By any objective measure, last year was a tough one. 2022 will forever be remembered as the year when the Fed unwound the easy monetary policy of the past 15 years to combat the highest inflation in four decades. Between March and December, the Fed raised interest rates seven times for a grand total of 425 basis points—bringing the Fed Funds rate to its highest level since 2007. As if that weren’t enough, beginning in June the Fed began a new “quantitative tightening” exercise to shrink its balance sheet, a process that adds further upward pressure to interest rates.

While the Fed’s rate hikes have ostensibly had little impact on inflation thus far (more on this below), they’ve undoubtedly had a major impact on global financial markets. Virtually every major asset class finished down for the year. More-speculative asset classes, such as cryptocurrency and growth stock, saw exceptionally steep losses. Relative outperformance, albeit still negative, was to be found in previously unloved asset classes such as dividend-paying, value, and low-beta stock as well as short-duration bond. Even Treasury inflation-protected securities (TIPS), despite the inflation protection they offer, finished the year down by double digits (see table of select asset-class returns at the end of this article).

While no one knows for sure what the future holds, one thing seems certain: 2022 was the year when sobriety and common sense returned to financial markets. Gone are the days of digital assets with no tangible value—what JPMorgan Chase CEO Jamie Dimon derisively called “pet rocks”1—outperforming solid companies with reliable cash flows. The same could be said for any number of speculative asset classes—growth stock, special-purpose acquisition company (SPAC), or non-fungible token (NFT), to name only the most popular of the past decade. The price of everything, from stocks and bonds to real estate and cryptocurrencies, is again re-tethered to interest rates. Consequently, monetary policy in 2023—specifically, where the Fed lands on interest rates—will most likely determine the direction of the economy and markets this year.

Economic outlook

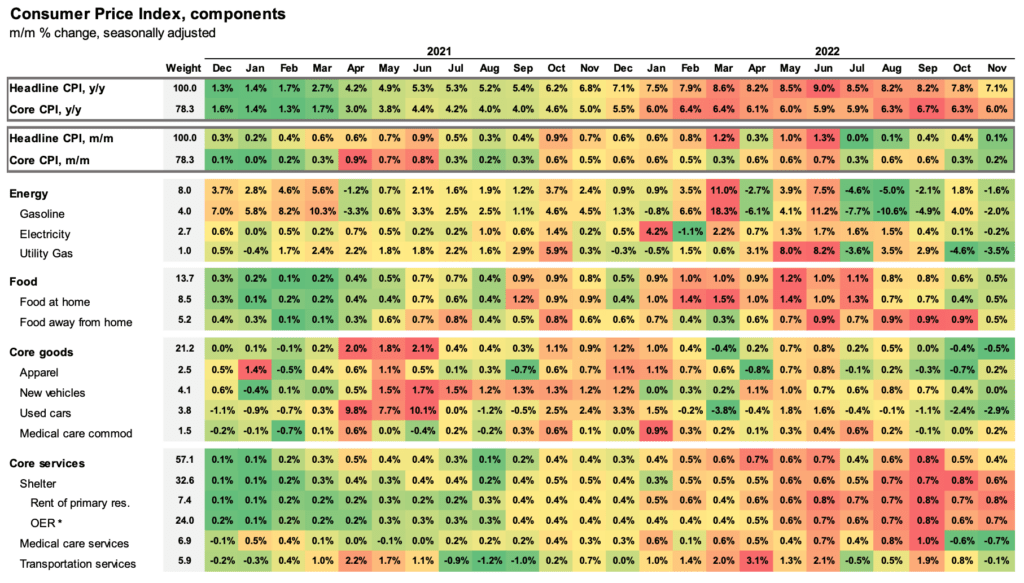

As 2022 came to a close, the Fed’s rate hikes had undoubtedly begun to broadly impact the economy. Consumer confidence, retail sales, homebuilder sentiment, and new housing starts are all down. The Purchasing Managers’ Index (PMI) has declined to 46, a leading indicator that suggests the economy may already be in recession.2 But there is some good news, too. The CPI report for November indicated that headline inflation rose just 0.1% (0.2% for core), bringing year-over-year inflation down to 7.1%—and suggests that inflation probably peaked back in June at 9.1%. More important, headline inflation of 0.1% in November—if sustained—suggests an annualized run-rate of 1.2% headline inflation over the next 12 months, a significant decline from the highs of 2022. Indeed, the consensus is for inflation to fall to somewhere around 3% to 4% by the end of 2023. Energy prices have come down significantly from their June highs, and gasoline prices at the end of 2022 were lower than a year earlier, a powerful tailwind that only adds to the disinflationary forces already building throughout the economy.3

All of this says three things:

- First, the economy today is now threatened more by recession than inflation. A steeply inverted yield curve, a declining PMI4, the highest mortgage interest rates in 15 years, a strong dollar, and slumping overseas growth all suggest relatively high odds of recession in the year ahead. Economists surveyed by Bloomberg forecast a 70% chance of a recession in 2023.5 Keep in mind, however, that there is always significant noise around economic forecasts; economists, in fact, tend to have a relatively poor record when it comes to predicting the future path of the economy.

- Second, we think the Fed will ultimately change course on interest rates, and recent events aside, we believe the Fed remains relatively data-dependent when making monetary policy.6 We believe there’s still a narrow window for the Fed to achieve a “soft landing” whereby it beats back inflation and the U.S. economy avoids recession. However, that window appears to be narrowing rapidly given the Fed’s hawkish tone and recent forecasts that, surprisingly, appear to ignore November’s big decline in inflation.7 There is, consequently, a very real possibility that the Fed overtightens and subsequently pushes the economy into recession—but we suspect it’ll change course on rates before that happens.

