Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Summary

With REITs posting strong returns this year, should investors overweight them?

In contrast to market sentiment and media hype, the answer is “no.” I advise investors to stick with a diversified, long-term investment strategy and avoid the urge to time the market, specific sectors or asset classes.

The Case Against Overweighting REITs

In 2016, Standard & Poor’s announced its decision to add an eleventh sector to the S&P 500 Index – real estate. This change was made effective August 31, 2016. At the time, market pundits predicted massive inflows to REITs from investors seeking to capitalize on the sector’s addition to the market’s most popular U.S. equity index.

And indeed investors did exactly that – in the two-week period following real estate’s addition to the S&P 500 Index, retail and professional investors alike poured over $3 billion into REIT funds. Not to be outdone by Standard & Poor’s, Congress and the White House doubled down on real estate in late 2017 with the passage of the passage of the Tax Cuts and Jobs Act (TCJA), which granted preferential tax treatment to REIT dividends. The new tax law effectively capped taxes on REIT dividends at 29.5% (which were previously taxed as ordinary income at rates as high as 39.6%). In light of so much favorable news, the argument for overweighting REITs seemed pretty ironclad at the time. If ever investors could time a good entry point into an asset class, late 2016 and 2017 was it.

What Have the Returns been for REIT Since this Decision was Made?

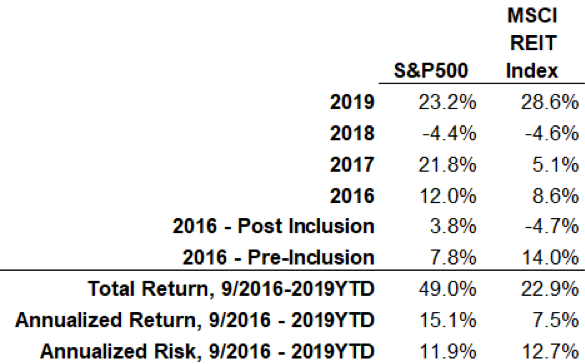

Using the MSCI REIT Index as a proxy for REITs, below I compare REITs to the returns of the S&P 500 Index since 2016 when real estate was added to the index. Since that time, the S&P 500 has outperformed the MSCI REIT Index on both an absolute and risk-adjusted basis, with the S&P 500 (inclusive of REITs) besting the REIT Index 43% to 23% on a cumulative basis subsequent to its inclusion in the S&P 500. On an annualized basis, the S&P 500 outperformed the MSCI REIT Index by 7.6% per year.

But a more granular analysis shows that timing asset classes based on news and tax policy is an exercise in futility. Investors who poured into REITs hoping to cash in on the sector’s new inclusion in the index were rewarded with negative returns the rest of the year. The return on REITs in 2016 prior to their inclusion in the S&P 500 was a staggering 14%; REIT returns post-inclusion were -4.7% for the remainder of 2016. The following year proved no better, with the S&P 500 Index outperforming REITs by nearly 17% in 2017. Those investors who, in response to the TCJA, overweighed REITs in late 2017 fared no better; they were disappointed in 2018 when the S&P outperformed REITs, this time by 0.2% (In the 2018, the S&P 500 returned -4.4% versus -4.6% for REITs).

What About Now?

REITs have posted strong returns in 2019. Through October 31, REITs have returned 28.6% versus 23.2% for the S&P 500. Alas, this is why investors are now suddenly bullish on them (recency bias, anyone?). But investors who entered REITs in late 2016 have a long way to go before they break-even on their market-timing decision; since that time, even in light of 2019’s strong returns, REITs are still underperforming the broad market by over 26%.

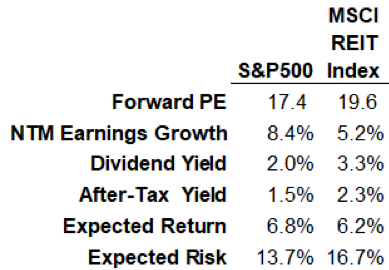

Does this mean now is a good time to overweight REITs, given their underperformance? Predicting market or asset class performance is difficult at best. But two fundamentals tell us that investors would be wise not to overweight REITs. With a forward price-to-earnings ratio of 19.6 times next year’s earnings, REITs are not very attractive. This means REITs are trading at a premium to the S&P 500 Index, which is currently priced at 17.4 times next year’s earnings. Said differently, REITs are about 13% more expensive than the broad market.

What do investors get for this premium pricing? Lower forecasted earnings growth of only 5.2% in 2020, versus 8.4% for the S&P 500. The math doesn’t support overweighting REITs.

Takeaway for Investors

Trying to outsmart the market by making outsized bets on specific sectors or asset classes is difficult at best and impossible at worst. Investors seeking to construct portfolios that differ significantly from the broad market should proceed with extreme caution. This isn’t to say there aren’t factors that have been shown to outperform the market over the long term. Indeed there are – many of them, like value and quality – that investors should continue to own as part of a long-term diversified investment strategy. But there is no evidence that a specific sector – no matter how good the news – will or should outperform the market over any horizon.

I advise clients to continue to take a globally diversified approach to investing while avoiding the urge to overweight specific sectors.

As published in advisorperspectives.com, December 11, 2019

Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements.All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate, but is not guaranteed or warranted by Mercer Advisors. Content, research, tools, and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark. This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control. Mercer Advisors is not a law firm and does not provide legal advice to clients. All estate planning documentation preparation and other legal advice is provided through its affiliation with Advanced Services Law Group, Inc.