Ready to learn more?

Explore More

Home » Insights » Retirement » 4 Tax Strategies for Maximizing Social Security Benefits

Jamie Block, CFP®, CPA/PFS, CDFA®, AEP®, MBA

Sr. Wealth Advisor, Sr. Director

A financial specialist discusses Social Security benefits calculations, tax mitigation, and other retirement-age wealth strategies.

Did you know that Social Security income is taxable, and that you may have to repay benefits if your income is higher than a certain threshold? Is it surprising that the Social Security Administration deems 67 to be the full retirement age? While these facts may be new to you, specific strategies can potentially mitigate your tax burden and help maximize your benefits. We’ve created a brief guide for deriving the most income potential from your Social Security benefits. Keeping in mind four key concepts is critical: be aware of income limits, determine how your benefits are taxed, consider the impact of a Roth IRA conversion, and determine the optimal age to begin collecting benefits.

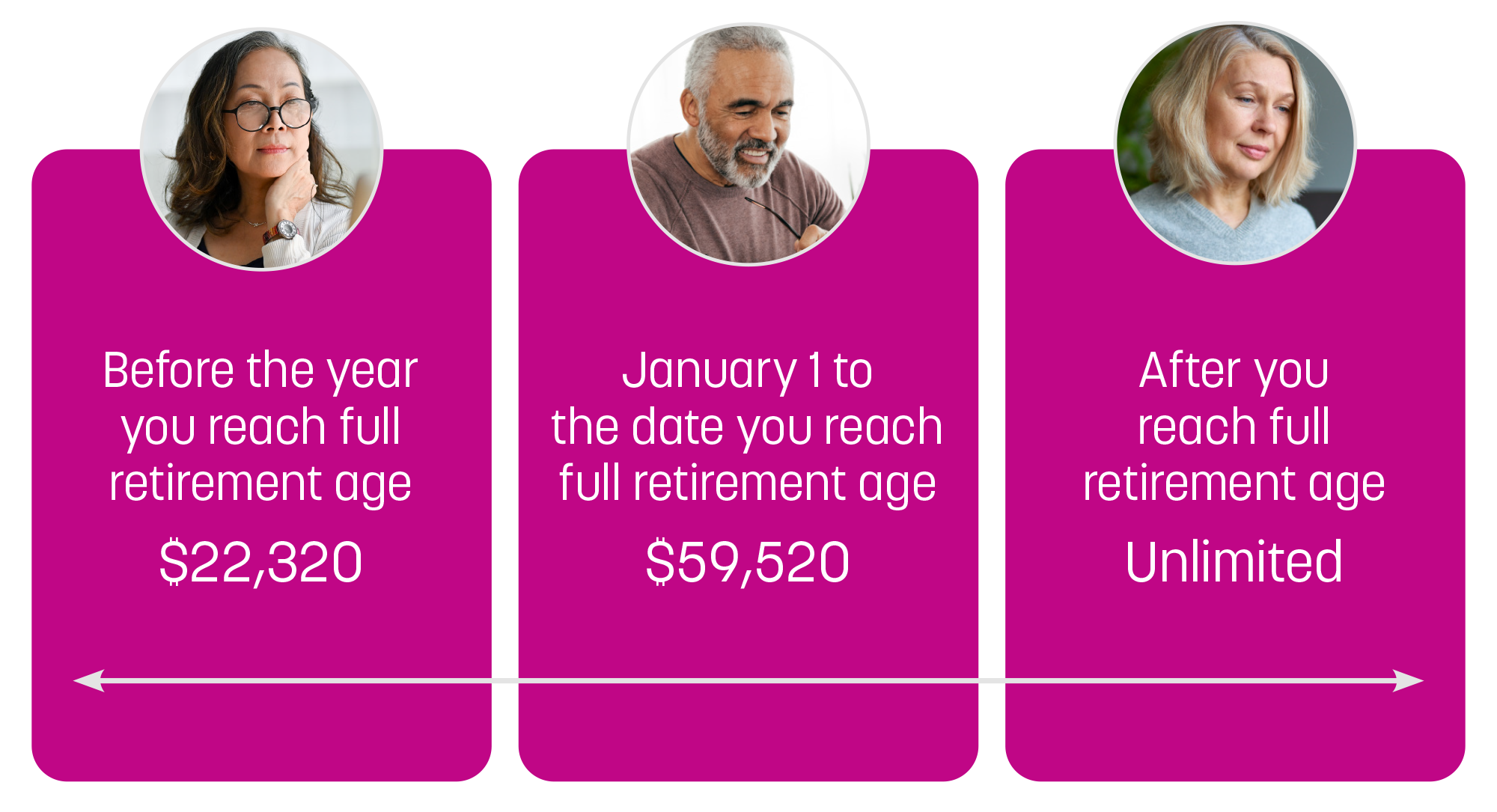

1. Be aware of income limits

If you collect Social Security before the full retirement age of 67, there are limits to how much income you can earn from work before you must repay some benefits. “Work” is defined as W-2 income (salary, hourly, bonuses, and commissions) as well as net income from self-employment (business income). It doesn’t include income from interest or dividends. In the year when you reach full retirement age, you’re allowed a higher income threshold than in the preceding year.

Table 1: Social Security Earning Limits, by Age

Source: Social Security Administration

Examples of income limits:

2.Determine how your Social Security benefits are taxed

A common misconception is that Social Security benefits are tax-free, but this is not necessarily the case. Here are some guidelines to help determine how much of your Social Security benefits will be taxed. Depending on income and filing status, up to 85% of benefits may be taxable. On the brighter side, the remaining 15% will always be tax-free.

