What a year it’s been. I’m sitting here staring at the Dow Jones at over 30,000. Who would’ve expected this back on March 23, when the Dow was sitting at close to 18,000?

As we look back over the past 11 months, it’s hard to believe where we’ve been and how far we’ve come. As we eagerly look to put a book end on 2020, let’s pause for a moment and take stock of several lessons we learned (and re-learned) this year.

- The unpredictable happened. At the onset of 2020, no one predicted a global pandemic would tragically take over 300,000 American lives, plunge the global economy into the deepest recession since the 1930s, that unemployment would spike to over 20%, or that millions of Americans would be forced to work from home for months on end. And no one expected the market to drop 34% from its February high only to fully recover by July and then rally to post new highs by August. Nor did anyone predict the Dow would cross 30,000 before year end.

- The economy is more resilient than we thought. The economy swung dramatically from -31.4% GDP growth in Q2 to +33.1% GDP growth in Q3. Millions of jobs were lost and gained within months of one another. But despite the pandemic’s crippling economic impact, it also unleased an explosive wave of entrepreneurial energy that saw firms like Door Dash, Zoom, Docusign, RingCentral, CrowdStrike, and Moderna go mainstream. The pandemic also accelerated existing trends, such as the “work from home” movement, the movement of consumer spending from brick and mortar to online retailers, and growing demands from investors for the incorporation of ESG principles into their operating philosophy. All of these powerful forces, among many others, coalesced in November to push the Dow over 30,000, a new record.

