We have recently received a timely question from our clients: “Why are we not allocating more of our portfolios to international stocks right now?”

To answer this, we first assess the investment thesis behind both international and U.S. equities, since increasing exposure to one necessarily reduces exposure to the other. When we evaluate the outlook for each market, as seen below, it’s clear in our view that both have compelling long-term characteristics. As a result, we believe a balanced, market-weighted approach to portfolio construction remains most appropriate.

(As context: at current market weights, about one-third of the opportunity for investment in global stocks is outside the U.S. This piece is assessing whether to invest even more than that.)

The case for international stocks

In 2025, international equities outperformed U.S. equities for the first time in eight years, rising 32% vs. 18% for the S&P 500. That momentum has continued into 2026, with international stocks up nearly 5% year-to-date, compared with 2% for those of the U.S.

There were three major drivers of international stock performance in 2025:

- Increased policy stimulus: European NATO governments (especially Germany) expanded defense and infrastructure spending. Asian countries introduced significant fiscal stimulus and policy reforms. These themes combined to lift economic activity across global markets.

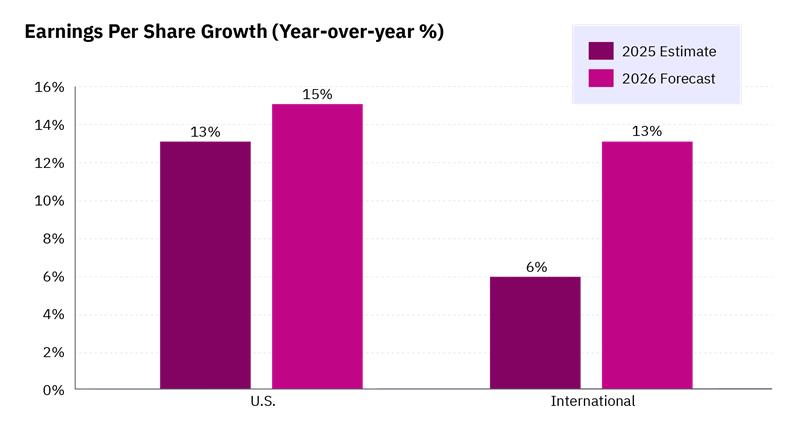

- Accelerating earnings growth: International companies are projected to finish 2025 with their fastest earnings growth since 2021, likely due in part to the aforementioned policy shifts.

- A weaker U.S. dollar: The dollar declined roughly 10% in 2025 due to elevated U.S. uncertainties around fiscal deficits, tariffs, and tensions between the executive branch and the Federal Reserve. A weakening dollar enhances international returns for U.S.-based investors when local performance is translated back to U.S. dollar terms.

Will international stocks continue to outperform?

Looking ahead, several factors suggest the investment thesis for international stocks remains intact:

- There is continued downward pressure on the U.S. dollar: U.S. policy and geopolitical uncertainties remain elevated (e.g., Greenland, Venezuela, Canada, federal shutdown, Federal Reserve tensions), placing continued downward pressure on the U.S. dollar. The U.S. Dollar Index is down an additional ~2% year-to-date, though it increased slightly after the Fed chair announcement.

- Fiscal stimulus in Europe and other regions is expected to continue: European earnings are expected to grow accordingly, from ~6% in 2025 to a forecasted ~13% in 2026.

- Valuations (based on expected earnings growth) remain more attractive internationally: The valuation gap, shown by the chart below, means investors pay far less for each dollar of international earnings.

| Region |

2-year forward price-to-earnings |

| U.S. |

21.99 |

| International |

14.81 |

| Developed ex-U.S. |

15.44 |

| Emerging Markets |

13.41 |

Source: MSCI, Factset, Mercer Advisors, as of 2/3/26.

The case for U.S. stocks

While international equities have enjoyed strong performance, it’s essential not to overlook the three major structural strengths of investing in the U.S. stock market:

- U.S. earnings growth continues to lead: In 2025, U.S. company earnings rose ~13%, more than double the ~6% growth internationally. Although Europe has an outlook for more improvement vs. 2025, the overall growth rate remains higher in the U.S. Looking to 2026, forecasts expect 15% earnings growth in the U.S. vs. 13% internationally.Given this strong earnings data, it’s important to remember that historically, stock prices have often been influenced by earnings. While U.S. valuations currently appear high, if U.S. equities experience persistently higher earnings, those valuations could ultimately prove to be warranted.

Past performance is no guarantee of future returns. You cannot invest in an index. Indexes: International—MSCI ACWI ex-US. U.S.—S&P 500. Source: MSCI, Bloomberg Finance L.P., Fidelity Investments (AART), Mercer Advisors, as of 12/31/25.

- The U.S. has a favorable regulatory environment: While hard to quantify, many investors see the U.S. as maintaining a generally pro-business and pro-capital markets regulatory landscape. This environment continues to foster greater innovation and profit growth relative to other developed economies. One example of what this means in practice is that highly innovative information technology and communication sectors make up 45% of the S&P 500, but only about 20% of international stocks.

- Investor planning considerations: Most of our clients are U.S. citizens who live in the United States and expect to spend their savings in the United States. It logically follows that they therefore allocate a majority of their portfolio to U.S. assets. We are looking to diversify their U.S. exposure, not avoid it.

