After more than a decade of extremely low interest rates, it’s certainly refreshing to see higher yields on money markets, which includes money market funds, certificates of deposit (CDs), Treasury bills, or other short-term investments that mature from one day to one year. The potential to earn north of 5% without enduring any market volatility is certainly welcome relief and a boon for savers. Yet, while many investors are swapping out longer-term investments for short-term interest-bearing ones, we don’t think it’s time to make major asset allocation shifts to chase today’s higher short-term yields. Here’s why.

Cash isn’t king

Investors certainly have a range of solutions for short-term cash reserves today: various money market funds, CDs, and our new 12-month and 1- to 5-year Treasury ladders, just to name a few of the most popular ones. As of this writing, Schwab’s Value Advantage Money Fund® – Ultra Shares (SNAXX) has a 7-day yield of 5.4%. When total returns on the U.S. Aggregate Bond Index were 5.5% in 2023, a low-risk money market yield of 5.4% seems (and is!) quite attractive, leading many to proclaim a new era of “cash is king”.

However, money markets are short-term investments that are unsuitable for building long-term wealth. Their short-duration—for example, SNAXX has a weighted average maturity of just 36 days—make them inferior to other longer-term investments. That’s because, if and when rates decline (the Fed recently forecasted it would cut rates three times this year and more in 2025), yields on money market funds will be quick to respond and follow rates down.

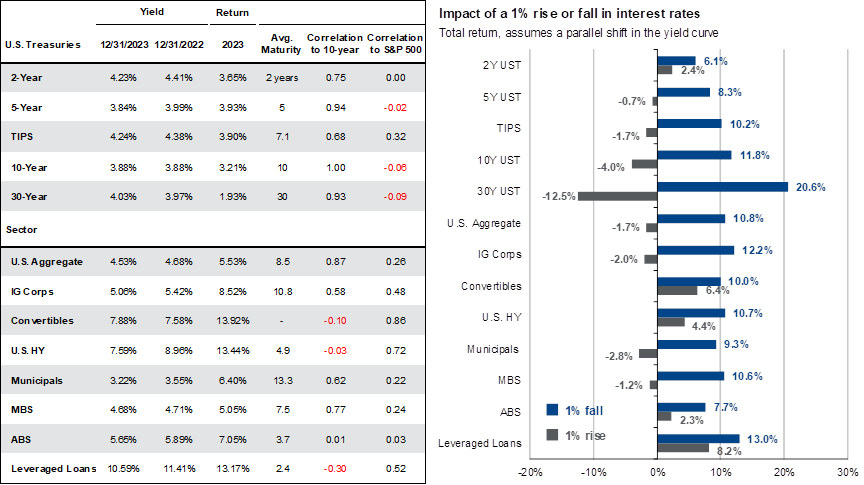

In contrast, longer duration investments typically rise in value as rates decline, providing investors a nice tailwind to compensate for their relatively lower yields. Consider very low-risk 5-year U.S. Treasury bonds that mature in five years. Because bond prices typically move inversely to yields, a 1% decrease in interest rates would result in an estimated capital appreciation of 8.3% in price (Exhibit A). Money market funds, however, due to their short duration, would experience no such appreciation in share prices as rates decline. For long-term assets, that represents a significant opportunity cost for mistakenly allocating long-term wealth to short-term investments.

Exhibit A: Fixed Income Yields, Returns, and Maturities, December 31, 2023 (Source: JP Morgan, Guide to the Markets, December 31, 2023, Slide 33)

Nor was cash king in 2023…

One of our key investing principles at Mercer Advisors is that we believe time in the market is more important than timing the market. To that end, in our 2023 outlook, we advised clients against making short-term decisions with long-term assets in response to recession and inflation forecasts—and to instead remain well-diversified in the year ahead. That turned out to be timely advice.

