Many clients have reached out to our wealth advisors recently about an email from the Social Security Administration (SSA) regarding tax relief on the benefits. Specifically, the notification states that newly passed legislation — the One Big Beautiful Bill — “includes a provision that eliminates federal income taxes on Social Security benefits for most beneficiaries.”

The problem? There is no such provision in the bill.

Brief history of Social Security taxation

Social Security was originally a tax-free benefit for recipients. However, this changed in 1983 and again in 1993.

The taxation of Social Security benefits had two purposes:

- Increase the equity between Social Security recipients and other pension plans, such as railroad worker pensions.

- Strengthen the financial solvency of the Social Security trust funds.

As most know, lawmakers created Social Security as a self-funded program through payroll taxes on a pay-as-you-go system. Unfortunately, the aging population and continual increases in benefits have created a shortfall. The most recent SSA Trustee’s Report shows the trust fund reserves depleted by 2033, allowing only 79% of promised benefits to be paid.1

One way to strengthen the system is to tax benefits received. This revenue can then go back into the Social Security system, as was done in the 1980s and 1990s.

Political promises and the One Big Beautiful Bill

While campaigning, President Trump promised to make Social Security tax-free. However, eliminating income taxes on Social Security benefits is complicated, since those taxes help fund the very system that’s facing insolvency.

Instead, lawmakers introduced a $6,000 deduction for seniors — those aged 65 or older by year-end. The deduction is $12,000 if Married Filing Jointly (MFJ) and both taxpayers are over age 65. This deduction reduces taxable income, regardless of the source, and is available from 2025 through 2028. It phases out at a rate of 6% for Modified Adjusted Gross Income (MAGI) above $75,000 ($150,000 MFJ).

Importantly, taxpayers take this deduction in addition to either the standard deduction or itemized deduction!

Ready to learn more about our family office for your family?

Senior deduction examples

- Liam is single, turned 66 in 2025, and receives $24,000 in Social Security benefits. Of those benefits, 85% are subject to tax because of his other income. If his Adjusted Gross Income (AGI) is below $75,000, he receives a $6,000 senior deduction in addition to the standard deduction of $15,000 plus a $2,000 age-based addition. If Liam’s AGI is $100,000, his senior deduction is reduced from $6,000 to $4,500. That is calculated as:

$6,000 – [($100,000 – $75,000) x 0.06] = 4,500.

If his AGI is $175,000 or higher, his senior deduction is reduced to $0.

- Noah and Olivia are MFJ and Noah turns 65 on Dec. 31, 2025. Olivia just turned 62. Since Noah will be 65 by the end of the year, he is eligible for the senior deduction, but Olivia is not. Therefore, even though they are MFJ, the total senior deduction is limited to $6,000.

- James and Charlotte are MFJ and both over 65. Neither has claimed Social Security yet, but they both still qualify for the $6,000 senior deduction ($12,000 total).

- Christina is single, aged 67, and has $75,000 in income. Her Social Security income is $18,000, of which $15,300 is taxable (the maximum of 85%). At a 22% marginal tax rate, she pays $3,366 in federal income tax on her Social Security benefit. The $6,000 deduction saves her $1,320, which is certainly helpful, but does not fully offset the taxes on her benefit.