- Finally, there are significant risks that could derail the most elegant economic forecasts. The past 12 months have sadly reminded us that we live in a dangerous world. The war in Ukraine, mounting tensions across the Taiwan Strait, the rise of a new COVID-19 variant, the end of China’s zero-COVID policy, or even public unrest in Iran could impact the global economy in unforeseen ways during the year ahead. Beyond geopolitics or epidemiological threats, mounting stress in the financial system could also derail the economy. It’s quite possible the Fed has already overtightened on monetary policy and is causing unintended damage somewhere. As we’ve written many times before, the economy is infinitely complex.

Exhibit A: Year-over-year inflation peaked in June 2022 and has since moderated.8 Green cells below represent lower inflation, and red ones represent higher inflation. We see that most categories, with the exception of shelter, cooled in November.

*OER refers to Owners Equivalent Rent

Market outlook

It’s important to remember: the economy isn’t the market, and the market isn’t the economy. The challenge with economic data is that it’s backward-looking; recessions are typically identified months after they’ve ended and the markets have rallied. Consider, for example, the global financial crisis (GFC) of 2008. While the recession began in December 2007, it wasn’t officially identified as such by the National Bureau of Economic Research (NBER) until 12 months later—in December 2008—by which time the S&P 500® had already declined 44%. Further, while the recession ended in May 2009, it wasn’t announced officially by NBER until September 2010—16 months later—by which time the S&P 500 had already rallied 38%.

There are many reasons for investors to be optimistic in the year ahead. I’ll focus here on just three: valuations, earnings growth, and market history.

Valuations

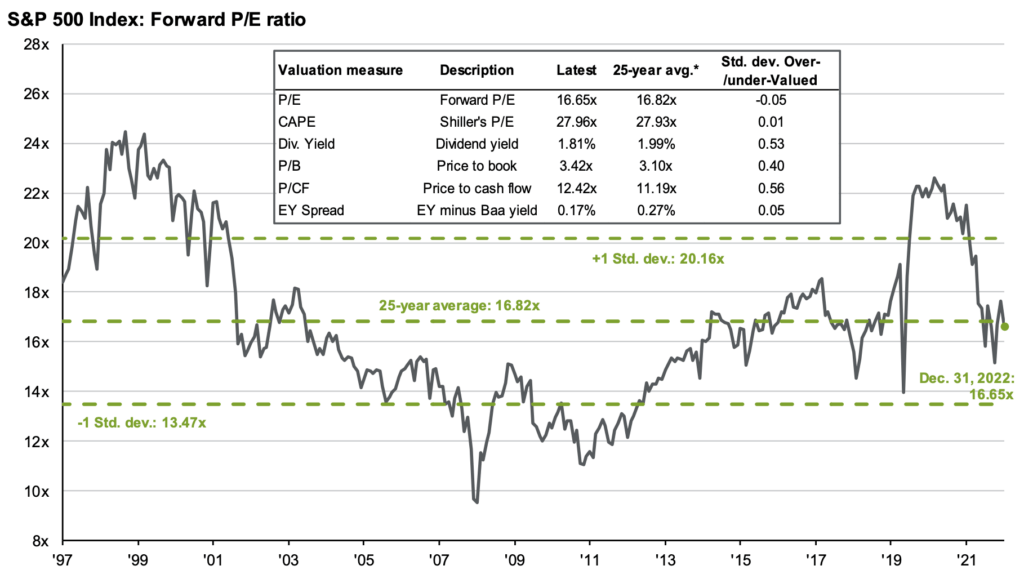

First, valuations for most asset classes are more attractive today than they’ve been in years. Negative returns for both stocks and bonds in 2022 succeeded in bringing down market valuations from their highs and, in the process, greatly improved the market’s overall financial health. Many asset classes today are attractively priced relative to their recent past, and moderately priced relative to their long-term history. For example, the S&P 500 finished the year trading at 16.65 times 2023 estimated earnings versus the 22 times earnings that it traded at this time last year.

Exhibit B: Equity market valuations have all come down, resulting in improved market health for investors relative to this time last year.9

It’s unlikely, however, that the market will remain valued at 16.65 times earnings; Exhibit B highlights how the S&P 500 valuation has changed over time. Wharton professor Jeremy Siegel argues that, for a number of reasons, the S&P 500 should on average trade at about 20 times earnings.10 Whether Professor Siegel is right or wrong remains to be seen, but we think he’s directionally accurate, given that both the market and the Fed project lower interest rates in the future. (The market predicts that the Fed will begin cutting rates in late 2023 or early 2024; the Fed predicts that it’ll begin cutting them in early 2025.) 11 As a result, it’s not a stretch to expect multiples to rise again once the Fed pauses and, ultimately, reverses course on interest rates. The S&P 500 trading at 17 or 18 times earnings by late 2023—about 5.5% higher than today’s level—seems possible.

Similarly, the returns prospect for value stocks—which trade at valuations less than that of the broad market—seem particularly attractive as 2023 begins, with value stocks trading at about 13.9 times earnings (versus a still-frothy 21.1 times earnings for growth stocks). While Mercer Advisors portfolios are broadly diversified across and within major global asset classes, it’s for this reason—valuations—that we specifically target value stocks in our portfolios.