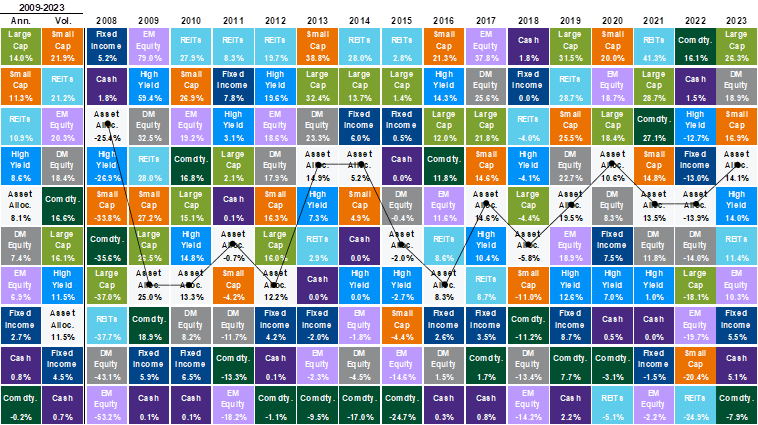

Despite higher money market yields, cash underperformed every major asset class in 2023—save one. Only commodities, a favorite of inflation hawks during periods of high inflation, performed worse—despite 2023 beginning the year with a year-over-year inflation rate of 6.4% (note that Mercer Advisors portfolios had no allocation to commodities in 2023). As Exhibit B shows, a diversified asset allocation portfolio outperformed cash by a full 9% in 2023 (14.1% versus 5.1%).

Exhibit B: Public Market Asset Class Returns, 2009 – 2023 (Source: JP Morgan, Guide to the Markets, Q1 2024, Slide 60)

What if I’m investing for income?

