High inflation over the past year has many consumers, investors, and market commentators wondering about its causes. Is today’s inflation a result of quantitative easing? Or is it perhaps due to the Biden administration’s environmental policies, as claimed by lobbyists from the oil industry? Or are “excessive” profit margins to blame, as argued by President Biden in a recent letter to petroleum refiners?

The short answer is: It’s complicated. Economics is not a discipline for those seeking easy, politically convenient answers. It’s messy and, despite its heavy reliance on big data and quantitative analysis, it offers painfully few conclusive, black-and-white answers. But what it does offer is insight, insight into what’s likely driving inflation (and, importantly, what isn’t); whether the Fed’s interest rate hikes will be successful in reigning it in; and the probability of the Fed, perhaps, changing course at some point in the future.

Two popular explanatory narratives for today’s high inflation focus on the administration’s environmental policies and, as claimed by the President, the “excessive” profit margins of oil refiners. In Part I we explore each of these narratives and evaluate the relative merit of their claims. In Part II, we explore what we believe to be the root causes of today’s high inflation, including Russia’s invasion of Ukraine, ongoing global supply chain disruptions, China’s COVID-shutdowns, limited refinery capacity, and—to a lesser degree—Quantitative Easing (“QE”) and COVID-related stimulus spending in the United States. Finally, in Part III we explore the implications for Fed policy, interest rates, and GDP growth.

Part I: Political Narratives

Government policy

Some have suggested that U.S. government energy policy is primarily to blame for inflation, arguing the current “administration’s policy agenda has shifted away from domestic oil and natural gas…”—presumably to one focused on encouraging the development of renewable energy and therefore resulting in constrained supplies of oil and gas.1

