I’m writing to address a question that has come up more frequently in recent months: “Why doesn’t my equity portfolio have more explicit exposure to sectors like artificial intelligence (AI), energy, or real estate — especially when these areas feel ‘hot’ or full of opportunity?”

The short answer, for Mercer Advisors clients is: You already do have exposure to these themes — often more than it appears at first glance — and the exposure is sized intentionally, based on how global markets are pricing risk, value, and long-term growth potential.

If you want to understand this better, consider the long answer:

1. Market weighting reflects collective, real-time pricing of opportunity

At Mercer Advisors, portfolios are built in close reference to globally diversified, market-cap-weighted indices. This approach means we are not guessing which sectors or industries should be larger in the portfolio — we are aligned closely with the aggregated judgment of millions of investors transacting daily in global markets.

When a sector has a smaller weight in a broad index (for example, real estate or energy today), that is not because it is being overlooked. It’s because global market participants are collectively assigning those sectors a proportionate value based on:

- Current earnings and cash flows

- Competitive positioning and innovation potential

This “wisdom of the market” helps ensure our portfolios reflect accurate and continuously updated pricing rather than top-down guesses.

2. You have more exposure than it appears on the surface

Even when a sector or sub-industry doesn’t appear prominently in the asset-allocation pie chart, it is still meaningfully represented within the underlying holdings of the funds we use.

Artificial intelligence

AI, for example, is not only represented by firms labeled as “AI companies.” Much of the real economic value in AI today lives inside:

- Large, diversified tech platforms investing billions in AI R&D

Your portfolio holds many of the global leaders in these categories — companies earning revenue from AI adoption across the economy, not just companies marketing themselves as “pure AI plays.”

It’s also worth noting that some of the most innovative and fastest-growing AI firms are private companies, not yet publicly traded. While these businesses are shaping the future, their absence from public markets means they cannot be directly owned in traditional equity portfolios.

Energy

Energy exposure is present through:

- Integrated oil and gas majors

- Refining and distribution firms

- Renewable energy producers and transition-focused utilities

The energy sector’s current market weight simply reflects expectations for long-term demand, margins, cost structures, and investment cycles. If the industry’s outlook improves materially, it can grow as a share of global market cap — and your exposure will likely automatically grow with it.

Real estate

Real estate’s listed universe (primarily REITs) is a small but stable slice of global equity markets. Your portfolio captures:

- Retail and office, where appropriate

Importantly, many companies outside the “real estate” sector own significant real estate assets — such as retail chains, hospitality firms, and even technology companies with large data center footprints. Similarly, in energy, some industrial and transportation firms own their own energy production capabilities, allowing them to benefit from sector-specific tailwinds even if they are not classified as energy companies.

3. This implicit exposure may often matter more than explicit sector bets

The goal is to invest in companies whose prospects are improved by a technology or market trend (implicit exposure) which isn’t necessarily the same as the companies entirely focused on a particular technology or trend (the explicit sector).

Many exciting themes, AI being the clearest example, are horizontal technologies, meaning they diffuse across virtually every sector.

A company does not need “AI” in its name to be monetizing AI. Similarly:

- Energy efficiency affects industrials, tech, utilities, and materials

- Real estate cycles influence financials, consumer sectors, and construction

- AI development drives demand for energy (especially electricity), semis, hardware, networking, and cloud infrastructure

Diversified exposure often captures the ecosystem of an opportunity more effectively — and with less risk — than taking narrow single-sector positions.

4. The role of discipline in long-term investing

While thematic investing can feel exciting, it is also where investors most often overpay. History shows that:

- Hot sectors frequently become overcrowded and overpriced

- Investors chasing recent performance typically underperform the broad market

- Market-cap-weighted exposure tends to outperform sector-picking over long horizons

Our philosophy is intentionally disciplined:

- Participate broadly in global innovation and growth

- Avoid concentrated bets where expectations are already extremely high

- Let market pricing determine weights, not sentiment or headlines

This keeps our portfolios aligned with long-term evidence rather than short-term enthusiasm.

