What happened?

After that 800-point fall, the Dow is now trading at the same level as it was on June 4. Still, it remains positive by about 11.7% for the year to date. The S&P 500 is also up 14.75% so far this year.

In nominal terms, the 800-point sell-off was the fourth-largest in the Dow’s 123-year history. However, what’s more material—and informative—is the percentage sell-off in the market. From that vantage point, Wednesday’s market decline is barely worthy of mention; in fact, it merely ranks 292nd all-time.

Why the sell-off?

This is the thousand-point question. Global markets are enormously complex systems that, collectively, digest new information in real time. Therefore, drawing a cause-and-effect conclusion is always extremely difficult.

That said, the evidence points toward three likely catalysts for the recent market volatility:

- Stellar year-to-date returns. Markets rose significantly in the first two quarters of 2019. As of July 31, the Dow was positive 16.69% for 2019 and the S&P 500 was up 20.24%. That basically represents more than two years’ worth of expected returns in a six-month span. When markets get ahead of themselves, it’s not uncommon for them to catch their breath and give up some recent gains—in this case, about two months’ worth.

- The ongoing trade war with China. Trade wars worry global markets because tariffs weigh on future economic growth. Tariffs are effectively a tax. Taxes discourage consumption, which in turn discourages production and typically suppresses economic growth. The tariffs levied on Chinese imports will be shared by US consumers and Chinese exporters. We’re seeing a repeat of 2018, when markets declined in response to an escalating trade war between China and the United States. Earlier this year, politicians were explicitly hinting that the two economic giants were close to a deal. That positive sentiment has now done a 180 as it appears the two sides are further apart than ever.

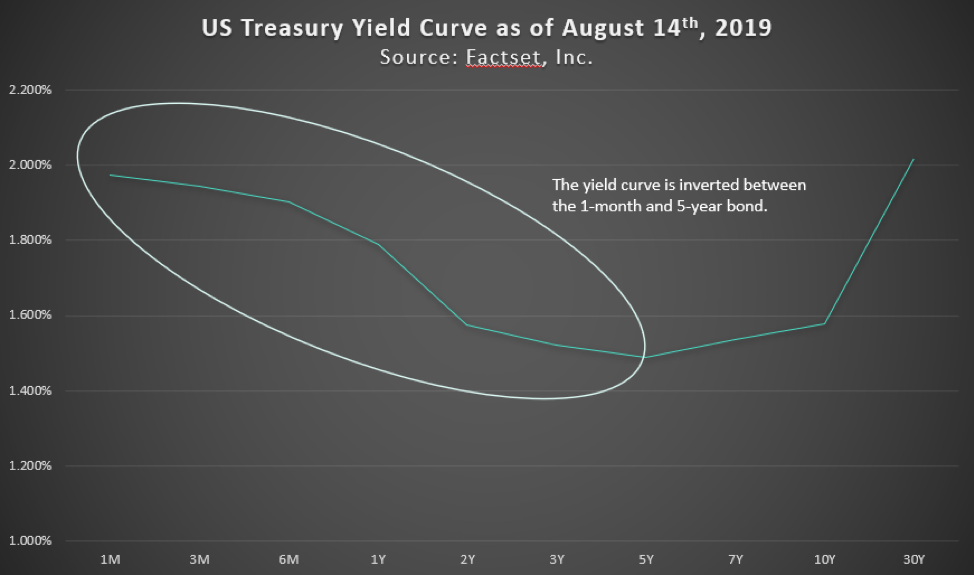

- The inverted yield curve. An inverted yield marks a point when short-term bonds pay more than longer-term ones. This occurred on Wednesday between the 2-year and 5-year Treasury yields. It’s common Wall Street lore that an inverted yield curve is a reliable predictor of future recessions. And it’s quite reasonable to think that investors—believing this truism to be economic gospel—have collectively reacted by selling off stocks. But, in reality, there’s little capital market evidence to confidently draw a cause-and-effect relationship between inverted yield curves and future market declines. Consider that when the yield curve inverted in December 2005, the S&P 500 returned 15.79% in the twelve months that followed. The yield curve turned positive in again in June 2007—just before a major market decline from October 2007 to February 2009.

What should investors do now?

I can’t predict future market returns; no one can. The next twelve months might very well deliver us a bear market—or not. Market pundits have been predicting the next bear market since the last one in 2008-2009. This is the most unloved bull market in history. But all bull markets come to an end, so the prudent thing to do is to plan appropriately.

