Want to learn more?

Jack McCloskey, CFP®

Lead, Senior Wealth Strategist

A common concern about early retirement is how to bridge the gap in health insurance coverage until Medicare eligibility at age 65.

Retirement before age 65 involves more than just financial planning. Along with the practical considerations of day-to- day affordability, a comprehensive early-retirement strategy should address factors such as taxation, life expectancy, and unforeseen expenses. You might also consider the emotional aspects of retiring before 65, such as potential boredom, loneliness, shift in identity, and family dynamics.

2023 Retirement Confidence Survey (ebri.org)

One of the most common concerns about early retirement is the gap in health insurance coverage until Medicare eligibility at age 65. Without proper planning, it can lead to unforeseen medical expenses. To mitigate this risk, individuals who are considering early retirement should explore the following options:

1. Employer-sponsored health insurance: If available through a spouse or domestic partner, this option often provides cost-effective coverage.

2. Private health insurance: If you’re ineligible for a partner’s employer-sponsored plan, you might consider a private insurance plan. Although an individual becomes qualified for Medicare at age 65, the coverage doesn’t include their spouse, domestic partner, or dependents. If you need insurance coverage for your entire family, a private plan is a potential solution.

3. Health savings account: If, prior to retirement, you contributed to a tax-advantaged health savings account (HSA) and accumulated a significant amount, utilize those funds for qualified medical expenses. HSA funds can also be used for health insurance premium payments if you’re covered by a COBRA plan or collecting unemployment. An HSA provides flexibility after age 65 and can be used to pay for long-term care and Medicare premiums.

4. COBRA coverage: This federal provision allows continuation of existing health insurance for 18 months post- employment, albeit with potentially higher premiums. Following the 18-month period, you may have the option to continue the plan.

5. Government-sponsored insurance exchange: You can apply for insurance through the U.S. government’s Health Insurance Marketplace®, which can serve as a bridge until Medicare kicks in. Federal health insurance is available in 31 states. In addition, 18 states and the District of Columbia offer their own health insurance programs.1 The premium varies and is based on your household’s modified adjusted gross income (MAGI). In some cases, higher MAGI will result in greater insurance costs. You could be eligible for a tax credit and lower monthly premiums, depending on your income and other people in your household, and thereby offset the expense of exchange-based health insurance in retirement. For many Mercer Advisors clients, this may be a tax- planning consideration.

