On Aug. 7, 2025, President Trump signed an executive order allowing 401(k) plans to offer alternative investments to plan participants, including private investment funds, direct real estate, cryptocurrencies, and more.

We believe this is a moment when our role as fiduciaries and stewards of our clients’ wealth is incredibly important. With those responsibilities in mind, we want to share our current thinking on this executive order and how investors should approach the changes coming (eventually) to their retirement plans.

The case for private investments

While our broad skepticism of crypto assets is well-documented, we believe the case for private investments is quite strong. The possibility of investing in private markets through 401(k)s is something we take seriously. We’ve helped clients invest in private markets for many years, and we think they are worth considering for the following reasons:

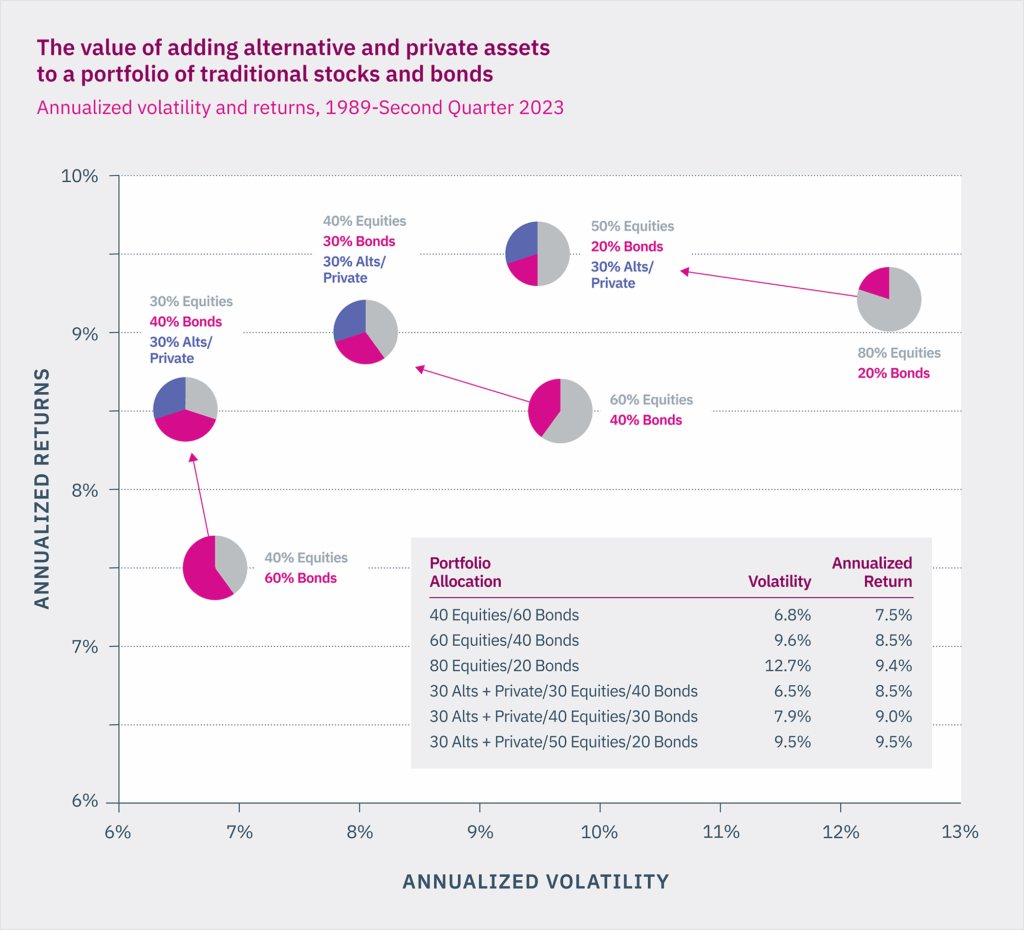

1. Private investments typically have higher long-term expected returns. We have often highlighted the chart below, which shows that including private markets in investor portfolios has delivered both higher returns and lower volatility over a long investment period. Many capital market experts, including us, believe that private investments have the potential to deliver higher expected returns over long periods of time. Historically, private markets have shown the potential to deliver returns that may exceed public market returns over time.

Exhibit A: Combining private assets with portfolios of public investments has historically shown potential for strong risk adjusted returns over many decades.

