Owning rental property can be a rewarding experience, offering both financial benefits and the satisfaction of providing a home for others. Whether you’re a seasoned investor or just starting out, understanding the tax implications of your rental property is crucial. Navigating the complexities of tax deductions and classifications can be daunting, but with the right information, you can make informed decisions that maximize your returns and minimize your liabilities.

Determining whether your rental property is tax-deductible depends on how the IRS classifies the property based on the number of days you rent it out and use it personally. Additionally, the amount of time you spend managing and maintaining the property can influence the tax implications for your rental income. In this article, we will simplify the process of understanding your tax liabilities or benefits from rental property. Plus, we’ll provide you with a convenient checklist to help you stay organized for tax filing.

IRS classifications for rental property

If you rent out your residential property for fewer than 15 days per year, it is classified as personal-use property. This means you do not need to report any rental income on your tax return. While you cannot claim rental expenses as deductions, you may still be eligible for certain itemized deductions, such as mortgage interest and property taxes.

Renting out your property for more than 14 days introduces more complex tax implications. If you use the property for personal purposes more than 10% of the days it’s rented at fair market rates, it is classified as a mixed-use property. You will need to report all rental income on Schedule E of your tax return. Qualified rental expense deductions and itemized deductions (if applicable) must be allocated proportionally between rental and personal use.1 Rental expenses allocable to the business of renting the property will help to offset rental income on Schedule E while any personal use portion of rental expenses are not deductible.

Lastly, if you rent the property more than 14 days and are using it personally for less than the greater of 14 days or 10% of the rental days, the property is considered rental-use property. In this case, the income and rental-use portion of expenses are all reported on Schedule E.

Rental property taxes and deductions

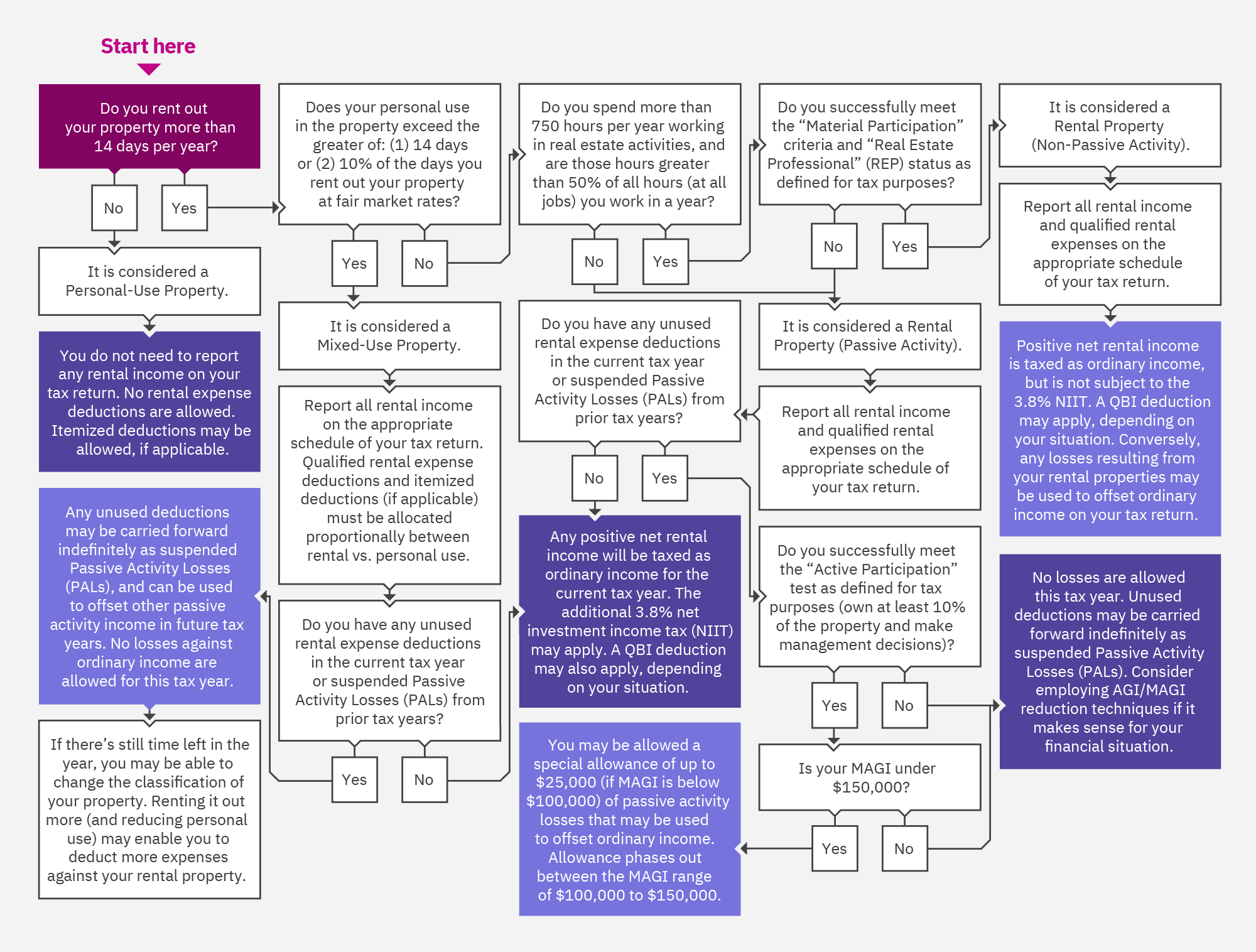

Follow the included chart to see the tax rules for your situation.

