While the year-to-date slump in U.S. stocks has garnered much of our attention in recent weeks, just as interesting is the ongoing strong performance of non-US stocks.

Non-U.S. developed market stocks had an exceptionally strong start to the year, but it was unclear if this trend would continue following the new U.S. administration’s tariff announcement on April 2. Initially, both U.S. and non-U.S. stocks fell sharply on the news. However, since then, non-U.S. stocks have rebounded far better than U.S. stocks, extending their year-to-date outperformance.

Post-tariff performance

Consider the five non-U.S. developed market exchange traded funds (ETFs) that we recommend at Mercer Advisors within our Multifactor Portfolios. In the week following the president’s tariff announcement, U.S. and non-U.S. stocks all fell quite sharply. The market has since recovered — albeit unevenly.

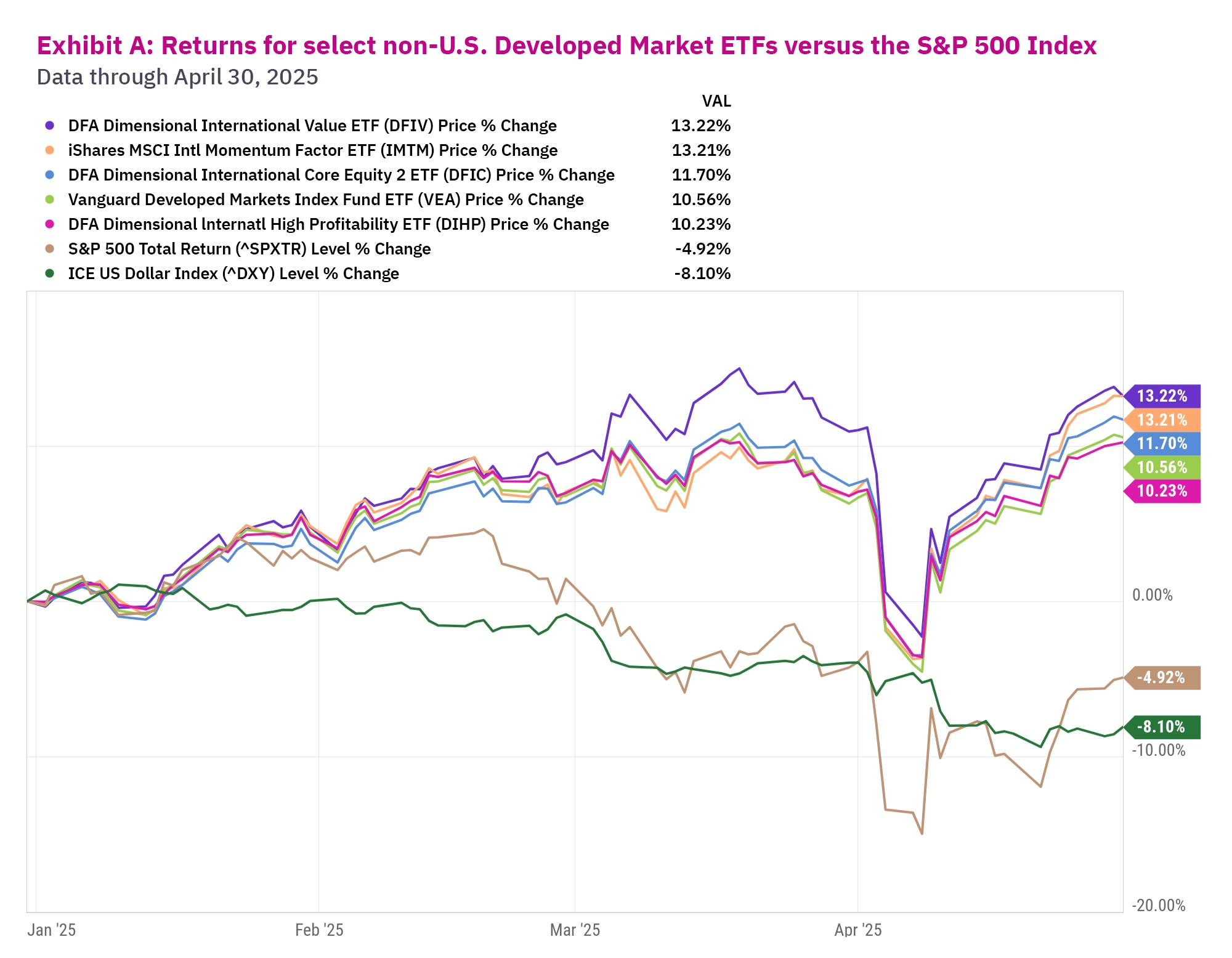

As you can see in the chart below, these five non-U.S. developed market ETFs have all fully recovered and continue to show strong outperformance compared to the S&P 500 Index.

Exhibit A: Returns for select non-U.S. Developed Market ETFs versus the S&P 500 Index. Data through April 30, 2025.

Source: YCharts, Inc. Past performance is not a guarantee of future results. Not intended as a recommendation for any individual to buy, sell, or hold any referenced investment product. Indices are not available for direct investment.

The U.S. dollar

The U.S. dollar is an important part of this story. Consider European stocks, which are up about 17.5% for the year but only 7.1% for Euro-based investors. Where did the other 10% in return come from? This is the currency effect; about 10 percentage points of the increase in European stocks this year, in U.S. dollar terms, is due to the weakening of the dollar against the euro. The green line in the above chart shows the ICE U.S. Dollar Index has declined 8.1% YTD. Said differently, even before tariffs are considered, the price of non-U.S. goods and services has become 8.1% more expensive for U.S. consumers.

Nevertheless, European stocks being up by 7.1% in euros is still a strong performance amid a period where U.S. stocks are down by nearly 6%.

