Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Summary

- Investors are more educated and better-informed today than at any time in history and are increasingly interested in ensuring their wealth is aligned with their values.

- To better align investors’ portfolios with their values, a new range of customizable, socially responsible investment strategies give investors choice and options.

- Contrary to conventional wisdom, new evidence tells us that these strategies do not harm returns but in fact may offer the potential for slight long-term outperformance.

War. Climate change. Pollution. Poverty. Racial and gender discrimination. Human trafficking. Corporate fraud. Gun violence. Dysfunctional governments. Today’s news headlines are dominated by a host of serious issues that increasingly rattle our consciousness.

It used to be that investors simply accepted these challenges as beyond their control, and best left to governments to address. But as these issues have become more pressing, investors increasingly conclude that the enormity of the challenges we face requires help from private capital.

But how can investors help solve such difficult, enduring issues? Global financial markets are among the most powerful human institutions ever created. Markets do significantly more than simply bring buyers and sellers together. They price capital, such as stocks and bonds. They set interest rates. And in doing so, markets reward and punish corporations – and governments. Financial markets can bring the largest multinational companies and most corrupt governments to their knees. But isn’t this hyperbole? Hardly – just look at Lehman Brothers and Venezuela. This is exactly why Socially Responsible Investing (SRI) holds such promise for solving some of the world’s most pressing problems.

The Rise of Socially Responsible Investing (SRI)

The rise of SRI has been fueled by three major developments. First, today’s investors are more educated and better informed than at any other time in history, which has led to a growing awareness of both the plethora and seriousness of the issues confronting our civilization. Second, there is growing consensus that government action by itself is a necessary but insufficient solution to the world’s problems. Finally, demographic and economic shifts have brought more women and millennials, who generally tend to be more socially conscious investors, into global capital markets.

And investment management firms are paying attention. On July 31, 2019, Mercer Advisors joined as the only Registered Investment Adviser signatory to the UN-backed “Principles for Responsible Investing,” a pledge whereby firms commit themselves to incorporating sustainability issues into their investment processes.1 As fiduciaries to our clients—and to future generations and the broader world in which we all live and work—we’re committed to doing our part to help solve our planet’s most tenacious challenges.

SRI, ESG, & Impact: What’s in a Name?

SRI. Community investing. Environmental, Social, and Governance (ESG) investing. Impact investing. The list goes on, but don’t be confused. The key word is “investing” – this is not about philanthropy. Regardless of the label, each of these approaches is ultimately about seeking a financial return while bringing about positive social or environmental change in some way.

SRI

SRI, the first term to gain wide acceptance, typically refers to constructing portfolios using “negative screens” to exclude firms or sectors involved in activities deemed to be unacceptable or controversial. For example, this might include building a portfolio that excludes firms that sell weapons or tobacco, or firms with egregious environmental or human rights records. Investors utilizing an SRI approach to portfolio construction essentially “punish” bad actors by denying them use of their capital. At Mercer Advisors, we currently offer our clients the ability to customize their portfolios using any combination of 17 different negative screens.

ESG Investing

ESG investing, while related to SRI, is materially different. ESG investing focuses on investing in companies with high environmental, social, and governance scores relative to their peers. Subsequently, ESG investing doesn’t necessarily exclude “bad actors” – it focuses on firms with high sustainability ratings relative to their peers. It’s an approach that subsequently focuses on “best-in-class” firms, but doesn’t explicitly exclude any firm or industry. For example, a tobacco company might receive a high ESG score for having a diverse board and sustainable agricultural practices, even though they’re in the business of selling tobacco. In this way, ESG investing “rewards” best-in-class actors by providing them exclusive use of investors’ capital. At Mercer Advisors, we offer a variety of low-cost ESG strategies across a number of asset classes, including US stocks, non-US stocks, and US fixed income.

Impact Investing

Impact investing takes both SRI and ESG investing further in that it explicitly focuses on solving specific social or environmental problems. It does this in two ways:

- Impact investing explicitly focuses on those companies with the very best ESG scores; and

- It typically excludes companies engaged in undesirable activities.

Subsequently, Impact investing is essentially a hybrid that borrows from both SRI and ESG investing approaches. Similar to ESG investors, Impact investors “reward” those companies making the most powerful impact on solving specific social or environmental problems. They do this by providing their capital exclusively to such companies. At Mercer Advisors, we have several impact strategies that focus on issues, such as gender equity and climate change.

Can SRI, ESG, and Impact Investing Outperform the Market?