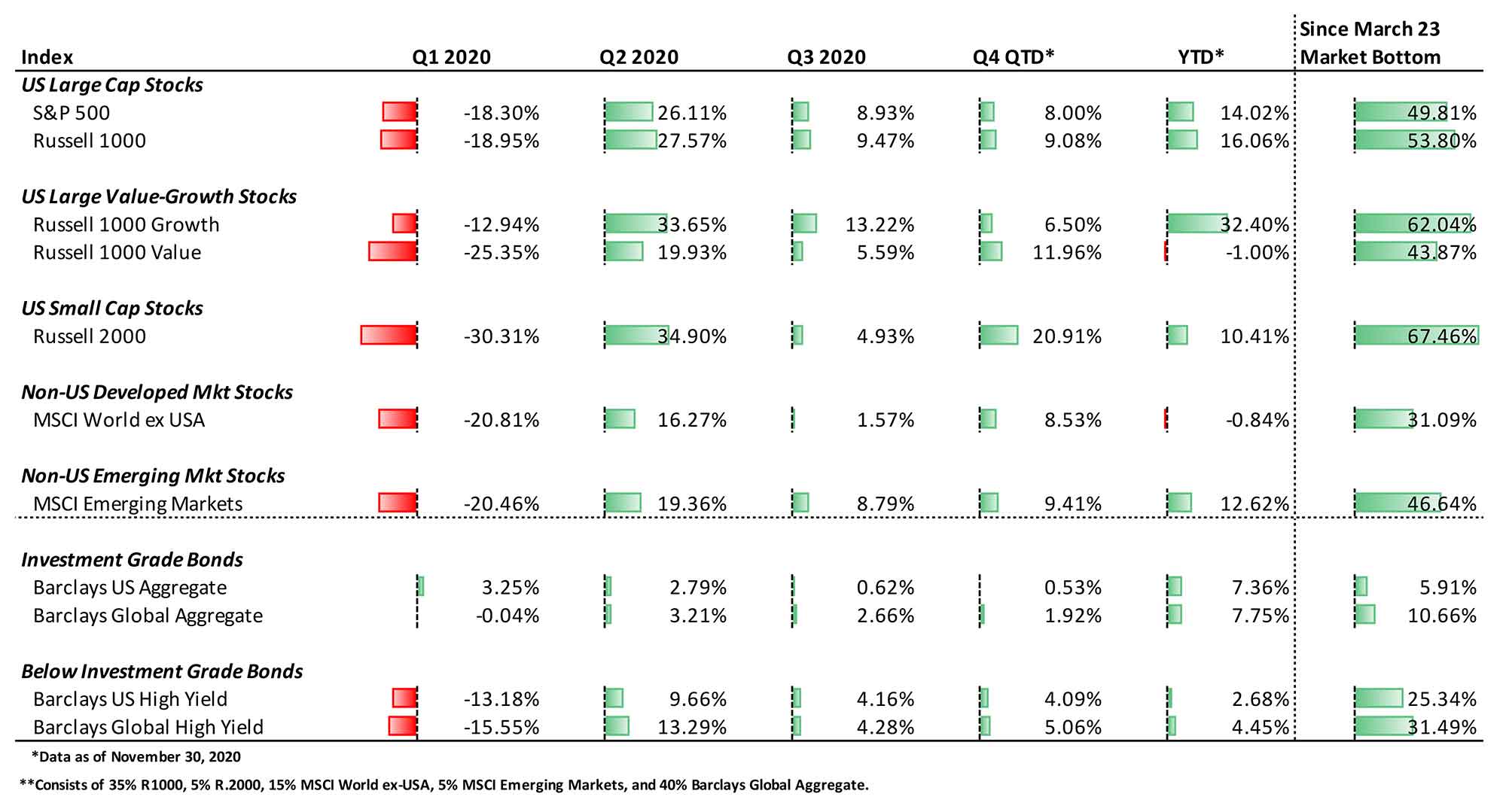

- Diversification worked when it was needed most. Investors holding diversified portfolios consisting of global stocks and bonds were glad they did, especially in March. U.S. equity markets lost a staggering 34% from February 20 to March 23rd. A globally diversified portfolio consisting of 60% global equities and 40% global bonds outperformed the S&P 500 by more than 12% during that time—losing 22% versus 34% for the S&P 500 Index. As of November 30, the same portfolio delivered a YTD return of 9.4%—showing yet again that diversified portfolios can deliver both risk reduction and healthy long-term returns.

- Bonds did their job in 2020—and then some. During the depths of the market decline, investment grade bond returns were virtually flat, a safe haven in an otherwise volatile market. From the market peak on February 19 until the market bottom on March 23, the Barclays U.S. bond index returned -0.9% (versus -34% returns for the S&P 500 Index). Yet despite low interest rates coming into 2020, the Barclays U.S. Aggregate Index returned an eye-popping 7.36% through November 30 and 30-year U.S. treasuries, that boring corner of the fixed income world, returned a staggering 20.47%. Finally, global bonds (ex-U.S.), despite flat to negative yields in much of the developed world, returned 7.68%, demonstrating yet again the merits of owning bonds in low interest rate environments.

Exhibit A: YTD Returns for Select Indexes. Data through November 30, 2020.

Late in the year we witnessed the beginnings of a rotation out of U.S., growth, and large cap stocks and into non-U.S., value, and small cap stocks, confirming that investment trends don’t continue endlessly.

2021 Market Outlook

In our view, despite all that ails us at the moment, 2021 looks quite promising. Here’s what we think is in store for 2021, what we’re watching, and—to temper our optimism—a healthy acknowledgement of what we think could jeopardize next year’s positive outlook.

- Uncertainty should decline in 2021. Most of the uncertainty that crippled us throughout 2020 revolved around COVID and the U.S. presidential election. But with the development of several vaccines, it appears COVID’s days are thankfully numbered. Similarly, despite a flurry of litigation, the court system (at all levels) and the electoral college have made it clear that Joseph Biden will be sworn in as president on January 20, putting an end to arguably one of the most tumultuous presidential elections in modern U.S. history. While COVID and politics will no doubt continue to be with us in 2021, their relative dominance will decline, and with it, so too should market uncertainty.

There are no guarantees that Washington’s political dysfunction will go away with the ending of the 2020 elections, nor are there any promises that COVID will disappear overnight with a new vaccine. The vaccine may ultimately be less effective than initially thought. Further, we could experience any number of problems associated with the Georgia Senatorial elections in early January. These are just a few of the things we’re on the lookout for that could fuel market uncertainty and disrupt our 2021 outlook.