Fund Focus: To invest in U.S. value stocks, our portfolios often use several different ETFs and funds, but our preferred fund is Dimensional Fund Advisors’ US Large Cap Value Portfolio (III) (or its ETF proxy, DFUV). DFUVX returned -5.69% in 2022 (versus -7.54% for the Russell 1000 Value), and the fund’s underlying holdings had a forward PE of only 12.06 times earnings as of December 31, 2022 (versus 13.9 times for the Russell 1000 Value and 16.65 times for the S&P 500 Index). [Source: Morningstar, Inc.]

With respect to non-U.S. stocks, valuations relative to U.S. stocks (as well as to history) remain quite low. For example, non-U.S. stocks currently trade at 12 times earnings—an 8% discount relative to their long-term valuation of 13.1 times earnings, and a staggering 30% discount relative to U.S. stocks. While it can be argued that non-U.S. stocks are valued to reflect geopolitical risks, slowing global growth, and a strong dollar, it also stands to reason that a cessation of hostilities in Ukraine, a weaker U.S. dollar (perhaps due to a pause in rate hikes or even a rate cut), and stronger-than-expected global growth could all boost returns on non-U.S. stocks for U.S. investors—which is very much in the cards for 2023. Mercer Advisors portfolios remain slightly underweight non-U.S. stocks, but for several reasons—diversification, attractive valuations, above-average dividend yields, a hedge against declines in the U.S. dollar—we continue to offer risk-appropriate allocations to both developed- and emerging-market stocks.

Fund Focus: To invest in non-U.S. value stocks, we use Dimensional Fund Advisors’ International Value Portfolio (III) (DFVIX) or its equivalent, International Value ETF (DFIV). DFVIX returned -3.37% in 2022 versus -5.64% for the MSCI World ex-USA Value Index; the fund’s underlying holdings have a forward PE of only 7.4 times earnings (versus 12 times earnings for the MSCI EAFE Index). [Source: Morningstar, Inc.]

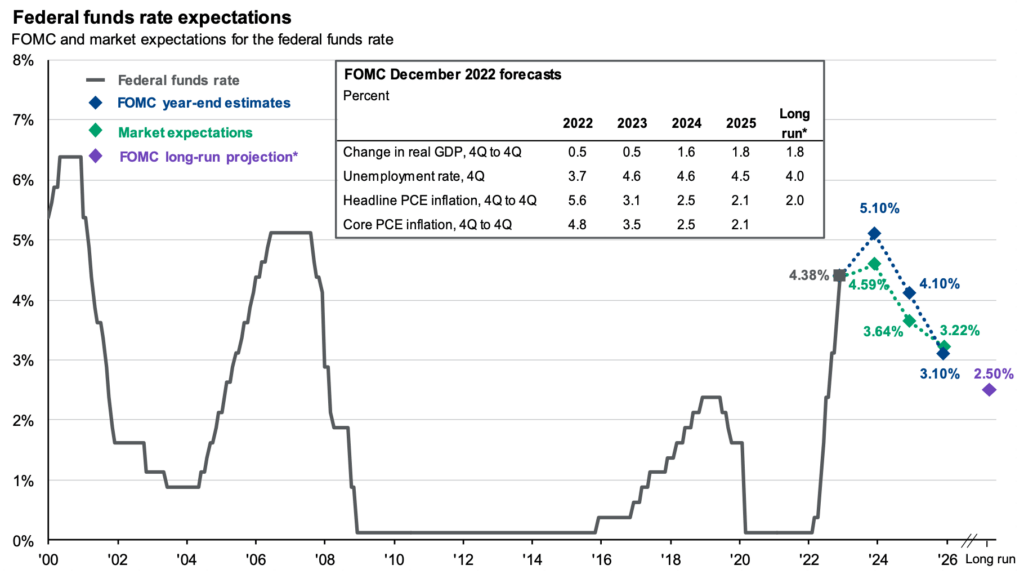

Exhibit C: The Federal Reserve (FOMC) and financial markets expect the Fed will cut rates sometime between late 2023 and early 2025.12

With respect to fixed income, bonds today offer investors the highest yields in nearly a decade. At the end of 2021, 2-year Treasuries yielded 0.73%; a year later they yield 4.41%. While the yield curve across a range of bonds may be steeply inverted, investors today have opportunities in short-duration fixed income that simply didn’t exist 12 months earlier—a major breath of fresh air for diversified portfolios and income-oriented investors. Should the Fed pause hikes and eventually begin to cut rates in late 2023, as the markets forecast they will, diversified portfolios with allocations to bonds should again be well positioned to benefit.

Finally, this also suggests that investors could begin adding slightly longer-duration bonds to their portfolios (perhaps going to 3–5 years in certain asset classes), but we don’t think those opportunities will materialize until later in 2023 or in early 2024. In response to the Fed’s rate hikes, the Mercer Advisors Investment Committee significantly shortened duration in our bond portfolios last year, in January and again in late April. At the moment, most of our bond portfolios have durations in the range of 2 to 2.5 years. Going forward, we’ll continue to pay close attention to bond yields and Fed policy to determine whether it makes sense to extend bond duration in our portfolios.

Fund Focus: To shorten duration in our portfolios, we often anchor our fixed income strategies around a combination of funds and ETFs such as Vanguard’s Short-Term Bond ETF (BSV) and State Street’s SPDR® Bloomberg 1-3 Month T-Bill ETF (BIL). BSV has an average duration of 2.65 years and returned -5.49% in 2022 (versus -13.01% for the much-longer-duration Bloomberg US Aggregate Bond Index, which has a duration of six years). State Street’s BIL has an effective duration of only 0.08 years (less than one month) and returned 1.4% in 2022. Source: Morningstar, Inc..

