Home » Insights » Retirement » Planning for Health Care Costs in Retirement

Planning for Health Care Costs in Retirement

James Todd

CFP®, CTFA, Client Advisor

Summary

- When it comes to retirement, figuring out your health care costs can seem daunting due to so many unknowns.

- Medicare can help cover some of your health care needs, so it’s important to learn about how it works and when you should enroll for coverage.

- You should also consider other ways to save for health care, whether it’s a health savings account or long-term care insurance. Your advisor can help you put a plan in place.

For many retirees, one of the biggest unknowns when approaching retirement is figuring out their health care costs. According to a recent study by Fidelity, the average retired 65-year-old couple may need approximately $285,000 saved (after tax) to cover health care expenses during retirement.1 Because these estimates are based on average costs, your actual costs may be more or less depending on when and where you retire, how healthy you are, and how long you’ll live.

For some, $285,000 might be a significant but manageable number. But for many retirees this number can derail even the most well-conceived retirement, because it doesn’t account for long-term care and other catastrophic events, such as a debilitating/chronic illness or injury. While there is no way you can completely plan for your health care costs in retirement, here are some steps you can take to make sure you’re covered.

What about Medicare?

Medicare is the government-sponsored health care system for US citizens aged 65 or over. It consists of Part A (hospital coverage), Part B (physician and outpatient hospital coverage), and Part D (prescription coverage). Most people do not pay any premiums for Part A (if you paid Medicare taxes while working).

For Part B, you pay a premium based on your modified adjusted gross income (Medicare uses your modified adjusted gross income as reported on your previous tax returns from two years ago to calculate your premium). Most Americans pay $135.50 per month for Part B coverage for 2019; however, Part B premiums can be as much as $460.50 per month for those with the highest incomes.2 In addition, many Americans purchase Medicare Supplement (also called Medigap) insurance to cover Part B deductibles and co-pays. There are many different Medicare Supplement plans, but the more popular plans typically cost a 65-year-old between $100–$150 per month.3

Part D varies depending on where you live and the insurance provider. According to the National Council on Aging, the nationwide average monthly Medicare Part D premium for 2019 is $33.19.4 When you add up all these costs, a “typical” retiree will spend more than $300 per month on Medicare premiums and supplemental insurance. Also, Medicare premium costs generally increase every year, while Medicare supplemental insurance costs increase every few years, depending on the company.

No Plan F for New Medicare Enrollees in 2020

Also, Medicare Supplement Plan F, which pays many of the out-of-pocket costs not covered under standard Medicare (as well as the Part B deductible), will no longer be available to people who become newly eligible for Medicare on or after January 1, 2020. Individuals who already have Plan F or who are eligible to enroll before the end of 2019 can retain Plan F coverage. You can read more about these changes here.

Things to remember

- Health care costs generally do not occur all at once. The estimated $285,000 for health care costs for a couple aged 65 is the cumulative amount over a 20-year retirement.

- On average, monthly premiums make up about 75% of the average retiree’s monthly health care expenditures5, making it a predictable and recurring expense that should be factored into your retirement plan.

Doesn’t Medicare Cover Long-Term Care?

Doesn’t Medicare Cover Long-Term Care?