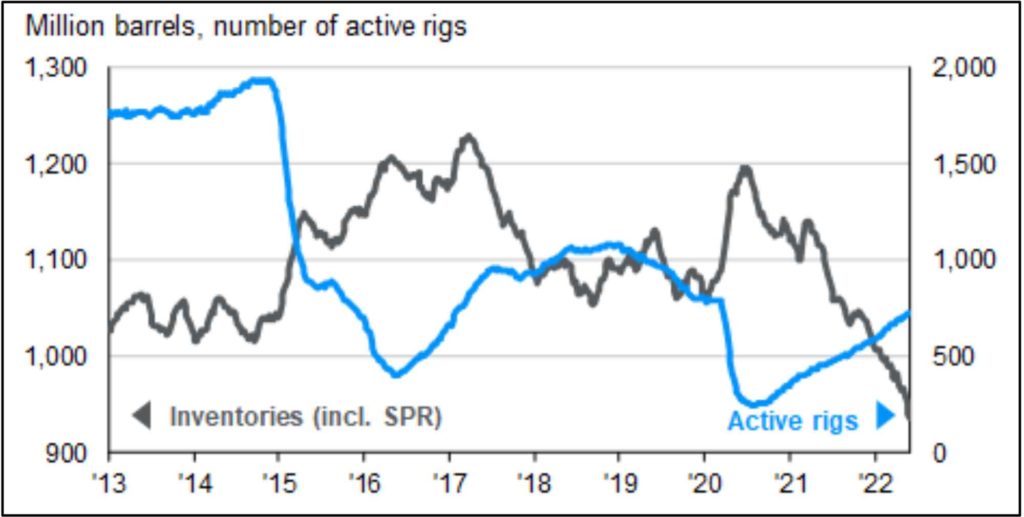

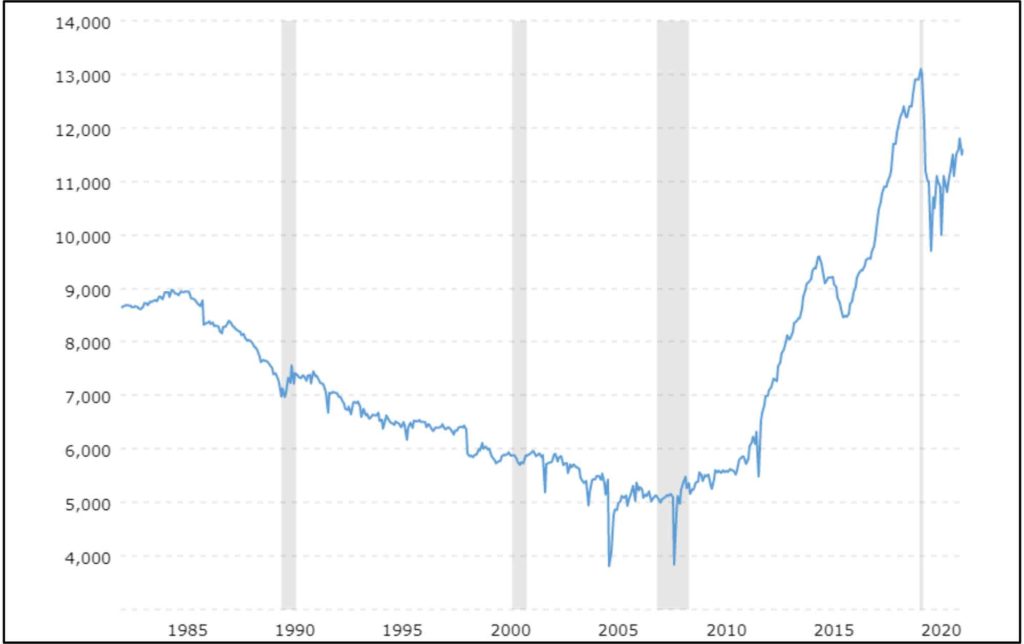

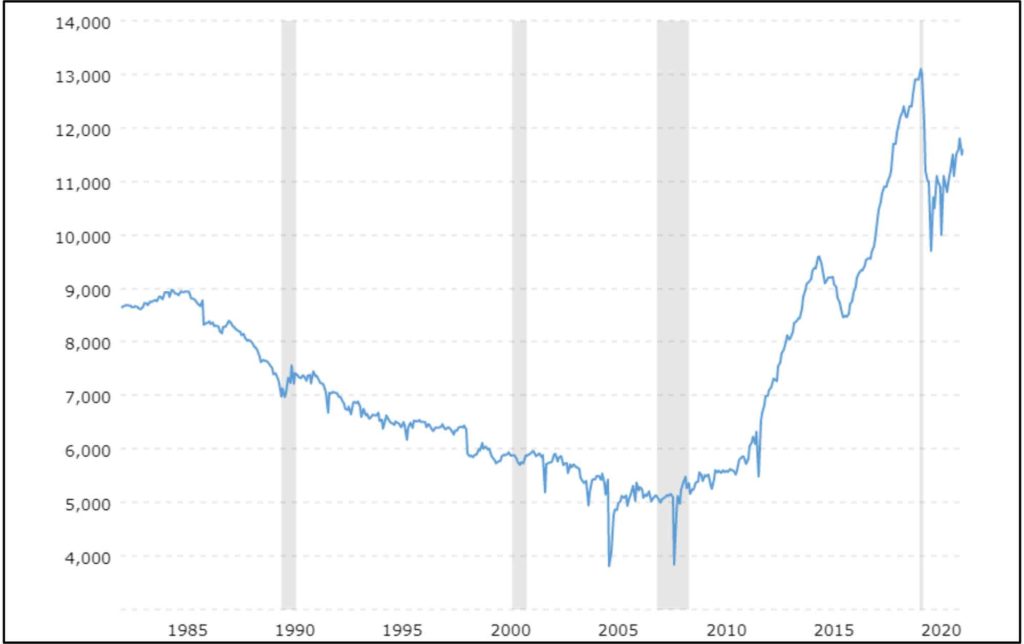

However, this argument lacks credible evidence. For example, U.S. active rig counts have more than doubled since early 2021, suggesting drillers who want to drill can do so (subject of course to the same labor and supply constraints as everyone else) (See Exhibit A). Further, U.S. oil and gas production has expanded dramatically over the past decade, tripling from its 2008 lows, and is now projected to grow an additional 10.3% by the end of 2023—compared to only 1.3% growth for total global oil production (see Exhibit B).2 Further, economists from Moody’s Analytics recently explored a similar question 3 and found no specific, identifiable environmental policy hindering U.S. energy production. None of this is to suggest that government policy doesn’t influence business decisions or capital costs; of course they do. But the fact remains that U.S. energy production has expanded dramatically over the past decade, it continues to expand (despite allegations that government policy is discouraging investment), and there’s no identifiable evidence at the moment that any U.S. government environmental policies are discouraging production or contributing to inflation.

Exhibit A: U.S. active rig counts (blue line) rise and fall in response oil prices. They’ve more than doubled since early 2021 (up from 351 at the end of 2020 to a current rig count of 740 as of June 17, 2022).4

A related view argues that environmental policies have somehow discouraged investment in expanding refinery capacity, the scarcity of which has rightly been identified as a major contributor to current inflation. But drawing a linear, cause-and-effect relationship between policy and scarcity is difficult at best. Between 1977 and 2019 no new refineries were built in the United States—not one. It doesn’t seem logical that the environmental policies of the past 18 months, whatever they may be, would’ve discouraged investment in refinery capacity expansion over the past four decades—a period that of course witnessed administrations from both political parties. Any expansion in refinery capacity during that time came through increases in operational efficiencies and expansion of existing refineries. Yet even that was anemic. For example, between 2001—2022, refinery capacity in the United States grew at a rate of only 0.30% annually, falling to -0.25% annually during the Trump administration. U.S. refinery capacity has now fallen to its lowest levels in 8 years.5 Therefore, rather than anything having to do with the current administration’s environmental policies, it seems more plausible that powerful economic and natural forces—such as increased capital costs, increases in extreme weather, increasing efficiency gains, and perhaps better investment opportunities elsewhere (e.g., renewable energy)—discouraged investment in expanding refinery capacity over the past few decades.

