Home » Insights » Retirement » Investing for Retirement Income in a Low-Yield World

Investing for Retirement Income in a Low-Yield World

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Summary

With interest rates at historic lows, investors are wondering how to generate retirement income. Despite low rates, there’s no need for investors to recklessly chase yields in high-risk asset classes. There’s a better way, one that focuses on your lifestyle, your legacy, and your willingness to accept risk.

Retirement income planning is a long-term strategy

The Federal Reserve’s decision to cut interest rates to near zero has left investors searching for ways to best position their portfolios to provide retirement income. In a world of declining interest rates and rising life expectancies, determining how best to transform a lifetime of savings into a steady income stream is a gargantuan task. It’s never been more imperative than it is now to build a retirement portfolio that’s fully integrated with your financial plan, that doesn’t unnecessarily rely on high interest rates, and that takes full advantage of tax laws, diversification, and market yields. To do so, investors need to first answer three fundamental questions that define their lifestyle, their legacy, and their likelihood for success.

1. What are you trying to accomplish?

For most families, retirement planning is a balancing act between lifestyle and legacy. Your lifestyle—funded by slow, monthly withdrawals from your savings—comes at the expense of leaving more to your heirs. The decisions made around spending, inflation, taxes, and asset allocation will ultimately determine how successful you are in striking a balance between the two. For example, consider a couple, both age 65, who would like to spend an amount equivalent to 4% of their savings each year. Before returns, taxes, and inflation, their nest egg would last for 25 years (1 ÷ 0.04 = 25). If they spend less, it will last longer, and vice versa. In doing so, they would likely leave very little to their heirs, unless they pass away early in retirement or have other non-retirement assets earmarked for bequests. But assuming they don’t, their retirement lifestyle conflicts with any desire they may have to leave a legacy. Our couple—fictional yet very real—also runs the very real risk of outliving their assets by age 90.

This concept—that of portfolio longevity—is at the heart of retirement income planning. Higher spending, inflation, taxes, and investment losses negatively impact portfolio longevity. Lower spending and positive returns—such as dividends, capital gains, and interest—all work to extend portfolio longevity. For these reasons—and because of the conflict of often trying to balance infinite priorities with finite assets—investing your wealth is necessary.

2. What are you willing to do to get there?

We all need to decide how we want to deal with inflation, risk, and spending down assets. Inflation is the erosion of your purchasing power over time. But it doesn’t impact all people equally. For retirees, inflation is often higher than the national average since they generally spend more on healthcare. Subsequently, retirees need to determine if—and to what extent—they should adjust their portfolio withdrawals to account for inflation. For example, a couple may elect to absorb inflation by slowly reducing their lifestyle spending over time; others may wish to increase their after-tax cash flow to fully sustain their lifestyle on an inflation-adjusted basis. How you answer this question will inform how best to invest your retirement assets.

For retirees with no desire to leave a legacy to heirs, spending down your assets over your lifetime may be perfectly acceptable. Conversely, there are others who wish to leave significant assets to beneficiaries and desire to never “invade” the principal of their nest egg—which can be an elusive ideal for many families. Why? First, we’re human, and most people have infinite priorities and finite assets. This puts stress on wealth’s ability to satisfy all your wants and needs—whether those be today’s or tomorrow’s. Second, market returns are volatile, regardless of asset allocation or investment strategy. When market returns are greater than the withdrawal rate, there’s no need to touch the principal. When market returns are lower than our withdrawal rates, we inevitably need to spend down principal. And market returns—regardless of asset class or strategy—are never both high and steady.

This brings us to the decision retirees need to make around risk. Investing in a conservative portfolio—one consisting mostly of short-term government bonds—is unlikely to outperform inflation. And in most instances, such a portfolio will require retirees to withdraw funds from their nest egg since yields paid on such investments are significantly less than what most retirees withdrawal annually. For example, a 10-year U.S. Treasury bond currently pays only 0.65% annually. Investors who are more willing to accept and live with risk—the risk that goes with investing in a diversified portfolio that includes stocks—will be better positioned to outperform inflation over time and leave a legacy to heirs.