First, let’s be clear on what not to do. Investors should never react to short-term market volatility by making reactionary changes to their portfolios. As I outlined above, while inverted yield curves may potentially be an indicator of a future economic recession, they’re not necessarily indicators of poor future market returns. Reactively changing your portfolio without carefully evaluating the long-term implications is a recipe for financial disaster. Mercer Advisors clients’ asset allocations are carefully determined through meticulous financial planning that reflects each client’s specific long-term goals.

Second, there is no substitute for a globally diversified portfolio—one that is systematically rebalanced, low-cost, scientifically implemented, and spread across multiple asset classes. Reducing equity exposure—or worse, abandoning broad asset class diversification—in response to market volatility can short-change your future returns. Expected returns for equities are highest after market sell-offs, and investors benefit most from asset class diversification when markets are volatile.

Events like Wednesday’s 800-point sell-off are why investors should continue to own fixed income (such as bonds), even if rates are rising like they were late last year. Who doesn’t wish they had a heavier allocation of bonds before yesterday’s sell-off? Consider the opposite question. Who doesn’t wish they had purchased more stocks on March 6, 2009, when the Dow was trading at 6,600? Or during last year’s Q4 market correction?

Lastly, I encourage you to meet with your advisor about what the Dow’s recent behavior and other trends might signify for your personal financial plan. We plan for market volatility. We’re not surprised by it. Don’t let it blow you off course.

Home » Insights » Investing » Takeaway from Dow’s Latest Plummet: Hold Steady

Takeaway from Dow’s Latest Plummet: Hold Steady

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Summary

What triggered Wednesday’s dramatic 800-point drop in the Dow Jones Industrial Average, and what does it mean for investors? Media pundits are firing on all cylinders with various theories, from hand-wringing over tariffs to the onset of global economic recession.

While this latest Dow sell-off was significant—and followed another 767-point fall on August 5—I urge investors to resist making knee-jerk changes in their portfolios as a response. Volatile periods are an inevitable part of the ride. That’s why our financial planning with clients at Mercer Advisors explicitly takes market volatility into account.

Let’s take a closer look at the market’s behavior over the past 24 hours and some of the lessons we can take away.

What happened?

After that 800-point fall, the Dow is now trading at the same level as it was on June 4. Still, it remains positive by about 11.7% for the year to date. The S&P 500 is also up 14.75% so far this year.

In nominal terms, the 800-point sell-off was the fourth-largest in the Dow’s 123-year history. However, what’s more material—and informative—is the percentage sell-off in the market. From that vantage point, Wednesday’s market decline is barely worthy of mention; in fact, it merely ranks 292nd all-time.

Why the sell-off?

This is the thousand-point question. Global markets are enormously complex systems that, collectively, digest new information in real time. Therefore, drawing a cause-and-effect conclusion is always extremely difficult.

That said, the evidence points toward three likely catalysts for the recent market volatility:

What should investors do now?

I can’t predict future market returns; no one can. The next twelve months might very well deliver us a bear market—or not. Market pundits have been predicting the next bear market since the last one in 2008-2009. This is the most unloved bull market in history. But all bull markets come to an end, so the prudent thing to do is to plan appropriately.

First, let’s be clear on what not to do. Investors should never react to short-term market volatility by making reactionary changes to their portfolios. As I outlined above, while inverted yield curves may potentially be an indicator of a future economic recession, they’re not necessarily indicators of poor future market returns. Reactively changing your portfolio without carefully evaluating the long-term implications is a recipe for financial disaster. Mercer Advisors clients’ asset allocations are carefully determined through meticulous financial planning that reflects each client’s specific long-term goals.

Second, there is no substitute for a globally diversified portfolio—one that is systematically rebalanced, low-cost, scientifically implemented, and spread across multiple asset classes. Reducing equity exposure—or worse, abandoning broad asset class diversification—in response to market volatility can short-change your future returns. Expected returns for equities are highest after market sell-offs, and investors benefit most from asset class diversification when markets are volatile.

Events like Wednesday’s 800-point sell-off are why investors should continue to own fixed income (such as bonds), even if rates are rising like they were late last year. Who doesn’t wish they had a heavier allocation of bonds before yesterday’s sell-off? Consider the opposite question. Who doesn’t wish they had purchased more stocks on March 6, 2009, when the Dow was trading at 6,600? Or during last year’s Q4 market correction?

Lastly, I encourage you to meet with your advisor about what the Dow’s recent behavior and other trends might signify for your personal financial plan. We plan for market volatility. We’re not surprised by it. Don’t let it blow you off course.

Don’t Change Your Portfolio in Response to Recession Forecasts

Markets: Planning Over Predicting

Investing and Politics – Are They Connected?

Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate, but is not guaranteed or warranted by Mercer Advisors. Content, research, tools, and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark. This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control