Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Summary

The first quarter of 2020 was a rough one for the record books. But investors shouldn’t overthink short-term returns. Taking the long view and remembering why we invest can help us keep Q1 returns in context while achieving long-term goals.

Our Emotional Reaction to Current Markets

It happens in every rough market: investors receive their monthly investment statements; we know we shouldn’t look, but sometimes we just can’t help ourselves. Against our better judgement, we open it. As we digest the information, feelings of fear, doubt, and regret begin to take hold.

“Thinking, Fast and Slow”1

Whether it’s markets, relationships, or politics, we’re hardwired to rely heavily on “fast thinking”―impulsive, instinctive, and emotional thinking. This served us well throughout our species’ evolution, but it doesn’t serve us well in an era where financial markets, science, and mathematics dominate. In contrast, “slow thinking” is more purposeful, deliberative, and logical―the type of thinking the modern world values and rewards and is key to our long-term success. Understanding the difference between the two—and being aware of what operating system our brain is running when reading our investment statements—can make all the difference between economic serfdom and economic freedom. Here are three things to help us properly evaluate our investment returns in times of stress.

First, Remember Why We Invest

Most investors don’t expect to spend their entire nest egg all at once. In fact, for most couples, at least one person will live to 92, which means they will spend more than 20 years of their life in retirement. So there really is no reason to focus on short-term returns during a volatile market. Retirement savings are intended to provide income over time, not to be spent all at once. Financial plans are often predicated on retirees spending, on average, 4% of their savings annually in retirement. That works out to 0.33% of a portfolio per month. If the portfolio drops 20%, then your spending rate would increase to only 0.41%, and only for those months while your portfolio was down. This is an immaterial change over a typical retirement horizon of 20 or more years. As the market recovers, your spending rate declines again back to 0.33%; if the portfolio rises further still, your spending rate as a percentage of your savings continues to decline. Subsequently, we should be careful not to invest retirement assets too conservatively in safe, but low, return assets. To outperform inflation, our retirement portfolio needs to invest in assets with greater return potential than safe, liquid investments.

Second, Stay Focused on the Long View

Our tendency to overweight short-term data and underweight long-term data can interfere with how we view our investments. How many of us look only at the bottom line on our monthly statements to see if our account values increased or decreased relative to those in the prior month? There is no logical reason why we should do so.