5. If the opportunity grows, your exposure will likely grow systematically

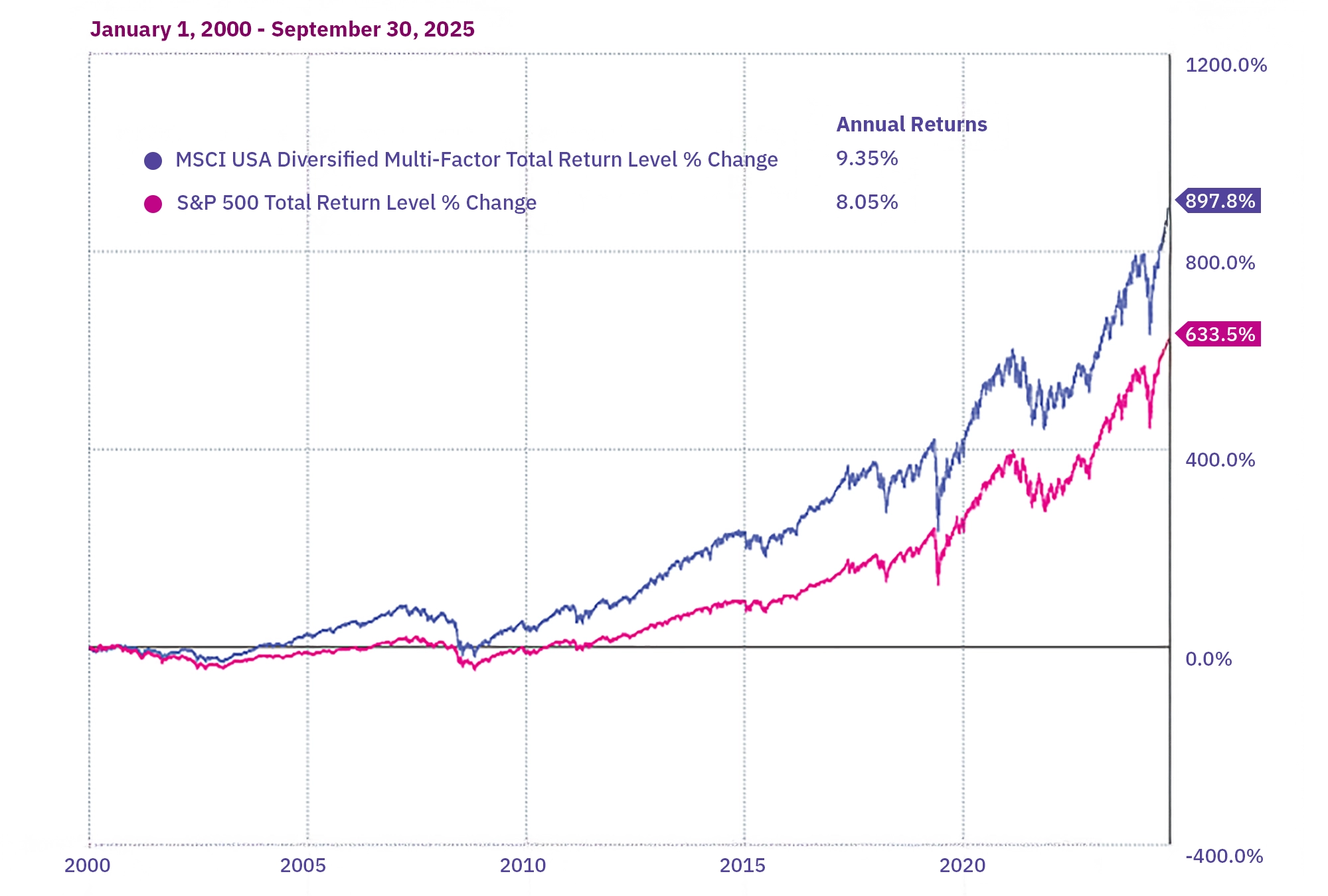

At Mercer Advisors, we are proponents of factor investing, an academically rigorous and peer-reviewed systematic approach that identifies those companies with quantifiable characteristics — factors — that are likely to yield higher risk-adjusted returns.