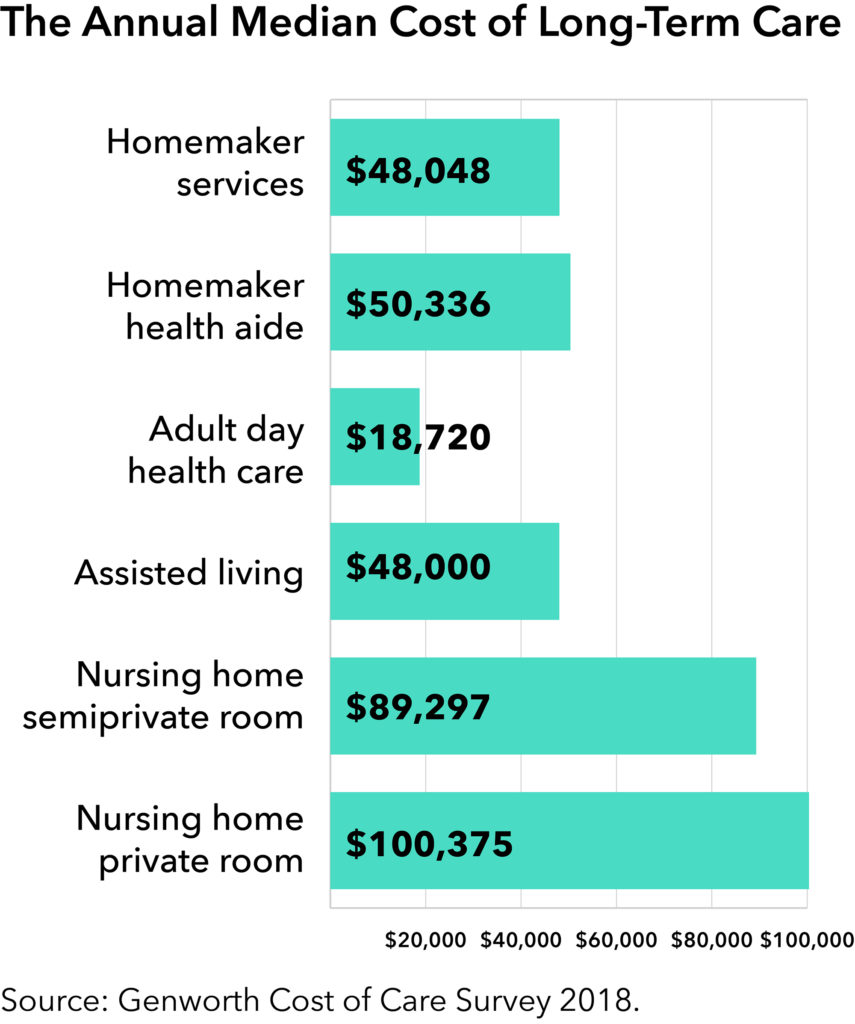

Unfortunately, Medicare has very limited benefits for long-term care. It only covers care under very specific circumstances, and generally for a portion of the costs for up to 100 days for each benefit period. For example, the level of care that some retirees may require in a nursing home would not be covered by Medicare.

Ways to Save for Health Care Costs

While you can factor in monthly Medicare premiums into your retirement plan, it’s critical to have a plan for long-term care. There are several options:

- Health Savings Accounts (HSAs) allow you to use pre-taxed dollars to pay for current or future health care expenses. Any balance remaining in your HSA at the end of the year rolls over to the following year, so you don’t lose it if you don’t use it. Also, since HSA plans allow you to invest your contributions (via mutual funds), you have the opportunity to grow your balance on a pre-tax basis. You also don’t pay tax on withdrawals if you use the funds for eligible expenses like deductibles, copays, coinsurance, and other qualified medical expenses not covered by your medical plan. For 2019, you can contribute up to $3,500 to an HSA (or $7,000 for your family). If you are over age 55, you can contribute an additional $1,000 per year. Once you enroll in Medicare, you can’t make HSA contributions, but you can continue to use the HSA balance for Medicare deductibles, prescription drugs, dental expenses, and other medical costs in retirement.

- Long-term care insurance may be a viable solution. There are two popular options: a traditional long-term care insurance policy, and life insurance with living benefits.

- With traditional long-term care insurance, you purchase a policy and pay a monthly premium. In return, your policy would provide a certain amount of coverage, usually on a maximum monthly or daily benefit basis. There are certain requirements that must be met before benefits are paid but generally, if a claim is made, benefits are paid by the insurer. Long-term care insurance policies are notoriously hard to underwrite and expensive, due to people living longer (but not necessarily healthier). Also, if you are in poor health or already have a chronic illness, you may not qualify for long-term care insurance. On the flip side, it’s possible that you may never need long-term care; approximately one-third of retirees never need long-term care support.6

- Traditional life insurance policies pay a benefit upon death of the insured, but some life insurance policies come with living benefits riders, which provide benefits for long-term care while the insured is living. With the living benefits rider, you would cover or offset any long-term care expenses using a portion of the life insurance payout. If you don’t use the long-term care benefit, your beneficiaries would receive the entire death benefit. Oftentimes, the long-term care benefit is a multiple of the life insurance benefit.

Meet with your advisor to discuss how your retirement plan addresses health care spending. This discussion may include details about your family history, liquidity needs for unexpected expenses, your options for Medicare and long-term care needs. Your advisor can help you plan ahead for the expected and unexpected life events you may face, and put a plan in place that you can rely on.

Additional Resources

Want to learn more about Medicare and health care costs in retirement? Consider these other resources:

To Max Retirement Savings Think HSA

1 “How to plan for rising health care costs,” Fidelity, 4/1/19.

2 Medicare.gov.

3 “How much do Medigap plans cost?” Forbes, 2/6/18.

4 “How much does Medicare Part D cost?” National Council on Aging.

5 “Breaking Down Health Care Expenses in Retirement,” T. Rowe Price, 2/26/19.

6 “How much care will you need?” LongTermCare.gov.

Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate, but is not guaranteed or warranted by Mercer Advisors. Content, research, tools, and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark. This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.