Meet Chris

Chris is the Managing Partner of Mercer Advisors Atlanta office. He started his career with PricewaterhouseCoopers in Atlanta before leaving in 2013 to pursue his career in personal finance. He worked with his mother and bought her practice upon her retirement and then merged that practice with Atlanta Financial Associated in 2018. He and his partners at Atlanta Financial joined Mercer Advisors as a team in 2020. Chris earned a Master of Accountancy degree from the University of Alabama. He is a Certified Public Accountant and CERTIFIED FINANCIAL PLANNER® professional.

Chris’s specialties

At Mercer Advisors, all of our wealth advisors provide a highly personalized approach, backed by a team of specialists that ensure every part of your financial list is addressed. Additionally, Chris has focused experience in these areas:

- Support for business owners, from growth and succession to liquidity events and legacy planning

- Helping new families shift financial priorities while building a strong foundation for the future

- Concentrated stock positions that require strategic diversification and tax efficiency

- For business owners, advice on selling your business to help maximize value — and plan what comes next

- Family businesses navigating succession, liquidity, and legacy goals

His working style

Chris places a lot of value on responsiveness, follow through, and organization. He believes entrusting your family wealth to Mercer Advisors is a big responsibility and he does not take that lightly. His job is to provide you with concise information and choices to help guide you to the right plan for your family.

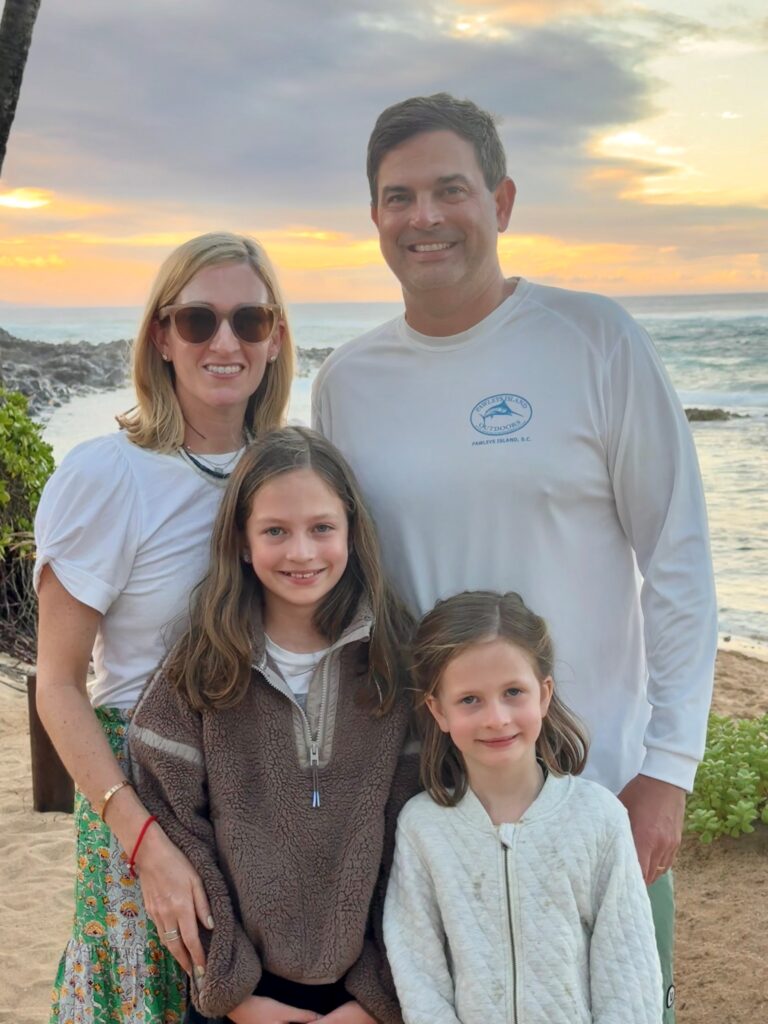

Chris in real life

What keeps you busy outside of work?

