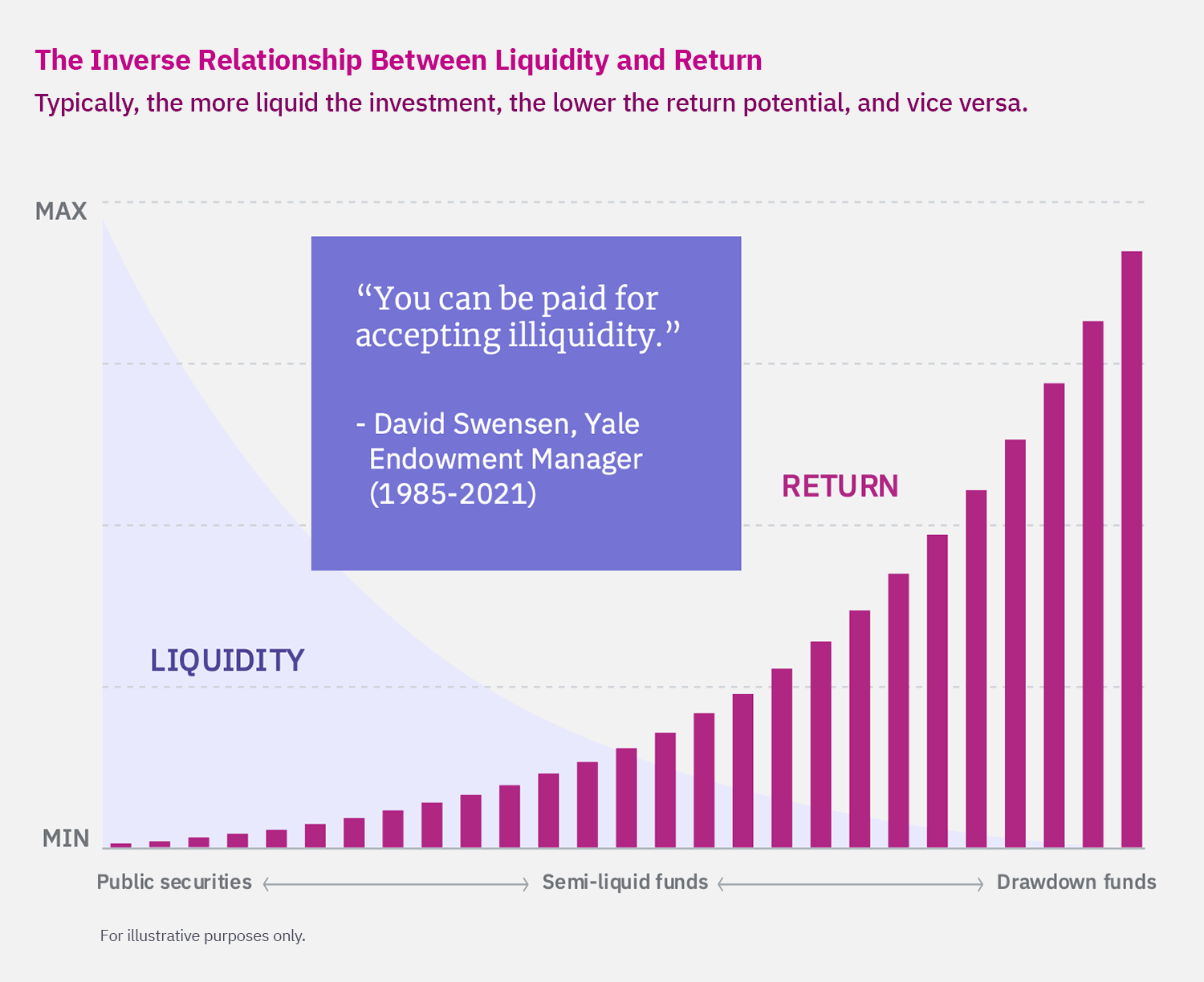

Incorporating private investments into your portfolio begins with a solid financial plan. Given their illiquid nature and the potential lack of early exit opportunities, careful planning is essential when considering private markets. Private investments can leverage the “illiquidity premium” to potentially achieve higher returns than public markets, if investors are comfortable with investment capital being locked up for the long term.

Public investments (stock, bonds, mutual funds, ETF’s) typically trade daily and are then available as cash the next day. Money market funds and higher-grade bonds that mature under twelve months generally have the benefit of lower volatility (or nearly none in the case of a money market fund), in addition to the liquidity to turn them into cash. Equity-based investments, directly or through an investment vehicle such as an ETF, should have at least a five-year time horizon in our view, but are available as cash the next business day after the sale. With many private investments, they do not trade daily or at all. Therefore, investors typically require an additional potential for return if they are locking up capital in a private investment that is not liquid. The additional return potential is referred to as the “illiquidity premium” and is the expected difference in return between a private investment and its corresponding public investment.