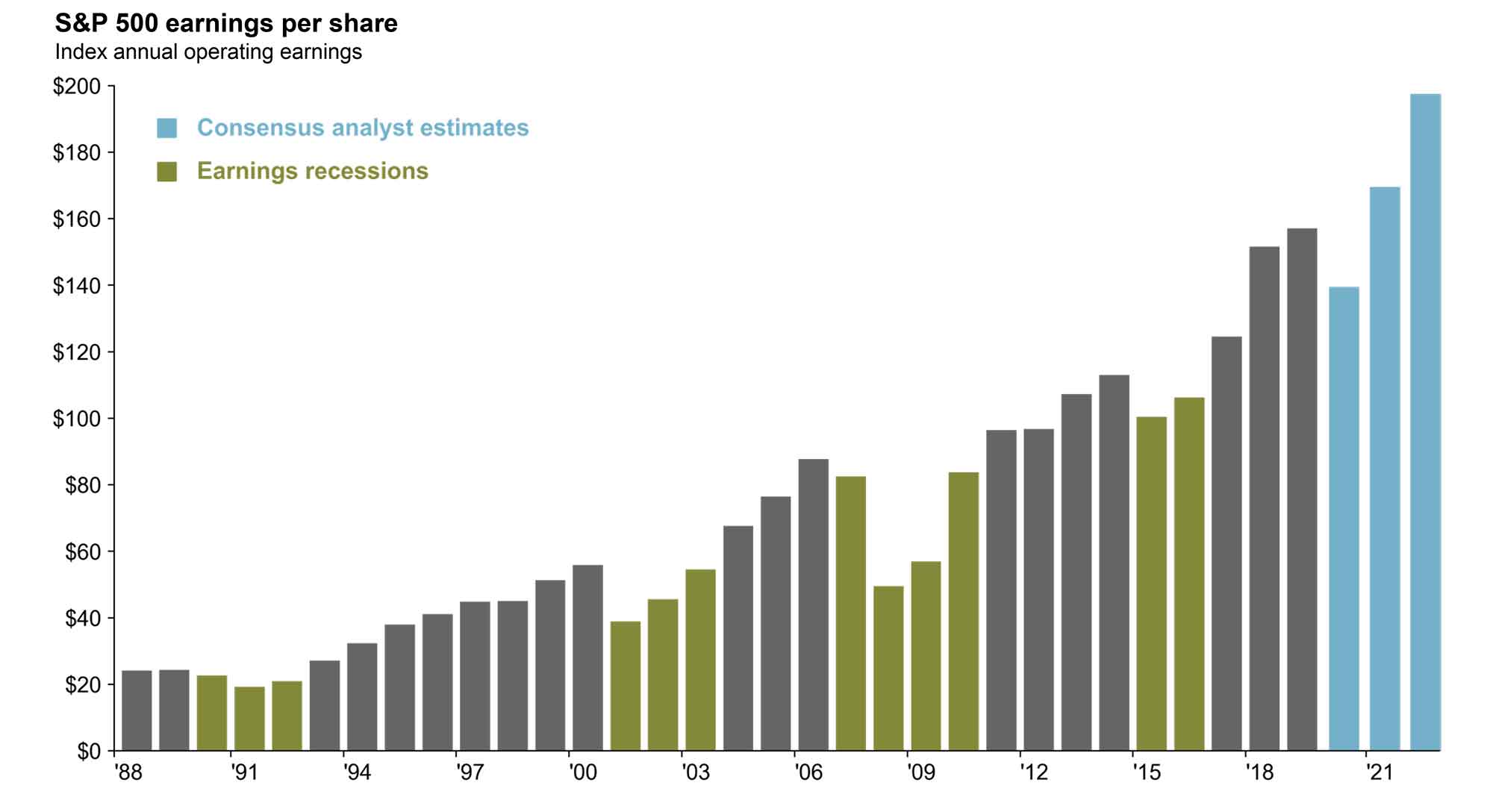

- Earnings should recover in 2021. With COVID and the election no longer dominating headlines, markets will pivot to refocus on fundamentals. Economists project GDP growth of 2.7% in 2021. Subsequently, analysts are expecting a similar recovery in corporate earnings. Consensus estimates put S&P 500 earnings at about $185 per share by the second half of 2021.

Threats to next year’s optimistic earnings projections are many. The economy could fail to re-gain traction after months of crippling shutdowns—a threat that seems increasingly more real as more governors move to again shut down their economies. Subsequently, consumers could pull back on discretionary spending, which seems especially likely given new shutdowns and the new, limited round of COVID relief for families and the unemployed.