Source: Bloomberg, Burgiss, FactSet, HRFI, NCREIF, Standard & Poor’s, J.P. Morgan Asset Management. Alternatives and Private allocation include hedge funds, real estate and private equity, with each receiving an equal weight. Portfolios are rebalanced at the start of the year. Data based on availability as of November 2023. Past performance is no guarantee of future results. Volatility is defined as the standard deviation of annual returns.

We note that while we anticipate outperformance to continue over time, it’s important to note that this is not guaranteed to occur every year or even every five or 10 years. . Projections can be, and often are, wrong. As I’ve written many times, markets and economies are infinitely complex, dynamic systems with many moving parts. Even the best forecasts are just that — forecasts.

2. In theory, both private investments and 401(k) plans are designed to be long-term investments. Many leaders within the private equity industry argue that private investments, being long-term investments, are ideal choices for 401(k) investors with long-term horizons. This is true in theory, but 401(k)s are employer-sponsored plans. When employees change jobs, it’s often advisable that they take their 401(k) plans with them (by rolling them over into a new employer plan or IRA). The average U.S. worker, for example, holds upward of 12 different jobs over the course of a career.

3. Private markets help diversify portfolios. While most 401(k) plans have access to broad market indexes, public markets don’t fully represent the entire investment set available across the U.S. and global economy. New high-growth technology companies and real assets, for example, are often more accessible in private markets than public ones.

Yet while the case for private assets may be strong, that doesn’t necessarily mean that they’re a good fit for qualified retirement plans like 401(k)s. We’ve commented before on the investment-specific concerns and challenges facing smaller investors attempting to allocate to quality private investments, including the importance of manager selection, high fees, liquidity risks, conflicts of interest, and more.

There are additional concerns that need to be addressed before we can conclude whether 401(k)s should include access to such investments. 401(k) plans are complex vehicles subject to the Employee Retirement Income Security Act of 1974 (ERISA) and overlapping regulations under both the Department of Labor (DOL) and Securities and Exchange Commission (SEC). (To address these concerns, the president’s order specifically directs the leaders of these two agencies to collaborate and streamline regulations over the next 180 days to make investing in alternative assets easier for 401(k) investors.)

Questions that need answers include, but aren’t limited to:

1. Investor eligibility: Many private investments are available only to investors who meet the SEC’s definition of accredited investors and qualified purchasers. Since 401(k) plan assets are sponsored by employers and held by third party trustees for the benefit of plan participants, who exactly needs to meet the SEC’s investor eligibility requirements? Or would these be waived entirely?

2.Liquidity mismatches: What happens when participants need to take a distribution from their 401(k) plans, but the funds are held in an illiquid investment? Plan rollovers, Qualified Domestic Relations Orders (QDROs), plan loans, and more all require 401(k) participants to make withdrawals. Doing so is simple when the participant’s account is invested in highly liquid mutual funds; it’s less clear how this would work when invested in illiquid investments.

3. Vehicle selection and dollar-cost averaging: Participants typically contribute to 401(k) plans in small increments via payroll deduction. How will this work with private investments that typically have only one or a handful of closes? Or will such plans only have access to ’40 Act products like interval funds that invest in underlying private investments?

4. Investor Education: Private investments are complex and are unlike anything plan participants have seen in the nearly 50-year history of 401(k) plans. Investor and advisor education will be critical. Who will deliver this education? What liability protections will they have? What will the fees be for the solutions that emerge?

5. Fiduciary Liability: Advisors to qualified plans, plan trustees, and plan sponsors all have significant liability that accompanies their management responsibilities. Lawsuits over the years directed at plan sponsors and advisors have centered on fees and the suitability of plan investments. For decades, 401(k) plans have trended toward investments with lower fees to minimize the amount of investment performance lost to fees. The introduction of private investments into 401(k)s could potentially change the landscape of this decades-long trend.

The president’s order would also allow investments in cryptocurrencies. We’ve previously shared reasons why we view cryptocurrencies, such as Bitcoin, as speculative assets rather than as investable assets. Does this mean fiduciaries will be shielded from liability when recommending private investments and cryptocurrencies?

These questions must be clearly and satisfactorily resolved before we, as fiduciaries, can begin to seriously consider the role of private assets in any 401(k) plan.