Exhibit B: U.S. crude oil production has expanded significantly since 2008.6

“Excessive” profit margins

On June 15, the Biden administration sent a letter to several oil companies calling on them to produce more to help alleviate the burden of high gas prices on consumers. Both in the letter and publicly, the President alleged that refiners’ profit margins had risen to “record levels”, implying excessive profit margins were contributing to high inflation. But this argument is unconvincing for several reasons.

First, neither profits nor profit margins are at all-time highs for refiners based on their Q1 2022 financials; it’s simply not true to claim otherwise. For most refiners, profits peaked sometime between 2015—2016. Consider Marathon Petroleum, currently the largest U.S. refiner. Its profits peaked at $16.92 billion in September 2015; its gross margin peaked at 23.77% in June 2016. As of March 31, 2022, the firm reported gross profit of $11.34 billion with a gross margin of 8.38%, significantly less than its all-time highs.7 We see similar profit metrics across other petroleum refiners.

What is true is that petroleum refinery prices, profits, and profit margins have recovered from the depths of the pandemic. For example, Marathon Petroleum’s Q1 2022 reported gross profit of $11.34 billion is nearly three times higher than it was during the depths of the pandemic; Marathon reported gross profit of $3.81 billion in Q1 2021, a decline of nearly 70% from its pre-pandemic (Q4 2019) gross profit of $11.92 billion. Comparing today’s profit metrics to a time when the front month oil contract in 2020 was trading at negative prices 8 is nothing more than simply playing with the math. Indeed, profits and profit margins declined dramatically for all companies during the pandemic but especially energy companies, including petroleum refiners. The truth remains that today’s profit metrics for petroleum refiners remain far from record levels and, in fact, have only now returned to their pre-pandemic levels (see Exhibit C). Whether one views a return to pre-pandemic profit levels as evidence of “excessive” profits is naturally subjective, but it’s hard to argue that simply returning to pre-pandemic profit levels is somehow unique evidence of such a time when most S&P 500 companies have posted significant increases in profits over and above their pre-pandemic levels. For example, the earnings per share of S&P 500 companies is now 36% higher than pre-pandemic levels—the same cannot be said for petroleum refiners 9.

