Matthew McCarthy, CPA

Senior Tax Advisor

Summary

Originally published in Wealth Point, November 2018

SUMMARY

The Tax Cuts and Jobs Act passed last year has major tax planning impacts for individuals and businesses which your financial advisor and tax planning professional can explain to you in detail. For example, C-corporations will now be taxed at a flat 21%, and there is a deduction of up to 20% for qualified business income, called the “pass-through” deduction for business entities other than C-Corporations. Even if your taxable income is above this threshold, there are still tax planning strategies which can help.

The Tax Cuts and Jobs Act is the largest tax reform legislation passed in over 30 years, and implements tax law changes that impact virtually all individuals and businesses. If you’re a business owner, here are some tips to make the most of these new tax provisions. We encourage you to speak with your financial advisor and tax planning professional about how these changes will impact your taxes for 2018 and beyond.

SHOULD YOU SWITCH TO A C-CORP FOR TAX BENEFITS?

One of the most significant changes from this new tax law is that C-corporations are taxed at a flat rate of 21% – an average decrease from the previous range of 15%–35%. At face value, this new tax rate for C-corps makes them look more attractive for tax savings compared to other business types, such as partnerships, limited liability companies (LLCs), and S-corporations (referred to as pass-through entities).

If you’re a sole proprietor (or independent contractor) or own an interest in a partnership, LLC or S-corp, you’re taxed under the individual tax brackets, meaning you could be dealing with taxes at the maximum tax bracket of 37%.

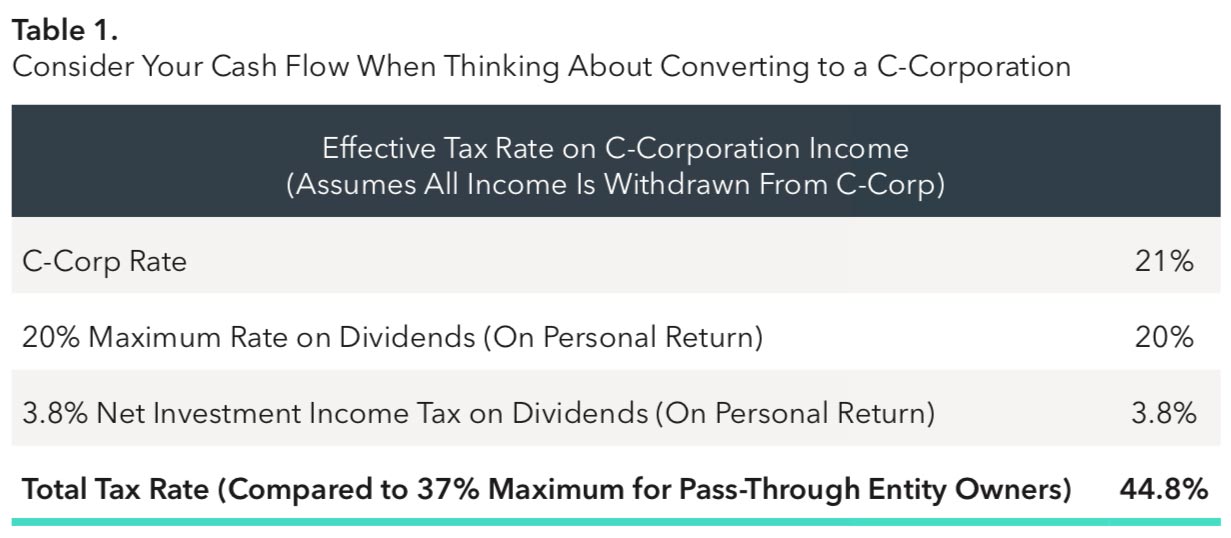

However, before you decide to switch your business entity to a C-corporation, it’s important to review your cash flow needs carefully. With C-corps, you often hear the term “double taxation,” which means that C-corps are taxed on income at the corporate level, and shareholders are then taxed on the same income when it’s distributed as dividends. Depending on your tax bracket, under current law, you’re looking at dividends being taxed at 0%, 15%, or 20% respectively, and there’s often a 3.8% additional tax.