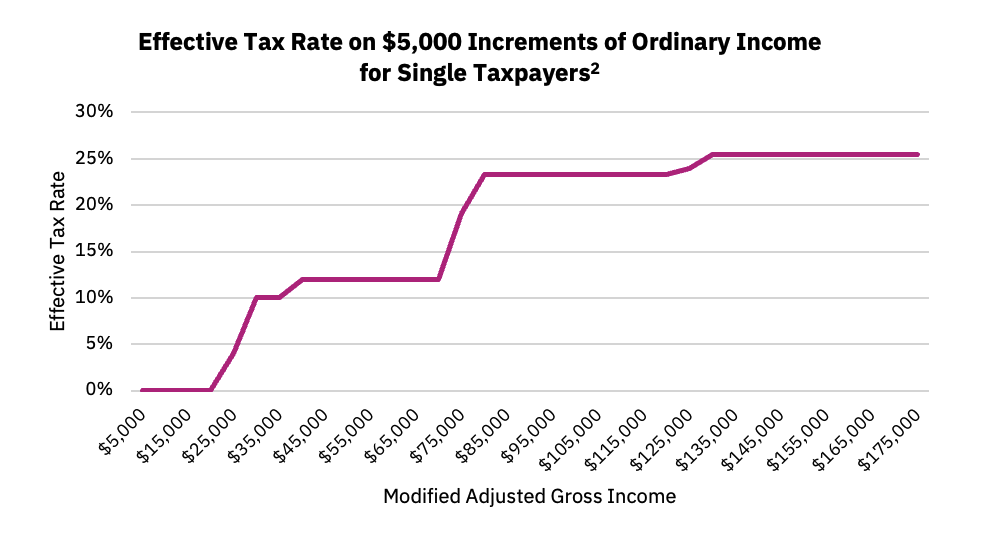

Effective tax rate in phase-out zone

There are many deductions, credits, and contribution limits that phase out for those with higher income levels. Each of these creates a higher effective tax rate than the marginal rate (tax bracket rate) would indicate.

For example, if your income increases by $1,000 and you lose $500 in deductions, your taxable income increases by $1,500. At 25%, that’s $375 in tax and an effective rate of 37.5%.

The good news? The senior deduction’s phase-out is gentler. For both single and MFJ filers, it starts in the 22% bracket and tops out in the 24% bracket. The 6% phase out adds about 1.32% to the 22% bracket and 1.44% to the 24% bracket.

| For more information on the OBBBA, visit our library of articles. |

Conclusion

While most people favor paying less in taxes, how the provisions are framed can create confusion at best and illicit emotional responses at worst.

The One Big Beautiful Bill does not eliminate taxes on Social Security benefits, despite what some messaging may suggest. Instead, it offers a temporary and modest deduction for seniors that may reduce overall tax liability, but not necessarily the income tax on Social Security.

Bottom line: The senior deduction is a meaningful benefit for many retirees, but it’s not a repeal of Social Security taxation. As always, careful planning and clear communication are key to navigating these changes and maximizing your retirement income.

If you’re a Mercer Advisors client and have questions about the One Big Beautiful Bill and its impact on your financial plan, please contact your wealth advisor. Not a Mercer Advisors client? We connect the dots of your financial life by unifying financial planning, investment management, tax, estate, insurance, and more. When you’re ready to amplify and simplify your financial life, let’s talk.

1 “The 2024 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds.” SSA.gov, May 6, 2024.

2 “IRS releases tax inflation adjustments for tax year 2025.” IRS.gov, Oct. 22, 2024.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Hypothetical examples are for illustrative purposes only, For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Mercer Advisors is not a law firm and does not provide legal advice to clients. All estate planning document preparation and other legal advice is provided through select third parties unaffiliated to Mercer Advisors.

Tax preparation and tax filing are a separate fee from our investment management and planning services.

Mercer Global Advisors has a related insurance agency. Mercer Advisors Insurance Services, LLC (MAIS) is a wholly owned subsidiary of Mercer Advisors Inc. MAIS provides individual life, disability, long term care coverage, and property and casualty coverage through various insurance companies. For Mercer Global Advisors clients who wish to purchase insurance products, MAIS has entered into a non-exclusive referral agreement with Strategic Partner(s), where the Strategic Partner will provide necessary services relative to the marketing, placement, and servicing of the insurance products, including without limitation preparing and presenting illustrations, supporting the underwriting process, assisting with the completion and execution of applications, delivering policies, and servicing in-force business. MAIS and the Strategic Partner will be listed as either “agents” or “co-agents” on the policies. While Mercer Global Advisors does not receive a referral fee, Strategic Partner receives a percentage of the commission revenue. MAIS and Strategic Partner do have a revenue sharing agreement.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.