Let’s consider for a moment why European stocks have been so strong and what we can surmise about the impact of tariffs on that success.

What can we say about the drivers of non-U.S. outperformance?

We can point to a few factors that have underpinned developed market stocks outside the U.S.

- Defense spending in the European Union — Russia’s invasion of Ukraine has startled the European Union into action on the defense front. It’s also become clear that the willingness of the U.S. to fund European defense has its limits. Brussels has announced plans to mobilize €800 billion euros ($873 billion U.S. dollars) for rearmament. Germany has pledged to undertake fiscal expansion. (A Reuters story noted, in a sign of the times, that the German tank maker Rheinmetall was briefly more expensive than Ferrari.)

- Strong European banks — This burst of investment has bolstered European banks. A separate report from Reuters encapsulates the outlook nicely. Jean-Laurent Bonnafe, the CEO of the French megabank BNP Paribas told analysts, “There is probably a lot to come in terms of restructuring, refinancing, deleveraging, mergers and acquisition,” referring to large European companies. “Europe has no choice but to reinvest.”

- A falling dollar has favored international stocks. As noted, the U.S. Dollar Index is down about 8.1% year-to-date, which means that stocks of non-U.S. companies are at least that much more valuable in U.S. dollar terms. The dollar fell 4.6% this year prior to the announcement of U.S. tariffs and has fallen an additional 3.5% since, reflecting a broader degree of waning enthusiasm by international investors to invest in U.S. assets.

- International stocks have also benefited from low valuations. Heading into the start of the year, European stocks were cheap compared to U.S. stocks. At that time, U.S. stocks were trading at around 21.5 times earnings while European stocks were at about 13 times earnings. This gap has narrowed – although arguably only slightly – so far this year, with Eurozone stocks trading at 13.8 times earnings, and U.S. stocks down to 20 times earnings. For investors seeking to de-risk their portfolios and hedge against a more difficult U.S. investing environment, re-allocating to lower valuation stocks elsewhere makes a lot of sense.