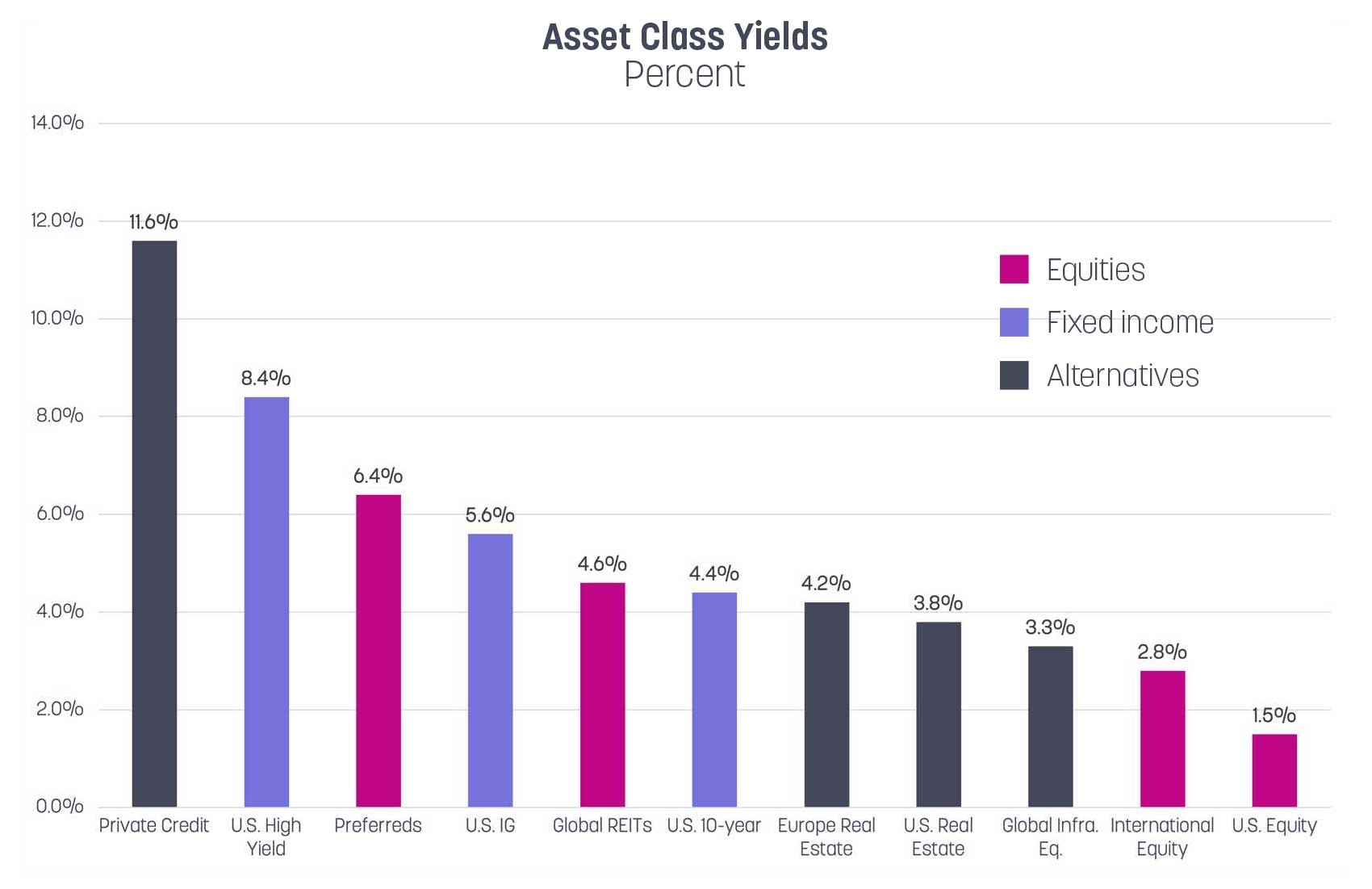

For long-term, income-focused investors, better yields can be found elsewhere than what’s available from money market funds. Any number of asset classes—private credit, high yield bonds, and investment grade bonds—all currently offer higher yields than money markets (Exhibit C). Further, these asset classes typically have longer durations than money markets, meaning—unlike money markets—they’ll benefit from declining rates. This also translates into greater income stability (higher coupon income for longer), higher total returns (coupon income plus price appreciation), and hence superior inflation fighting power over time (relative to money markets).

Exhibit C: Asset Class Yields (Source: JP Morgan Guide to Alternatives, November 2023, Slide 8)

Takeaways for investors

Before making major asset allocation shifts to short-term higher yielding investments, bear in mind these three timeless lessons:

- The first is that we should be careful not to confuse short-term savings with long-term wealth. It’s one thing to invest our emergency reserves in money market funds. It’s quite another to invest long-term capital, like retirement or intergenerational wealth, in short-term investments. Doing so results in a serious “duration mismatch” that can have real consequences. Working with a trusted advisor to build, manage, and monitor a well-crafted plan helps to clearly separate short- and long-term assets on our balance sheets and subsequently provides guidance for how best to go about investing those assets.

- The second lesson is that we should build diversified balance sheets—not just portfolios, but entire balance sheets—that are designed to build wealth and outperform inflation over time. To do that successfully requires we stay committed to investing in a broad range of asset classes (not just cash), especially when they’re underperforming. Stocks, for example, had a tough year 2022, with the S&P 500 losing almost 20%. However, successful investors who remained committed to equities recaptured most of the losses in 2023 (or more), as the S&P 500 gained 26.3% and is back within striking distance of all-time highs.

- Finally, the most successful investors in the world always remain focused on the long game. Like a fine wine, the best investments need time to age and work their magic. For all the collective fixation with short-term yields and 2024’s market predictions, the fact remains that the very best investors look out ten years, not twelve months. A dollar invested in the S&P 500 in 1926 is today worth over $11,000. That same dollar invested in short-term U.S. Treasury bills (a proxy for cash) is worth only $22.

Deploying some cash to money markets certainly makes sense after the increase in yields over the past two years, but no investment is risk free. Reinvestment risk, or the inability to capture today’s higher yields in the future, should be on top of investors’ minds as expectations for falling rates come to fruition this year and next. Instead, bonds with longer maturities, other higher yielding instruments, and equities could see continued tailwinds from falling yields and should remain core holdings within long-term portfolios. As always, if you have concerns about your asset allocations, please reach out to your Mercer Advisors professional for a complete review of your portfolio and financial plan.

Home » Insights » Market Commentary » Despite Higher Rates, Cash Isn’t King

Despite Higher Rates, Cash Isn’t King

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Why the possibility of falling rates introduces reinvestment risk to short-term money markets with higher yields.

After more than a decade of extremely low interest rates, it’s certainly refreshing to see higher yields on money markets, which includes money market funds, certificates of deposit (CDs), Treasury bills, or other short-term investments that mature from one day to one year. The potential to earn north of 5% without enduring any market volatility is certainly welcome relief and a boon for savers. Yet, while many investors are swapping out longer-term investments for short-term interest-bearing ones, we don’t think it’s time to make major asset allocation shifts to chase today’s higher short-term yields. Here’s why.