Earnings Growth

Earnings growth should be another positive tailwind for equity markets this year. Earnings drive stock prices, and in today’s market, with a newfound emphasis on fundamentals, earnings really matter. Short of a recession—a very real possibility—consensus estimates are for around 5% earnings growth for S&P 500 companies in 2023.13 While analysts continue to revise earnings estimates downward, they remain positive at the moment.

To be clear, not all sectors are expected to experience positive earnings growth in the year ahead; the energy, materials, and healthcare sectors, for example, are all expected to see negative earnings growth in 2023. Should the U.S. or global economy dip into recession, more companies and sectors could experience negative earnings growth. At the moment, however, strong earnings momentum in sectors such as consumer discretionary, industrials, and financials is expected to offset losses elsewhere. Overall, analysts continue to expect earnings growth of 5.3% for S&P 500 companies.14

When we combine a potential for a 5.5% increase in valuations for the S&P 500 (from 16.6 times earnings to 17.5 times) with the prospect of 5% earnings growth, that equates to a potential return of about 10% for the S&P 500 Index in 2023, an estimate that aligns with those of most other managers.15

Fund Focus: To invest in U.S. companies with above-average profitability, our preferred fund is Dimensional Fund Advisors’ US High Relative Profitability Portfolio (DURPX) or its ETF equivalent, DUHP. DURPX returned -11.81% in 2022 versus -19.13% for the Russell 1000 Index. Source: Morningstar, Inc.

Market History

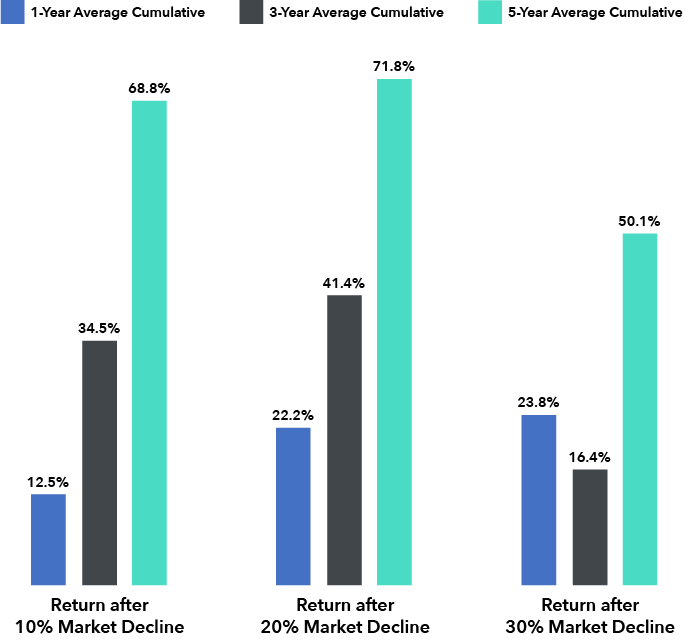

Market history is on the side of the optimists. Historically, market returns after a relatively sharp decline have been quite good. Since 1926, stocks have averaged a 12.5% return in the years following a decline of 10%; the average return has been 22.2% in the years following a decline of 20%. The S&P 500 fell 18% in 2022. While history rarely repeats, it does tend to rhyme.

Exhibit D: Market returns tend to be quite positive in the years following a significant decline.16

Advice for investors in the new year

If there’s a silver lining to 2022, it’s that it helped re-ground investors in the basics: fundamentals matter, predictions should be taken with a healthy dose of skepticism, and prudent planning prevails in the long run. With these lessons in mind, we recommend that investors focus on five key essentials in the year ahead.

- Forget the forecasts. This might seem odd in a year-end review that includes several forecasts, but the reality is that the future is ultimately unknowable, economic forecasting is far from a precise science, and the economy is infinitely complex. While some forecasts are certainly better than others, all of them contain a high degree of uncertainty. Investors would be wise to avoid making big financial or investment decisions based on what they expect will happen, and should instead build plans and portfolios that help protect against what they least expect. After all, we diversify for the very same reason. Hubris has destroyed more wealth than any bear market; sound advice is to hedge against it with humility.

- Keep speculative assets in context. This is your wealth that we’re talking about, so significant allocations to cryptocurrencies or individual stocks simply aren’t prudent. Bitcoin’s staggering losses (-65% in 2022), the implosion of FTX (-100% return), and steep losses in popular technology-related stocks (see exhibit below) taught investors painful lessons in 2022. To be clear, we’re not against investing in speculative new technologies. But every investment, especially a highly speculative one, needs to be carefully evaluated, understood, and sized so that a negative outcome doesn’t compromise your financial security, financial-planning objectives, or financial future.

Exhibit E: Popular technology stocks and cryptocurrencies experienced steep losses in 2022.17

| Stock/Cryptocurrency |

2022 Return |

| Coinbase |

-86.3% |

| Tesla |

-67.7% |

| Ethereum |

-67.3% |

| Bitcoin |

-64.7% |

| Meta Platforms (formerly Facebook) |

-64.2% |

| Netflix |

-51.1% |

| Amazon |

-49.6% |

| Alphabet (Google) |

-38.7% |

| Apple |

-26.4% |

- Be on alert for sales pitches. It seems that the aftermath of a bad market is always filled with pitches for strategies and products that “worked” during the decline. The challenge is that these offerings are typically undiversified, expensive, illiquid, or incapable of delivering sustainable, long-term returns. While things such as commodities, annuities, TIPS, or hedge funds may have their place in a portfolio, investors should be careful not to invest in these products or asset classes based on recent past performance, and should work closely with their advisor to carefully assess the risks, complexity, long-term-return prospects, fees, tax treatment, and relative lack of transparency and liquidity before making any serious decisions.