Exhibit B: 500 earnings are expected to recover in 2021.1

- S&P 500 Price Target. A good bit of 2021’s projected earnings recovery is likely already priced into stocks but industry analysts, Mercer Advisors included, still see room for growth with a year-end price target for the S&P 500 of 3,900, about 7% higher from where it is today.2 That’s predicated on the fact that we anticipate pent-up consumer demand and growing consumer confidence (thanks in part to several new vaccines) will fuel a robust recovery in economic growth.This projection assumes an earnings recovery and no changes in current market valuations—specifically, that the S&P 500 remains priced at about 21 times next year’s earnings. Since the Fed has committed to keeping rates steady through at least 2023, we think this is a realistic assumption. However, market valuations are influence by more than just interest rates. Threats to this outlook include renewed anti-trust momentum directed at large technology stocks (which collectively make up about 25% of the S&P 500), increase in inflationary pressures, geopolitical tensions, or sluggish GDP growth, all of which could all create a “risk off” market environment and push down valuations. Similarly, if earnings fail to recover as projected, the prospect of flat or even negative returns for the S&P 500 becomes more likely.

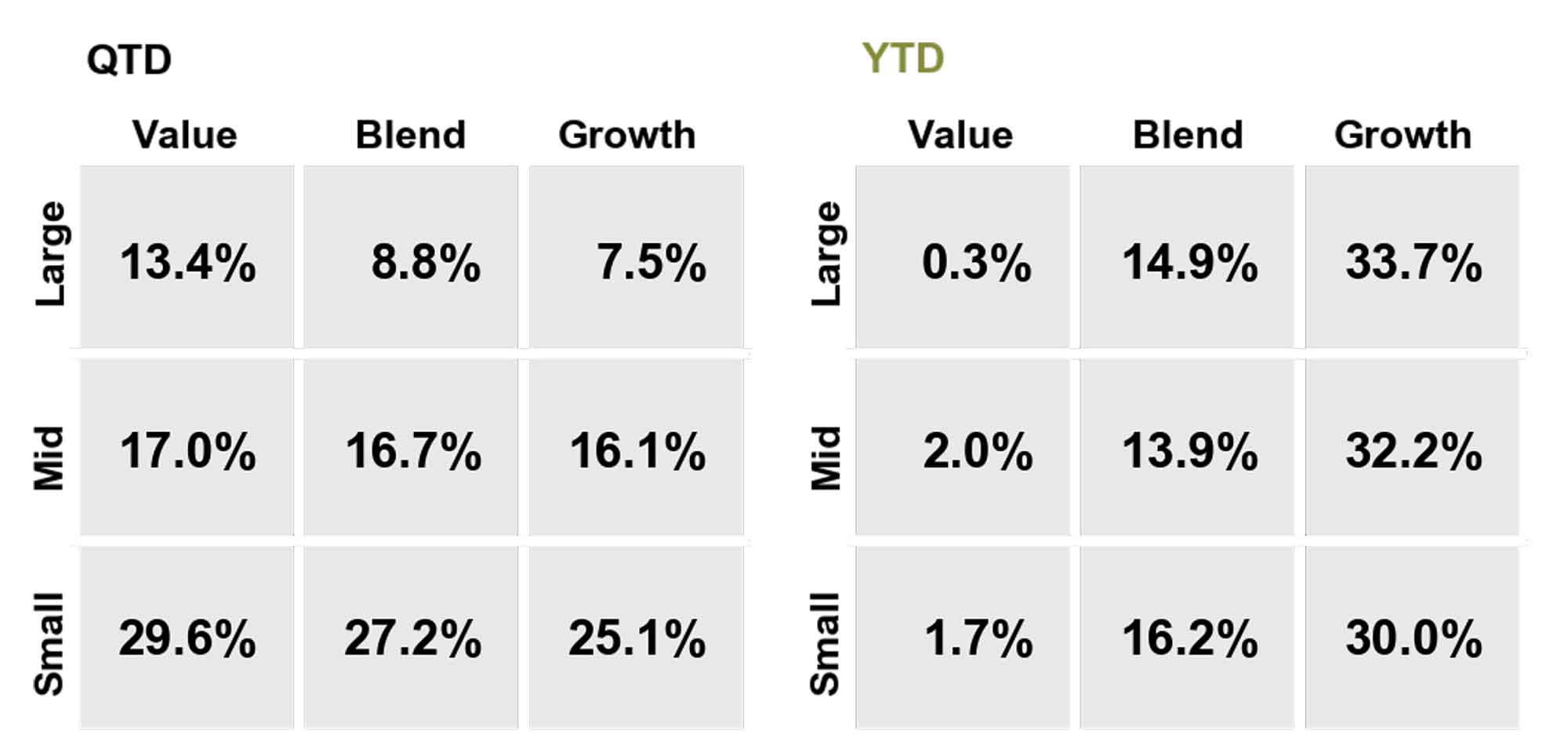

- Market performance should broaden in 2021 as market leadership pivots to value and small cap stocks. The bottom 495 stocks in the S&P 500 returned -3% for the first three quarters of 2020 versus +35% for 5 largest companies; not a broad-based advance. A broader economic recovery should affect topline growth and corporate earnings for more companies and more sectors resulting in a more broad-based equity market rally than what we’ve seen recently. As we approach year-end, we’ve already seen a pivot in market leadership with value and small capitalization stocks significantly outperforming growth and large cap stocks by wide margins.

Exhibit C: Style Box Returns by Size and Valuation, QTD and YTD through 12/14/2020.3

There are of course no guarantees that small cap and value stocks will continue to outperform as they have over the past quarter; returns, after all, can be quite random. We could, for example, see market leadership pivot back to mega-cap technology and growth stocks. For the moment, that appears less likely given the nosebleed valuations of many technology and growth companies relative to small caps and value stocks. Further, the prospect of a broad-based economic recovery in 2021 should facilitate a broader market rally versus a narrower lead by a handful of stocks.

