Funding for the U.S. federal government lapsed at midnight October 1, marking the fifth government shutdown since 2000. The market has remained relatively unphased so far, but if the shutdown becomes prolonged, we expect many investors will begin to worry. With that in mind, we wanted to answer some common questions about the situation.

Who is directly affected?

When the government shuts down, federal government employees stop receiving paychecks, and many functions deemed “non-essential” are suspended.

Essential workers — such as air traffic controllers and TSA officers — continue working without pay during the shutdown.

Programs considered essential and mandatory, including Medicare, Medicaid, Social Security, and the Federal Reserve, continue operating because they are self-funded or supported by dedicated revenue streams.

How did we get here?

At the heart of the congressional impasse is a dispute over health care policy. Democrats are pushing to extend tax credits under the Affordable Care Act (ACA), which benefit about 22 million people who purchase insurance through ACA marketplaces. The credits were set to expire.

Republicans, meanwhile, sought to keep the government open without renewing the tax credits.

This has happened before, right? How long will this last?

There have been 22 government shutdowns over the last 50 years.1 Since the mid-1970s, shutdowns have lasted an average of eight days. The most recent, which began at the end of 2018 during President Trump’s first term, was the longest — lasting 35 days. Given today’s heightened political tensions and polarization in Washington, some wonder whether this standoff could also be prolonged. It’s certainly possible.

What are the economic impacts of past shutdowns?

Economists estimate that each week of a government shutdown reduces growth domestic product by about 0.1% or 0.2%.2 Much of that loss however, is typically recovered once the government reopens.

In past shutdowns, federal workers have received back pay, which helps limit the overall economic impact.

After the 2018-2019 shutdown, the Congressional Budget Office estimated that $18 billion in federal spending was delayed.3 Ultimately, only $3 billion of GDP was permanently lost, as most spending resumed later. These are relatively small effects in the context of the $30.5 trillion U.S. economy or the $38 trillion in total public debt.

Will this time be different?

This shutdown could prove different. The administration has threatened to fire — rather than furlough — some federal workers. The scale of this impact is uncertain, but job loss is clearly more severe than delayed paychecks.

Shutdowns can also weigh on consumer confidence. The last shutdown saw a 7% decline in consumer confidence. Today, however, that measure is already quite a bit lower than it was in late 2018.

One issue with particular market-relevance right now is the suspension of key economic data releases during the shutdown — including jobs and inflation reports. These reports have been key inputs in the debate at the Federal Reserve over how quickly to lower interest rates. Without them, the Fed and markets risk being caught off guard by what the economy looks like when we start getting the reports again.

What other market impacts can we expect?

Markets tend to look past government shutdowns. Over the past 50 years, there have been 22 shutdowns, and they have not historically aligned with market downturns. In fact, most have been entirely forgettable from the stock market’s perspective. The market’s muted reaction since October 1 supports this view. In fact, the last time the S&P 500 posted a negative return during a shutdown/funding gap was 1990.

Should we change our investment strategy?

Shutdowns are typically transitory, and equity drawdowns have historically been limited, on average. We continue to advise investors to avoid making decisions based on headlines. We know from historical experience that markets typically look beyond short-term disruptions.

Should we be concerned about underlying U.S. political dysfunction?

We believe the recurring fiscal standoffs in Washington are a symptom of broader political and economic challenges facing the U.S. As we noted in May — shortly after Moody’s downgraded the U.S. government’s credit rating — the country has struggled for nearly 25 years to put federal spending on a sustainable trajectory. That hasn’t changed and, indeed, has continued to worsen. A potent mix of tax increases and spending cuts seems increasingly necessary to stave off more serious economic challenges.

We repeat again that politics and investing don’t mix. While we may like to think that our preferred political party can easily resolve these challenging and complex issues, the fact remains that deficit reduction has remained elusive for both parties across many decades. This is not a new problem — it’s one that has been decades in the making.

How do we respond as investors?