- Keep it simple and play the long game. There’s no substitute for a low-cost core portfolio that’s highly diversified across and within global asset classes. In 2022, the market’s most-popular technology stocks—such as Meta (formerly Facebook), Amazon, Apple, Netflix, Google, Tesla, and Coinbase—collectively declined by a staggering 55% versus the relatively modest decrease of 18.1% for the S&P 500.18 But the benefits of diversification didn’t stop there. In a year when non-U.S. stocks outperformed U.S. stocks, global diversification was helpful. Within equities, even modest allocations to certain factors—such as value, dividend paying, or minimum volatility—would’ve further muted those losses. Any allocation to bonds (especially short-term bonds) would’ve also been helpful. The Bloomberg US Aggregate Bond Index, for example, returned -13%; 2-year Treasuries returned -4.1%. While no one likes losing money—especially not on bonds—it goes without saying that -4.1% or -13% is far better than -18.1% or -55%. A year like 2022 reminds us that while diversification doesn’t guarantee protection from investment losses, it nevertheless remains an investor’s best friend.

- Connect the dots. There’s a lot more to wealth management than just portfolio management. Spend some time evaluating your balance sheet, liquidity needs, and what financial security and fulfillment look like for you and your family. Further, in a year when nearly all asset classes delivered negative returns, there’s real opportunity for value creation through the integration of healthcare, tax, and estate planning within your broader balance sheet. Connecting all your financial dots can bring the big picture into focus and ensure that you don’t miss the forest for the trees.

Exhibit F: Calendar-year 2022 returns for select indexes and Mercer Advisors select recommended funds and ETFs. Recommended funds/ETFs are italicized.19 [Please note, this is not a comprehensive list of all Mercer Advisors recommended funds and ETF’s. The list provided below is for illustrative and informational purposes only and was done at the discretion of the Mercer Advisors Investment Committee based upon, the available data, the underlying funds’ factor exposures, and/or the fund’s prospect benchmark. Performance was not the sole criterion for inclusion in this list.]