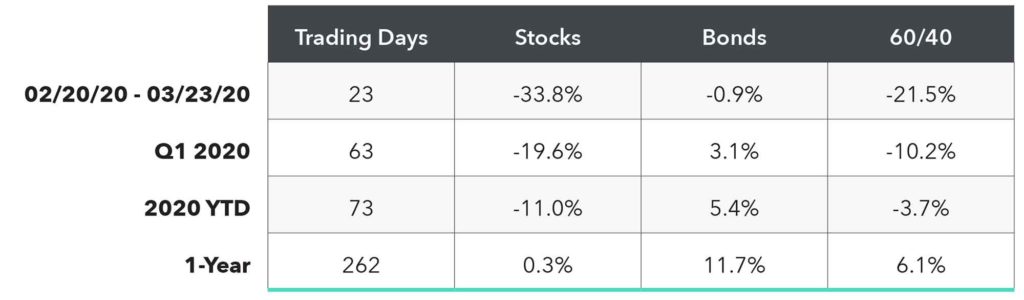

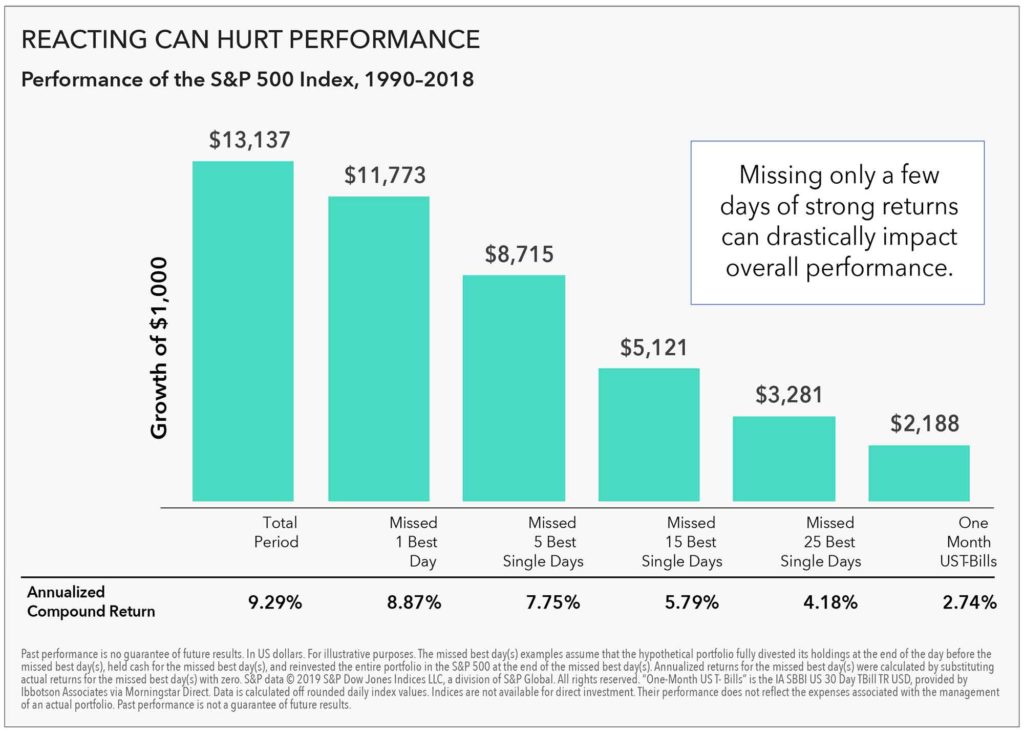

We should take a longer view that doesn’t underweight long-term data in favor of short-term data. For example, when the market bottomed on March 23, it had fallen 33.8% from its February 19 high. Sure, that didn’t feel good, but when we take a longer view, we see that S&P 500 returns haven’t been so bad. Even better, a diversified portfolio consisting of 60% stocks and 40% bonds fell less than 4% YTD. Those investors who liquidated their portfolios during the March sell-off unfortunately didn’t benefit from its recent rise, which included some of the market’s best days ever. Investors should remember that the market’s best days are often huddled closely among its worst days, and missing the market’s best days can seriously dent your portfolio’s long-term returns.

Third, Don’t Obsess Over Short-Term Returns

To make confident decisions—whether in the fields of medicine or finance—we need lots of data, often a decade or more, to properly evaluate performance. The truth is that short-term returns are statistically meaningless. I recognize this is often hard for us to digest. Whether it’s the rush to quickly approve a vaccine for COVID-19 without sufficient clinical trials, or finding “better” investments based on short-term investment returns, fast thinking tempts us to make emotionally charged decisions. But such “fast,” impulsive thinking isn’t rewarded in financial markets (or medicine for that matter).

You may be thinking that we don’t have decades to accumulate such data, that we need to make investment decisions in the here and now. I don’t disagree, but the laws of mathematics care little for how humans feel; nor were they designed to accommodate our individual time horizons. So, we shouldn’t fall into the trap of making long-term investment decisions based on short-term data. And thanks to nearly nine decades of academic research, we don’t have to. At Mercer Advisors, we make investment decisions every day based on academic research, nearly a century of market data, quantitative analysis, and a lot of common sense. The result is an investment philosophy and platform constructed using the best science available anywhere that, when combined with a personalized and comprehensive financial plan, is designed to provide you with the best long-term investment experience possible.

1See: Kahneman, Daniel. Thinking, Fast and Slow. Farrar, Straus, Giroux, 2011. 499 pages.

Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements.All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate, but is not guaranteed or warranted by Mercer Advisors. Content, research, tools, and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark. This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control. Mercer Advisors is not a law firm and does not provide legal advice to clients. All estate planning documentation preparation and other legal advice is provided through its affiliation with Advanced Services Law Group, Inc.