Cash isn’t king

Investors certainly have a range of solutions for short-term cash reserves today: various money market funds, CDs, and our new 12-month and 1- to 5-year Treasury ladders, just to name a few of the most popular ones. As of this writing, Schwab’s Value Advantage Money Fund® – Ultra Shares (SNAXX) has a 7-day yield of 5.4%. When total returns on the U.S. Aggregate Bond Index were 5.5% in 2023, a low-risk money market yield of 5.4% seems (and is!) quite attractive, leading many to proclaim a new era of “cash is king”.

However, money markets are short-term investments that are unsuitable for building long-term wealth. Their short-duration—for example, SNAXX has a weighted average maturity of just 36 days—make them inferior to other longer-term investments. That’s because, if and when rates decline (the Fed recently forecasted it would cut rates three times this year and more in 2025), yields on money market funds will be quick to respond and follow rates down.

In contrast, longer duration investments typically rise in value as rates decline, providing investors a nice tailwind to compensate for their relatively lower yields. Consider very low-risk 5-year U.S. Treasury bonds that mature in five years. Because bond prices typically move inversely to yields, a 1% decrease in interest rates would result in an estimated capital appreciation of 8.3% in price (Exhibit A). Money market funds, however, due to their short duration, would experience no such appreciation in share prices as rates decline. For long-term assets, that represents a significant opportunity cost for mistakenly allocating long-term wealth to short-term investments.

Exhibit A: Fixed Income Yields, Returns, and Maturities, December 31, 2023 (Source: JP Morgan, Guide to the Markets, December 31, 2023, Slide 33)

Nor was cash king in 2023…

One of our key investing principles at Mercer Advisors is that we believe time in the market is more important than timing the market. To that end, in our 2023 outlook, we advised clients against making short-term decisions with long-term assets in response to recession and inflation forecasts—and to instead remain well-diversified in the year ahead. That turned out to be timely advice.

Despite higher money market yields, cash underperformed every major asset class in 2023—save one. Only commodities, a favorite of inflation hawks during periods of high inflation, performed worse—despite 2023 beginning the year with a year-over-year inflation rate of 6.4% (note that Mercer Advisors portfolios had no allocation to commodities in 2023). As Exhibit B shows, a diversified asset allocation portfolio outperformed cash by a full 9% in 2023 (14.1% versus 5.1%).

Exhibit B: Public Market Asset Class Returns, 2009 – 2023 (Source: JP Morgan, Guide to the Markets, Q1 2024, Slide 60)

What if I’m investing for income?

For long-term, income-focused investors, better yields can be found elsewhere than what’s available from money market funds. Any number of asset classes—private credit, high yield bonds, and investment grade bonds—all currently offer higher yields than money markets (Exhibit C). Further, these asset classes typically have longer durations than money markets, meaning—unlike money markets—they’ll benefit from declining rates. This also translates into greater income stability (higher coupon income for longer), higher total returns (coupon income plus price appreciation), and hence superior inflation fighting power over time (relative to money markets).

Exhibit C: Asset Class Yields (Source: JP Morgan Guide to Alternatives, November 2023, Slide 8)

Takeaways for investors

Before making major asset allocation shifts to short-term higher yielding investments, bear in mind these three timeless lessons:

Deploying some cash to money markets certainly makes sense after the increase in yields over the past two years, but no investment is risk free. Reinvestment risk, or the inability to capture today’s higher yields in the future, should be on top of investors’ minds as expectations for falling rates come to fruition this year and next. Instead, bonds with longer maturities, other higher yielding instruments, and equities could see continued tailwinds from falling yields and should remain core holdings within long-term portfolios. As always, if you have concerns about your asset allocations, please reach out to your Mercer Advisors professional for a complete review of your portfolio and financial plan.

Explore More

Beyond Fees: What to Consider When Hiring a Wealth Advisor

RSUs 101: A Tech Professional’s Guide to Equity, Tax Strategy, and Financial Planning

The Downgrade of U.S. Government Debt: Insights From Our CIO

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark. Diversification and asset allocation do not ensure a profit or protect against a loss. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.