Modern Portfolio Theory suggests that limiting the investing universe results in the construction of a less risk-efficient portfolio. Subsequently, for many decades conventional wisdom held that socially responsible approaches to portfolio construction resulted in lower risk-adjusted returns to investors. However, there is now a considerable amount of academic evidence that proves socially responsible investing—in all its forms—does not detract from portfolio performance. An exhaustive 2015 meta-analysis of more than 85 academic studies found no negative relationship between SRI approaches and investment performance.2

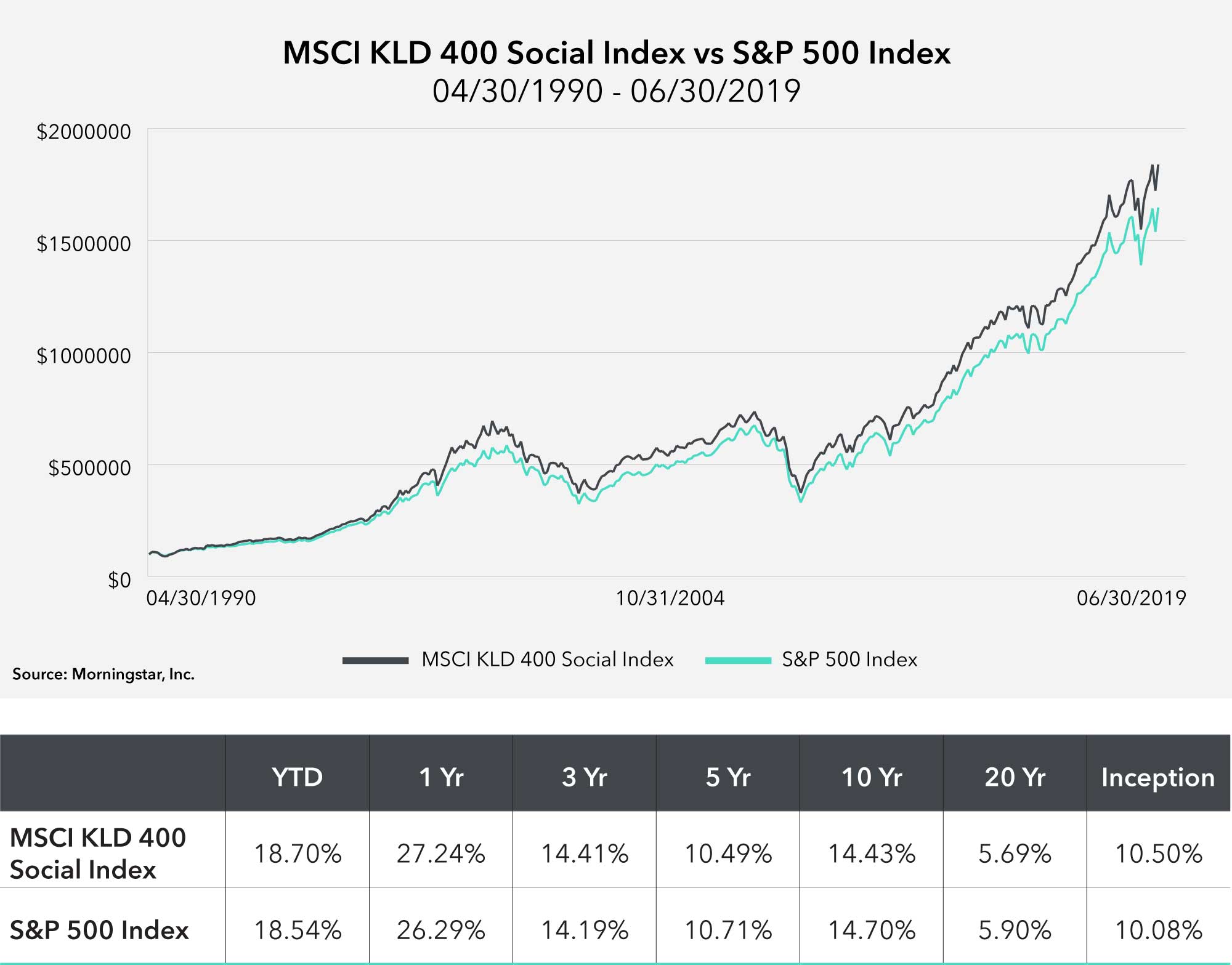

Thus far, academic studies have focused mostly on the performance of SRI, ESG, and impact strategies collectively. But there’s some real-world evidence that ESG and Impact investing can result in outperformance.3 The MSCI KLD 400 Social Index is an index of 400 US companies with outstanding ESG ratings and excludes companies whose products have negative social or environmental impacts.4 We offer several strategies that mirror this index. Since its inception on May 31, 1990, the index had an annualized return of 10.5% versus 10.08% for the S&P 500 Index5, suggesting that a systematic approach to ESG investing may offer the potential for slight long-term outperformance.

Options to Invest with Purpose at Mercer Advisors

At Mercer Advisors, we believe achieving economic freedom needn’t come at the expense of others or the environment. We believe, and the data proves, that investors can capture market returns (or potentially better) while still having a powerful and positive impact on the world around us. To that end, it is our privilege and fiduciary responsibility—to you and to the communities in which we all live and work—to make SRI, ESG, and Impact investing foundational elements of our approach to managing client wealth.

1 Signatory Directory as of July 31, 2019.

2 “Financial Performance of Socially Responsible Investing (SRI): What Have We Learned? A Meta-Analysis,” Business Ethics: A European Review, vol.24, n.2, p.169, 2015.

3 “Sustainable Investing Research Suggests No Performance Penalty,” November 2016.

4 MSCI KLD 400 Social Index factsheet.

5 Data as of June 30, 2019.

Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate, but is not guaranteed or warranted by Mercer Advisors. Content, research, tools, and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark. This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.