| Index, Asset Class, or Fund |

2022 Returns |

| U.S. Stocks – Large and Mid Cap Blend |

|

| S&P 500 Index |

-18.1% |

| Vanguard S&P 500 ETF |

-18.2% |

| Russell 1000 Index |

-19.1% |

| AQR Large Cap Defensive Style Fund (AUEIX) |

-13.8% |

| iShares Edge MSCI Min. Vol USA ETF (USMV) |

-9.4% |

| DFA US High Relative Profitability Portfolio (DURPX) |

-11.8% |

| iShares MSCI USA Quality Factor ETF (QUAL) |

-20.5% |

| U.S. Stocks – Large and Mid Cap by Style |

|

| Russell 1000 Growth Index |

-29.1% |

| AQR Momentum Style Fund (AMOMX) |

-17.9% |

| iShares Edge MSCI Momentum Factor ETF (MTUM) |

-18.3% |

| Russell 1000 Value Index |

-7.5% |

| DFA US Large Cap III Portfolio (DFUVX) |

-5.7% |

| iShares MSCI USA Value Factor ETF (VLUE) |

-14.2% |

| U.S. Stocks – Small-Cap Blend |

|

| Russell 2000 Total Return |

-20.4% |

| Vanguard Small Cap ETF (VB) |

-17.5% |

| iShares MSCI USA Small-Cap Multifactor ETF (SMLF) |

-12.2% |

| U.S. Stocks – Small-Cap by Style |

|

| Russell 2000 Growth Index |

-26.4% |

| AQR Small Cap Momentum Style (ASMOX) |

-19.6% |

| DFA US Small Cap Growth (DSCGX) |

-17.8% |

| Russell 2000 Value Index |

-14.5% |

| DFA US Targeted Value ETF (DFAT) |

-7.5% |

| Non-U.S. Developed Markets Stock – Blend |

|

| MSCI World ex-USA Index |

-13.8% |

| Vanguard FTSE Developed Markets ETF (VEA) |

-15.4% |

| Fidelity International Index Fund (FSPSX) |

-14.2% |

| iShares MSCI EAFE Min. Vol. Factor ETF (EFAV) |

-15.1% |

| Non-U.S. Stocks by Style |

|

| MSCI World ex-USA Growth Index |

-22.4% |

| AQR International Momentum Style (AIMOX) |

-19.4% |

| iShares MSCI Intl Momentum Factor ETF (IMTM) |

-16.8% |

| DFA International Hi Relative Profitability Institutional Portfolio (DIHRX) |

-16.6% |

| MSCI World ex-USA Value Index |

-5.0% |

| DFA International Value III (DFVIX) |

-3.4% |

| iShares Edge MSCI Intl Value Factor ETF |

-5.7% |

| Emerging Markets Stock – Blend |

|

| MSCI Emerging Markets Index |

-19.7% |

| Vanguard FTSE Emerging Markets ETF (VWO) |

-18.0% |

| DFA Emerging Markets Core Equity (DFCEX) |

-16.4% |

| iShares MSCI Emerging Markets Multifactor ETF (EMGF) |

-16.6% |

| Fixed Income – U.S. Treasuries |

|

| 2-Year Treasuries |

-4.1% |

| 5-Year Treasuries |

-9.7% |

| 10-Year Treasuries |

-16.3% |

| 30-Year Treasuries |

-33.3% |

| Treasury Inflation-Protected Securities (TIPS) |

-11.9% |

| Schwab US TIPS ETF (SCHP) |

-12.0% |

| Vanguard Short-Term Inflation-Protected Securities ETF (VTIP) |

-3.0% |

| iShares 0-5 Year TIPS Bond ETF (STIP) |

-3.0% |

| Fixed Income – Sector |

|

| US Aggregate |

-13.0% |

| iShares Core US Aggregate Bond ETF |

-13.0% |

| Municipals |

-8.5% |

| iShares Short-Term National Muni Bond ETF (SUB) |

-2.1% |

| iShares National Muni Bond (MUB) |

-7.4% |

| Vanguard Tax-Exempt Bond (VTEB) |

-8.0% |

| Vanguard Short-Term Tax-Exempt Fund Admiral Shares (VWSUX) |

-0.8% |

| DFA Selective State Municipal Bond Portfolio (DSSMX) |

-6.6% |

| U.S. Corporate High Yield |

-11.2% |

| Vanguard High Yield Corporate Admiral Shares (VWEAX) |

-9.0% |

| iShares 0-5 Year High Yield Corporate Bond ETF (SHYG) |

-4.7% |

| iShares Broad USD High Yield Corporate Bond ETF (USHY) |

-11.2% |

| Fixed Income – Global |

|

| Global Aggregate |

-16.3% |

| Global ex-U.S. |

-18.1% |

| Vanguard Total International Bond Index Fund ETF (BNDX) |

-12.8% |

Home » Insights » Market Commentary » Year-End Review and 2023 Outlook

Year-End Review and 2023 Outlook

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

While no one knows for sure what the future holds, one thing seems certain: 2022 was the year when sobriety and common sense returned to financial markets.

By any objective measure, last year was a tough one. 2022 will forever be remembered as the year when the Fed unwound the easy monetary policy of the past 15 years to combat the highest inflation in four decades. Between March and December, the Fed raised interest rates seven times for a grand total of 425 basis points—bringing the Fed Funds rate to its highest level since 2007. As if that weren’t enough, beginning in June the Fed began a new “quantitative tightening” exercise to shrink its balance sheet, a process that adds further upward pressure to interest rates.

While the Fed’s rate hikes have ostensibly had little impact on inflation thus far (more on this below), they’ve undoubtedly had a major impact on global financial markets. Virtually every major asset class finished down for the year. More-speculative asset classes, such as cryptocurrency and growth stock, saw exceptionally steep losses. Relative outperformance, albeit still negative, was to be found in previously unloved asset classes such as dividend-paying, value, and low-beta stock as well as short-duration bond. Even Treasury inflation-protected securities (TIPS), despite the inflation protection they offer, finished the year down by double digits (see table of select asset-class returns at the end of this article).

While no one knows for sure what the future holds, one thing seems certain: 2022 was the year when sobriety and common sense returned to financial markets. Gone are the days of digital assets with no tangible value—what JPMorgan Chase CEO Jamie Dimon derisively called “pet rocks”1—outperforming solid companies with reliable cash flows. The same could be said for any number of speculative asset classes—growth stock, special-purpose acquisition company (SPAC), or non-fungible token (NFT), to name only the most popular of the past decade. The price of everything, from stocks and bonds to real estate and cryptocurrencies, is again re-tethered to interest rates. Consequently, monetary policy in 2023—specifically, where the Fed lands on interest rates—will most likely determine the direction of the economy and markets this year.

Economic outlook

As 2022 came to a close, the Fed’s rate hikes had undoubtedly begun to broadly impact the economy. Consumer confidence, retail sales, homebuilder sentiment, and new housing starts are all down. The Purchasing Managers’ Index (PMI) has declined to 46, a leading indicator that suggests the economy may already be in recession.2 But there is some good news, too. The CPI report for November indicated that headline inflation rose just 0.1% (0.2% for core), bringing year-over-year inflation down to 7.1%—and suggests that inflation probably peaked back in June at 9.1%. More important, headline inflation of 0.1% in November—if sustained—suggests an annualized run-rate of 1.2% headline inflation over the next 12 months, a significant decline from the highs of 2022. Indeed, the consensus is for inflation to fall to somewhere around 3% to 4% by the end of 2023. Energy prices have come down significantly from their June highs, and gasoline prices at the end of 2022 were lower than a year earlier, a powerful tailwind that only adds to the disinflationary forces already building throughout the economy.3

All of this says three things:

Exhibit A: Year-over-year inflation peaked in June 2022 and has since moderated.8 Green cells below represent lower inflation, and red ones represent higher inflation. We see that most categories, with the exception of shelter, cooled in November.

*OER refers to Owners Equivalent Rent

Market outlook

It’s important to remember: the economy isn’t the market, and the market isn’t the economy. The challenge with economic data is that it’s backward-looking; recessions are typically identified months after they’ve ended and the markets have rallied. Consider, for example, the global financial crisis (GFC) of 2008. While the recession began in December 2007, it wasn’t officially identified as such by the National Bureau of Economic Research (NBER) until 12 months later—in December 2008—by which time the S&P 500® had already declined 44%. Further, while the recession ended in May 2009, it wasn’t announced officially by NBER until September 2010—16 months later—by which time the S&P 500 had already rallied 38%.

There are many reasons for investors to be optimistic in the year ahead. I’ll focus here on just three: valuations, earnings growth, and market history.