Our key takeaways: Why we maintain a market‑weighted global allocation

After reviewing the data and global landscape, the strongest long‑term approach is to remain fully diversified across the global stock market in market‑weighted proportions.

Several principles reinforce this view:

- Diversification works: International equities outperformed in 2025 and provided meaningful ballast during periods of U.S. volatility (such as the sharp April 2025 selloff). This is a real-time reminder of how global diversification helps stabilize portfolios.

- Both the U.S. and international markets have strong investment cases: International stocks tend to benefit from attractive valuations, ongoing policy stimulus, and a weaker dollar. U.S. stocks enjoy stronger earnings growth, a comparatively supportive regulatory environment, and better alignment for investors planning to spend in the U.S. economy. Each market is driven by different economic forces — they complement, rather than replace, one another.

- Market leadership changes – it is impossible to predict from year to year: While recent trends have favored international markets, there is no reliable way to forecast whether U.S. or international equities will lead in 2026. Chasing whatever performed best last year often leads to poor timing decisions.

Owning both U.S. and international stocks in proportion to the global market’s assessment of opportunity remains the most effective and disciplined strategy.

This allows investors to capture opportunities wherever they manifest, since market weights automatically increase allocations to leading countries as their stock values rise. This approach also helps to reduce concentrated regional risks, minimize unnecessary portfolio turnover, and build resiliency for client portfolios across various market cycles.

Click here for past insights about wealth management and other interesting topics. Not a Mercer Advisors client but interested in more information? Let’s talk.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors.

The information is believed to be accurate, but is not guaranteed or warranted by Mercer Advisors. This information is not intended as a recommendation or solicitation to buy, sell, or hold, any particular security or to engage in any particular investment strategy. Different types of investments involve varying degrees of risk, investments mentioned in this document may not be suitable for all investors. Investments are subject to market risk, including the possible loss of principal. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Portfolio management strategies such as diversification, asset allocation, and rebalancing do not ensure a profit or guarantee against loss.

This content may contain forward looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Home » Insights » Market Commentary » Why Not Invest More in International Stocks: Insights From Our CIO

Why Not Invest More in International Stocks: Insights From Our CIO

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

CIO Don Calcagni tackles the question: Should investors bet bigger on international stocks in a period of U.S. uncertainty?

We have recently received a timely question from our clients: “Why are we not allocating more of our portfolios to international stocks right now?”

To answer this, we first assess the investment thesis behind both international and U.S. equities, since increasing exposure to one necessarily reduces exposure to the other. When we evaluate the outlook for each market, as seen below, it’s clear in our view that both have compelling long-term characteristics. As a result, we believe a balanced, market-weighted approach to portfolio construction remains most appropriate.

(As context: at current market weights, about one-third of the opportunity for investment in global stocks is outside the U.S. This piece is assessing whether to invest even more than that.)

The case for international stocks

In 2025, international equities outperformed U.S. equities for the first time in eight years, rising 32% vs. 18% for the S&P 500. That momentum has continued into 2026, with international stocks up nearly 5% year-to-date, compared with 2% for those of the U.S.

There were three major drivers of international stock performance in 2025:

Will international stocks continue to outperform?

Looking ahead, several factors suggest the investment thesis for international stocks remains intact:

Source: MSCI, Factset, Mercer Advisors, as of 2/3/26.

The case for U.S. stocks

While international equities have enjoyed strong performance, it’s essential not to overlook the three major structural strengths of investing in the U.S. stock market:

Past performance is no guarantee of future returns. You cannot invest in an index. Indexes: International—MSCI ACWI ex-US. U.S.—S&P 500. Source: MSCI, Bloomberg Finance L.P., Fidelity Investments (AART), Mercer Advisors, as of 12/31/25.

Our key takeaways: Why we maintain a market‑weighted global allocation

After reviewing the data and global landscape, the strongest long‑term approach is to remain fully diversified across the global stock market in market‑weighted proportions.

Several principles reinforce this view:

Owning both U.S. and international stocks in proportion to the global market’s assessment of opportunity remains the most effective and disciplined strategy.

This allows investors to capture opportunities wherever they manifest, since market weights automatically increase allocations to leading countries as their stock values rise. This approach also helps to reduce concentrated regional risks, minimize unnecessary portfolio turnover, and build resiliency for client portfolios across various market cycles.

Click here for past insights about wealth management and other interesting topics. Not a Mercer Advisors client but interested in more information? Let’s talk.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors.

The information is believed to be accurate, but is not guaranteed or warranted by Mercer Advisors. This information is not intended as a recommendation or solicitation to buy, sell, or hold, any particular security or to engage in any particular investment strategy. Different types of investments involve varying degrees of risk, investments mentioned in this document may not be suitable for all investors. Investments are subject to market risk, including the possible loss of principal. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Portfolio management strategies such as diversification, asset allocation, and rebalancing do not ensure a profit or guarantee against loss.

This content may contain forward looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Explore More

Why Every Family Can Benefit from a Financial Plan

Insurance Check In: Tips for Reviewing Existing Coverage

Estate Planning: Protecting Tangible Assets and Collectibles