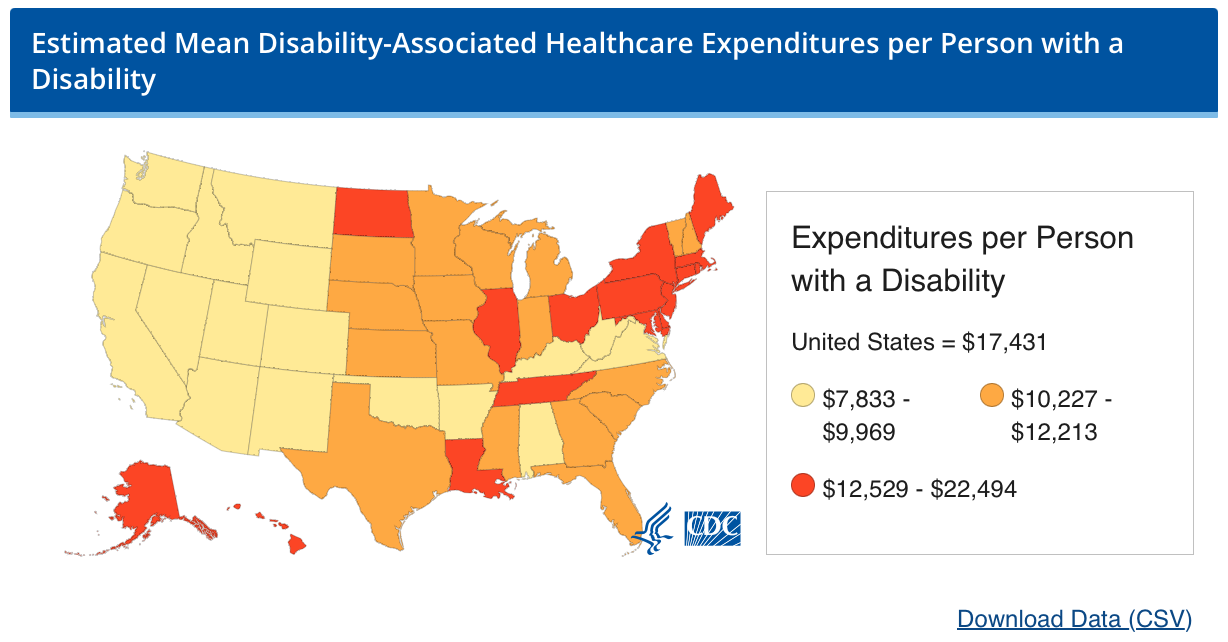

Families that include people with disabilities need more robust and elaborate plans than typical families. As shown in the cart, the expense per person with disability varies by state — as low as $7,833 in Nevada to as high as $22,494 in Washington, DC — and continues to rise.1 A comprehensive special needs plan has three key components to add to a basic financial plan: an augmented estate plan, a person-centered life plan, and a caregiving operations manual.

#1. Prevent bad outcomes with an estate plan

According to a 2023 survey cited by Fortune, two out of three American adults (66%) are without a will or other key estate planning documents.2 If you fail to draft a will or trust to ensure your wishes are carried out, the state where you reside will apply its rules to determine which debts to pay on your behalf and who gets a share of the assets you leave behind.

A state’s default estate plan could produce an adequate plan for some of its citizens, but for parents of children with special needs the consequences can be dire. For example, if your loved one with a disability receives means-tested public benefits, like Supplemental Security Income (SSI) or Medicaid, those benefits could potentially be stripped from them when you die. In addition, any assets you leave them, directly through inheritance or gifts, could be reclaimed by the state to pay back benefits received in the past. To support your loved one with a disability beyond your own lifetime, a supplemental needs trust, among other planning techniques may be necessary. Over the past 20 years, a growing number of legal professionals have become familiar with the proper use of special needs trusts. However, you should ask questions to ensure your attorney has the knowledge and experience in this specialized area of estate planning. Mercer Advisors can help you find an attorney if you don’t have one.

