We know from history that the best time to prepare for a market downturn is not when markets are in a tailspin, but when markets are doing well. For many investors, that means recognizing that the time is now to think seriously about de-risking portfolios and financial plans.

The current market

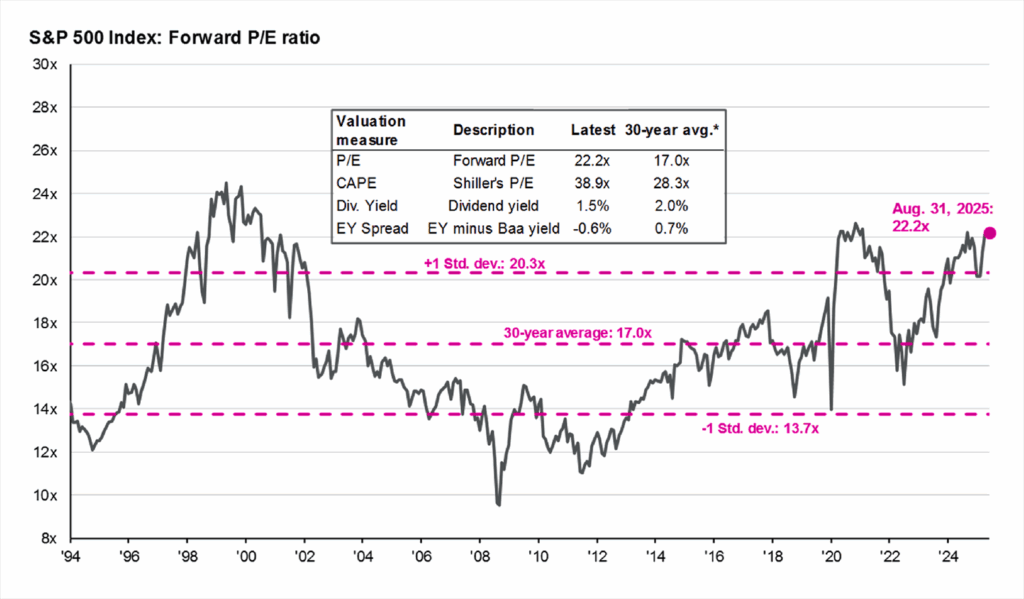

By virtually all major valuation measures, the current bull market looks a little gray around the ears. That doesn’t mean that market correction is imminent — indeed, markets often continue to hit new highs for extended periods of time. However, at more than 22 times earnings, the valuation of the S&P 500 is fast approaching valuations last seen in the wake of the COVID-19 pandemic and the dot-com bubble of the late 1990s. Growth stocks, the market’s most expensive stocks, currently trade at more than 30 times next year’s earnings.

Exhibit A: Market valuations are near all-time highs

Source: Bloomberg, FactSet, Moody’s, Refinitiv Datastream, Robert Shiller, Standard & Poor’s, J.P. Morgan Asset Management.

None of this is necessarily bad. After all, today’s high valuations have resulted in spectacular gains for many investors’ portfolios. Whether they own stocks, real estate, ETFs, or mutual funds, investors nowadays find themselves sitting on significant unrealized — aka, untaxed — capital gains.

However, there are likely some storm clouds on the economic horizon. The Sept. 5, 2025, jobs report, for example, is the most recent data point to suggest the economy may be slowing. And regardless of whether we agree that the economy is slowing today, we know at some point it inevitably will. Long before it’s clear the economy has slowed, markets will likely experience a correction or even another bear market. Experienced investors know all too well that the good times inevitably come to an end, that markets severely punish undiversified portfolios, and that the best approach to managing risk and maximizing long-term returns is through careful diversification.

And therein lays the rub. A large unrealized gain is often paralyzing. No one wants to take the biggest winners in their portfolio and lose a chunk of it to taxes. This, of course, is why diversification needs to be carefully planned and even more carefully implemented. It also requires a more multidimensional approach when it comes to thinking about diversification.

Three types of diversification

When we think about diversification, we should consider three types.

Usually we only think about one, but there are others.

1. Diversification within your portfolio. When done properly, portfolio diversification takes place both across and within asset classes. If you own Apple, selling some of it to invest in other tech stocks is an example of diversification within a sector.

But a sector is not an asset class; an asset class is a broad group of investments that tend to behave similarly to broader macroeconomic developments. Selling technology stocks to invest in stocks in many sectors is an example of diversifying within a single asset class (U.S. large cap stocks).

Selling some of our U.S. stocks to invest in non-U.S. stocks, bonds, real estate, and private equity is an example of what it means to diversify across asset classes. When done properly, portfolio diversification not only helps reduce risk, it can also maximize a portfolio’s expected return for a given level of risk.

2. Diversification within your financial plan. There are multiple ways to go about diversifying within your financial plan. Diversifying our assets across multiple tax environments is one. For example, funding Roth IRAs (either directly or through back door contributions), 401(k)s, and joint accounts is a form of tax diversification that creates flexibility in managing our current and future tax liabilities.

Another way of diversifying within our financial plan is through careful contingency planning. After all, life happens, and no financial plan is bullet proof. The major tax law changes, a terminally ill spouse or child, uninsured health events, the loss of a job, or a devastating lawsuit can all derail even the most meticulous financial plan. And when it does, having a plan B, plan C, or even D, can make all the difference between financial success and financial ruin.

3. Diversification across strategies. Just as we shouldn’t put all our eggs in one basket within our portfolio, we should also resist investing too heavily in any single diversification strategy.

