California’s PTE tax election: A path to reduce federal taxable income

California business owners — specifically those operating S corporations, multi-member LLCs or partnerships — may have a viable tax planning tool at their disposal: the Pass-Through Entity (PTE) Tax Election. This strategy allows eligible businesses to convert potentially nondeductible state income taxes into deductible federal business expenses, effectively bypassing the federal SALT deduction cap.

The challenge: SALT deduction limits still persist

Since the 2017 Tax Cuts and Jobs Act, individuals who itemize deductions on Federal returns have faced a $10,000 cap on state and local tax (SALT) deductions. The One Big Beautiful Bill Act (OBBBA), signed on July 4, 2025, temporarily raised this cap to $40,000. However, high-income earners still face limitations when itemizing deductions:

- The $40,000 cap phases out starting at $250,000 Modified Adjusted Gross Income (MAGI) for married filing separately filers and $500,000 for all others.

- Once phased out, the deduction reverts to $10,000, but not lower.

For many California S corps, multi member LLCs and partnership owners, this could mean a large portion of their California state income tax remains nondeductible, unless they elect to the PTE tax regime. Additionally, the Alternative Minimum Tax (AMT) may further increase their federal tax burden.

The solution: How the California PTE tax election works

The California PTE tax election, authorized under Assembly Bill 150 and expanded by SB 113 and SB 132, allows pass-through entities to pay certain state income tax at the entity level. This can shift the tax burden from the individual to the business, creating a federal deduction for the entity and a California tax credit for the individual owner(s).

Example

Meet Sam, a California resident and S corp owner whose personal SALT deduction is already maxed out because of real property and wage-based state income taxes.

- Without the PTE Tax Election: Sam pays California income tax on S corp profits personally. Due to the SALT cap, this tax is not deductible on his federal return.

- With the PTE Tax Election: The S corp pays tax directly. This payment becomes a deductible business expense, reducing Sam’s federal K-1 income. Sam also receives a California tax credit on his personal return, provided all requirements are met.

Bottom line: Sam pays the same total to California, but his federal tax liability is reduced, and potentially his AMT exposure as well.

Impact of OBBBA and California SB 132

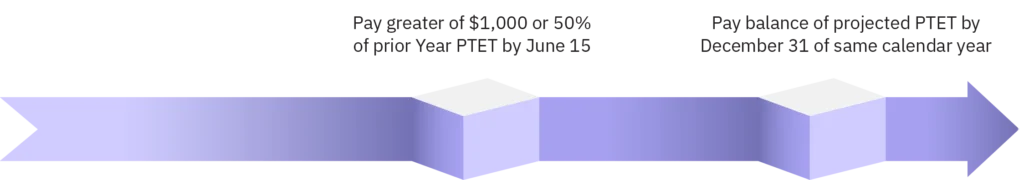

Many feared the One Big Beautiful Bill would eliminate SALT workaround strategies, but the final law preserved entity-level tax elections. Although the opportunity to elect for 2025 expired on June 15, 2025, there is opportunity to begin planning around how this election could benefit business owners in 2026. California Senate Bill 132, signed into law on June 27, 2025, made the PTET election process more flexible — businesses no longer lose the election if they miss a June 15 minimum prepayment deadline. Nevertheless, the best practice for timing of payments remains the same.

| Timing Aspect | Before SB 132 (through 2025) | After SB 132 (2026 through 2030) |

| Maximum Credit Possible | Credit limited to 9.3% of California tax on pass through income if all requirements are met | Same |

| Election Deadline | Business must make election payment by June 15 or lose election | No payment required to elect, but credit may be reduced |

| June 15 Prepayment | Required: Greater of $1,000 or 50% of prior-year PTET | Recommended: Same amount to avoid credit reduction |

| Penalty for Missing June 15 Prepayment | Strategy not possible | Strategy possible but tax credit reduced by 12.5% of unpaid June 15 prepayment amount |

| Final PTET Payment Recommended for Calendar Year Businesses | December 31 of same tax year | Same |

| Best Practice | Pay minimum by June 15, balance by year-end | Same |

Continued Best Practice Recommended

Key considerations for the PTE election

- 2025 election deadline expired: The 2025 election deadline for this strategy expired on June 15, 2025. Only businesses that made the election prior to June 15 should plan to pay remainder of PTE tax by Dec. 31, 2025, (as advised by business CPA).

- 2026 election planning: Beginning in 2026, businesses electing this strategy would likely want to pay minimum PTE prepayment tax by June 15, 2026, (or face a 12.5% reduction in the unpaid prepayment amount after June 15).

- Eligibility: May apply to California-based S corporations, partnerships, and multi member LLCs. C corporations, single Member LLCs, and sole proprietors are ineligible.

- Cash Flow: The entity must have sufficient liquidity to make timely payments.

- Coordination: Calendar-year taxpayers should ensure that PTE taxes are paid within the same tax year to maximize the California tax credit on personal returns.

A strategic tax planning opportunity

The California PTE tax election offers a significant opportunity for eligible business owners, to reduce federal taxable income while preserving state tax credits. Proactive planning can lead to significant tax savings for high-income earners and business owners.

Consult your wealth advisor and your CPA early to determine eligibility, optimize timing, and ensure your business is positioned to take full advantage of this viable tax strategy. Not a client? Let’s talk.

Mercer Advisors Inc. is a parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Hypothetical examples are for illustrative purposes only. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.