- A weakening U.S. dollar should provide a strong tailwind for non-US stocks. Moving beyond the U.S., growing U.S. debt and the expansion of the Fed’s balance sheet should continue to put downward pressure on the dollar (the dollar is down about 11% from its March peak and about 6% YTD). Subsequently, a continued decline in the dollar should boost non-U.S. equity returns relative to U.S. equity returns. Since October 1, non-U.S. and emerging market stocks have handsomely outperformed U.S. stocks. And given the dovish and expansionary tendencies of the incoming Biden administration, we can expect a weakening U.S. dollar to continue to provide a tailwind for non-U.S. stocks.But while a mildly weakening dollar can have positive benefits for investors in non-U.S. assets, a U.S. dollar that weakens too much or too rapidly can be highly disruptive. Should the dollar weaken too much, consumer spending could decline and subsequently weaken or thwart a meaningful economic recovery—and with it, any prospective recovery in corporate earnings.

- Bonds, for the most part, should be boring next year. With the Fed’s commitment to keeping rates unchanged through 2023, duration risk shouldn’t be a major concern heading into 2021. The Fed has also effectively put a floor under investment grade corporate bonds. A robust economic recovery should also help keep debt defaults in check.But we should keep our eyes on municipal bonds. It’s unclear at the moment whether or not the incoming Biden administration can convince Congress to provide financial support to states and municipalities. Unlike the federal government, states don’t have a central bank to purchase their debt and they obviously can’t print their own currencies. State budgets are under major stress given new shutdowns, the “work from home” movement (which has resulted in lost wage-related taxes for major metropolitan areas), reduce sales- and transportation-related taxes, and a significant rise in healthcare-related expenses.

While we’re optimistic for all that 2021 promises, none of this is to say we should expect 2021 to be smooth sailing. There will certainly be starts and stops along the rough road to recovery. At times, just like in 2020, the future may seem dark and ominous; at other times, it may appear bright and full of promise. The secret to successful investing is taking the market’s mood swings in stride—and not letting the mood of the moment lead you to make short-term decisions with long-term assets. As we learned yet again in 2020, the best way to deal with volatility is through broad diversification, careful and proactive planning, and a healthy, long-term perspective.

Home » Insights » Investing » 2021 Market Outlook

2021 Market Outlook

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Summary

The lessons of 2020 are many and will no doubt be with investors for years to come. During the depths of the March sell-off, investors again learned that diversification—often unappreciated until it’s needed most—did its job and provided some much-needed refuge during a torrent of market volatility. In the spectacular recovery that followed, we were reminded what it means to be long-term investors and how we shouldn’t make investment decisions based on short-term emotions. And we saw yet again that investment trends don’t continue endlessly when late in the year we witnessed the beginnings of a rotation out of U.S., growth and large cap stocks and into non-US, value, and small cap stocks.