No matter how much effort goes into creating it, no estate plan is permanent. Any number of changes in law or your life can make it sub-optimal or even obsolete. Big changes in the rules for retirement plans were made at the end of 2019 (the SECURE Act) and again at the end of 2022 (SECURE 2.0). The current (very generous) federal estate tax law sunsets in 2026. Since significant changes in family circumstances can happen at any time, you should review your estate plan at least every five years.

#2. Create better outcomes with a person-centered life plan

A life plan incorporates all the elements of your loved one’s ideal life: Home, job, education, healthcare, and social activities, plus whatever assistance is necessary to make them happen. Using a five-year timeframe is ideal. It is far enough into the future to accommodate significant changes, but not too distant to make realistic predictions impossible. This timeframe also helps you determine which issues belong on the front burner, which can move to a back burner, and which can be put into the deep freeze for a while. For example, if your child is not yet in preschool, the life plan you create today does not need to include detailed assessments of post-secondary educational opportunities, or local residential settings for adults with special needs.

Start by imagining your relative’s ideal life five years from now and build the plan around that image, like how you might organize construction plans around a vision of your dream home.

Once you have a clear vision of the future you want to create for your child or other relative with special needs, calculate how much it might cost to provide that level of support and what resources are available. Without the estimate, all you have is a wish list; adding concrete numbers is what turns wishes into achievable goals. For most families, the support provided by public benefits programs will be essential. An adult who qualifies for SSI and a comprehensive Medicaid waiver program today could receive benefits over the next 30 years of more than $1,500,000.3 Not many families can afford to do without these benefits, which underscores the importance of getting your estate plan right, as noted above.

Tallying up the costs of your loved one’s needs, over and above what may be provided by public benefits, will likely yield another big number. Ideally, over the course of a long and productive life, you have gradually accumulated the assets needed to provide for yourself as well as leave a legacy sufficient for your child’s supplemental needs. If you want to supplement your assets, consider having life insurance. The most common and appropriate use of term life insurance for a typical family might be protecting against the loss of a family breadwinner before the youngest child has attained independence. But families with a disabled child also must consider that their child may never attain independence and, therefore, the time horizon that insurance must cover will be longer. Insurance can also help replace income, such as pensions and Social Security benefits, which stop upon a parent’s death. Some form of permanent life insurance may be most appropriate to meet these extended needs.

If you are a client of Mercer Advisors, our estate planning professionals, along with your wealth advisor, can assist with creating a life plan. If you are not a client and have questions, let’s talk.

#3. Ensure continuity with a caregiving operations manual

Parents and other household members typically know more about our children than anyone else. The depth and intricacy of such knowledge is even greater for a child with a disability. If someone else had to suddenly take on your role as caretaker, how could they quickly learn everything they need to know? A caregiving operations manual provides essential guidance for anyone who might have to step into your shoes at a moment’s notice.

Most couples tend to split the responsibilities of a family’s regular tasks, so neither of them may be aware of how to do the other’s tasks. Your family might also think about providing input for the caregiving operations manual in the same way, by dividing and conquering.

When it comes to planning, starting is the most important step

Starting is key when planning for the future of a loved one with disabilities. Just like investors facing market uncertainties, parents of individuals with special needs encounter challenges requiring foresight. Establishing an estate plan, crafting a life plan, and creating a caregiving manual are vital steps. These actions shield against legal issues, help ensure individual needs are met, and provide guidance for care continuity. By embracing these strategies, families can confidently navigate uncertainties, helping to secure a brighter future for their loved ones.

1“Disability and Health Healthcare Cost Data”, CDC, March 8, 2021.

2“What is a will? The estate planning document you need ASAP (even if you think you don’t)”, Fortune, June 19, 2023.

3Financial Freedom for Special Needs Families: 9 Building Blocks to Preserve Benefits, Reduce Stress and Create a Fulfilling Financial Future, Rob Wrubel, CFP, Rosalibean Publishing, LLC, 2017, pg. 61

4“Personal Income and Outlays: April 2020,” Bureau of Economic Analysis, May 29, 2020.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment

Mercer Advisors is not a law firm and does not provide legal advice to clients. All estate planning document preparation and other legal advice is provided through select third parties unrelated to Mercer Advisors.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.