Home » Insights » Personal Finance » COVID-19 Relief Aid for Small Businesses: What You Need to Know

COVID-19 Relief Aid for Small Businesses: What You Need to Know

Jeremiah H. Barlow

JD, Head of Family Wealth Services

Kara Duckworth

CFP®, CDFA®, Managing Director of Client Experience

Summary

A recap of our Monday, April 6, 2020, webinar (updated as of April 22, 2020)

U.S. small businesses affected by the COVID-19 crisis qualified for forgivable loans along with other benefits under the Coronavirus Aid, Relief, and Economic Security (CARES) Act. This Guide is a recap of an educational webinar we hosted to help small-business owners and sole proprietors evaluate their options under the CARES Act. You can also replay the webinar in our online Resource Center.

Please note, as of April 16, the SBA emergency loan program had run out of funds, but received additional funds of up to $310B through new legislation passed in Congress April 23. The information that is provided in this guide is for information purposes and is not intended to replace tax or legal advice specific to your situation. To navigate to the recently added ‘Precautions to Avoid Small Business Loan Fraud’, click here.

On June 3, 2020, the Paycheck Protection Program Flexibility Act (PPPFA) of 2020 was signed into law to give borrowers additional time and flexibility to use the Paycheck Protection Program (PPP) loan proceeds. Please refer to this link for updates on the PPP program as of June 3, 2020.

OVERVIEW

Who’s eligible to receive small-business assistance through the CARES Act?

Businesses and nonprofits with 500 or fewer employees that have experienced economic uncertainty as result of the novel coronavirus pandemic. This piece of the overall CARES legislation seeks to help businesses remain open, pay their employees, provide benefits, and cover other expenses during this crisis. Sole proprietors can also receive assistance.

What types of assistance can I receive?

Small businesses can choose one of the following three CARES Act relief options to help with payroll costs:

- Paycheck Protection Program (PPP)—forgivable loans for eligible expenses associated with retaining employees for up to about two months

- Employee Retention Credit—equaling 50% of wages, up to a maximum credit of $5,000 per eligible employee, paid between March 12, 2020 and December 31, 2020

- Payroll tax deferral—allowing an employer’s portion of the tax for the remainder of 2020 to be paid in two installments of 50%, the first payment on December 31, 2021, and the second one on December 31, 2022

Two other CARES relief programs are also available:

- Economic Injury Disaster Loan (EIDL) expansion—up to $2 million, including a “quick deposit” of $10,000 that is automatically forgiven, to be used toward a broader range of qualifying business expenses

- Unemployment for self-employed individuals—up to 39 weeks of compensation (which cannot be combined with PPP benefits) and deferral of self-employment tax payments

If I want to apply for a loan, what information do I need to submit a loan application?

All applications:

- Business start date

- Bank account and routing number

Sole Proprietors/Self Employed:

- Complete copy of Federal tax returns for 2017, 2018, and 2019

- 2019 IRS Forms 1099-MISC for any independent contractors paid

- 2019 Schedule C or Schedule F (if a farm)

Entities:

- Articles of incorporation for each borrowing entity

- By-laws or operating agreement for each borrowing entity

- Copies of each owner’s driver’s license

- Payroll expense verification

Applicants with employees will need the following:

- “Headcount” of Employees

- 2019 IRS Form W-3

- 2019 IRS Forms 941 for quarterly salary, wages, commissions, and tips

- 2019 IRS Form 944 (if used…only use if annual liability is less than $1,000)

- 2019 IRS Form 940 for any unemployment costs

- 2019 IRS Forms 1099-MISC for any independent contractors paid, not to exceed $100,000 for the year

- 2019 IRS Form 1040, Schedule C if your business is a sole proprietorship, or Schedule F if a farm

- Monthly payroll statements that will provide the following information:

-

- Salary, wages, commissions, or tips (not exceeding $100,000 annually for each employee)

- Costs for vacation, parental, family, medical or sick leave

- Costs for separation or dismissal of employees

- State & local taxes assessed on employee compensation

PPP LOAN DETAILS

How much can I borrow through PPP?