As we look towards 2021, we see glimmers of hope that the year ahead will see a return to some degree of normalcy. The U.S. presidential election is behind us and we have three viable vaccines for COVID-19. Economists are projecting robust economic growth in 2021. Equity analysts subsequently forecast a healthy recovery in corporate earnings and with it, a broader recovery in stock prices to include asset classes hit especially hard by the pandemic—asset classes such as value, small cap, and non-U.S. stocks.

Yet there is much that could derail such optimistic forecasts. To name a few, the federal government’s vaccine distribution strategy appears unclear and haphazard at best; politically, our country remains deeply divided; and new shutdowns to combat a steep increase in infections may ultimately delay or stunt the long-awaited economic recovery. And an additional COVID-relief package to combat the economic fallout from the virus remains limited. All of which is to say nothing of the U.S. federal government’s ballooning debt.

What a year it’s been. I’m sitting here staring at the Dow Jones at over 30,000. Who would’ve expected this back on March 23, when the Dow was sitting at close to 18,000?

As we look back over the past 11 months, it’s hard to believe where we’ve been and how far we’ve come. As we eagerly look to put a book end on 2020, let’s pause for a moment and take stock of several lessons we learned (and re-learned) this year.

Exhibit A: YTD Returns for Select Indexes. Data through November 30, 2020.

Late in the year we witnessed the beginnings of a rotation out of U.S., growth, and large cap stocks and into non-U.S., value, and small cap stocks, confirming that investment trends don’t continue endlessly.

2021 Market Outlook

In our view, despite all that ails us at the moment, 2021 looks quite promising. Here’s what we think is in store for 2021, what we’re watching, and—to temper our optimism—a healthy acknowledgement of what we think could jeopardize next year’s positive outlook.

There are no guarantees that Washington’s political dysfunction will go away with the ending of the 2020 elections, nor are there any promises that COVID will disappear overnight with a new vaccine. The vaccine may ultimately be less effective than initially thought. Further, we could experience any number of problems associated with the Georgia Senatorial elections in early January. These are just a few of the things we’re on the lookout for that could fuel market uncertainty and disrupt our 2021 outlook.

Threats to next year’s optimistic earnings projections are many. The economy could fail to re-gain traction after months of crippling shutdowns—a threat that seems increasingly more real as more governors move to again shut down their economies. Subsequently, consumers could pull back on discretionary spending, which seems especially likely given new shutdowns and the new, limited round of COVID relief for families and the unemployed.

Exhibit B: 500 earnings are expected to recover in 2021.1

Exhibit C: Style Box Returns by Size and Valuation, QTD and YTD through 12/14/2020.3

There are of course no guarantees that small cap and value stocks will continue to outperform as they have over the past quarter; returns, after all, can be quite random. We could, for example, see market leadership pivot back to mega-cap technology and growth stocks. For the moment, that appears less likely given the nosebleed valuations of many technology and growth companies relative to small caps and value stocks. Further, the prospect of a broad-based economic recovery in 2021 should facilitate a broader market rally versus a narrower lead by a handful of stocks.

While we’re optimistic for all that 2021 promises, none of this is to say we should expect 2021 to be smooth sailing. There will certainly be starts and stops along the rough road to recovery. At times, just like in 2020, the future may seem dark and ominous; at other times, it may appear bright and full of promise. The secret to successful investing is taking the market’s mood swings in stride—and not letting the mood of the moment lead you to make short-term decisions with long-term assets. As we learned yet again in 2020, the best way to deal with volatility is through broad diversification, careful and proactive planning, and a healthy, long-term perspective.

1JP Morgan, Guide to the Markets, As of December 11, 2020

2FactSet “Earnings Insight”, December 11, 2020

3JP Morgan, “Guide to the Markets”, December 14, 2020

Hiring an Estate Planning Attorney: When Does it Make Sense?

Notice 2024-35: Relief With Respect to Certain RMDs

The Hidden Hazards of Inheriting an IRA: Why Beneficiaries may Face More Harm than Good

Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.