On Wednesday, Sept. 17, the Federal Reserve cut its target interest rate by 0.25% and signaled that an additional 0.5% of cuts are likely coming by the end of the year. U.S. equities rallied on the news.

The move draws particular interest because this was the first rate cut since December 2024, and because the Fed has been the focus of political pressure from the president to cut interest rates.

Let’s set aside the politics and focus on the state of the U.S. economy. What might rate cuts mean for investors right now?

The Fed’s dual mandate

The Fed has what is described as a “dual mandate” to pursue two primary goals: stable prices and maximum employment.

Sometimes, these goals make it obvious what the Fed ought to do. When inflation is high, unemployment is very low, and abundant jobs are being created, for example, it’s clear that higher interest rates will slow down borrowing, help tamp down inflation, and the labor market will be in position to withstand it. Conversely, when the labor market is weak and inflation is tame, it’s clear that lower interest rates would boost borrowing and support job creation, without risking runaway inflation.

So, how does the current economic landscape align with Fed’s dual mandate?

Do we have stable prices?

The Federal Reserve has defined its price stability target as an inflation rate of 2% per year. Clearly the recent track record on this score has been poor — inflation has exceeded the target for the past four years. Inflation is when the overall level of prices in the economy is rising.

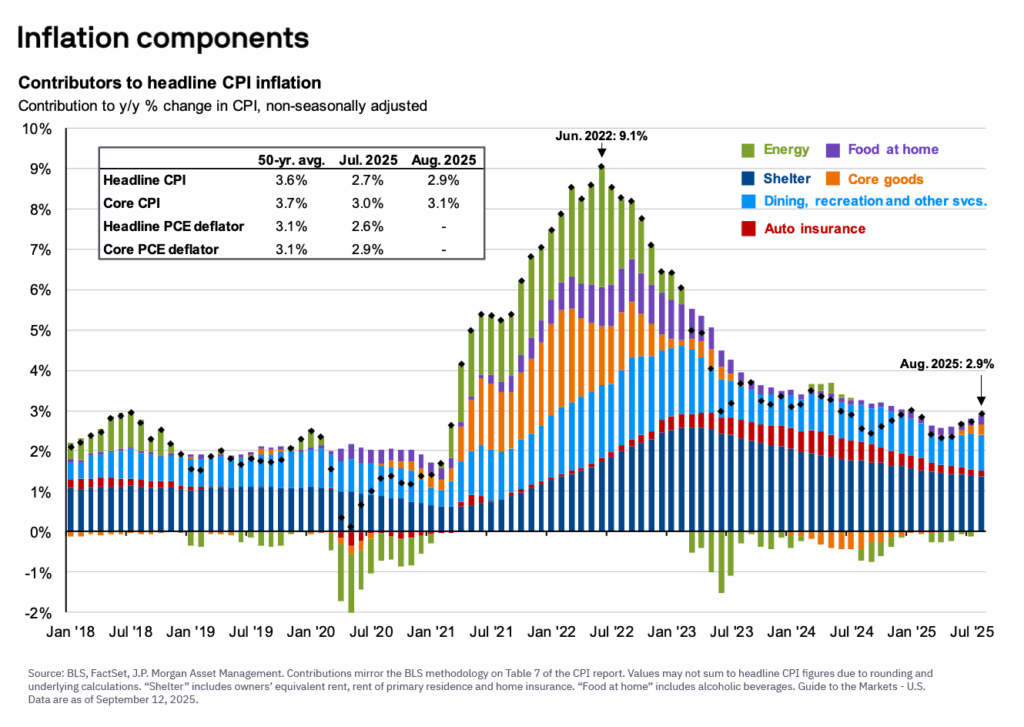

On the flipside of inflation are two related concepts that are sometimes confused. The first is deflation, which refers to a decline in the overall level of prices. We haven’t seen true deflation in recent years — although certain categories, like energy, have experienced outright price drops at times.

Then there is disinflation, which refers to prices continuing to climb, but at a much slower pace than previously. To be clear, what the chart shows above is disinflation and not deflation. Prices are no longer rising as rapidly as they were in 2022, but they are still rising significantly more than the Fed is comfortable with.

Core prices — which exclude the volatile categories of food and energy, and which economists generally believe capture the underlying trend in inflation — climbed 3.1% in August from a year earlier, according to the Consumer Price Index. That’s 110 basis points above the Fed’s target level of 2%. In recent months, this rate of increase has climbed slightly higher.