Second, arguments that refiners’ profits and profit margins have grown to excessive levels suggests a degree of monopoly power that just doesn’t exist in the U.S. refinery space (or it would suggest an unprecedented degree of collusion, a serious charge that would require evidence). No less than 10 U.S.-based petroleum refiners compete for market share in the United States. Further, petroleum refining is a global market; the administration’s U.S.-centric view of the refinery space ignores the fact that, of the top 10 global refiners, only 3 are U.S. companies.10 The only logical conclusion is that excessive profits and profit margins, however defined, do not appear to be significant contributors to today’s high inflation rates.

Exhibit C: Marathon Petroleum (MPC) TTM Revenues, TTM Gross Profit, and Gross Margin, 2010 – 2022.11

Conclusion

To conclude Part I, there is no convincing evidence to support what are arguably the two most popular political narratives attempting to explain today’s high inflation. The lack of investment in refinery capacity is a long-term phenomenon, stretching back more than four decades, that isn’t satisfactorily explained by the environmental policies of the past 18 months. Further, an exponential increase in oil and gas production since 2008 and a tripling of rig counts since early 2021 concludes that drillers can clearly expand production when market prices justify doing so. Similarly, claims that today’s high inflation is a result of “excessive” profits and profit margins of refiners are unsupported by the data. To the contrary, corporate financial statements show that profits and profit margins are not at all-time highs as claimed by President Biden, but have, instead, simply recovered from their pre-pandemic lows.

Part II: What Are the Causes of Today’s High Inflation?

Home » Insights » Market Commentary » What’s Not Causing Today’s High Inflation

What’s Not Causing Today’s High Inflation

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Summary

This is a three-part series about why we’re experiencing inflation now and how it can be mitigated.

High inflation over the past year has many consumers, investors, and market commentators wondering about its causes. Is today’s inflation a result of quantitative easing? Or is it perhaps due to the Biden administration’s environmental policies, as claimed by lobbyists from the oil industry? Or are “excessive” profit margins to blame, as argued by President Biden in a recent letter to petroleum refiners?

The short answer is: It’s complicated. Economics is not a discipline for those seeking easy, politically convenient answers. It’s messy and, despite its heavy reliance on big data and quantitative analysis, it offers painfully few conclusive, black-and-white answers. But what it does offer is insight, insight into what’s likely driving inflation (and, importantly, what isn’t); whether the Fed’s interest rate hikes will be successful in reigning it in; and the probability of the Fed, perhaps, changing course at some point in the future.

Two popular explanatory narratives for today’s high inflation focus on the administration’s environmental policies and, as claimed by the President, the “excessive” profit margins of oil refiners. In Part I we explore each of these narratives and evaluate the relative merit of their claims. In Part II, we explore what we believe to be the root causes of today’s high inflation, including Russia’s invasion of Ukraine, ongoing global supply chain disruptions, China’s COVID-shutdowns, limited refinery capacity, and—to a lesser degree—Quantitative Easing (“QE”) and COVID-related stimulus spending in the United States. Finally, in Part III we explore the implications for Fed policy, interest rates, and GDP growth.