If you need to withdraw money from your business for living expenses, C-corps are often worse than other entity types, as shown in Table 1. If you are able to leave your business’s earnings untouched and keep them within the business, reincorporating your business as a C-corporation may be worth considering.

TAX AND THE 20% PASS-THROUGH DEDUCTION

The new tax law does include some tax benefits for business owners operating pass-through entities. Starting this year, there is a deduction of up to 20% for qualified business income (also called the “pass-through” deduction) available to business owners with entities other than C-corporations. However, there are two qualifiers that could reduce or eliminate the deduction:

- Taxable Income: If your taxable income is over $157,500 as a single filer (or $315,000 for married couples), your deduction gets either reduced or eliminated. Income from all sources (including business income, wages, investment income, etc.) counts towards your taxable income.

- Type of Business: Above these income limits, you can only take the maximum deduction if the business is a “non- specified” business that pays enough wages to its employees. While the definition of a “non-specified” business is lengthy and has not been fully clarified by the IRS, generally speaking, businesses providing professional service (e.g., medical services, legal services, etc.) do not qualify for this deduction. It’s best to contact your financial advisor for more details to determine if your business falls into this category of a “non-specified” business.

TAX PLANNING TO TAKE ADVANTAGE OF THE 20% DEDUCTION

Is your taxable income over or under the income threshold? This is the most important question to determine if you can utilize the 20% pass-through deduction. Even if you think these two qualifiers (your taxable income and business type) exclude your business from taking advantage of this deduction, there are potential tax planning strategies that may help.

of this deduction, there are potential tax planning strategies that may help.

REDUCE YOUR TAXABLE INCOME

Since you can take the full deduction if you come under the income thresholds, reducing your income is one of the simplest ways to maximize the deduction.

- Take a look at your household expenses against your self-employment income. If you use part of your home solely for self-employed business activities, you can deduct part of your household expenses against your self-employment income. Due to the new limits on itemized deductions, this tax strategy can be especially useful now, as there likely is little or no benefit from taking these expenses as itemized deductions. Consider structuring your home so that part of it is used for self-employed business activities. For example, you don’t have to use an entire room; any separate space used for your business, a desk, computer, etc. would get you the home office deduction, as long as that space is used solely for business.

- Pay for business expenses this year, defer your income until next year. Another strategy to consider is to pay for business expenses by year-end and defer your income until the start of the following year. With this new tax law, you can write off 100% of the cost of your new or used equipment and certain qualified investment property purchased after September 27, 2017 and before January 1, 2023.

- Consider maximizing your contributions to your retirement accounts. Self- employed retirement plans—especially defined benefit and cash balance plans—let you contribute substantial amounts in retirement savings while potentially reducing your taxable income. These plans must be opened by the end of the tax year (December 31 for most taxpayers). If you are not able to open an account by then, a SEP IRA also lets you make deductible retirement contributions and can be opened as late as October 15 of the following year (the tax filing deadline, including extensions). For all self-employed retirement accounts, you must make any contributions by the extended tax filing deadline.

ASK YOUR FINANCIAL ADVISOR ABOUT PAYING ADDITIONAL WAGES TO DECREASE YOUR TAX BURDEN

Depending on whether your taxable income falls over or under the income threshold (again, over $157,500 as a single filer or $315,000 for married couples), you can consider paying additional wages from the business to take the full deduction.

An important note: This scenario assumes your business is a qualified “non-specified” business eligible for the deduction. Please see your financial advisor to determine if paying additional wages makes sense for you and your business, and how much in wages you should pay to take advantage of this deduction. In general, the deduction is limited to 50% of the wages paid, which works out to paying 28.57% of net income as wages.

Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements.All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate, but is not guaranteed or warranted by Mercer Advisors. Content, research, tools, and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.