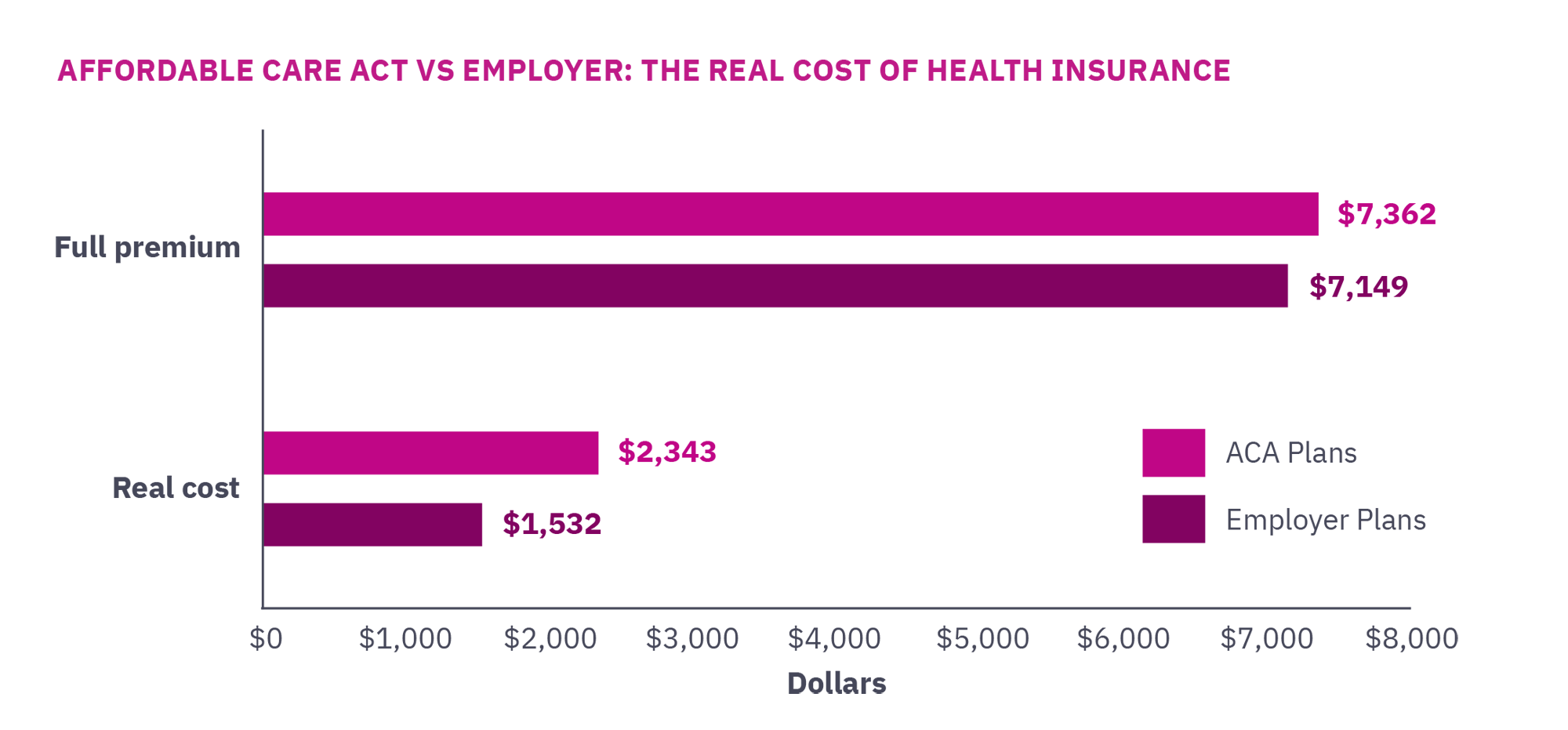

Affordable Care Act vs Employer: The Real Cost of Health Insurance – HealthCare.com

Choose what’s best for you

Navigating these choices can be complex, with implications for both short-term and long-term financial security. It’s essential to carefully weigh the costs, benefits, and tax implications of each option. In addition to determining whether a tax credit is available, you must also ensure that it’s applicable to your situation.

Opting for early retirement is a big decision, so it’s important to secure health care coverage before age 65. Health typically declines with age, and not just physically. Retirees generally find themselves with unfamiliar extra time, which, if not structured meaningfully, can lead to mental health challenges. Research shows a connection between the early stages of retirement and cognitive decline, and numerous studies indicate that retirement can exacerbate a slew of mental health issues, including anxiety and depression.2

Introspection should precede early retirement. That’s why we ask clients these questions:

We can help

One of the most difficult things about health care is just navigating the system. Did you know that Mercer Advisors clients receive an introductory offer to Wellthy? This concierge service provides personalized support for the logistical and administrative tasks of caring for yourself or a loved one.

Wellthy can help with a range of tasks, such as booking appointments, finding the right health care provider, researching case solutions, vetting an in-home aide, and more. If you’re already a Mercer Advisors client but not utilizing Wellthy, contact your advisor to learn more about the service.

And if you aren’t a client but would like more information about all of the services available from Mercer Advisors, let’s talk.

1 As of March 2024.

2 “Retirement Is One Of Life’s Major Transitions—Maintaining Cognitive Health Can Make It Easier,” Forbes Health, January 11, 2024.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors. More information about Wellthy and our Strategic Partners may be found in our Form ADV 2A.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.