Last week the Federal Reserve lowered its target overnight interest rate range by 0.5% to 4.75%-5%. This is an important shift in U.S. monetary policy, but the bond market’s reaction to the cut shows why it’s important not to overreact even to a large rate cut.

Case in point: The yield on the benchmark 10-year U.S. Treasury note, which helps set interest rates on everything from mortgages to corporate bonds, was higher on Friday.

Why is the Fed’s target rate so important?

The federal funds target rate guides overnight lending among U.S. banks and is a key tool for U.S. monetary policy, which aims to control inflation and guide the unemployment rate. Through setting this rate, the Fed effectively dictates the cost of money in the U.S. economy. It’s set as a range between an upper and lower limit. Specifically, the rate leads to direct changes in costs on credit-card debt and other types of floating-rate loans, but the Fed’s target only indirectly affects long-term rates like the yield on Treasury bonds. Despite making a half-point cut last week, Fed officials signaled they were optimistic enough about the economy that they will most likely cut rates by only a quarter point at future meetings.

What are the implications of the decision on a 0.5% cut versus a 0.25% cut?

Advocates for a larger cut were generally more concerned about the economy. They believed the Fed should take a bolder step to prevent further weakening in the labor market. In opting for the larger reduction, the Fed signaled that it was willing to fight to keep the economy out of a recession.

All but one vote from the Fed’s rate-setting Open Market Committee was for a 0.50% cut. The dissenting official, Fed governor Michelle Bowman, said she believed the economy was strong enough, and that inflation was enough of a concern, that she would have preferred a 0.25% cut. That means the Fed was unanimous in thinking it was time to cut rates, even though there was a small difference in view about how large to make the first cut.

Did all interest rates go down last week?

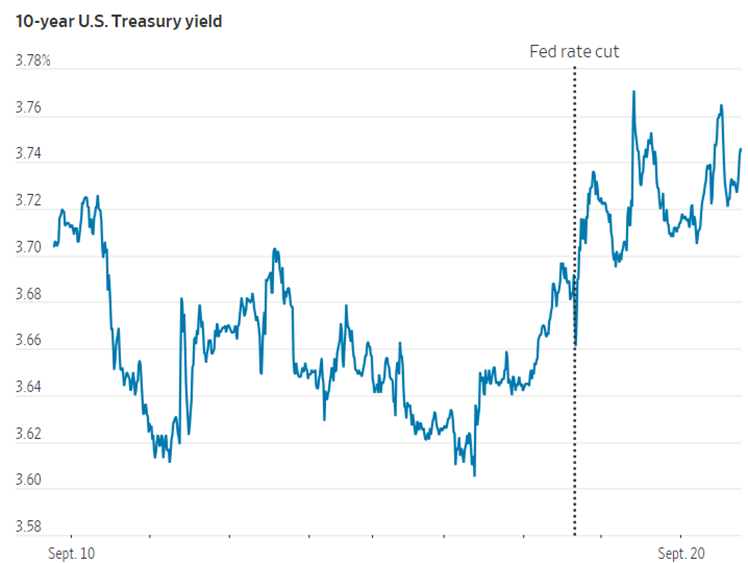

No, not all interest rates moved downward last week – and this is a key point. The yield on the benchmark 10-year U.S. Treasury note, which helps set interest rates on everything from mortgages to corporate bonds, was higher on Friday and settled at around 3.73%, up from 3.64% the day before the Fed’s move.

The rates that the Fed controls are not the same as intermediate and long-term treasury yields. Yes, there is a relationship, but intermediate and long-term yields are also driven by technical factors like the pace of institutional bond buying, international capital flows, the market’s view of future interest rates, and expectations about the economy.

Since earlier in the year, 10-year Treasury yields have come down about a percentage point, when rate cuts seemed more uncertain. But they went up slightly the day the Fed announced the rate cut, a market movement which highlights that there’s no guarantee Treasury yields will fall any further if the economy remains stable. This would be a frustrating outcome for potential home buyers and other borrowers hoping for bigger interest rate declines on mortgages and other debt.

Source: The Wall Street Journal

Will the economic outlook likely lead to more rate cuts?

There is a lagging effect of rate cuts. Last week’s 0.50% cut in rates will have an impact on borrowing and economic activity in the future. But short-term rates have been above 5% for about a year and a half, and so the slowing effect on the economy may still be around for some time to come.

Remember why we are here. Inflation was a large problem and is one of the Fed’s key mandates to control. While we are still feeling the impact of higher prices in the grocery store, for example, the rate at which prices are growing has lessened. The recent rate cut implies that the Fed is more comfortable with the current pace of inflation and is turning its attention more towards supporting employment and economic growth.

Across the board, the short-term economic outlook is mixed right now. The unemployment rate is fairly low but has been steadily climbing this year. The number of jobs created each month has been positive but has slowed from earlier in the year. The inflation rate has moderated, but the annual rate of inflation remains higher than the Fed’s target. This means future economic reports will be important to watch. The latest reading of the Fed’s preferred inflation gauge will be released on Friday. The next jobs report will be released Oct. 4.