Table 2: Social Security Taxation, by Income and Filing Status

| Single, combined income | Married filing jointly, combined income | |

| No tax on Social Security benefits | < $25,000 | < $32,000 |

| Up to 50% of benefits are taxable | $25,000–$34,000 | $32,000–$44,000 |

| 85% of benefits are taxable | > $34,000 | > $44,000 |

Source: Social Security Administration

How to calculate combined income:

Adjusted gross income (AGI) (line 11 of Form 1040 for tax-year 2023 minus Social Security on line 6b)

+ Tax-exempt interest (line 2a of Form 1040 for tax-year 2023)

+ Half of Social Security benefits (SSA-1099, box 5)

= Combined income

3.Consider the impact of a Roth IRA conversion

Roth IRA conversion is a strategy for moving money from a taxable IRA to a tax-free IRA. Typically, this process is reported in the tax return for the year when the conversion occurred. There are many reasons to consider a Roth IRA conversion:

There may be some drawbacks, however, to a Roth IRA conversion:

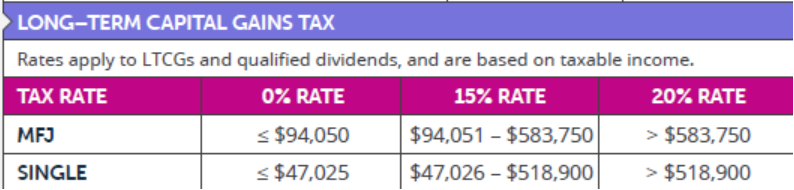

Table 3: Long-term Capital Gains Tax Brackets

Source: Internal Revenue Service

Beware the “tax torpedo.” This concept is threatening not only in name but also in execution: higher income means greater taxation of Social Security benefits (see Table 3 above). For every dollar of income above the threshold of $34,000 for a single filer and $44,000 for married filing jointly, an additional $0.85 of Social Security benefits will be taxed—until a maximum of 85% of benefits is reached. For example, if you earn $1 more in interest, that dollar will be taxed as income and another $0.85 of Social Security benefits will be taxed. Thus, $1 of interest income actually means $1.85 of taxable income, so the marginal tax rate is 185% of the tax bracket.1 This is why the term “tax torpedo” was coined—an increase in income can nearly double the amount of tax due, because Social Security benefits must be included.

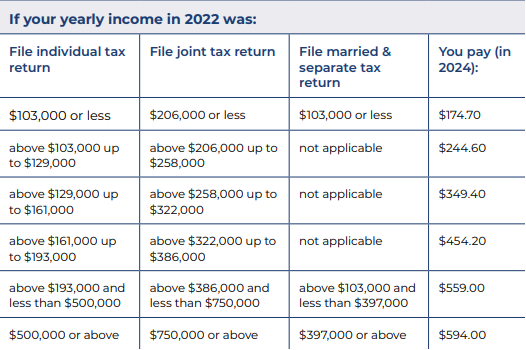

A Roth IRA conversion can increase the amount of AGI in a tax return. Not only will more Social Security income be taxable, but Medicare premiums can also be affected. The income-related monthly adjustment amount (IRMAA) determines the Medicare premium that must be paid. Social Security uses the income tax return from two years prior, so a Medicare premium for 2024 will be based on the reported income in a 2022 tax return. In Table 4, you can see that when modified AGI moves you into a higher bracket, Medicare premiums for that year may also increase.

Table 4: Medicare Premiums, by Income and Filing Status

Source: Centers for Medicare & Medicaid Services

4.Determine the optimal age to begin collecting benefits

If only we had a crystal ball that could foresee our age at death, then we’d know exactly when to begin collecting Social Security benefits. Unfortunately (or fortunately, depending on your viewpoint), we must instead use other tools in making this decision. Three different benefits are available to individuals, assuming eligibility has been met:

When determining the best strategy, you must consider which benefits are applicable and what they would amount to. If no one in your family has lived past age 65, you might decide to collect benefits sooner rather than later. If longevity is on your side, delaying Social Security could be a better option. You should also evaluate the health of the Social Security system itself. In their 2023 annual report, trustees of the Social Security fund said it will be capable of paying 100% of benefits until 2033, at which point the rate will fall to 77%. While this is a staggering decline, Congress has many tools that can help address the deficit in advance, such as increasing the full retirement age, raising the Social Security tax rate above 6.2%, raising the amount of wages subject to Social Security tax above $168,000, or reducing benefits.

If no other assets or income are available to you, then collecting Social Security may be your only option. Benefits increase by 8% for every year you defer after reaching full retirement age. Conversely, benefits decrease by as much as 30% if you collect them early. Waiting until full retirement age—or later, if possible—is the best strategy for a higher payout.

Table 5: Social Security Payout, by Age, for Individuals Born in 1960 and Later

| Age at collection | Benefits received |

| 62 | 70% |

| 63 | 75% |

| 64 | 80% |

| 65 | 86.7% |

| 66 | 93.3% |

| 67 | 100% |

| 68 | 108% |

| 69 | 116% |

| 70 | 124% |

Source: Social Security Administration

Social Security benefits calculations may seem like rocket science, but we’ve highlighted a few savvy strategies to help you maximize benefits while minimizing the tax burden. If you’re still uncertain or need help in determining which Social Security tax strategies are best suited to your portfolio, contact your wealth advisor today. If you’re currently looking for an advisor, let’s talk.

1Morningstar, “How Retirees Can Avoid the ‘Tax Torpedo,’ March 8, 2023.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. The hypothetical examples are for illustrative purposes. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements. The CDFA® and Certified Divorce Financial Analyst marks are the property of the Institute for Divorce Financial Analysts, which reserve sole rights to their use, and are used by permission.