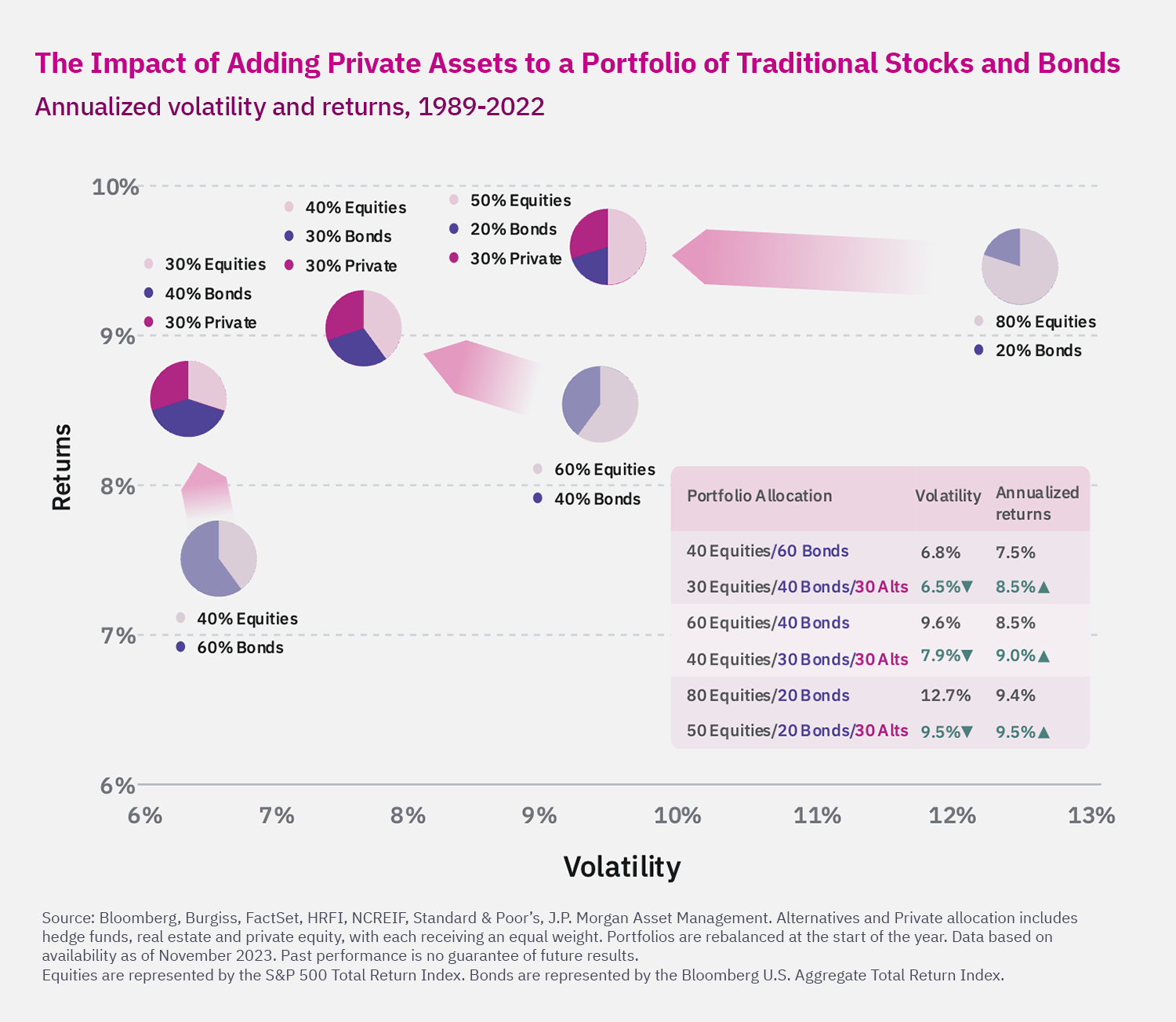

A discussion about a diversified investment portfolio would not be complete without considering private assets.

- Of the $1,540 trillion in global economic assets, only $230 trillion are publicly traded.1 Limiting a portfolio to public investments alone means missing out on potential diversification benefits that private investments offer. Notably, 85% of companies with revenues exceeding $100 million are privately held.2

- Traditionally, companies went public to access investor capital. However, with the availability of additional private funding sources, founders and other key stakeholders can now manage a company’s liquidity and financing needs without entering public markets.