This would not normally be considered a benign inflation outlook. Typically, the Fed seeks to raise interest rates when inflation is above its target.

Do we have full employment?

The unemployment rate in August stood at 4.3%, which is low by any objective historical measure. Over the past 50 years, the unemployment rate has only been lower than this about 16% of the time.

However, the unemployment rate has slowly drifted up from 3.4% last spring and the pace of monthly job creation has slowed. The Fed traditionally does lower interest rates when the job market is deteriorating.

Now, there are questions about the quality of the jobs data. The president recently fired the commissioner of the Bureau of Labor Statistics, the agency responsible for compiling and publishing unemployment figures. While there’s no evidence of political interference, it has become increasingly difficult for the BLS to get businesses and individuals to respond to its surveys, which are its primary method of data collection. That challenge has raised concerns about the accuracy of the initial economic readings.

In justifying its decision to cut rates Wednesday, the Fed said in its monetary policy statement that “downside risks to employment have risen,” that is, they fear the possibility that the labor market might deteriorate in the absence of action.

Conflicting signals

The economy, in terms of the Fed’s dual mandate, is sending mixed signals about its overall health. Inflation is still running a little hot for the Fed’s comfort, but job creation may be stalling rapidly. The stock market appears relieved by the prospect of additional rate cuts later this year.

But, once this development is priced into the market, attention will quickly shift to how much further — and how much faster — the Fed might cut. While the politics surrounding the Fed are drawing plenty of attention, the real question is what lies ahead for the economy. If the labor market continues to deteriorate, we could see additional cuts. But if inflation reaccelerates — a real possibility, given signs that tariff-related pricing pressures are building in supply chains — the Fed may be more cautious. Cutting rates further could potentially fuel even more inflation.

What are the investment implications?

Regardless of what happens next, we can share a few takeaways on investment implications.

1. Bond prices should rise. When interest rates fall, bond prices rise. To the extent the Fed succeeds in pushing down interest rates across the economy, this should support bond prices.

2. Lower rates help support today’s lofty market valuations. Stocks are at very high valuations currently, some of the highest levels we’ve seen since the dot-com bubble. Lower interest rates help support such frothy valuations by making it easier for companies and investors to borrow.

3. Lower yields, mean less income from bond holdings. To the extent interest rates decline, bond investors receive less income. Perhaps the bigger concern for these investors, however, is that lower interest rates at a time of already-high inflation could cause prices to rise further.

4. Lower rates and inflation could cause the dollar to decline further. All else equal, lower rates and higher inflation are a recipe for the U.S. dollar to decline relative to non-U.S. currencies. As we’ve written previously, the decline of the dollar has been one of the defining market trends in 2025. This is a key reason we continue to recommend international equities as part of any broadly diversified portfolio.

The bottom line is this: There are always multiple trends unfolding across the global economy. It’s not uncommon for some of these trends to present conflicting information to investors — and that’s especially the case today. So, what’s the best course of action? We diversify — across and within asset classes — because a broadly diversified, low-cost portfolio remains the best approach to staying well-positioned for whatever comes next.

Click here for past insights about the recent market volatility and other interesting topics. Not a Mercer Advisors client but interested in more information? Let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Diversification does not ensure a profit or guarantee against loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Home » Insights » Market Commentary » The Fed’s Rate Cut – Implications for Investors: Insights From Our CIO

The Fed’s Rate Cut – Implications for Investors: Insights From Our CIO

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

The Federal Reserve’s first rate cut of the year has important implications for investors.

On Wednesday, Sept. 17, the Federal Reserve cut its target interest rate by 0.25% and signaled that an additional 0.5% of cuts are likely coming by the end of the year. U.S. equities rallied on the news.

The move draws particular interest because this was the first rate cut since December 2024, and because the Fed has been the focus of political pressure from the president to cut interest rates.

Let’s set aside the politics and focus on the state of the U.S. economy. What might rate cuts mean for investors right now?

The Fed’s dual mandate

The Fed has what is described as a “dual mandate” to pursue two primary goals: stable prices and maximum employment.

Sometimes, these goals make it obvious what the Fed ought to do. When inflation is high, unemployment is very low, and abundant jobs are being created, for example, it’s clear that higher interest rates will slow down borrowing, help tamp down inflation, and the labor market will be in position to withstand it. Conversely, when the labor market is weak and inflation is tame, it’s clear that lower interest rates would boost borrowing and support job creation, without risking runaway inflation.

So, how does the current economic landscape align with Fed’s dual mandate?