Many clients who are interested in “hot” sectors have an instinct to pursue highly profitable companies in sectors that seem to have momentum.

A key point, in response to this, is that two of the “factors” that we rigorously identify are “quality” which has profitability as one of its inputs and “momentum” which quantifies the tendency of winning stocks to keep winning (to a point). In other words, our strategy does seek to identify high-profitability companies, and those companies with quantifiable momentum. It does so within a rigorous, methodological framework, and not via guesswork or gut instinct.

Factor investing, not sector investing, is the systematic way we pursue elevated returns.

Source: S&P Global and MSCI. The MSCI USA Diversified Multiple-Factor Index is based on a traditional market cap weighted parent index, the MSCI USA Index, which includes U.S. large and mid-cap stocks. The index aims to maximize exposure to four factors — Value, Momentum, Quality and Low Size — while maintaining a risk profile similar to that of the underlying parent index. Past performance is no guarantee of future results. Actual returns may be lower. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. Investors cannot invest directly in an index.

When the earnings and profitability of AI companies grow faster than the rest of the market, they will likely become both a larger percentage of global market capitalization, and their performance may influence the factor exposures we seek systematically – and therefore our portfolios will naturally adjust with them.

This is one of the strengths of our approach: We participate in the upside by making informed investment decisions.

The bottom line

At Mercer Advisors, your portfolio has meaningful exposure to artificial intelligence, energy, real estate, and other long-term opportunities — both directly and indirectly. The level of exposure is not a reflection of skepticism; it reflects disciplined investing guided by global market pricing.

Many of our portfolios seek to identify and participate in trends as they appear across industries, but our broader goal is to build portfolios that are positioned to grow steadily tomorrow, next year, and over the coming decades.

Click here for past insights about wealth management and other interesting topics. Not a Mercer Advisors client but interested in more information? Let’s talk.

Home » Insights » Market Commentary » Understanding Your Portfolio’s Exposure to AI, Energy, and Real Estate

Understanding Your Portfolio’s Exposure to AI, Energy, and Real Estate

David Krakauer, CFA®, CRPS®

Vice President, Portfolio Management

How Mercer Advisors approaches investing in “hot” sectors like AI, energy, and real estate.

I’m writing to address a question that has come up more frequently in recent months: “Why doesn’t my equity portfolio have more explicit exposure to sectors like artificial intelligence (AI), energy, or real estate — especially when these areas feel ‘hot’ or full of opportunity?”

The short answer, for Mercer Advisors clients is: You already do have exposure to these themes — often more than it appears at first glance — and the exposure is sized intentionally, based on how global markets are pricing risk, value, and long-term growth potential.

If you want to understand this better, consider the long answer:

1. Market weighting reflects collective, real-time pricing of opportunity

At Mercer Advisors, portfolios are built in close reference to globally diversified, market-cap-weighted indices. This approach means we are not guessing which sectors or industries should be larger in the portfolio — we are aligned closely with the aggregated judgment of millions of investors transacting daily in global markets.

When a sector has a smaller weight in a broad index (for example, real estate or energy today), that is not because it is being overlooked. It’s because global market participants are collectively assigning those sectors a proportionate value based on:

This “wisdom of the market” helps ensure our portfolios reflect accurate and continuously updated pricing rather than top-down guesses.

2. You have more exposure than it appears on the surface

Even when a sector or sub-industry doesn’t appear prominently in the asset-allocation pie chart, it is still meaningfully represented within the underlying holdings of the funds we use.

Artificial intelligence

AI, for example, is not only represented by firms labeled as “AI companies.” Much of the real economic value in AI today lives inside:

Your portfolio holds many of the global leaders in these categories — companies earning revenue from AI adoption across the economy, not just companies marketing themselves as “pure AI plays.”

It’s also worth noting that some of the most innovative and fastest-growing AI firms are private companies, not yet publicly traded. While these businesses are shaping the future, their absence from public markets means they cannot be directly owned in traditional equity portfolios.

