Retiring prior to age 65 when Medicare begins is a dream of many. However, early retirement involves finding and affording health insurance coverage, which can be difficult without access to an employer plan.

For taxpayers earning between 100% and 400% of the federal poverty line (FPL), approximately $15,060 to $60,240 for a single person household in 2024, help is available. The Affordable Care Act (ACA) premium tax credit (PTC) was introduced in 2009 and became available when the Health Insurance Marketplace opened in 2014.

This article explains how the PTC works and how to prepare for changes planned for 2026.

Qualifying for the premium tax credit

The PTC is especially helpful in reducing health care insurance premiums for early retirees, self-employed individuals, and others with coverage through the Health Insurance Marketplace.

To meet premium tax credit eligibility:

- Household modified adjusted gross income (MAGI) must fall within a certain range relative to the FPL.

-

- MAGI is adjusted gross income, plus tax exempt interest income, plus nontaxable Social Security benefits, plus foreign earned income exclusion.

- Do not file a tax return using Married Filing Separately.

- You cannot be claimed as a dependent by another person.

- You’re ineligible for other “minimum essential coverage.”

-

- This includes Medicaid, Medicare, CHIP, TRICARE, and employer coverage that costs the employee more than 9.02% (in 2025) or 9.96% (in 2026) of household income.

Calculating the premium tax credit

The credit is calculated based on your family size and MAGI relative to the FPL for the prior year. The FPL for 2024 and 2025 (used in calculating 2025 and 2026 PTC, respectively) is shown below. Please note, Alaska and Hawaii have their own FPLs and are excluded for simplicity in this article.

1. Find your FPL on the chart.

| Federal Poverty Level for 48 Contiguous States and DC | ||

| Family size | 2024 | 2025 |

| 1 | $15,060 | $15,650 |

| 2 | $20,440 | $21,150 |

| 3 | $25,820 | $26,650 |

| 4 | $31,200 | $32,150 |

| 5 | $36,580 | $37,650 |

| 6 | $41,960 | $43,150 |

| 7 | $47,340 | $48,650 |

| 8 | $52,720 | $54,150 |

| 9+ | +$5,380 | +$5,500 |

2. Find the second-lowest cost silver plan (SLCSP) based on your ZIP code. Yes, geography matters a lot! The premium amount can be found on Healthcare.gov or using the Kaiser Family Foundation’s interactive calculator.

| For instance, Santa Barbara in California has a SLCSP for a 60-year-old couple at $33,651 per year. Less than 100 miles south in Los Angeles, the SLCSP for the same couple runs $20,878 for the year. The U.S. average for this couple is $25,305. |

3. Divide your MAGI by the FPL and multiply by 100. Drop the decimal and use this “applicable figure” in the chart for the IRS Form 8962 instructions. This will provide an expected contribution factor that is multiplied by your MAGI.

4. The PTC is computed as your SLCSP premium less the expected contribution, limited to $0.

| Example 1: A married couple, both age 60, have a $50,000 MAGI for 2025. Using the 2024 FPL of $20,440, their MAGI as a percentage of FPL is 244%, which equates to a 3.76% expected contribution factor. Multiplying that by their MAGI gives us an expected contribution of $1,880. If their SLCSP is $25,000, their PTC is $23,120. |

| Example 2: A single person aged 60 with $30,000 of MAGI for 2025 is at 199% of the FPL for 2024. This means their expected contribution is $588 and the PTC covers 95% of the annual premiums, assuming the U.S. average SLCSP! |

| Example 3: A married couple, aged 55, with a MAGI of $100,000 and SLCSP of $20,000 have an income to FPL of 489%. The expected contribution is $8,500 and the PTC is $11,500. |