Do we have stable prices?

The Federal Reserve has defined its price stability target as an inflation rate of 2% per year. Clearly the recent track record on this score has been poor — inflation has exceeded the target for the past four years. Inflation is when the overall level of prices in the economy is rising.

On the flipside of inflation are two related concepts that are sometimes confused. The first is deflation, which refers to a decline in the overall level of prices. We haven’t seen true deflation in recent years — although certain categories, like energy, have experienced outright price drops at times.

Then there is disinflation, which refers to prices continuing to climb, but at a much slower pace than previously. To be clear, what the chart shows above is disinflation and not deflation. Prices are no longer rising as rapidly as they were in 2022, but they are still rising significantly more than the Fed is comfortable with.

Core prices — which exclude the volatile categories of food and energy, and which economists generally believe capture the underlying trend in inflation — climbed 3.1% in August from a year earlier, according to the Consumer Price Index. That’s 110 basis points above the Fed’s target level of 2%. In recent months, this rate of increase has climbed slightly higher.

This would not normally be considered a benign inflation outlook. Typically, the Fed seeks to raise interest rates when inflation is above its target.

Do we have full employment?

The unemployment rate in August stood at 4.3%, which is low by any objective historical measure. Over the past 50 years, the unemployment rate has only been lower than this about 16% of the time.

However, the unemployment rate has slowly drifted up from 3.4% last spring and the pace of monthly job creation has slowed. The Fed traditionally does lower interest rates when the job market is deteriorating.

Now, there are questions about the quality of the jobs data. The president recently fired the commissioner of the Bureau of Labor Statistics, the agency responsible for compiling and publishing unemployment figures. While there’s no evidence of political interference, it has become increasingly difficult for the BLS to get businesses and individuals to respond to its surveys, which are its primary method of data collection. That challenge has raised concerns about the accuracy of the initial economic readings.

In justifying its decision to cut rates Wednesday, the Fed said in its monetary policy statement that “downside risks to employment have risen,” that is, they fear the possibility that the labor market might deteriorate in the absence of action.

Conflicting signals

The economy, in terms of the Fed’s dual mandate, is sending mixed signals about its overall health. Inflation is still running a little hot for the Fed’s comfort, but job creation may be stalling rapidly. The stock market appears relieved by the prospect of additional rate cuts later this year.

But, once this development is priced into the market, attention will quickly shift to how much further — and how much faster — the Fed might cut. While the politics surrounding the Fed are drawing plenty of attention, the real question is what lies ahead for the economy. If the labor market continues to deteriorate, we could see additional cuts. But if inflation reaccelerates — a real possibility, given signs that tariff-related pricing pressures are building in supply chains — the Fed may be more cautious. Cutting rates further could potentially fuel even more inflation.

What are the investment implications?

Regardless of what happens next, we can share a few takeaways on investment implications.

1. Bond prices should rise. When interest rates fall, bond prices rise. To the extent the Fed succeeds in pushing down interest rates across the economy, this should support bond prices.

2. Lower rates help support today’s lofty market valuations. Stocks are at very high valuations currently, some of the highest levels we’ve seen since the dot-com bubble. Lower interest rates help support such frothy valuations by making it easier for companies and investors to borrow.

3. Lower yields, mean less income from bond holdings. To the extent interest rates decline, bond investors receive less income. Perhaps the bigger concern for these investors, however, is that lower interest rates at a time of already-high inflation could cause prices to rise further.

4. Lower rates and inflation could cause the dollar to decline further. All else equal, lower rates and higher inflation are a recipe for the U.S. dollar to decline relative to non-U.S. currencies. As we’ve written previously, the decline of the dollar has been one of the defining market trends in 2025. This is a key reason we continue to recommend international equities as part of any broadly diversified portfolio.

The bottom line is this: There are always multiple trends unfolding across the global economy. It’s not uncommon for some of these trends to present conflicting information to investors — and that’s especially the case today. So, what’s the best course of action? We diversify — across and within asset classes — because a broadly diversified, low-cost portfolio remains the best approach to staying well-positioned for whatever comes next.

Click here for past insights about the recent market volatility and other interesting topics. Not a Mercer Advisors client but interested in more information? Let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Diversification does not ensure a profit or guarantee against loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Explore More

Parent PLUS Loans: 2026 Deadline for Lower Payments and Relief

How to Handle Intellectual Property With Your Estate Planning

Why Not Invest More in International Stocks: Insights From Our CIO