Part I: Political Narratives

Government policy

Some have suggested that U.S. government energy policy is primarily to blame for inflation, arguing the current “administration’s policy agenda has shifted away from domestic oil and natural gas…”—presumably to one focused on encouraging the development of renewable energy and therefore resulting in constrained supplies of oil and gas.1

However, this argument lacks credible evidence. For example, U.S. active rig counts have more than doubled since early 2021, suggesting drillers who want to drill can do so (subject of course to the same labor and supply constraints as everyone else) (See Exhibit A). Further, U.S. oil and gas production has expanded dramatically over the past decade, tripling from its 2008 lows, and is now projected to grow an additional 10.3% by the end of 2023—compared to only 1.3% growth for total global oil production (see Exhibit B).2 Further, economists from Moody’s Analytics recently explored a similar question 3 and found no specific, identifiable environmental policy hindering U.S. energy production. None of this is to suggest that government policy doesn’t influence business decisions or capital costs; of course they do. But the fact remains that U.S. energy production has expanded dramatically over the past decade, it continues to expand (despite allegations that government policy is discouraging investment), and there’s no identifiable evidence at the moment that any U.S. government environmental policies are discouraging production or contributing to inflation.

Exhibit A: U.S. active rig counts (blue line) rise and fall in response oil prices. They’ve more than doubled since early 2021 (up from 351 at the end of 2020 to a current rig count of 740 as of June 17, 2022).4

A related view argues that environmental policies have somehow discouraged investment in expanding refinery capacity, the scarcity of which has rightly been identified as a major contributor to current inflation. But drawing a linear, cause-and-effect relationship between policy and scarcity is difficult at best. Between 1977 and 2019 no new refineries were built in the United States—not one. It doesn’t seem logical that the environmental policies of the past 18 months, whatever they may be, would’ve discouraged investment in refinery capacity expansion over the past four decades—a period that of course witnessed administrations from both political parties. Any expansion in refinery capacity during that time came through increases in operational efficiencies and expansion of existing refineries. Yet even that was anemic. For example, between 2001—2022, refinery capacity in the United States grew at a rate of only 0.30% annually, falling to -0.25% annually during the Trump administration. U.S. refinery capacity has now fallen to its lowest levels in 8 years.5 Therefore, rather than anything having to do with the current administration’s environmental policies, it seems more plausible that powerful economic and natural forces—such as increased capital costs, increases in extreme weather, increasing efficiency gains, and perhaps better investment opportunities elsewhere (e.g., renewable energy)—discouraged investment in expanding refinery capacity over the past few decades.

Exhibit B: U.S. crude oil production has expanded significantly since 2008.6

“Excessive” profit margins

On June 15, the Biden administration sent a letter to several oil companies calling on them to produce more to help alleviate the burden of high gas prices on consumers. Both in the letter and publicly, the President alleged that refiners’ profit margins had risen to “record levels”, implying excessive profit margins were contributing to high inflation. But this argument is unconvincing for several reasons.

First, neither profits nor profit margins are at all-time highs for refiners based on their Q1 2022 financials; it’s simply not true to claim otherwise. For most refiners, profits peaked sometime between 2015—2016. Consider Marathon Petroleum, currently the largest U.S. refiner. Its profits peaked at $16.92 billion in September 2015; its gross margin peaked at 23.77% in June 2016. As of March 31, 2022, the firm reported gross profit of $11.34 billion with a gross margin of 8.38%, significantly less than its all-time highs.7 We see similar profit metrics across other petroleum refiners.

What is true is that petroleum refinery prices, profits, and profit margins have recovered from the depths of the pandemic. For example, Marathon Petroleum’s Q1 2022 reported gross profit of $11.34 billion is nearly three times higher than it was during the depths of the pandemic; Marathon reported gross profit of $3.81 billion in Q1 2021, a decline of nearly 70% from its pre-pandemic (Q4 2019) gross profit of $11.92 billion. Comparing today’s profit metrics to a time when the front month oil contract in 2020 was trading at negative prices 8 is nothing more than simply playing with the math. Indeed, profits and profit margins declined dramatically for all companies during the pandemic but especially energy companies, including petroleum refiners. The truth remains that today’s profit metrics for petroleum refiners remain far from record levels and, in fact, have only now returned to their pre-pandemic levels (see Exhibit C). Whether one views a return to pre-pandemic profit levels as evidence of “excessive” profits is naturally subjective, but it’s hard to argue that simply returning to pre-pandemic profit levels is somehow unique evidence of such a time when most S&P 500 companies have posted significant increases in profits over and above their pre-pandemic levels. For example, the earnings per share of S&P 500 companies is now 36% higher than pre-pandemic levels—the same cannot be said for petroleum refiners 9.