What’s the impact on other fixed income investments?

Looking across fixed income investments, we must consider corporate and municipal bonds. The yield on these bonds has a spread above the yield on Treasury’s with an equivalent maturity. The spread, however, changes over time.

Even if Treasury bond yields go down (which means prices go up), the yields of corporate and municipal bonds may not go down at the same rate due to their underlying credit risk. When the economy is weakening, municipalities and corporations may in fact see their yields climbing if investors become concerned that a weak economy means those debts won’t be serviced. (Treasury debt is considered free of credit risk, but it’s certainly not free of risk with regards to changes in interest rates.) For more on this, see: Of Rate Cuts and Bond Portfolios.

Takeaways

Remember the Fed is not the only game in town: The market believes more Fed cuts lie ahead, but it is uncertain how longer-term rates will change. The Fed has an important impact on longer-term rates, but it’s not the only factor. It’s likely the volatility in bond markets will be more driven by the election (see: Politics and Investing Don’t Mix) than the Fed in the coming six weeks.

Take a longer-term approach when thinking about bond markets: Active mutual fund managers get interest rate guessing (duration bets) wrong more than they get it right. We like bond ladders for this reason. Bond ladders mitigate interest rate risk. Sometimes interest rates are higher upon reinvestment, sometimes they are lower, sometimes it varies between different parts of the yield curve. The great part about bonds is that they mature at par (100 cents on the dollar) and the coupon on bonds you already own won’t change until your bond matures. Stay invested, leverage bonds for income and diversification, and focus on tax efficient investing as you decide between treasury, corporate, and municipal bonds.

History lesson: Finally, don’t lose sight of the history of the Fed’s key rate. Even when a near-term path seems clear, over the longer-run rates have varied considerably. Over the last 50 years, the federal funds rate has ranged from a low of 0% to a high of 20% as the Fed attempted to manage the economy.

Fed funds rate high: In 1980, the Federal Reserve increased the fed funds rate to 20% to address double-digit inflation. Higher interest rates typically reduce borrowing and spending as the cost of accessing lending and credit rise for consumers and businesses, typically slowing down economic growth.

Fed fund rate low: In 2008, the Federal Reserve lowered the fed funds rate to 0% to revive the economy following the global financial crisis. It did so once again in 2020 to minimize the economic fallout from the Covid-19 crisis. Lower interest rates typically increase borrowing and spending as the cost of accessing lending and credit decrease for consumers and businesses, typically increasing economic growth. Although the Fed took interest rates to zero during its last two rate cutting cycles, it’s important to remember that hasn’t been the historical norm and we shouldn’t necessarily expect things to go back to zero this time.

Not a Mercer Advisors client but interested in more information? Let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Diversification does not ensure a profit or guarantee against loss. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Home » Insights » Market Commentary » Parsing the Market’s Reaction to the Fed’s Rate Cut

Parsing the Market’s Reaction to the Fed’s Rate Cut

Will Rockett, CFA®

Sr. Director of Investment Strategy

When the Federal Reserve cuts interest rates, the effects on the bond market are not always predictable

Last week the Federal Reserve lowered its target overnight interest rate range by 0.5% to 4.75%-5%. This is an important shift in U.S. monetary policy, but the bond market’s reaction to the cut shows why it’s important not to overreact even to a large rate cut.

Case in point: The yield on the benchmark 10-year U.S. Treasury note, which helps set interest rates on everything from mortgages to corporate bonds, was higher on Friday.

Why is the Fed’s target rate so important?

The federal funds target rate guides overnight lending among U.S. banks and is a key tool for U.S. monetary policy, which aims to control inflation and guide the unemployment rate. Through setting this rate, the Fed effectively dictates the cost of money in the U.S. economy. It’s set as a range between an upper and lower limit. Specifically, the rate leads to direct changes in costs on credit-card debt and other types of floating-rate loans, but the Fed’s target only indirectly affects long-term rates like the yield on Treasury bonds. Despite making a half-point cut last week, Fed officials signaled they were optimistic enough about the economy that they will most likely cut rates by only a quarter point at future meetings.

What are the implications of the decision on a 0.5% cut versus a 0.25% cut?

Advocates for a larger cut were generally more concerned about the economy. They believed the Fed should take a bolder step to prevent further weakening in the labor market. In opting for the larger reduction, the Fed signaled that it was willing to fight to keep the economy out of a recession.

All but one vote from the Fed’s rate-setting Open Market Committee was for a 0.50% cut. The dissenting official, Fed governor Michelle Bowman, said she believed the economy was strong enough, and that inflation was enough of a concern, that she would have preferred a 0.25% cut. That means the Fed was unanimous in thinking it was time to cut rates, even though there was a small difference in view about how large to make the first cut.