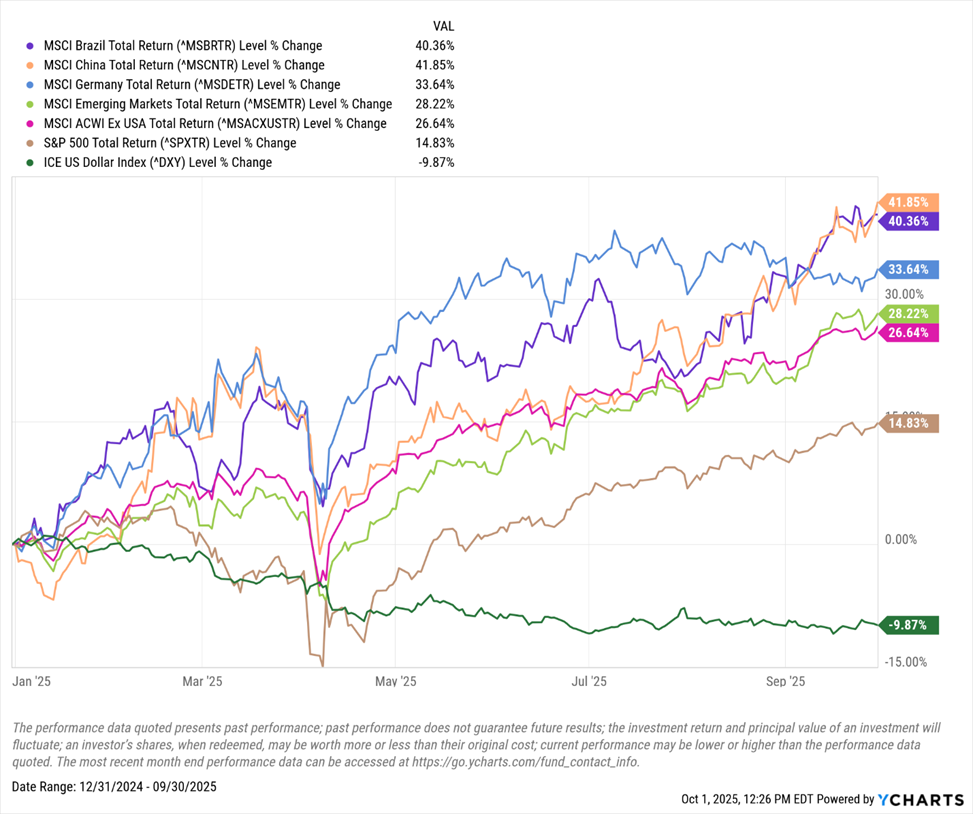

One of the most important trends in financial markets this year has been the strong performance of non-U.S. assets. In fact, we view the shutdown as yet another reminder that the case for non-U.S. assets remains strong and may strengthen further.

Through the end of Q3, the S&P 500 Index has posted a respectable 14.8% return. However, international performance has been even stronger:

- Non-US developed markets were up 26.6%

- Emerging markets were up 28.2%

- A few countries have had remarkably strong years, such as Germany (up 33.6%), China (up 41.9%), and Brazil (up 40.4%).

- The U.S. dollar has declined nearly 10% this year against other major currencies, which has helped buoy returns of non-U.S. assets.

The below chart summarizes the trends this year:

Recent events, including major changes in U.S. trade policy and the current government shutdown, underscore why international diversification can be helpful. We diversify portfolios to help guard against economic challenges here at home, while at the same time hedging against declines in the U.S. dollar.

Our baseline recommendation for all investors remains unchanged: maintain a thoughtfully and broadly diversified low-cost portfolio — one that’s diversified across and within major global asset classes and across and within both public and private markets.

Click here for past insights about the recent market volatility and other interesting topics. Not a Mercer Advisors client but interested in more information? Let’s talk.

1 “Timeline of US government shutdowns over last 50 years.” USA Today (Oct. 1, 2025).

2 “How much does a US government shutdown cost the economy?” Goldman Sachs (Sept. 1, 2023).

3 “The Effects of the Partial Shutdown Ending in January 2019.” Congressional Budget Office (Jan. 28, 2019).

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Diversification does not ensure a profit or guarantee against loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Home » Insights » Market Commentary » Q&A on the Federal Government Shutdown: Insights From Our CIO

Q&A on the Federal Government Shutdown: Insights From Our CIO

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

CIO Don Calcagni answers questions on how investors should respond to the ongoing federal government shutdown

Funding for the U.S. federal government lapsed at midnight October 1, marking the fifth government shutdown since 2000. The market has remained relatively unphased so far, but if the shutdown becomes prolonged, we expect many investors will begin to worry. With that in mind, we wanted to answer some common questions about the situation.

Who is directly affected?

When the government shuts down, federal government employees stop receiving paychecks, and many functions deemed “non-essential” are suspended.

Essential workers — such as air traffic controllers and TSA officers — continue working without pay during the shutdown.

Programs considered essential and mandatory, including Medicare, Medicaid, Social Security, and the Federal Reserve, continue operating because they are self-funded or supported by dedicated revenue streams.

How did we get here?

At the heart of the congressional impasse is a dispute over health care policy. Democrats are pushing to extend tax credits under the Affordable Care Act (ACA), which benefit about 22 million people who purchase insurance through ACA marketplaces. The credits were set to expire.