Parting thoughts

- The surprising strength of European stocks is a reminder of how hard it is to time the markets. With hindsight, we can point to the factors that drove European markets higher, but it’s fair to say that few investors saw this coming at the start of the year. Even if you correctly identified the factors that would eventually drive European stocks higher, it would have been difficult to predict when exactly they would do so.

- While markets view tariffs as anti-growth, the ultimate economic and market impact of the U.S. administration’s new tariffs remains unclear. There’s still no real certainty about where U.S. tariff policy is headed. We’ve seen the pattern repeat itself several times — where recently announced tariffs are quickly walked back or watered down. Investors are wise to remain cautious.

- In a world where winners and losers remain particularly unclear, diversification remains the best strategy. It was diversification that helped portfolios weather the first four months of 2025, and we believe it remains the best strategy going forward amid a global trade war. Moments like now are a case study in why diversification remains forever and always investors’ most prudent course of action for weathering volatility. We diversify not because of what we expect to happen, but to protect against what we don’t.

Click here for past insights about the recent market volatility and other interesting topics. Not a Mercer Advisors client but interested in more information? Let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Diversification does not ensure a profit or guarantee against loss. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Home » Insights » Market Commentary » International Stocks Win Again: Insights From Our CIO

International Stocks Win Again: Insights From Our CIO

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

The slump in U.S. stocks has been atop the headlines, but our Chief Investment Officer, Don Calcagni, says the ongoing strong performance of non-U.S. stocks is just as interesting.

While the year-to-date slump in U.S. stocks has garnered much of our attention in recent weeks, just as interesting is the ongoing strong performance of non-US stocks.

Non-U.S. developed market stocks had an exceptionally strong start to the year, but it was unclear if this trend would continue following the new U.S. administration’s tariff announcement on April 2. Initially, both U.S. and non-U.S. stocks fell sharply on the news. However, since then, non-U.S. stocks have rebounded far better than U.S. stocks, extending their year-to-date outperformance.

Post-tariff performance

Consider the five non-U.S. developed market exchange traded funds (ETFs) that we recommend at Mercer Advisors within our Multifactor Portfolios. In the week following the president’s tariff announcement, U.S. and non-U.S. stocks all fell quite sharply. The market has since recovered — albeit unevenly.

As you can see in the chart below, these five non-U.S. developed market ETFs have all fully recovered and continue to show strong outperformance compared to the S&P 500 Index.

Exhibit A: Returns for select non-U.S. Developed Market ETFs versus the S&P 500 Index. Data through April 30, 2025.

Source: YCharts, Inc. Past performance is not a guarantee of future results. Not intended as a recommendation for any individual to buy, sell, or hold any referenced investment product. Indices are not available for direct investment.

The U.S. dollar

The U.S. dollar is an important part of this story. Consider European stocks, which are up about 17.5% for the year but only 7.1% for Euro-based investors. Where did the other 10% in return come from? This is the currency effect; about 10 percentage points of the increase in European stocks this year, in U.S. dollar terms, is due to the weakening of the dollar against the euro. The green line in the above chart shows the ICE U.S. Dollar Index has declined 8.1% YTD. Said differently, even before tariffs are considered, the price of non-U.S. goods and services has become 8.1% more expensive for U.S. consumers.

Nevertheless, European stocks being up by 7.1% in euros is still a strong performance amid a period where U.S. stocks are down by nearly 6%.

Let’s consider for a moment why European stocks have been so strong and what we can surmise about the impact of tariffs on that success.

What can we say about the drivers of non-U.S. outperformance?

We can point to a few factors that have underpinned developed market stocks outside the U.S.

Parting thoughts

Click here for past insights about the recent market volatility and other interesting topics. Not a Mercer Advisors client but interested in more information? Let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Diversification does not ensure a profit or guarantee against loss. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Explore More

Insurance Check In: Tips for Reviewing Existing Coverage

Estate Planning: Protecting Tangible Assets and Collectibles

Before April 15: Learn Unmarried-Couple HSA Contribution Advantage