For example, there are many very effective strategies investors can use to diversify concentrated stock positions tax efficiently. Direct indexing, staged sales, options strategies, exchange funds, opportunity zone funds, 1042 exchanges, pre-paid variable forwards, long-short strategies, and charitable trusts are all legitimate, very effective approaches to tax efficiently diversifying concentrated stock positions. Yet all too often investors (and their advisors) tend to go all in on one to the exclusion of the others. This approach results in taking unnecessary strategy-specific risk.

A more optimal approach, one that reduces the risk of something going horribly wrong with any one strategy, is one that diversifies across multiple strategies (versus betting the house on just one).

The takeaway is that we diversify within our financial plans and across various strategies for the same reasons that we diversify across and within asset classes: to help reduce risk and maximize returns.

Click here for past insights about the recent market volatility and other interesting topics. Not a Mercer Advisors client but interested in more information? Let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Home » Insights » Market Commentary » The Time to Diversify: Insights From Our CIO

The Time to Diversify: Insights From Our CIO

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

The best time to prepare for a downturn is when markets are flying high. Consider these three types of diversification.

We know from history that the best time to prepare for a market downturn is not when markets are in a tailspin, but when markets are doing well. For many investors, that means recognizing that the time is now to think seriously about de-risking portfolios and financial plans.

The current market

By virtually all major valuation measures, the current bull market looks a little gray around the ears. That doesn’t mean that market correction is imminent — indeed, markets often continue to hit new highs for extended periods of time. However, at more than 22 times earnings, the valuation of the S&P 500 is fast approaching valuations last seen in the wake of the COVID-19 pandemic and the dot-com bubble of the late 1990s. Growth stocks, the market’s most expensive stocks, currently trade at more than 30 times next year’s earnings.

Exhibit A: Market valuations are near all-time highs

Source: Bloomberg, FactSet, Moody’s, Refinitiv Datastream, Robert Shiller, Standard & Poor’s, J.P. Morgan Asset Management.

None of this is necessarily bad. After all, today’s high valuations have resulted in spectacular gains for many investors’ portfolios. Whether they own stocks, real estate, ETFs, or mutual funds, investors nowadays find themselves sitting on significant unrealized — aka, untaxed — capital gains.

However, there are likely some storm clouds on the economic horizon. The Sept. 5, 2025, jobs report, for example, is the most recent data point to suggest the economy may be slowing. And regardless of whether we agree that the economy is slowing today, we know at some point it inevitably will. Long before it’s clear the economy has slowed, markets will likely experience a correction or even another bear market. Experienced investors know all too well that the good times inevitably come to an end, that markets severely punish undiversified portfolios, and that the best approach to managing risk and maximizing long-term returns is through careful diversification.

And therein lays the rub. A large unrealized gain is often paralyzing. No one wants to take the biggest winners in their portfolio and lose a chunk of it to taxes. This, of course, is why diversification needs to be carefully planned and even more carefully implemented. It also requires a more multidimensional approach when it comes to thinking about diversification.

Three types of diversification

When we think about diversification, we should consider three types.

Usually we only think about one, but there are others.

1. Diversification within your portfolio. When done properly, portfolio diversification takes place both across and within asset classes. If you own Apple, selling some of it to invest in other tech stocks is an example of diversification within a sector.

But a sector is not an asset class; an asset class is a broad group of investments that tend to behave similarly to broader macroeconomic developments. Selling technology stocks to invest in stocks in many sectors is an example of diversifying within a single asset class (U.S. large cap stocks).

Selling some of our U.S. stocks to invest in non-U.S. stocks, bonds, real estate, and private equity is an example of what it means to diversify across asset classes. When done properly, portfolio diversification not only helps reduce risk, it can also maximize a portfolio’s expected return for a given level of risk.

2. Diversification within your financial plan. There are multiple ways to go about diversifying within your financial plan. Diversifying our assets across multiple tax environments is one. For example, funding Roth IRAs (either directly or through back door contributions), 401(k)s, and joint accounts is a form of tax diversification that creates flexibility in managing our current and future tax liabilities.

Another way of diversifying within our financial plan is through careful contingency planning. After all, life happens, and no financial plan is bullet proof. The major tax law changes, a terminally ill spouse or child, uninsured health events, the loss of a job, or a devastating lawsuit can all derail even the most meticulous financial plan. And when it does, having a plan B, plan C, or even D, can make all the difference between financial success and financial ruin.

3. Diversification across strategies. Just as we shouldn’t put all our eggs in one basket within our portfolio, we should also resist investing too heavily in any single diversification strategy.

For example, there are many very effective strategies investors can use to diversify concentrated stock positions tax efficiently. Direct indexing, staged sales, options strategies, exchange funds, opportunity zone funds, 1042 exchanges, pre-paid variable forwards, long-short strategies, and charitable trusts are all legitimate, very effective approaches to tax efficiently diversifying concentrated stock positions. Yet all too often investors (and their advisors) tend to go all in on one to the exclusion of the others. This approach results in taking unnecessary strategy-specific risk.

A more optimal approach, one that reduces the risk of something going horribly wrong with any one strategy, is one that diversifies across multiple strategies (versus betting the house on just one).

The takeaway is that we diversify within our financial plans and across various strategies for the same reasons that we diversify across and within asset classes: to help reduce risk and maximize returns.

Click here for past insights about the recent market volatility and other interesting topics. Not a Mercer Advisors client but interested in more information? Let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Explore More

How to Handle Intellectual Property With Your Estate Planning

Why Not Invest More in International Stocks: Insights From Our CIO

Understanding Qualified Small Business Stock (QSBS)