Energy

Energy exposure is present through:

The energy sector’s current market weight simply reflects expectations for long-term demand, margins, cost structures, and investment cycles. If the industry’s outlook improves materially, it can grow as a share of global market cap — and your exposure will likely automatically grow with it.

Real estate

Real estate’s listed universe (primarily REITs) is a small but stable slice of global equity markets. Your portfolio captures:

Importantly, many companies outside the “real estate” sector own significant real estate assets — such as retail chains, hospitality firms, and even technology companies with large data center footprints. Similarly, in energy, some industrial and transportation firms own their own energy production capabilities, allowing them to benefit from sector-specific tailwinds even if they are not classified as energy companies.

3. This implicit exposure may often matter more than explicit sector bets

The goal is to invest in companies whose prospects are improved by a technology or market trend (implicit exposure) which isn’t necessarily the same as the companies entirely focused on a particular technology or trend (the explicit sector).

Many exciting themes, AI being the clearest example, are horizontal technologies, meaning they diffuse across virtually every sector.

A company does not need “AI” in its name to be monetizing AI. Similarly:

Diversified exposure often captures the ecosystem of an opportunity more effectively — and with less risk — than taking narrow single-sector positions.

4. The role of discipline in long-term investing

While thematic investing can feel exciting, it is also where investors most often overpay. History shows that:

Our philosophy is intentionally disciplined:

This keeps our portfolios aligned with long-term evidence rather than short-term enthusiasm.

5. If the opportunity grows, your exposure will likely grow systematically

At Mercer Advisors, we are proponents of factor investing, an academically rigorous and peer-reviewed systematic approach that identifies those companies with quantifiable characteristics — factors — that are likely to yield higher risk-adjusted returns.

Many clients who are interested in “hot” sectors have an instinct to pursue highly profitable companies in sectors that seem to have momentum.

A key point, in response to this, is that two of the “factors” that we rigorously identify are “quality” which has profitability as one of its inputs and “momentum” which quantifies the tendency of winning stocks to keep winning (to a point). In other words, our strategy does seek to identify high-profitability companies, and those companies with quantifiable momentum. It does so within a rigorous, methodological framework, and not via guesswork or gut instinct.

Factor investing, not sector investing, is the systematic way we pursue elevated returns.

Source: S&P Global and MSCI. The MSCI USA Diversified Multiple-Factor Index is based on a traditional market cap weighted parent index, the MSCI USA Index, which includes U.S. large and mid-cap stocks. The index aims to maximize exposure to four factors — Value, Momentum, Quality and Low Size — while maintaining a risk profile similar to that of the underlying parent index. Past performance is no guarantee of future results. Actual returns may be lower. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. Investors cannot invest directly in an index.

When the earnings and profitability of AI companies grow faster than the rest of the market, they will likely become both a larger percentage of global market capitalization, and their performance may influence the factor exposures we seek systematically – and therefore our portfolios will naturally adjust with them.

This is one of the strengths of our approach: We participate in the upside by making informed investment decisions.

The bottom line

At Mercer Advisors, your portfolio has meaningful exposure to artificial intelligence, energy, real estate, and other long-term opportunities — both directly and indirectly. The level of exposure is not a reflection of skepticism; it reflects disciplined investing guided by global market pricing.

Many of our portfolios seek to identify and participate in trends as they appear across industries, but our broader goal is to build portfolios that are positioned to grow steadily tomorrow, next year, and over the coming decades.

Click here for past insights about wealth management and other interesting topics. Not a Mercer Advisors client but interested in more information? Let’s talk.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Diversification does not ensure a profit or guarantee against loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Indices are not available for direct investment. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

[Chartered Retirement Plan Specialist℠] and [CRPS℠] are trademarks or registered service marks of the College for Financial Planning in the United States and/or other countries.

Explore More

Parent PLUS Loans: 2026 Deadline for Lower Payments and Relief

How to Handle Intellectual Property With Your Estate Planning

Why Not Invest More in International Stocks: Insights From Our CIO