Beyond Investing Support: A True Partner in Your Mission

At Mercer Advisors, we go beyond the standard duties of an Outsourced Chief Investment Officer (OCIO). As a financial advisor for your nonprofit organization, we become an integrated fiduciary partner for your board and internal team.

We’ll help your organization:

Invest Smarter

- Institutional-Grade Portfolio Management

- Aligned to Your Organization’s Values

- Access to Private and Alternative Markets

Govern Better

- Board and Stakeholder Guidance

- Fiduciary Support

- Access to a Network of Nonprofit Professionals

Grow Stronger

- Donor and Board Education

- Major Gift Planning

- Fundraising Strategies

Comprehensive & Tailored Support

Mercer Advisors is positioned to serve as a financial advisor for nonprofit organizations. Here’s how our approach is different.

Who We Serve

Mercer Advisors is proud to support endowments and foundations across the nation. Dive deeper to learn how we can support your nonprofit’s mission through fiduciary advice and partnership.

-

- Prepare financial statements to showcase progress and attract donors.

- Develop a financial plan and Investment Policy Statement for immediate needs and long-term growth.

- Strengthen ties with community stakeholders to boost awareness and collective impact.

-

- Build resilient portfolios designed for long-term growth.

- Define metrics to measure impact and share best practices with stakeholders.

- Train leaders and staff on financial management, governance, and fundraising in healthcare.

-

- Offer guidance on Investment Policy Statement and manager selection to align decisions with goals and values.

- Train leaders and staff on finance, governance, and risk strategies for working with children.

- Build networks with other youth-focused groups to share insights.

-

- Refine Investment Policy Statement to align decision with values and risk tolerance.

- Guide compliance with IRS tax-exempt rules for religious organizations.

- Customize portfolios with values-based overlays for alignment and long-term growth.

-

- Develop endowment liquidity plans for operational needs and distributions.

- Advise on Investment Policy Statements to align decisions with academic priorities and growth goals.

- Partner with development teams to engage alumni and donors in intiatives.

-

- Develop investing strategies to help support growth while addressing economic sensitivity.

- Provide guidance on IRS compliance, covering tax-exempt status and intellectual property.

- Design portfolios that balance artistic integrity with financial objectives.

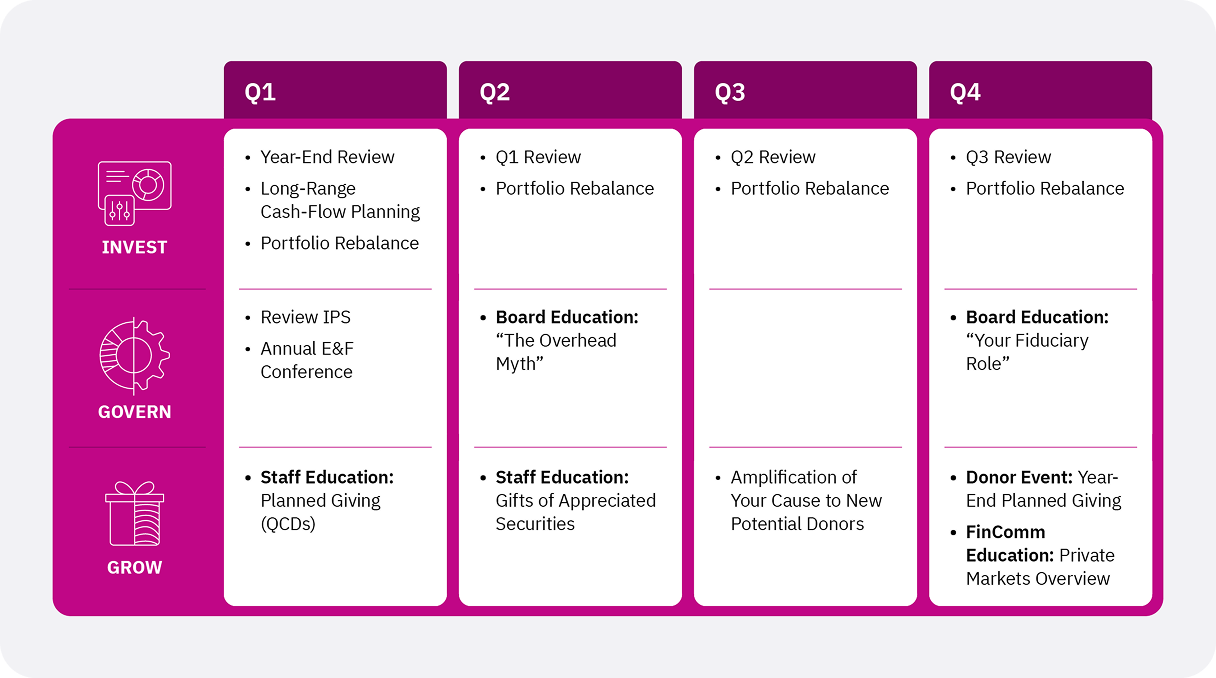

Snapshot: Year-Round Partnership

Our nonprofit financial advising services are designed for integration into your organizational processes and ongoing support of your team. Here’s a representative “year in the life” of a Mercer Advisors nonprofit client as we invest, govern, and grow together.

Experienced Advisors,

Rooted in Your Local Community

Our team offers institutional-grade investing and advisory

support with decades of experience in the nonprofit sector.

And with offices across the country, you can get connected

with an advisor close to home.

Read Reviews from our Clients

Helping families like yours for over

40 years and counting.

Frequently Asked Questions

-

A fiduciary is legally obligated to act in your best interest, placing your needs above their own. As a Registered Investment Advisor (RIA), Mercer Advisors upholds this fiduciary duty, our recommendations are based on what we believe is in your best financial interest.

-

Mercer Advisors employs a factor-based investing approach, grounded in decades of academic research. This investment strategy involves assessing factors such as company size, quality, momentum, value, and volatility to construct well-diversified portfolios with higher expected returns.

Our investment committee oversees this process, helping to ensure that your portfolio aligns with your financial goals and risk tolerance. -

Mercer Advisors offers flexible engagement options to meet your preferences. While we have 100+ offices nationwide, we also provide virtual services, allowing you to collaborate with your advisory team remotely.

-

We believe in simple, transparent fees. As a fee-based fiduciary, we can remain focused on doing what’s best for you, not commissions.

-

Yes! We offer a complimentary consultation where we’ll discuss your financial goals and how we can help. If you’d like to move forward and work with us, you’ll be thoughtfully matched with an advisor suited to your needs who can create a plan and help you put it into action.

Mercer Advisors was ranked #1 for RIA firms with up to $70 billion in assets. The Barron’s top RIA ranking is based on a combination of metrics – including size, growth, service quality, technology, succession planning and others. No fee was paid for participation in the ranking, however, Mercer Advisors has paid a fee to Barron’s to use the ranking in marketing. Please see important information about the ranking criteria methodology here.

Please Note: Limitations. Neither rankings and/or recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any professional designation, certification, degree, or license, membership in any professional organization, or any amount of prior experience or success, should be construed by a client or prospective client as a guarantee that they will experience a certain level of results if Mercer Advisors or its investment professionals are engaged, or continues to be engaged, to provide investment advisory services. A fee was not paid by either Mercer Advisors or its investment professionals to receive the award or ranking. The award or ranking is based upon specific criteria and methodology (see ranking criteria/methodology via the “Read More” links). No ranking or recognition should be construed as an endorsement by any past or current client of Mercer Advisors or its investment professionals.