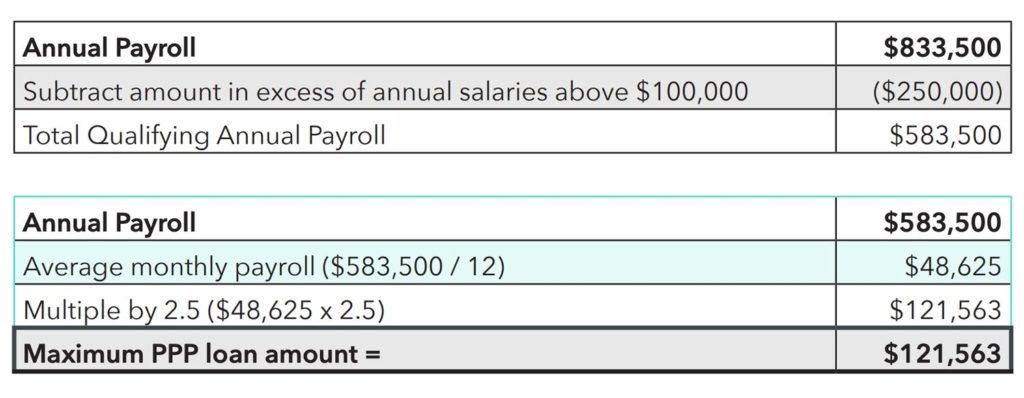

To determine your maximum loan amount, calculate your business’s average monthly payroll costs—capped at $100,000 annually for each employee—and multiply the average by 2.5. In general, borrowers can calculate annual payroll costs using either the previous 12 months or the calendar year 2019. Also, the cap of $100,000 is for cash compensation, and not for non-cash benefits, such as employer contributions to retirement plans, premiums for group healthcare coverage, and payment of state and local taxes assessed on compensation of employees.

What types of expenses are covered by PPP ?

- Payroll costs, including benefits for vacation, parental, family, medical, sick leave, and retirement

- Interest on mortgage obligations incurred before February 15, 2020

- Rent under lease agreements in force before February 15, 2020

- Utilities for services begun before February 15, 2020

What portion of my PPP loan will be forgiven?

You will not be required to repay the amount that you spend on qualifying costs to maintain your staff and payroll during the eight weeks after you receive the loan. However, no more than 25% of the forgiven amount can be applied to non-payroll costs, such as mortgage interest, rent, or utilities.

The eight week period begins on the date the lender makes the first disbursement of the PPP loan to the borrower. The lender must make the first disbursement of the loan no later than 10 calendar days from the date of loan approval.

Any borrowed amount beyond what you spent on qualifying costs must be repaid. Your amount of loan forgiveness could also be reduced if you decrease your full-time employee headcount or reduce salaries and wages by more than 25% for any employee who earned less than $100,000 in 2019.

What are the PPP loan terms?

The interest rate is fixed at 1.00%. All payments are deferred for six months—though interest will accrue over that period—and the repayment period is two years. No collateral or personal guarantee is required.

For more details, consult this PPP fact sheet.

Can you provide an example of how PPP will work?

Here is a hypothetical case study: A dentist office with eight employees, including the owner, had to close March 28 due to COVID-19 restrictions. It expects to reopen with four employees on May 1 and bring back the remaining four employees on May 25.

The business borrows its maximum allowable PPP loan amount based on the following calculations:

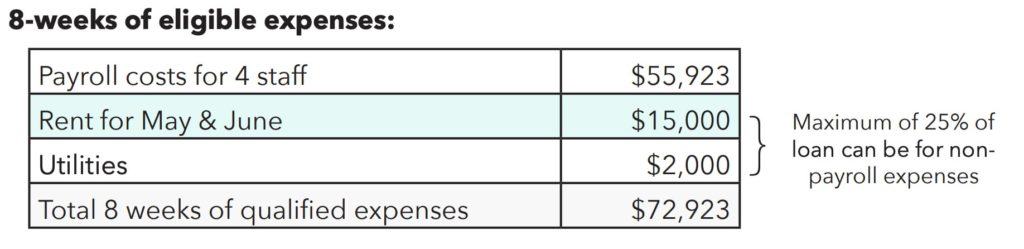

From the loan origination date of April 30, 2020 through the end of June 2020, the dentist office incurs $72,923 of qualifying expenses:

In addition, the office continued to pay its four idled employees $21,154—bringing the total eligible expenses to $94,077. With that amount forgiven, the business must repay just $27,486.

If I’m a sole proprietor, how do I calculate my payroll expenses for a PPP loan?

You determine payroll expenses by using your net income, which is the amounts you entered on tax schedules C and F (profit and loss from the business).