Our takeaways

It will take time before we see how this plays out. The answers that emerge – and therefore our ultimate recommendations – could vary plan-by-plan and even fund-by-fund. We will be following this issue very closely. For now, we share the following takeaways:

1. There is a strong case for private investments in portfolios, but it is an asset class where investors need to tread very carefully. While private investments have delivered strong returns in the past — and are expected to do so in the long-term — there is also great variability in the quality of these investments and, in many cases, very high fees, which can significantly erode investor returns.

2. The details of how this executive order is implemented will matter tremendously. We cannot fully evaluate this until we see the answers to our questions above. We will be following these developments closely as this issue unfolds.

3. We believe these developments provide an incredibly strong argument for investors to work with a fiduciary advisor. When private investment fund options become available in 401(k)s, it will likely be challenging for investors to assess whether these new investment options are worthy of investment. The quality of investments that become available is likely to vary widely from plan to plan. As fiduciaries, we remain committed to always critically evaluating any and all investment options, whether those would be held within 401(k) plans or not and regardless of whether those investment choices are public, private, or crypto assets.

If you’re a client of Mercer Advisors, your advisor now has the ability to manage your employer-sponsored 401(k), helping to ensure our advice is implemented and maintained in more of your investment accounts. This allows us to implement standard portfolio management strategies such as asset allocation and rebalancing. If you’re interested in this service, talk to your advisor. Not a Mercer Advisors client but interested in more information? Let’s talk.

Click here for past insights about the recent market volatility and other interesting topics.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

Investing in private funds is speculative and will entail substantial risks.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Home » Insights » Market Commentary » The Executive Order on Private Equity and Crypto in 401(k)s: Insights From Our CIO

The Executive Order on Private Equity and Crypto in 401(k)s: Insights From Our CIO

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

A new executive order could reshape 401(k)s with private investments and crypto. Here’s what investors should know.

On Aug. 7, 2025, President Trump signed an executive order allowing 401(k) plans to offer alternative investments to plan participants, including private investment funds, direct real estate, cryptocurrencies, and more.

We believe this is a moment when our role as fiduciaries and stewards of our clients’ wealth is incredibly important. With those responsibilities in mind, we want to share our current thinking on this executive order and how investors should approach the changes coming (eventually) to their retirement plans.

The case for private investments

While our broad skepticism of crypto assets is well-documented, we believe the case for private investments is quite strong. The possibility of investing in private markets through 401(k)s is something we take seriously. We’ve helped clients invest in private markets for many years, and we think they are worth considering for the following reasons:

1. Private investments typically have higher long-term expected returns. We have often highlighted the chart below, which shows that including private markets in investor portfolios has delivered both higher returns and lower volatility over a long investment period. Many capital market experts, including us, believe that private investments have the potential to deliver higher expected returns over long periods of time. Historically, private markets have shown the potential to deliver returns that may exceed public market returns over time.

Exhibit A: Combining private assets with portfolios of public investments has historically shown potential for strong risk adjusted returns over many decades.

Source: Bloomberg, Burgiss, FactSet, HRFI, NCREIF, Standard & Poor’s, J.P. Morgan Asset Management. Alternatives and Private allocation include hedge funds, real estate and private equity, with each receiving an equal weight. Portfolios are rebalanced at the start of the year. Data based on availability as of November 2023. Past performance is no guarantee of future results. Volatility is defined as the standard deviation of annual returns.

We note that while we anticipate outperformance to continue over time, it’s important to note that this is not guaranteed to occur every year or even every five or 10 years. . Projections can be, and often are, wrong. As I’ve written many times, markets and economies are infinitely complex, dynamic systems with many moving parts. Even the best forecasts are just that — forecasts.

2. In theory, both private investments and 401(k) plans are designed to be long-term investments. Many leaders within the private equity industry argue that private investments, being long-term investments, are ideal choices for 401(k) investors with long-term horizons. This is true in theory, but 401(k)s are employer-sponsored plans. When employees change jobs, it’s often advisable that they take their 401(k) plans with them (by rolling them over into a new employer plan or IRA). The average U.S. worker, for example, holds upward of 12 different jobs over the course of a career.

3. Private markets help diversify portfolios. While most 401(k) plans have access to broad market indexes, public markets don’t fully represent the entire investment set available across the U.S. and global economy. New high-growth technology companies and real assets, for example, are often more accessible in private markets than public ones.

Yet while the case for private assets may be strong, that doesn’t necessarily mean that they’re a good fit for qualified retirement plans like 401(k)s. We’ve commented before on the investment-specific concerns and challenges facing smaller investors attempting to allocate to quality private investments, including the importance of manager selection, high fees, liquidity risks, conflicts of interest, and more.