3. What’s the best portfolio for the job?

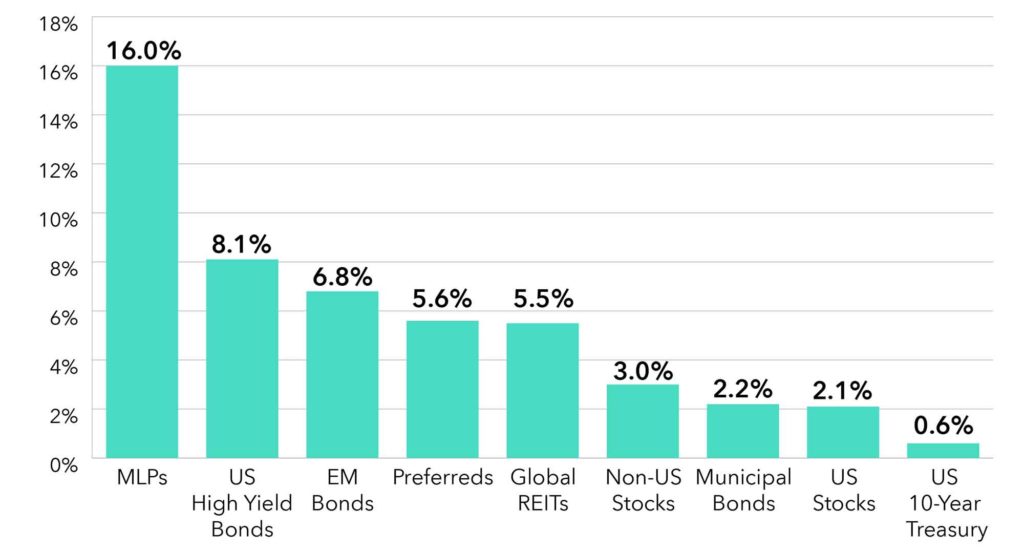

Selecting an optimal portfolio that carefully balances lifestyle and legacy is a delicate exercise. There is no one portfolio that’s ideal for everyone. And while rates are low for short-term bonds, other asset classes offer more promising yields (see exhibit 1) and long-term return prospects. Stocks, for example, have outperformed bonds by about 6% annually over time. But that return includes both dividends and price appreciation; and relying on price appreciation to fund short-term needs can be an admittedly risky and difficult exercise. Subsequently, investors need to customize their asset mix—between things like stocks, bonds, and cash—to achieve the proper balance between short-term yield and principal to fund their lifestyle while reserving longer-term returns for legacy goals and to combat inflation.

What’s less obvious, perhaps, is the need to customize the implementation and management of the portfolio to maximize its longevity. Something as simple as selecting a bond mutual fund versus individual bonds could have serious implications for the timing of cash flows paid to retirees since bond funds pay interest monthly, whereas individual bonds pay interest semiannually. Further, taxes are an ever-present threat to our lifestyle and legacy. Many investors who straddle multiple tax brackets risk falling into unnecessarily high tax brackets, eroding after-tax cash flow, with sloppy portfolio implementation. Such investors may benefit from a delicate blending of stock dividends (taxed at capital gains rates) with taxable bonds (taxed as income) and municipal bonds (whose interest is tax-free) to engage in a form of “tax arbitrage,” a strategy that earns the highest possible yield without inadvertently pushing themselves unnecessarily into higher tax brackets.

Beware of chasing yield

Despite historically low interest rates, there are still high-yield asset classes in today’s market, as shown below. Energy master limited partnerships (MLPs), high-yield bonds, emerging markets (EM) all offer yields well north of 5%. But not all yields are created equal; some are taxed as ordinary income while others are taxed at capital gains rates. A stock paying a 4% dividend yield could easily net the same after-tax cash flow as a high-yield bond paying 6% interest. Further, with higher yield comes greater risk. For example, despite the high yields offered presently by MLPs, those yields are likely unsustainable given the recent decline in energy prices, a fact that is reflected in the asset class’s year-to-date return of -38%.

Exhibit 1: Asset-class yields as of May 4, 2020. Note the yield for municipal bonds is the taxable equivalent yield.

There’s a better way

A better approach, both short term and long term, would be to invest in a diversified portfolio of global stocks and bonds that tilts towards high-dividend-paying value stocks. U.S. value stocks pay a current annual dividend yield of 3.6%; that yield rises to 4.8% for non-U.S. value stocks. Further, dividend yields for U.S. stocks have risen 7% per year for the past 20 years, so much so that $100,000 in annual dividends in 2000 rose to over $390,000 in annual dividends by 2019. When stocks are viewed as the income-producing vehicles that they are, their ability to provide retirement income on an inflation-adjusted basis becomes apparent. But doing so requires investors to let go of fixating so heavily on changes in companies’ share prices.

Embrace the power of diversification

Despite low rates, there’s no need for investors to recklessly chase yields in high-risk asset classes. There’s a better way, one that focuses on your lifestyle, your legacy, and your willingness to accept risk. It’s an approach that embraces the power of diversification and views stocks through an income producing lens rather than purely with a price-appreciation measure. And while planning for retirement income is admittedly a difficult, complex task, a planning-centric approach not only makes the task easier, it results in a less risky and more balanced approach to investing for retirement income.

Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements.All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate, but is not guaranteed or warranted by Mercer Advisors. Content, research, tools, and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark. This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control. Mercer Advisors is not a law firm and does not provide legal advice to clients. All estate planning documentation preparation and other legal advice is provided through its affiliation with Advanced Services Law Group, Inc.