Home » Insights » Retirement » How to Generate Retirement Income

How to Generate Retirement Income

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Summary

For retirees, how to generate retirement income on their portfolio is an important part of a retirement plan. However, the last time we saw double digit interest rates was in the mid-1980s. Given that the Fed expects to leave interest rates near zero through at least 2023, generating higher yields for your retiring strategy means taking a different investing approach than in the past.

Can retirees find higher yields?

With interest rates on government bonds near zero, generating retirement income from a lifetime of savings has never been more challenging. With the economy suffocating under a crushing recession, retirees are facing the prospect of low interest rates for many years to come. Given the current low-interest rate environment, is there anywhere retirees can find higher yields?

Thankfully, the answer is “yes.” There are a variety of unique asset classes and solutions available to help retirees generate higher yields on their assets. But full disclosure: yield isn’t free. There are dangers to chasing yield. Higher-yielding asset classes almost always involve greater risks or other tradeoffs. Retirees should work closely with their trusted advisor to assess whether stretching for yield is right for them and, if so, how best to go about doing so.

Dividend-paying stocks

There’s more to investing in stocks than simply hoping their prices rise over time. While today’s media-fueled, stock-investing culture tends to overly fixate on changes in stock prices, this myopic view misses one of the most powerful benefits of stock ownership. It’s true that stock prices generally rise over time, but banking on this every year would be an admittedly risky approach to retirement income planning. To the contrary, the number one reason investors should arguably own stocks is for income—specifically, the dividends paid to shareholders. Dividends, unlike bond interest, are taxed at lower capital gains.1 Why else own part of a company if not to participate in its profits?

The current dividend yield of the S&P 500 Index is about 2.1% and 3.25% for non-US stocks. These are just averages; a portfolio of high dividend paying stocks can deliver yields well north of this. One of our strategies makes targeted investments in about 80 high-dividend-paying companies and delivers a current yield in the range of about 4.6% per year. And while a company can always elect to cut its dividend to shareholders, dividends typically rise over time as companies grow. For example, an investor receiving $100,000 in dividend income per year in 2000 saw those same dividends grow nearly 44% by 2009 despite the global financial crisis, and by 290% by 2019. In annual terms, dividends paid by S&P 500 Index companies grew at a rate of 6.7% per year from 2000-2019, a rate well north of inflation.

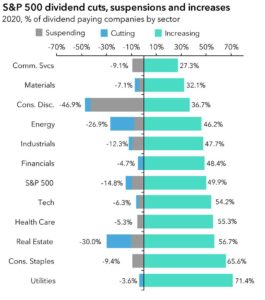

But what about COVID’s impact on dividends? Perhaps surprisingly, only 14.8% of dividend-paying companies have cut or suspended their YTD dividends in 2020. That compares to nearly 50% of dividend-paying companies that actually increased their dividends thus far in 2020.

Exhibit 1: More S&P 500 Companies Have Increased Than Cut or Suspended Dividends YTD in 20202

High-yield bonds

High-yield bonds have credit ratings below BBB. Because of the bonds’ lower credit quality, bond investors rightly extract a higher interest rate from companies that issue such bonds. And these yields remain attractive; global high-yield bonds currently offer yields in the 5-7% range.3

Yet high-yield bonds aren’t without risk. They’re less liquid, more volatile, and subject to greater default risk than investment-grade bonds. And with the economy continuing to struggle under the weight of COVID, managing these risks through proper diversification is more critical than ever.

Private placements: private credit and infrastructure funds

For those investors who qualify, private credit and infrastructure funds offer attractive yields uncorrelated with the broader public markets. A private placement is a partnership open only to “accredited” or “qualified” investors (as defined by the Securities and Exchange Commission). They typically have minimum investment requirements in the $250,000 range, require investors to commit capital for a period of not less than 5-10 years, and are highly illiquid. In exchange, investors can often expect yields in the 6% to 10% range (net of fees) depending on the fund, the amount of leverage employed (if any), and the fund manager’s investment strategy.

As one might imagine, any investment in a partnership is not without its risks. Private placements are illiquid, can be difficult for inexperienced investors to understand, and typically make concentrated investments in only a handful of companies. For all these reasons, investors should seek professional financial advice before considering any such investments.

Fixed and immediate annuities

Those investors looking for a relatively safe alternative to bonds might wish to consider a fixed annuity from a highly rated insurer. Fixed annuities are contracts whereby the insurer agrees to pay the annuity owner a guaranteed interest rate for the duration of the contract. And annuity interest payments are tax-deferred until withdrawn, making annuities a powerful tax-planning vehicle. At the time of writing, fixed annuities offered by an A-rated insurer pays a guaranteed interest rates in the range of about 2.9% per year for the duration of the contract, which typically lasts about five years.

For those looking to maximize guaranteed cash flow (which includes a combination of yield and return of principal), an immediate annuity might be a viable option. This is an annuity in its purest form where an individual purchases a guaranteed stream of lifetime income from an insurance company in exchange for a single lump-sum payment. For example, a married couple, aged 65, can currently purchase a guaranteed joint lifetime monthly income of $4,000 for $1 million that would continue to make payments until the passing of the second spouse. And it pays to delay where possible; that guaranteed monthly income rises to about $4,410 per month for a couple aged 70, and to approximately $5,229 per month for a couple aged 75.

However, annuities, despite their guarantees and tax-planning benefits, aren’t without their tradeoffs. Guarantees don’t come cheap. Fees can be high, surrender periods (contract duration) can last many years, and the surrender penalties can be steep. And in the case of immediate annuities, the decision to annuitize is typically irrevocable or revocable only at great cost.

Yield vs risk

Despite the low-yield environment, there are asset classes and solutions that offer investors significantly higher yields than those on treasuries and high-quality bonds. But higher yields come with costs, typically in the form of higher risk, less liquidity, and higher fees. Subsequently, clients should always discuss with their advisors whether they require exposure to higher-yielding assets and, if so, how best to incorporate those into their financial plans.

1 The highest capital gains rate is 20%. The highest marginal income tax rate is 37%. Other taxes may apply, such as the Net Investment Income Tax of 3.8%.

2 JP Morgan Guide to the Markets, August 31, 2020, slide 9.

3 MA US High Yield Fixed Income ETF Portfolio. Yield as of 8/31/2020. The MA US High Yield Fixed Income ETF Portfolio includes allocations to SHYG, USHY, and AGGY.

Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate, but is not guaranteed or warranted by Mercer Advisors. Content, research, tools, and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark. This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control. Mercer Advisors is not a law firm and does not provide legal advice to clients. All estate planning documentation preparation and other legal advice is provided through its affiliation with Advanced Services Law Group, Inc.