Valuations

First, valuations for most asset classes are more attractive today than they’ve been in years. Negative returns for both stocks and bonds in 2022 succeeded in bringing down market valuations from their highs and, in the process, greatly improved the market’s overall financial health. Many asset classes today are attractively priced relative to their recent past, and moderately priced relative to their long-term history. For example, the S&P 500 finished the year trading at 16.65 times 2023 estimated earnings versus the 22 times earnings that it traded at this time last year.

Exhibit B: Equity market valuations have all come down, resulting in improved market health for investors relative to this time last year.9

It’s unlikely, however, that the market will remain valued at 16.65 times earnings; Exhibit B highlights how the S&P 500 valuation has changed over time. Wharton professor Jeremy Siegel argues that, for a number of reasons, the S&P 500 should on average trade at about 20 times earnings.10 Whether Professor Siegel is right or wrong remains to be seen, but we think he’s directionally accurate, given that both the market and the Fed project lower interest rates in the future. (The market predicts that the Fed will begin cutting rates in late 2023 or early 2024; the Fed predicts that it’ll begin cutting them in early 2025.) 11 As a result, it’s not a stretch to expect multiples to rise again once the Fed pauses and, ultimately, reverses course on interest rates. The S&P 500 trading at 17 or 18 times earnings by late 2023—about 5.5% higher than today’s level—seems possible.

Similarly, the returns prospect for value stocks—which trade at valuations less than that of the broad market—seem particularly attractive as 2023 begins, with value stocks trading at about 13.9 times earnings (versus a still-frothy 21.1 times earnings for growth stocks). While Mercer Advisors portfolios are broadly diversified across and within major global asset classes, it’s for this reason—valuations—that we specifically target value stocks in our portfolios.

Fund Focus: To invest in U.S. value stocks, our portfolios often use several different ETFs and funds, but our preferred fund is Dimensional Fund Advisors’ US Large Cap Value Portfolio (III) (or its ETF proxy, DFUV). DFUVX returned -5.69% in 2022 (versus -7.54% for the Russell 1000 Value), and the fund’s underlying holdings had a forward PE of only 12.06 times earnings as of December 31, 2022 (versus 13.9 times for the Russell 1000 Value and 16.65 times for the S&P 500 Index). [Source: Morningstar, Inc.]

With respect to non-U.S. stocks, valuations relative to U.S. stocks (as well as to history) remain quite low. For example, non-U.S. stocks currently trade at 12 times earnings—an 8% discount relative to their long-term valuation of 13.1 times earnings, and a staggering 30% discount relative to U.S. stocks. While it can be argued that non-U.S. stocks are valued to reflect geopolitical risks, slowing global growth, and a strong dollar, it also stands to reason that a cessation of hostilities in Ukraine, a weaker U.S. dollar (perhaps due to a pause in rate hikes or even a rate cut), and stronger-than-expected global growth could all boost returns on non-U.S. stocks for U.S. investors—which is very much in the cards for 2023. Mercer Advisors portfolios remain slightly underweight non-U.S. stocks, but for several reasons—diversification, attractive valuations, above-average dividend yields, a hedge against declines in the U.S. dollar—we continue to offer risk-appropriate allocations to both developed- and emerging-market stocks.

Fund Focus: To invest in non-U.S. value stocks, we use Dimensional Fund Advisors’ International Value Portfolio (III) (DFVIX) or its equivalent, International Value ETF (DFIV). DFVIX returned -3.37% in 2022 versus -5.64% for the MSCI World ex-USA Value Index; the fund’s underlying holdings have a forward PE of only 7.4 times earnings (versus 12 times earnings for the MSCI EAFE Index). [Source: Morningstar, Inc.]

Exhibit C: The Federal Reserve (FOMC) and financial markets expect the Fed will cut rates sometime between late 2023 and early 2025.12

With respect to fixed income, bonds today offer investors the highest yields in nearly a decade. At the end of 2021, 2-year Treasuries yielded 0.73%; a year later they yield 4.41%. While the yield curve across a range of bonds may be steeply inverted, investors today have opportunities in short-duration fixed income that simply didn’t exist 12 months earlier—a major breath of fresh air for diversified portfolios and income-oriented investors. Should the Fed pause hikes and eventually begin to cut rates in late 2023, as the markets forecast they will, diversified portfolios with allocations to bonds should again be well positioned to benefit.

Finally, this also suggests that investors could begin adding slightly longer-duration bonds to their portfolios (perhaps going to 3–5 years in certain asset classes), but we don’t think those opportunities will materialize until later in 2023 or in early 2024. In response to the Fed’s rate hikes, the Mercer Advisors Investment Committee significantly shortened duration in our bond portfolios last year, in January and again in late April. At the moment, most of our bond portfolios have durations in the range of 2 to 2.5 years. Going forward, we’ll continue to pay close attention to bond yields and Fed policy to determine whether it makes sense to extend bond duration in our portfolios.

Fund Focus: To shorten duration in our portfolios, we often anchor our fixed income strategies around a combination of funds and ETFs such as Vanguard’s Short-Term Bond ETF (BSV) and State Street’s SPDR® Bloomberg 1-3 Month T-Bill ETF (BIL). BSV has an average duration of 2.65 years and returned -5.49% in 2022 (versus -13.01% for the much-longer-duration Bloomberg US Aggregate Bond Index, which has a duration of six years). State Street’s BIL has an effective duration of only 0.08 years (less than one month) and returned 1.4% in 2022. Source: Morningstar, Inc..

