Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Summary

Bitcoin has again recently come to dominate the headlines. The digital “currency” has quintupled since its March low; it’s doubled in the past two months alone. Why? No one really knows but, regardless, the digital currency’s recent meteoric rise has come to attract a fair amount of attention—so much so that recently I participated in a Bloomberg-sponsored panel discussion with several promoters of cryptocurrencies, including Bitcoin.

Should I invest in Bitcoin?

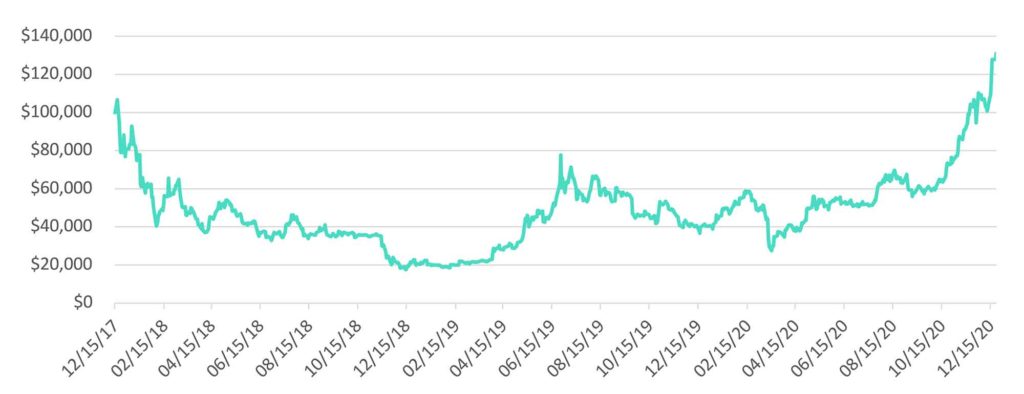

I first wrote about Bitcoin in a November 2017 piece in Financial Planning where I dismantled arguments that Bitcoin was a viable currency.1 I argued, and still argue, that the digital “currency” is not really a “currency” since it’s not a medium of exchange, it doesn’t serve as a unit of account, and it’s far from a reliable store of value—all critical attributes that define what it is to be a currency. In the months that followed my article, the digital currency plummeted 85% in value. Why? Again, no one really knows. Imagine having something in your portfolio, no matter its allocation weight, that lost 85% and you’re not exactly sure why. Unlike declines in stocks—where you can point to new information, such as a recession, pandemic, or interest rates—no one has any real insight as to why Bitcoin collapsed so violently in early 2018. For this reason alone, I think investors should avoid adding Bitcoin to their portfolios. If you don’t know how to value something, you don’t know how much to pay for it. It’s that simple. And the price you pay is always the most important part of the return equation.

Exhibit A: Growth of $100,000 invested in Bitcoin, 12/17/2017 – 12/21/20202

Bitcoin’s recent rise

With respect to Bitcoin’s recent rise, no one seems to have a good reason why it’s now suddenly worth twice what it was merely two months ago or why it’s up nearly 40% in the past three weeks. When pressed, I often hear arguments that pivot between lectures on not understanding blockchain technology or that the digital currency has gone “mainstream” with institutional investors getting into the mix. Other arguments for investing in Bitcoin tend to center around the digital “currency” as a hedge against inflation or its diversification properties due to its non-correlation to other asset classes. These arguments all fail for the following reasons:

- Naysayers don’t understand blockchain technology. Crypto promoters are partially right; many of us don’t understand blockchain technology but we don’t need to. One can still get excited about investing in technology they don’t understand; we do it all the time. Who understands how gene editing CRSPR technology works? Or even an Apple iPhone for that matter? Very few. Does that stop people from investing in Pfizer, Moderna, or Apple? Of course not. But what I really don’t understand is how investing in Bitcoin is somehow a proxy for investing in blockchain technology (it isn’t).

- Institutional “Investors”. I don’t doubt that institutions are rushing to provide services to those investors who wish to buy and sell digital currencies. Examples include Fidelity’s decision to launch a Bitcoin fund and Northern Trust’s joint venture with Standard Chartered Bank to establish a qualified custodian for digital currencies. Grayscale, one of the largest single asset Bitcoin fund providers in the market, charges a hefty 2% annual fee (they also offer other crypto currency funds). Believe it or not, you can even purchase Bitcoin now via vending machines. But those “investments” in related services are very different than investing in the digital currency itself. And even if a select few large institutions are now allocating investor capital to Bitcoin, that doesn’t explain why they think the digital currency will be worth more in the future than it is today—which, in my view, is critical to upholding one’s fiduciary obligation to clients.

- Bitcoin as an inflation hedge. First, what inflation? The Fed printed trillions of dollars between 2010-2015 to combat the financial crisis of 2007-2009 and again most recently to combat the economic fallout from COVID-19. This is precisely the form central bank “fiat currency dilution” that crypto investors (and others) seem to lose sleep over. Yet, despite massive quantitative easing, inflation has been largely absent; economists have, in fact, been more concerned about deflation than inflation. Economists and central banks the world over have been begging for inflation—so much so that the Fed made important changes to how it thinks about its (now) “average” 2% inflation target. Second, to argue that digital currencies—in this case Bitcoin—are somehow incapable of dilution is beyond laughable. Today, there are more than 2,000 cryptocurrencies on the market—more if we count air miles, Marriott Rewards Points, or Diners’ Club Cards. When we run out of those, we’ll simply make more.

- Bitcoin as a diversifying asset. Bitcoin has little to no correlation to global equities. That much is true. But neither do lotto tickets or Beanie Babies. That doesn’t mean they should be added to portfolios. An asset class with a lower correlation does indeed offer diversification but it makes sense to add those asset classes to a portfolio only when they offer positive expected returns. It’s unclear how Bitcoin, which generates no cash flows and no profits, offers long-term investors a positive expected return.

Digital currencies—a new asset class?

I think the best argument I’ve heard thus far for how to think about crypto currencies is that they’re a form of “digital gold”, which is presumably better than investing in the shiny metal that generates no profits and has only very limited industrial use. That doesn’t mean it’s a good argument, only that I think it’s the best I’ve heard thus far. Others argue Bitcoin is more of a collectible, that we should view Bitcoins as a form of digital art. Maybe that’s true, I don’t know, but I’m open to the possibility.

New asset classes and our role as a fiduciary

We’re very open to the idea that there will be new and exciting asset classes in the future. Some of those may be digital in nature and will go parabolic, like Bitcoin; others, probably most, will sadly destroy investor capital. On occasion, we may be early and benefit from some; we may also miss the train on others. Such is the nature of investing. But regardless of where we invest our clients’ capital, we always owe them a high standard of care—the very highest—when it comes to managing their family’s wealth. And for that reason, we have yet to seriously consider cryptocurrencies as part of any responsibly diversified portfolio.

1Calcagni, Donald. “Why Your Clients Shouldn’t Own Bitcoin”, Financial Planning. November 28, 2017

2Source: FactSet, Inc.

Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.