While some investors may prefer the liquidity provided by public securities, qualified investors willing to allocate a portion of their portfolio to illiquid securities can potentially benefit from an “illiquidity premium.” Including private investments offers an additional allocation choice that, when combined with effective cash flow management, can enhance diversification and/or returns. Historical data shows that private equity and private credit have outperformed their corresponding public counterparts (U.S. public equities versus private equity and private credit versus U.S. high-yield bonds).3,4

It is important to note that access to private markets is typically restricted to accredited investors, qualified clients, or qualified purchasers. This ensures that only those with sufficient financial resources can participate, given the higher risks and complexities involved in private investments.

Equities are represented by the S&P 500 Total Return Index. Bonds are represented by the Bloomberg U.S. Aggregate Total Return Index.

Private investments are available through various asset classes:

- Private Equity: Involves making an investment in a private company, either in partnership with other funds or as an individual owner. The firm may be purchased from another private investor, acquired as a division of a larger company, or taken private from being public.

- Venture Capital: Focuses on small or startup companies with high growth potential. Investments can be made at the inception of the company or at various early stages of development.

- Hedge Funds: Typically involves trading in public investments using alternative strategies such as leverage, short selling, or investing in securities with limited liquidity.

- Private Real Estate: Involves direct investment in real estate, which can include multifamily/apartment buildings, commercial properties, or industrial spaces. Strategies may focus on managing ongoing projects or making improvements to enhance potential capital gains.

- Private Credit: Involves lending funds that provide liquidity based on the fund’s focus. Some funds lend to higher-quality companies, while others provide financing to distressed companies in need of capital.

Various investment vehicles provide access to private markets, each with distinct levels of liquidity:

- Semi-liquid Funds: These funds typically allow daily purchases but may restrict redemptions to quarterly, semi-annual, or annual periods. The amount that can be sold during each redemption period may be limited based on the number of sellers.

- Private Funds (Evergreen Funds): Generally, require a single purchase, often on a monthly or quarterly basis. They may impose redemption fees and/or restrictions on selling within the first year or two.

- Outcome Funds: Designed to achieve specific objectives such as growth or income, these funds combine various investments. They operate as drawdown vehicles, investing over the initial few years based on an initial commitment and then distributing proceeds from sold investments. These funds typically have a seven-to-ten-year lifespan once capital is fully committed.

- Asset Class Funds: These funds focus on a single private asset class to provide more direct exposure. They can be structured either as a fund of funds or as a single fund. Similar to outcome funds, they often operate as drawdown vehicles with a seven-to-ten-year life span once fully invested. Funds of funds usually have lower minimum investment requirements compared to single funds.

Due to the risks and illiquidity associated with private investments, the Securities and Exchange Commission requires private investors to meet certain criteria:

- Accredited Investor: An individual with an annual income of at least $200,000, or a couple with a combined annual income of $300,000. Alternatively, an individual or couple with a net worth exceeding $1 million, excluding their primary residence, also qualifies.

- Qualified Client: An individual or couple with $1.1 million or more in assets under management, or with a net worth of $2.1 million or more, excluding the primary residence. Qualified clients can invest in funds that charge performance-based fees by investment advisors or hedge funds.

- Qualified Purchaser: An individual or entity with $5 million or more in investable assets, a family-owned company with $5 million or more, or a trust with $5 million or more in investable assets.

While private investments can add diversification and potentially enhance returns, it is crucial to begin with a well-built financial plan to understand your net worth and cash flow needs. Unlike stocks, bonds, ETFs, and mutual funds, which offer daily liquidity and potential capital gains, private investments may require a commitment of up to 10 years. Therefore, planning for this time horizon is essential. Private investments should be considered as long-term vehicles rather than short-term income or growth options.

Your advisor can help determine whether private investments are appropriate for your portfolio. Not a Mercer Advisors client but interested in more information? Let’s talk.

1.“The Rise and Rise of the Global Balance Sheet,” McKinsey Global Institute, November 2021.

2. Bain analysis of S&P Capital IQ data, as of December 2022.

3. Burgiss, Yahoo Finance, as of February 26, 2024. Data for period January 1, 2000, to January 1, 2020. Private fund returns are a median calculated internal rate of return, net of fees. US equity returns annualized from S&P 500 Total Returns Index. Past performance is not a guarantee of future results. Indices are not available for direct investment.

4. Burgiss, FRED Economic Data, as of February 26, 2024. Data for period January 1, 2000, to January 1, 2020. Private fund returns are a median calculated internal rate of return, net of fees. High-yield bond returns annualized from ICE BofA US High Yield Index Total Return Index. Past performance is not a guarantee of future results. Indices are not available for direct investment.