Earnings Growth

Earnings growth should be another positive tailwind for equity markets this year. Earnings drive stock prices, and in today’s market, with a newfound emphasis on fundamentals, earnings really matter. Short of a recession—a very real possibility—consensus estimates are for around 5% earnings growth for S&P 500 companies in 2023.13 While analysts continue to revise earnings estimates downward, they remain positive at the moment.

To be clear, not all sectors are expected to experience positive earnings growth in the year ahead; the energy, materials, and healthcare sectors, for example, are all expected to see negative earnings growth in 2023. Should the U.S. or global economy dip into recession, more companies and sectors could experience negative earnings growth. At the moment, however, strong earnings momentum in sectors such as consumer discretionary, industrials, and financials is expected to offset losses elsewhere. Overall, analysts continue to expect earnings growth of 5.3% for S&P 500 companies.14

When we combine a potential for a 5.5% increase in valuations for the S&P 500 (from 16.6 times earnings to 17.5 times) with the prospect of 5% earnings growth, that equates to a potential return of about 10% for the S&P 500 Index in 2023, an estimate that aligns with those of most other managers.15

Fund Focus: To invest in U.S. companies with above-average profitability, our preferred fund is Dimensional Fund Advisors’ US High Relative Profitability Portfolio (DURPX) or its ETF equivalent, DUHP. DURPX returned -11.81% in 2022 versus -19.13% for the Russell 1000 Index. Source: Morningstar, Inc.

Market History

Market history is on the side of the optimists. Historically, market returns after a relatively sharp decline have been quite good. Since 1926, stocks have averaged a 12.5% return in the years following a decline of 10%; the average return has been 22.2% in the years following a decline of 20%. The S&P 500 fell 18% in 2022. While history rarely repeats, it does tend to rhyme.

Exhibit D: Market returns tend to be quite positive in the years following a significant decline.16

Advice for investors in the new year

If there’s a silver lining to 2022, it’s that it helped re-ground investors in the basics: fundamentals matter, predictions should be taken with a healthy dose of skepticism, and prudent planning prevails in the long run. With these lessons in mind, we recommend that investors focus on five key essentials in the year ahead.

Exhibit E: Popular technology stocks and cryptocurrencies experienced steep losses in 2022.17

Exhibit F: Calendar-year 2022 returns for select indexes and Mercer Advisors select recommended funds and ETFs. Recommended funds/ETFs are italicized.19 [Please note, this is not a comprehensive list of all Mercer Advisors recommended funds and ETF’s. The list provided below is for illustrative and informational purposes only and was done at the discretion of the Mercer Advisors Investment Committee based upon, the available data, the underlying funds’ factor exposures, and/or the fund’s prospect benchmark. Performance was not the sole criterion for inclusion in this list.]

1https://www.bloomberg.com/news/articles/2022-12-06/jpmorgan-ceo-jamie-dimon-calls-crypto-tokens-pet-rocks

2J.P. Morgan, Guide to the Markets, December 16, 2022, slide 51.

3AAA Gas Prices (gasprices.aaa.com). The national average cost of a gallon of gasoline on December 20, 2022, was $3.12, compared with $3.31 a year earlier.

4As of December 20, 2022, the composite PMI stood at 46.4 (includes both services and manufacturing). Anything lower than 50 suggests economic activity is contracting.

5https://www.bloomberg.com/news/articles/2022-12-20/economists-place-70-chance-for-us-recession-in-2023

6https://www.bloomberg.com/news/articles/2022-12-16/federal-reserve-forecasts-higher-inflation-despite-recent-cpi-data

7Ibid.

8J.P. Morgan, Guide to the Markets, December 31, 2022, slide 29.

9J.P. Morgan, Guide to the Markets, December 31, 2022, slide 5.

10Jeremy Siegel, Stocks for the Long Run, 6th edition.

11J.P. Morgan, Guide to the Markets, December 16, 2022, slide 34.

12J.P. Morgan, Guide to the Markets, December 31, 2022, slide 34.

13FactSet Earnings Insight, December 15, 2022, page 2.(https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_121522C.pdf)

14FactSet Earnings Insight, December 15, 2022, page 28.

15“Top Money Managers See Global Stocks Gaining in 2023,” Bloomberg, December 9, 2022.

16“History Shows That Stock Gains Can Add Up after Big Declines,” Dimensional Fund Advisors, June 2022. Data is the Fama/French Total US Market Research Index Returns, July 1926–December 2021.

17YCharts, Inc.

18YCharts, Inc.

19YCharts, Inc. Returns data for fixed income asset classes comes from J.P. Morgan, Guide to the Markets, December 31, 2022, slides 37 and 42.

Explore More

The Downgrade of U.S. Government Debt: Insights From Our CIO

Q2 Market Outlook: What Does Q2 Hold for Investors?

After the Fall: Four Questions for Investors: Insights From Our CIO

Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Diversification and asset allocation do not ensure a profit or protect against a loss. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Why do you work so hard?

Welcome to a

new kind of wealth management

that gets you to think about

money like you’ve never

thought about it before

Investing isn’t about

hitting home run

It’s about avoiding the strike outs

Our investment philosophy is based on so much more than just returns

Academic

Our investment strategies are rooted in science and research. They’re designed to incorporate the best thinking available when it comes to portfolio design and manager selection.

Balanced

Our mission is to build you a globally diversified, very low cost, very tax efficient portfolio, rebalancing as circumstances change. All combined with exceptionally high quality financial planning

Innovative

We take a systematic and comprehensive approach with emphasis on saving as well as making money. Because what good are returns if your tax liabilities cancel them out?

Why?