Did all interest rates go down last week?

No, not all interest rates moved downward last week – and this is a key point. The yield on the benchmark 10-year U.S. Treasury note, which helps set interest rates on everything from mortgages to corporate bonds, was higher on Friday and settled at around 3.73%, up from 3.64% the day before the Fed’s move.

The rates that the Fed controls are not the same as intermediate and long-term treasury yields. Yes, there is a relationship, but intermediate and long-term yields are also driven by technical factors like the pace of institutional bond buying, international capital flows, the market’s view of future interest rates, and expectations about the economy.

Since earlier in the year, 10-year Treasury yields have come down about a percentage point, when rate cuts seemed more uncertain. But they went up slightly the day the Fed announced the rate cut, a market movement which highlights that there’s no guarantee Treasury yields will fall any further if the economy remains stable. This would be a frustrating outcome for potential home buyers and other borrowers hoping for bigger interest rate declines on mortgages and other debt.

Source: The Wall Street Journal

Will the economic outlook likely lead to more rate cuts?

There is a lagging effect of rate cuts. Last week’s 0.50% cut in rates will have an impact on borrowing and economic activity in the future. But short-term rates have been above 5% for about a year and a half, and so the slowing effect on the economy may still be around for some time to come.

Remember why we are here. Inflation was a large problem and is one of the Fed’s key mandates to control. While we are still feeling the impact of higher prices in the grocery store, for example, the rate at which prices are growing has lessened. The recent rate cut implies that the Fed is more comfortable with the current pace of inflation and is turning its attention more towards supporting employment and economic growth.

Across the board, the short-term economic outlook is mixed right now. The unemployment rate is fairly low but has been steadily climbing this year. The number of jobs created each month has been positive but has slowed from earlier in the year. The inflation rate has moderated, but the annual rate of inflation remains higher than the Fed’s target. This means future economic reports will be important to watch. The latest reading of the Fed’s preferred inflation gauge will be released on Friday. The next jobs report will be released Oct. 4.

What’s the impact on other fixed income investments?

Looking across fixed income investments, we must consider corporate and municipal bonds. The yield on these bonds has a spread above the yield on Treasury’s with an equivalent maturity. The spread, however, changes over time.

Even if Treasury bond yields go down (which means prices go up), the yields of corporate and municipal bonds may not go down at the same rate due to their underlying credit risk. When the economy is weakening, municipalities and corporations may in fact see their yields climbing if investors become concerned that a weak economy means those debts won’t be serviced. (Treasury debt is considered free of credit risk, but it’s certainly not free of risk with regards to changes in interest rates.) For more on this, see: Of Rate Cuts and Bond Portfolios.

Takeaways

Remember the Fed is not the only game in town: The market believes more Fed cuts lie ahead, but it is uncertain how longer-term rates will change. The Fed has an important impact on longer-term rates, but it’s not the only factor. It’s likely the volatility in bond markets will be more driven by the election (see: Politics and Investing Don’t Mix) than the Fed in the coming six weeks.

Take a longer-term approach when thinking about bond markets: Active mutual fund managers get interest rate guessing (duration bets) wrong more than they get it right. We like bond ladders for this reason. Bond ladders mitigate interest rate risk. Sometimes interest rates are higher upon reinvestment, sometimes they are lower, sometimes it varies between different parts of the yield curve. The great part about bonds is that they mature at par (100 cents on the dollar) and the coupon on bonds you already own won’t change until your bond matures. Stay invested, leverage bonds for income and diversification, and focus on tax efficient investing as you decide between treasury, corporate, and municipal bonds.

History lesson: Finally, don’t lose sight of the history of the Fed’s key rate. Even when a near-term path seems clear, over the longer-run rates have varied considerably. Over the last 50 years, the federal funds rate has ranged from a low of 0% to a high of 20% as the Fed attempted to manage the economy.

Fed funds rate high: In 1980, the Federal Reserve increased the fed funds rate to 20% to address double-digit inflation. Higher interest rates typically reduce borrowing and spending as the cost of accessing lending and credit rise for consumers and businesses, typically slowing down economic growth.

Fed fund rate low: In 2008, the Federal Reserve lowered the fed funds rate to 0% to revive the economy following the global financial crisis. It did so once again in 2020 to minimize the economic fallout from the Covid-19 crisis. Lower interest rates typically increase borrowing and spending as the cost of accessing lending and credit decrease for consumers and businesses, typically increasing economic growth. Although the Fed took interest rates to zero during its last two rate cutting cycles, it’s important to remember that hasn’t been the historical norm and we shouldn’t necessarily expect things to go back to zero this time.

Not a Mercer Advisors client but interested in more information? Let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Diversification does not ensure a profit or guarantee against loss. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Explore More

Was There an AI Bubble?

Beyond Fees: What to Consider When Hiring a Wealth Advisor

Questions to Ask When Choosing a Financial Advisor