CHOOSING BETWEEN THE OPTIONS

How should I decide which program—is best for my business needs?

We recommend consulting with your financial and tax advisors before you choose an option. Generally speaking, the PPP option may be better for a business with higher-salaried staff while the Employee Retention Credit is a more appropriate choice for covering lower salaries and wages. If you prefer not to incur a loan, then deferring your payroll tax obligation may be the most attractive choice.

EIDL DETAILS

How much can I borrow?

Up to $2 million; for a loan of $200,000 or less, no personal guarantee is required. The EIDL interest rate is fixed at 3.5% and the loan can be repaid over 30 years. An EIDL is not forgivable, however.

How does the “quick deposit” work?

When you apply for an EIDL, the lender is required to pay $10,000 within three days. The three-day countdown starts when the lender acknowledges receipt of the loan application. This amount does not have to be repaid—regardless of whether your EIDL application is approved.

Can I receive both an EIDL and a PPP loan?

Yes—but your business cannot apply EIDL and PPP funds toward the same expenses. For example, you would not be allowed to count your May and June rent payments, or the salaries and wages for specific employees, as eligible costs under both loans.

OTHER RESTRICTIONS BETWEEN PROGRAMS

Can I defer my payroll taxes and have that expense forgiven from my PPP loan?

No, you can only choose one of those actions.

HOW TO APPLY FOR CARES ACT ASSISTANCE

U.S. Small Business Administration (SBA) lending institutions are currently accepting applications, and the available funds are limited, so you should apply as soon as possible.

What should I keep in mind?

- You can only receive one loan through the PPP program, so consider applying for the maximum allowable amount.

- The pool of PPP funding is currently set at $349 billion and will be allocated on a first-come, first-served basis, though a second tranche of PPP funding is being discussed by the U.S. Department of Treasury and Congress.

- Work with your financial and tax advisors to help assemble the necessary documents—including 2018 and 2019 tax returns; employee payroll records; and rent, mortgage, and utility payments—that may be required by the lender.

- Consider applying through local credit unions and online SBA-specific lenders in addition to your current banking resources.

- Keep a clear audit trail for loan forgiveness purposes by opening a separate bank account for loan funds received and payments made.

- Certify that current economic uncertainty makes the loan necessary to support your current business operations.

- Document your employee payroll records, rent, mortgage and utility payments as this information may be required by the lender.

- You can always apply for these loans and decide not to take the loan. Submitting an application provides more options for you to navigate your cash flow.

Precautions to Avoid Small Business Loan Fraud

Don’t reveal personal financial information.

If you receive any calls, emails, or other communications claiming to be from the Treasury Department or the SBA offering you grants or stimulus payments in exchange for personal financial information, do not respond. Neither the Treasure Department nor the SBA makes such calls. In addition, don’t provide any private information, especially not social security numbers, credit card details, or banking information. Scammers could use this information to apply for a loan on your behalf―and you’ll be on the hook for paying it back.

Don’t pay fees and be wary of quick action promises.

If someone or some entity says they can get you a loan faster for a fee, don’t buy it. Loans under the new CARES Act are set up so that business owners will not have to pay any kind of related fees―this includes application fees, package fees, and closing fees. If a company or person is telling you they can get you an SBA loan under the new PPP in a matter of hours, steer clear. If a company offers you a quick advance that’s unrelated to the new PPP or any other stimulus package, you should also be leery, as you may run into rapid repayment terms at exorbitant interest rates.

Don’t work with unknown lenders.

While lenders don’t have to be on the SBA’s preferred lender’s list to process these loans, they do have to apply for SBA certification before granting your loan, and there’s no telling how long that will take. We recommend you go through a bank with whom you already have a relationship. That familiarity with your company might make the lending process easier. If not, then we recommend you go through a federally backed credit union or traditional SBA lender, as they’ll be the most familiar with the program. The Treasury Department requires that all new loans to small businesses comply with the Know Your Customer (KYC) requirement for anti-money laundering purposes. KYC is a costly and time-consuming process and puts the risk of error on the banks’ shoulders. It is one reason why some of the largest banks are only offering these loans to existing customers whom they already know.

How can I stay up to date on the evolving CARES Act details?

Check the following websites daily for new information and official requirements associated with each specific relief program:

Mercer Advisors is also posting frequent updates about the CARES Act and other coronavirus-related topics on our “Insights for Navigating Recent Events” Resource Center.