(Originally published in Financial Advisor Magazine)

A spike in new coronavirus cases outside of China, especially in Italy and South Korea, has put investors on edge.

Monday’s coronavirus-fueled market sell-off drove global equity markets to their lowest levels since December, with the Dow Jones falling over 1,000 points or 3.56%. The S&P 500 Index, a broader measure of the market, fell over 100 points or 3.35%.

As advisors, we should remember that markets are mechanisms for rapidly digesting large volumes of new information into asset prices. And it’s in times like these, when market volatility increases, that it’s prudent to step back, catch our breath, and evaluate what we know and don’t know.

The Coronavirus (COVID-19)

We know the coronavirus, COVID-19, is a previously unidentified virus, hence the term “novel” coronavirus. COVID-19 is a respiratory illness that comes from a large family of coronaviruses that typically affect animals; in rare instances, as is suspected with COVID-19, the virus can spread from animals to humans. The virus was first detected in Wuhan, China and has since spread to 25 countries. What we don’t know is how the virus is transmitted, how to cure it, or how far it will spread, or how it will affect the global economy.

There are currently about 80,000 reported cases of coronavirus globally. To put that in context, the influenza virus infects about 3 to 5 million people globally in any given year. But it’s also highly likely that coronavirus cases are underreported due to a lack of diagnostic capabilities in many countries, or, perhaps, due to bureaucratic incompetence or public relations concerns in authoritarian countries such as China and Iran. We also know that the virus’ mortality rate is approximately 2.5%. This compares to a global mortality rate of 9.6% for Severe Acute Respiratory Syndrome (SARS – 2003) and about 10% for influenza in any given year, and for the U.S. alone, below a 0.1% mortality rate for influenza.

Projected Economic Impact

Any attempt to forecast the economic impact of the virus may ultimately prove futile but we likely know enough to make an educated guess. Economists from Deutsche Bank estimate the coronavirus will reduce China’s GDP rate by about 2%, about twice the decline experienced during the SARS pandemic in 2003 (which also originated in China). This doubling of the estimated economic impact of coronavirus (relative to that of SARS) makes sense; China’s economy today is much larger than it was in 2003.

With respect to the United States, economists predict the virus will erode GDP growth by about 0.1% in 2020, about 0.03% more than the SARS pandemic did in 2003. Goldman Sachs today reduced its forecast for US GDP growth to an annualized rate of 1.2% in Q1 but predict growth will subsequently return to its current rate of about 2% later this year.

In earlier times, human civilization lacked the communication networks, such as social media, technology, and institutions to effectively combat global pandemics. This is why the influenza pandemic of 1918 was so devastating. But we also know that human civilization is better positioned today than at any point in its history to deal with such crises. The World Health Organization (WHO), the United States Center for Disease Control (CDC), global healthcare companies, world class research universities, and many others are working in tandem to combat the virus. In fact, Gilead has already announced it will partner with the University of Nebraska to begin human trials on a new vaccine.

Market Impact

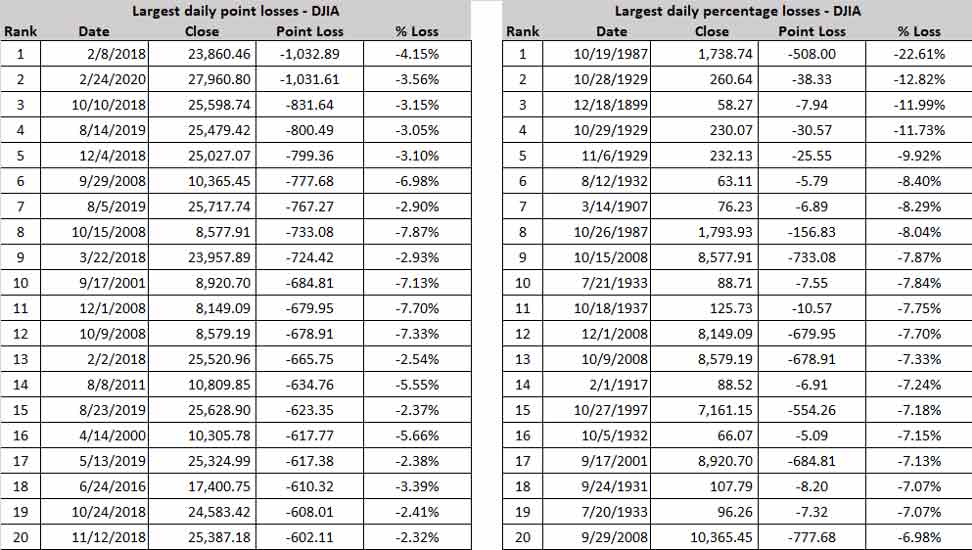

For most, a 1,000 point sell-off in the Dow Jones is alarming. Monday’s sell-off was the second largest point sell-off in the history of the Dow Jones Industrial Average. That sounds ominous. But while my intent is not to minimize the sell-off, it’s also important to note there was nothing historic about Monday’s decline in percentage terms. In fact, Monday’s decline doesn’t even rank among the top 20 market declines of all-time.

What should investors do?

First, don’t panic. Clients should be careful not to make investment decisions based on hype or the unknown; investing is always about the future, which is fundamentally unknowable. And we know that investor returns suffer significantly when investors make long-term investments based on short-term information. Breathe.