Explanations of tax terms

Passive activity loss (PAL): If you own a rental property and your expenses, such as mortgage interest, maintenance, and property taxes, exceed your rental income, the resulting loss is classified as a PAL. Generally, rental activities are considered passive, and losses can only be used to offset passive income, not active income from a salary or business. Any losses not permitted in the current year are carried forward to future years to offset income from the rental activity or when the property is sold. However, there are exceptions for real estate professionals and those who actively participate in rental activities (see below).

Net Investment Income Tax (NIIT): The NIIT applies to individuals with high modified adjusted gross incomes (MAGIs) and is intended for investment income but does not apply to positive net rental income. For 2025, the NIIT is 3.8% and applies if your MAGI exceeds $250,000 for married filing jointly, $125,000 for married filing separately, or $200,000 for singles.2 If your income exceeds these thresholds, the NIIT will apply to the lesser of your net investment income or the amount by which your MAGI exceeds the threshold. This tax is imposed in addition to the ordinary income tax for the year from the rental income.

MAGI or AGI: Your MAGI may be different from your adjusted gross income (AGI) because it adds back certain deductions, such as losses from rental property. In addition, the calculation of your MAGI may include foreign-earned income. If so, calculate MAGI for NIIT by starting with AGI and adding back the foreign-earned income exclusion.

Qualified business income (QBI) deduction: If you’re filing as a sole proprietorship, partnership, or S corporation, you may be able to deduct 20% for the tax year on non-passive or mixed-use property income. In addition, 20% of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income could be eligible for deduction.

Material versus active participation and real estate professional (REP): While long-term rental of a property is generally considered passive activity, as a real estate professional it can be considered material participation. The IRS considers a real estate professional to be someone who works more than 750 hours and spends more than half their work in the tax year in real estate activity. A material participant may be eligible to deduct net losses from the rental against ordinary income from other sources.

Active participation (a lower standard than material participation) in the property requires owning at least a 10% stake and making management decisions such as approving tenants and authorizing repairs. An active participant may be allowed to deduct up to $25,000 of rental property passive losses against ordinary income from other sources. The deduction phases out for taxpayers whose MAGI is between $100,000 and $150,000.

Checklist for rental property taxes

How you answer the following questions can help determine whether you may be eligible to receive deductions on a rental property.

| Question | Yes | No | Tax information |

| 1. Do you rent out your property more than 14 days per year? | If the answer is no, it is considered personal-use property, and the rest of the questions are not applicable. | ||

| 2. Does your personal use in the property exceed the greater of: (1) 14 days or (2) 10% of the days you rent out your property at fair market rates? | If the answer is yes, it is considered a mixed-use property. | ||

| 3. Do you spend less than 750 hours per year working in real estate activities, and are those hours greater than 50% of all hours (at all jobs) you work in the year? | If the answer is yes, it is considered a rental property with passive activity. | ||

| 4. Do you successfully meet the material participation criteria and real estate professional (REP) status as defined for tax purposes? | If the answer is yes, it is considered a rental property with non-passive activity. Positive net rental income is taxed as ordinary income but is not subject to the 3.8% NIIT. A QBI deduction may apply, depending on your situation. Conversely, any losses resulting from your rental properties may be used to offset ordinary income on your tax return. | ||

| 5. Do you have any unused rental expense deductions in the current tax year or suspended passive activity losses (PALs) from prior tax years? | If the answer is no, any positive net rental income will be taxed as ordinary income for the current tax year. The additional 3.8% NIIT may apply. A QBI deduction may also apply, depending on your situation. | ||

| 6. Do you successfully meet the active participation test as defined for tax purposes (own at least 10% of the property and make management decisions)? | If the answer is no, there are no losses are allowed this tax year. Unused deductions may be carried forward indefinitely as suspended PALs. Consider employing AGI/MAGI reduction techniques if it makes sense for your financial situation. | ||

| 7. Did you answer yes to questions 4 and 6? If so, is your MAGI under $150,000? | If the answer is yes, you may be allowed a special allowance of up to $25,000 (if MAGI is below $100,000) of passive activity losses that may be used to offset ordinary income. Allowance phases out between the MAGI range of $100,000 to $150,000. | ||

| 8. Did you answer no to question 7? If so, is your MAGI under $150,000? | If the answer is no, there are no losses are allowed this tax year. Unused deductions may be carried forward indefinitely as suspended PALs. Consider employing AGI/MAGI reduction techniques if it makes sense for your financial situation. | ||

| 9. Did you answer yes to questions 2 and 4? | Any unused deductions may be carried forward indefinitely as suspended PALs and can be used to offset other passive activity income in future tax years. No losses against ordinary income are allowed for this tax year. If there’s still time left in the year, you may be able to change the classification of your property. Renting it out more (and reducing personal use) may enable you to deduct more expenses against your rental property. |

Summary

Whether you’re already renting property or considering doing so in the near future, it’s crucial to understand the potential deductions available for the tax year. While the information provided in this article can guide you on whether your professional status in real estate or personal use of rental property will allow for deductions, these are merely guidelines. Tax situations can sometimes be confusing and complex, especially if you own multiple properties. Therefore, it’s wise to collaborate with a tax or finance professional if you aren’t already doing so. Additionally, consider how these activities and taxes could impact your overall financial picture and long-term goals.

If you’re a Mercer Advisors client, connect with your wealth advisor who can help with advising on these matters. Not a Mercer Advisors client? Our wealth management solutions integrate financial planning, investment management, tax, estate, insurance, and more. We connect the dots of your financial life to help you achieve Economic Freedom™. When you’re ready to worry less about money, let’s talk.

1 “Passive Activity and At-Risk Rules.” IRS Publication 925 (2024), Feb. 26, 2025.

2 “Topic no. 559, Net investment income tax.” IRS.gov, Jan. 2, 2025.

3 “Understanding and establishing ‘Material Participation’ for tax purposes.” IRS.com, Nov. 13, 2023.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.