I have two young daughters, Alice and Birdie, who are in a fun phase of life. They are in elementary and middle school and I love watching them become their own people, coaching their basketball, leading their Sunday school, and just being a spectator at the things I know nothing about, like gymnastics and cheer. We are a big game family and love they are at an age where we can all play games together; even Birdie (6) is a Mahjong player.

Favorite thing about where you live?

I grew up in a small town, Eufaula, Alabama, before going to college at the University of Alabama, and have been in Atlanta since 2006. While I don’t enjoy the crowds of Atlanta, I love all the things to do here with restaurants, concerts, and sporting events. It is also great that you can fly almost anywhere in the world from our airport. My family loves to travel and I have a motto that if Delta doesn’t fly there direct, we probably don’t need to go. I also love that we are just a short drive from the North Georgia mountains and lakes.

What makes you tick?

I’m a huge sports fan. I love everything about the competition and learning to win as a team AND lose as a team. Sports can teach you so many life lessons, such as how to celebrate wins and pick teammates up when they are down. I love watching football (the ultimate team game) and enjoy golfing, running, and playing pickleball. I am a big believer that you can learn more about someone in four hours on a golf course or watching their team play a game than almost any other avenue in life.

Chris’s snapshots

Meet Chris’s Teammates

Articles by Chris

Executive Compensation: 4 Perks and Pitfalls

Learn more

Ready to learn more?

Explore More

Wealth managers do not pay a fee to be considered or placed on the final list of Five Star Wealth Managers. The award is based on 10 objective criteria. Eligibility criteria-required: 1. Credentialed as a registered investment adviser (RIA) or a registered investment adviser representative; 2. Actively licensed as a RIA or as a principal of a registered investment adviser firm for a minimum of 5 years; 3. Favorable regulatory and complaint history review (As defined by FSP, the wealth manager has not; A. Been subject to a regulatory action that resulted in a license being suspended or revoked, or payment of a fine; B. Had more than a total of three settled or pending complaints filed against them and/or a total of five settled, pending, dismissed or denied complaints with any regulatory authority or FSP’s consumer complaint process. Unfavorable feedback may have been discovered through a check of complaints registered with a regulatory authority or complaints registered through FSP’s consumer complaint process; feedback may not be representative of any one client’s experience; C. Individually contributed to a financial settlement of a customer complaint; D. Filed for personal bankruptcy within the past 11 years; E. Been terminated from a financial services firm within the past 11 years; F. Been convicted of a felony); 4. Fulfilled their firm review based on internal standards; 5. Accepting new clients. Evaluation criteria-considered: 6. One-year client retention rate; 7. Five-year client retention rate; 8. Non-institutional discretionary and/or non-discretionary client assets administered; 9. Number of client households served; 10. Education and professional designations. FSP does not evaluate quality of services provided to clients. The award is not indicative of the wealth manager’s future performance . Wealth Managers may or may not use discretion in their practice and therefore may not manage their clients’ assets. The inclusion of a wealth manager on the Five Star Wealth Manager list should not be construed as an endorsement of the wealth manager by FSP or this publication. Working with a Five Star Wealth Manager or any wealth manager is no guarantee as to future investment success, nor is there any guarantee that the selected wealth managers will be awarded this accomplishment by FSP in the future. Visit www.fivestarprofessional.com.

Please Note: Limitations. Neither rankings and/or recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any professional designation, certification, degree, or license, membership in any professional organization, or any amount of prior experience or success, should be construed by a client or prospective client as a guarantee that they will experience a certain level of results if Mercer Advisors or its investment professionals are engaged, or continues to be engaged, to provide investment advisory services. A fee was not paid by either Mercer Advisors or its investment professionals to receive the award or ranking. The award or ranking is based upon specific criteria and methodology. No ranking or recognition should be construed as an endorsement by any past or current client of Mercer Advisors or its investment professionals.