Republicans, meanwhile, sought to keep the government open without renewing the tax credits.

This has happened before, right? How long will this last?

There have been 22 government shutdowns over the last 50 years.1 Since the mid-1970s, shutdowns have lasted an average of eight days. The most recent, which began at the end of 2018 during President Trump’s first term, was the longest — lasting 35 days. Given today’s heightened political tensions and polarization in Washington, some wonder whether this standoff could also be prolonged. It’s certainly possible.

What are the economic impacts of past shutdowns?

Economists estimate that each week of a government shutdown reduces growth domestic product by about 0.1% or 0.2%.2 Much of that loss however, is typically recovered once the government reopens.

In past shutdowns, federal workers have received back pay, which helps limit the overall economic impact.

After the 2018-2019 shutdown, the Congressional Budget Office estimated that $18 billion in federal spending was delayed.3 Ultimately, only $3 billion of GDP was permanently lost, as most spending resumed later. These are relatively small effects in the context of the $30.5 trillion U.S. economy or the $38 trillion in total public debt.

Will this time be different?

This shutdown could prove different. The administration has threatened to fire — rather than furlough — some federal workers. The scale of this impact is uncertain, but job loss is clearly more severe than delayed paychecks.

Shutdowns can also weigh on consumer confidence. The last shutdown saw a 7% decline in consumer confidence. Today, however, that measure is already quite a bit lower than it was in late 2018.

One issue with particular market-relevance right now is the suspension of key economic data releases during the shutdown — including jobs and inflation reports. These reports have been key inputs in the debate at the Federal Reserve over how quickly to lower interest rates. Without them, the Fed and markets risk being caught off guard by what the economy looks like when we start getting the reports again.

What other market impacts can we expect?

Markets tend to look past government shutdowns. Over the past 50 years, there have been 22 shutdowns, and they have not historically aligned with market downturns. In fact, most have been entirely forgettable from the stock market’s perspective. The market’s muted reaction since October 1 supports this view. In fact, the last time the S&P 500 posted a negative return during a shutdown/funding gap was 1990.

Should we change our investment strategy?

Shutdowns are typically transitory, and equity drawdowns have historically been limited, on average. We continue to advise investors to avoid making decisions based on headlines. We know from historical experience that markets typically look beyond short-term disruptions.

Should we be concerned about underlying U.S. political dysfunction?

We believe the recurring fiscal standoffs in Washington are a symptom of broader political and economic challenges facing the U.S. As we noted in May — shortly after Moody’s downgraded the U.S. government’s credit rating — the country has struggled for nearly 25 years to put federal spending on a sustainable trajectory. That hasn’t changed and, indeed, has continued to worsen. A potent mix of tax increases and spending cuts seems increasingly necessary to stave off more serious economic challenges.

We repeat again that politics and investing don’t mix. While we may like to think that our preferred political party can easily resolve these challenging and complex issues, the fact remains that deficit reduction has remained elusive for both parties across many decades. This is not a new problem — it’s one that has been decades in the making.

How do we respond as investors?

One of the most important trends in financial markets this year has been the strong performance of non-U.S. assets. In fact, we view the shutdown as yet another reminder that the case for non-U.S. assets remains strong and may strengthen further.

Through the end of Q3, the S&P 500 Index has posted a respectable 14.8% return. However, international performance has been even stronger:

The below chart summarizes the trends this year:

Recent events, including major changes in U.S. trade policy and the current government shutdown, underscore why international diversification can be helpful. We diversify portfolios to help guard against economic challenges here at home, while at the same time hedging against declines in the U.S. dollar.

Our baseline recommendation for all investors remains unchanged: maintain a thoughtfully and broadly diversified low-cost portfolio — one that’s diversified across and within major global asset classes and across and within both public and private markets.

Click here for past insights about the recent market volatility and other interesting topics. Not a Mercer Advisors client but interested in more information? Let’s talk.

1 “Timeline of US government shutdowns over last 50 years.” USA Today (Oct. 1, 2025).

2 “How much does a US government shutdown cost the economy?” Goldman Sachs (Sept. 1, 2023).

3 “The Effects of the Partial Shutdown Ending in January 2019.” Congressional Budget Office (Jan. 28, 2019).

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Diversification does not ensure a profit or guarantee against loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Explore More

Tax-Free Gifting in 2026: What Financial Givers Should Know

Capital Gains Tax Basics: Rules, Rates, and Tax‑Saving Strategies

The Greenland Sell-off: Insights From Our CIO