Second, investors should remain globally diversified with a healthy allocation to high quality fixed income. If investors feel the need to “do something”, they should rebalance their portfolios by selling bonds, buying stocks, or putting idle cash to work. Further, given equity markets were already a bit frothy in terms of valuations, within equities investors would be wise to overweight value stocks, which tend to outperform growth stocks during market corrections. For example, the Russell 1000 Value declined 2.9% versus 3.7% for the Russell 1000 Growth on Monday.

Finally, investors should have a crisis plan in place before they need one. The worst time to draft a crisis plan is during a crisis. Investors would benefit from having a written, long-term financial plan in place that includes an action plan for how they’ll deal with market volatility. Such approaches might include a plan to rebalance your portfolio mid-cycle, reinvest dividends, or delay large expenses. But regardless of the approach, the mere presence of having an action plan in place before it’s needed is often by itself enough to calm rattled nerves.

Home » Insights » Investing » The Coronavirus & Financial Markets: Advice for Investors

The Coronavirus & Financial Markets: Advice for Investors

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Summary

(Originally published in Financial Advisor Magazine)

A spike in new coronavirus cases outside of China, especially in Italy and South Korea, has put investors on edge.

Monday’s coronavirus-fueled market sell-off drove global equity markets to their lowest levels since December, with the Dow Jones falling over 1,000 points or 3.56%. The S&P 500 Index, a broader measure of the market, fell over 100 points or 3.35%.

As advisors, we should remember that markets are mechanisms for rapidly digesting large volumes of new information into asset prices. And it’s in times like these, when market volatility increases, that it’s prudent to step back, catch our breath, and evaluate what we know and don’t know.

The Coronavirus (COVID-19)

We know the coronavirus, COVID-19, is a previously unidentified virus, hence the term “novel” coronavirus. COVID-19 is a respiratory illness that comes from a large family of coronaviruses that typically affect animals; in rare instances, as is suspected with COVID-19, the virus can spread from animals to humans. The virus was first detected in Wuhan, China and has since spread to 25 countries. What we don’t know is how the virus is transmitted, how to cure it, or how far it will spread, or how it will affect the global economy.

There are currently about 80,000 reported cases of coronavirus globally. To put that in context, the influenza virus infects about 3 to 5 million people globally in any given year. But it’s also highly likely that coronavirus cases are underreported due to a lack of diagnostic capabilities in many countries, or, perhaps, due to bureaucratic incompetence or public relations concerns in authoritarian countries such as China and Iran. We also know that the virus’ mortality rate is approximately 2.5%. This compares to a global mortality rate of 9.6% for Severe Acute Respiratory Syndrome (SARS – 2003) and about 10% for influenza in any given year, and for the U.S. alone, below a 0.1% mortality rate for influenza.

Projected Economic Impact

Any attempt to forecast the economic impact of the virus may ultimately prove futile but we likely know enough to make an educated guess. Economists from Deutsche Bank estimate the coronavirus will reduce China’s GDP rate by about 2%, about twice the decline experienced during the SARS pandemic in 2003 (which also originated in China). This doubling of the estimated economic impact of coronavirus (relative to that of SARS) makes sense; China’s economy today is much larger than it was in 2003.

With respect to the United States, economists predict the virus will erode GDP growth by about 0.1% in 2020, about 0.03% more than the SARS pandemic did in 2003. Goldman Sachs today reduced its forecast for US GDP growth to an annualized rate of 1.2% in Q1 but predict growth will subsequently return to its current rate of about 2% later this year.

In earlier times, human civilization lacked the communication networks, such as social media, technology, and institutions to effectively combat global pandemics. This is why the influenza pandemic of 1918 was so devastating. But we also know that human civilization is better positioned today than at any point in its history to deal with such crises. The World Health Organization (WHO), the United States Center for Disease Control (CDC), global healthcare companies, world class research universities, and many others are working in tandem to combat the virus. In fact, Gilead has already announced it will partner with the University of Nebraska to begin human trials on a new vaccine.

Market Impact

For most, a 1,000 point sell-off in the Dow Jones is alarming. Monday’s sell-off was the second largest point sell-off in the history of the Dow Jones Industrial Average. That sounds ominous. But while my intent is not to minimize the sell-off, it’s also important to note there was nothing historic about Monday’s decline in percentage terms. In fact, Monday’s decline doesn’t even rank among the top 20 market declines of all-time.

What should investors do?

First, don’t panic. Clients should be careful not to make investment decisions based on hype or the unknown; investing is always about the future, which is fundamentally unknowable. And we know that investor returns suffer significantly when investors make long-term investments based on short-term information. Breathe.

Second, investors should remain globally diversified with a healthy allocation to high quality fixed income. If investors feel the need to “do something”, they should rebalance their portfolios by selling bonds, buying stocks, or putting idle cash to work. Further, given equity markets were already a bit frothy in terms of valuations, within equities investors would be wise to overweight value stocks, which tend to outperform growth stocks during market corrections. For example, the Russell 1000 Value declined 2.9% versus 3.7% for the Russell 1000 Growth on Monday.

Finally, investors should have a crisis plan in place before they need one. The worst time to draft a crisis plan is during a crisis. Investors would benefit from having a written, long-term financial plan in place that includes an action plan for how they’ll deal with market volatility. Such approaches might include a plan to rebalance your portfolio mid-cycle, reinvest dividends, or delay large expenses. But regardless of the approach, the mere presence of having an action plan in place before it’s needed is often by itself enough to calm rattled nerves.

Don’t Change Your Portfolio in Response to Recession Forecasts

Markets: Planning Over Predicting

Investing and Politics – Are They Connected?

Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.