Tuesday’s CPI report for the month of August came hotter than expected—and likely cements the Fed’s decision to hike rates 0.75% at their meeting next week. While declining gasoline prices helped keep a lid on headline inflation—which increased 0.1% versus an expected decline of 0.1%–the core measure that excludes food and energy prices (core inflation) increased a staggering 0.6% for the month and suggests that inflation is broadening out across the economy. Equity markets declined significantly on the news on Tuesday, with the S&P 500 Index and growth-heavy NASDAQ falling 4.3% and 5.2%, respectively—the market’s worst trading day since June 2020. Interest rates rose, with the 2-year treasury rising 0.17%.

By any measure, this is not what economists or markets were expecting. Jerome Powell’s hawkish comments from Jackson Hole in late August similarly caught the market off guard—how, we thought, could he be so committed to hiking rates when evidence suggests inflation is moderating? Big declines in gasoline prices, easing supply chains, and steeply higher interest rates on all sorts of consumer borrowing were widely (and rightly) expected to help bring down consumer prices. Only that didn’t happen—at least not yet—and the Fed is now all but certain to continue hiking rates higher and for longer in the months ahead. It appears Mr. Powell, after all, may know something the market doesn’t.

Reminders for investors

What are investors to make of all this? In our view, today’s news presents three powerfully important reminders for investors.

The first is that, with billions of participants and a complex web of global supply chains, the global economy is infinitely complex. Attempting to draw simple, cause-and-effect relationships—no matter how well-reasoned our expectations—is exceptionally difficult. Even PhDs in economics struggle to define the future. Whether we’re talking about inflation and interest rates or European stocks and the war in Europe, there is real wisdom in humility. The economy and markets can quickly—and painfully—prove us wrong.

The second is that humility is best manifested through broad diversification. As investors, we diversify portfolios not because of what we expect—after all, if our expectations were always right there would be no need to diversify—but to help protect against what we don’t. Successful investing isn’t about hitting home runs; it’s about avoiding strike outs. And the best way to put this lesson to work in portfolios is through broad asset class diversification. Is it perfect? No. Nothing is in life. But we believe diversification, often characterized as the only “free lunch” in markets, is the best approach to weathering difficult markets and to help successfully build long-term wealth.

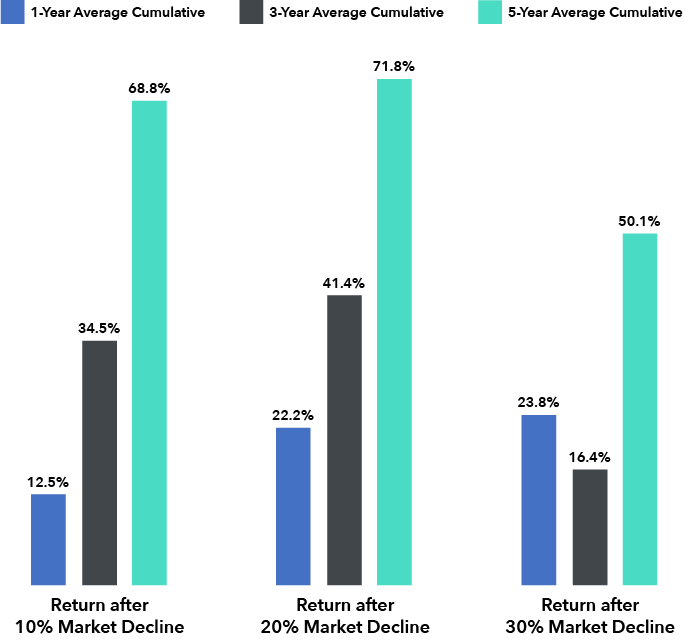

Finally, we should remind ourselves that time in the market is more important than timing the market. Putting our faith in capitalism and long-term investing is far better than placing our faith in anyone promising god-like clairvoyance. Even now, with markets facing difficult headwinds and U.S. stocks down nearly 14% for the year, history strongly suggests investors should expect higher returns in the future. In fact, the record shows that after a 10% market decline, subsequent 1-, 3-, and 5-year returns have been exceptionally strong (see below exhibit). Moving out of markets when times get tough—selling low—only to re-enter markets when times are better—buying high—is not a recipe for success. Instead, a sound approach is to allow markets to work for you by remaining fully invested in a diversified portfolio—one that appropriately reflects your personal need, appetite, and capacity for risk.