There are additional concerns that need to be addressed before we can conclude whether 401(k)s should include access to such investments. 401(k) plans are complex vehicles subject to the Employee Retirement Income Security Act of 1974 (ERISA) and overlapping regulations under both the Department of Labor (DOL) and Securities and Exchange Commission (SEC). (To address these concerns, the president’s order specifically directs the leaders of these two agencies to collaborate and streamline regulations over the next 180 days to make investing in alternative assets easier for 401(k) investors.)

Questions that need answers include, but aren’t limited to:

1. Investor eligibility: Many private investments are available only to investors who meet the SEC’s definition of accredited investors and qualified purchasers. Since 401(k) plan assets are sponsored by employers and held by third party trustees for the benefit of plan participants, who exactly needs to meet the SEC’s investor eligibility requirements? Or would these be waived entirely?

2.Liquidity mismatches: What happens when participants need to take a distribution from their 401(k) plans, but the funds are held in an illiquid investment? Plan rollovers, Qualified Domestic Relations Orders (QDROs), plan loans, and more all require 401(k) participants to make withdrawals. Doing so is simple when the participant’s account is invested in highly liquid mutual funds; it’s less clear how this would work when invested in illiquid investments.

3. Vehicle selection and dollar-cost averaging: Participants typically contribute to 401(k) plans in small increments via payroll deduction. How will this work with private investments that typically have only one or a handful of closes? Or will such plans only have access to ’40 Act products like interval funds that invest in underlying private investments?

4. Investor Education: Private investments are complex and are unlike anything plan participants have seen in the nearly 50-year history of 401(k) plans. Investor and advisor education will be critical. Who will deliver this education? What liability protections will they have? What will the fees be for the solutions that emerge?

5. Fiduciary Liability: Advisors to qualified plans, plan trustees, and plan sponsors all have significant liability that accompanies their management responsibilities. Lawsuits over the years directed at plan sponsors and advisors have centered on fees and the suitability of plan investments. For decades, 401(k) plans have trended toward investments with lower fees to minimize the amount of investment performance lost to fees. The introduction of private investments into 401(k)s could potentially change the landscape of this decades-long trend.

The president’s order would also allow investments in cryptocurrencies. We’ve previously shared reasons why we view cryptocurrencies, such as Bitcoin, as speculative assets rather than as investable assets. Does this mean fiduciaries will be shielded from liability when recommending private investments and cryptocurrencies?

These questions must be clearly and satisfactorily resolved before we, as fiduciaries, can begin to seriously consider the role of private assets in any 401(k) plan.

Our takeaways

It will take time before we see how this plays out. The answers that emerge – and therefore our ultimate recommendations – could vary plan-by-plan and even fund-by-fund. We will be following this issue very closely. For now, we share the following takeaways:

1. There is a strong case for private investments in portfolios, but it is an asset class where investors need to tread very carefully. While private investments have delivered strong returns in the past — and are expected to do so in the long-term — there is also great variability in the quality of these investments and, in many cases, very high fees, which can significantly erode investor returns.

2. The details of how this executive order is implemented will matter tremendously. We cannot fully evaluate this until we see the answers to our questions above. We will be following these developments closely as this issue unfolds.

3. We believe these developments provide an incredibly strong argument for investors to work with a fiduciary advisor. When private investment fund options become available in 401(k)s, it will likely be challenging for investors to assess whether these new investment options are worthy of investment. The quality of investments that become available is likely to vary widely from plan to plan. As fiduciaries, we remain committed to always critically evaluating any and all investment options, whether those would be held within 401(k) plans or not and regardless of whether those investment choices are public, private, or crypto assets.

If you’re a client of Mercer Advisors, your advisor now has the ability to manage your employer-sponsored 401(k), helping to ensure our advice is implemented and maintained in more of your investment accounts. This allows us to implement standard portfolio management strategies such as asset allocation and rebalancing. If you’re interested in this service, talk to your advisor. Not a Mercer Advisors client but interested in more information? Let’s talk.

Click here for past insights about the recent market volatility and other interesting topics.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

Investing in private funds is speculative and will entail substantial risks.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Explore More

Parent PLUS Loans: 2026 Deadline for Lower Payments and Relief

How to Handle Intellectual Property With Your Estate Planning

Why Not Invest More in International Stocks: Insights From Our CIO