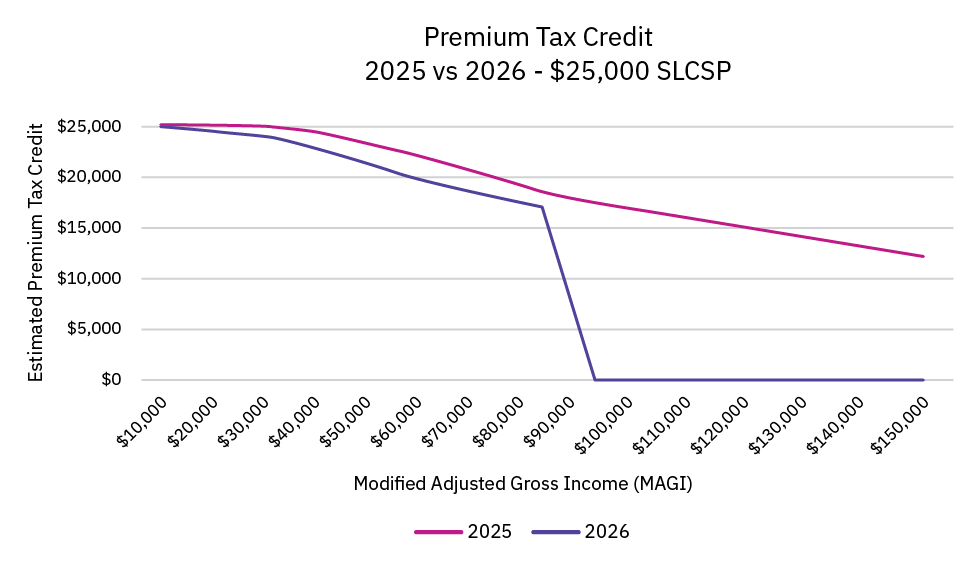

2026 changes to the premium tax credit

Let’s look first at how the credits worked prior to 2021:

- The PTC is officially laid out in the internal revenue code section 36B.

- Subsection 36B(b)(3)(A)(i) outlines the expected contribution factor based on a taxpayer’s MAGI relative to the FPL.

- Above 400%, the expectation was that the taxpayer covered 100% of their premium cost. Said differently, the taxpayer didn’t get a PTC.

In March 2021, the American Rescue Plan was signed into law allowing enhanced premium credits for everyone by reducing the expected contribution factors. In fact, even those with income over the 400% income limit were permitted a PTC, as Example 3 above illustrates.

The American Rescue Plan only permitted this change for 2021 and 2022, so in August of 2022 Congress enacted the Inflation Reduction Act, which extended the new limits through the end of 2025.

As most are aware, the federal government (as of this writing) was shut down. The Republicans signed off on a continuing resolution in the House of Representatives, but the Democrats are filibustering in the Senate to have the current factors extended.

If the law does revert to pre-2021 rules, the expected taxpayer contribution will be higher — starting at 132% of FPL with a “cliff” at 400%.

Planning for the future

The PTC is very much a Goldilocks story. If you have too little or too much income, you will not qualify for the credit. Therefore, planning to adjust your income is important if you are on a Health Insurance Marketplace plan.

To help bring your income down:

- Consider utilizing taxable brokerage accounts and qualified distributions from Roth accounts.

- Plan for tax loss harvesting to mitigate capital gain exposure.

- Make deductible contributions to IRAs or, if self-employed, to other retirement plans.

- If age 62 or older, delay taking Social Security benefits, which could help you qualify for larger PTC now and larger Social Security checks in the future.

Do not plan to invest in municipal bonds to skirt the threshold because this interest is added back to determine your MAGI.

Additional considerations:

- If your income is below 100% of the FPL, you might take taxable distributions from your IRAs or other tax-deferred retirement accounts for spending needs.

- If your needs are covered already, performing small Roth conversions may help increase your income where you need it.

- Your other options involve working part-time, recognizing gains inside your brokerage accounts, allocating investments to higher yielding vehicles, and more.

Getting help

The premium tax credit can be a significant windfall for early retirees and others without access to affordable health care. Qualifying for these benefits takes careful planning and execution.

If you have health insurance through the Marketplace and are concerned about navigating the upcoming changes to the premium tax credit, reach out to your Mercer Advisors wealth advisor.

Not a Mercer Advisors client and want to know more about managing your health care costs and optimizing tax credits? Let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. The hypothetical examples above are for illustrative purposes only. Client experiences will vary, successful outcomes are not guaranteed. Third-party links are presented for information and educational purposes only. Mercer Global Advisors Inc. is not affiliated with, does not guarantee nor does it endorse any of the applications or services mentioned in this article.

For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER® certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.