Second, arguments that refiners’ profits and profit margins have grown to excessive levels suggests a degree of monopoly power that just doesn’t exist in the U.S. refinery space (or it would suggest an unprecedented degree of collusion, a serious charge that would require evidence). No less than 10 U.S.-based petroleum refiners compete for market share in the United States. Further, petroleum refining is a global market; the administration’s U.S.-centric view of the refinery space ignores the fact that, of the top 10 global refiners, only 3 are U.S. companies.10 The only logical conclusion is that excessive profits and profit margins, however defined, do not appear to be significant contributors to today’s high inflation rates.

Exhibit C: Marathon Petroleum (MPC) TTM Revenues, TTM Gross Profit, and Gross Margin, 2010 – 2022.11

Conclusion

To conclude Part I, there is no convincing evidence to support what are arguably the two most popular political narratives attempting to explain today’s high inflation. The lack of investment in refinery capacity is a long-term phenomenon, stretching back more than four decades, that isn’t satisfactorily explained by the environmental policies of the past 18 months. Further, an exponential increase in oil and gas production since 2008 and a tripling of rig counts since early 2021 concludes that drillers can clearly expand production when market prices justify doing so. Similarly, claims that today’s high inflation is a result of “excessive” profits and profit margins of refiners are unsupported by the data. To the contrary, corporate financial statements show that profits and profit margins are not at all-time highs as claimed by President Biden, but have, instead, simply recovered from their pre-pandemic lows.

Part II: What Are the Causes of Today’s High Inflation?

1 Mike Sommers, president and CEO of the American Petroleum Institute, as quoted by CNBC on June 15, 2022 in “Biden tells oil companies in letter ‘well above normal’ refinery profit margins are ‘not acceptable’”.

2 JP Morgan Guide to the Markets. June 16, 2022, slide 29.

3 See Moody’s Inside Economics: Lousy Inflation & Life Lessons with Mark Zandi, Ryan Sweet, and Chris deRitis, June 11, 2022.

4 Source: Data from Baker Hughes; chart provided by JP Morgan Asset Management in Guide to the Markets, June 16, 2022. Slide 29.

5 US Energy Information Administration. See also, “US refining capacity falls to lowest mark in 8 years”, S&P Global, June 21, 2022.

6 Source: Macrotrends: US Crude Oil Production (data from US Energy Information Administration).

7 Source: Macrotrends. See Q1 2022 Gross Margin and Profit metrics for the three largest US refiners: Marathon Petroleum (MPC); Valero Energy (VLO); and Phillips 66 (PSX). Analysis based on most recently available public financial statements.

8 On April 20, 2020, the front-month May 2020 WTI crude contract settled at negative $37.63 a barrel on the New York Mercantile Exchange.

9 Source: FactSet, Inc.

10 “Largest refining companies in the world”, Off Shore Technology, February 3, 2022.

11 Source: Macrotrends. See Q1 2022 Gross Margin and Profit metrics for Marathon Petroleum (MPC). Analysis based on most recently available public financial statements.

Hiring an Estate Planning Attorney: When Does it Make Sense?

Notice 2024-35: Relief With Respect to Certain RMDs

The Hidden Hazards of Inheriting an IRA: Why Beneficiaries may Face More Harm than Good

Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Diversification does not ensure a profit or guarantee against loss. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark. Indexes are not available for direct investment.