Exhibit: Market returns have been strong in the wake of bear markets.

Source: Fama/French Total US Market Research Index Returns, July 1926 – December 2021

Home » Insights » Market Commentary » Market Update – September 14, 2022

Market Update – September 14, 2022

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Summary

Tuesday’s CPI report for the month of August came hotter than expected—and likely cements the Fed’s decision to hike rates 0.75% at their meeting next week. While declining gasoline prices helped keep a lid on headline inflation—which increased 0.1% versus an expected decline of 0.1%–the core measure that excludes food and energy prices (core inflation) increased a staggering 0.6% for the month and suggests that inflation is broadening out across the economy. Equity markets declined significantly on the news on Tuesday, with the S&P 500 Index and growth-heavy NASDAQ falling 4.3% and 5.2%, respectively—the market’s worst trading day since June 2020. Interest rates rose, with the 2-year treasury rising 0.17%.

By any measure, this is not what economists or markets were expecting. Jerome Powell’s hawkish comments from Jackson Hole in late August similarly caught the market off guard—how, we thought, could he be so committed to hiking rates when evidence suggests inflation is moderating? Big declines in gasoline prices, easing supply chains, and steeply higher interest rates on all sorts of consumer borrowing were widely (and rightly) expected to help bring down consumer prices. Only that didn’t happen—at least not yet—and the Fed is now all but certain to continue hiking rates higher and for longer in the months ahead. It appears Mr. Powell, after all, may know something the market doesn’t.

Reminders for investors

What are investors to make of all this? In our view, today’s news presents three powerfully important reminders for investors.

The first is that, with billions of participants and a complex web of global supply chains, the global economy is infinitely complex. Attempting to draw simple, cause-and-effect relationships—no matter how well-reasoned our expectations—is exceptionally difficult. Even PhDs in economics struggle to define the future. Whether we’re talking about inflation and interest rates or European stocks and the war in Europe, there is real wisdom in humility. The economy and markets can quickly—and painfully—prove us wrong.

The second is that humility is best manifested through broad diversification. As investors, we diversify portfolios not because of what we expect—after all, if our expectations were always right there would be no need to diversify—but to help protect against what we don’t. Successful investing isn’t about hitting home runs; it’s about avoiding strike outs. And the best way to put this lesson to work in portfolios is through broad asset class diversification. Is it perfect? No. Nothing is in life. But we believe diversification, often characterized as the only “free lunch” in markets, is the best approach to weathering difficult markets and to help successfully build long-term wealth.

Finally, we should remind ourselves that time in the market is more important than timing the market. Putting our faith in capitalism and long-term investing is far better than placing our faith in anyone promising god-like clairvoyance. Even now, with markets facing difficult headwinds and U.S. stocks down nearly 14% for the year, history strongly suggests investors should expect higher returns in the future. In fact, the record shows that after a 10% market decline, subsequent 1-, 3-, and 5-year returns have been exceptionally strong (see below exhibit). Moving out of markets when times get tough—selling low—only to re-enter markets when times are better—buying high—is not a recipe for success. Instead, a sound approach is to allow markets to work for you by remaining fully invested in a diversified portfolio—one that appropriately reflects your personal need, appetite, and capacity for risk.

Exhibit: Market returns have been strong in the wake of bear markets.

Source: Fama/French Total US Market Research Index Returns, July 1926 – December 2021

Help Meet Portfolio Objectives with Factor Investing

Beyond Fees: What to Consider When Looking for an Advisor

Crypto and Bitcoin ETF Frequently Asked Questions

Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Diversification does not ensure a profit or guarantee against loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark. Indices are not available for direct investment.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.