Part III: Implications for Fed Policy and Investors

Implications for interest rates and GDP growth

Given inflation is a global phenomenon, with a myriad of global and domestic contributing factors, the Fed’s ability to tame inflation through rate hikes and quantitative tightening (“QT”) is limited. The Fed largely influences demand; it cannot miraculously increase supply—but it can heavily influence demand by constraining credit (via rate hikes). And since so many of today’s inflationary pressures can be attributed to supply side constraints—COVID-shutdowns in China, limited refinery capacity, and the war in Ukraine’s impact on food and energy prices—it’s quite possible that the Fed’s policy actions will be less effective than it thinks.

There are two possible outcomes implied by this view. First, the Fed could very well continue its current course of action, a conclusion that’s reinforced by the recent hawkish tone of several FOMC board members, including Chair Jerome Powell. Yet there are several problems with the Fed’s current approach. As we’ve shown, food and energy prices are significant drivers of today’s high inflation and the Fed has no control over COVID-shutdowns in China, global refinery capacity, or the war in Ukraine. In addition, it’s not very “data-dependent”, as the Fed so often claims is a requisite for how it approaches policy decisions. For example, there are some signs that inflation is beginning to cool—core inflation appears to have peaked in March and commodity prices, after peaking on June 9, have since fallen 11%.1 Forward inflation expectations have all come down recently and the 5-year forward inflation expected rate now stands at 2.3%−within easy striking distance of the Fed’s 2% average long-term target inflation rate.2 When we consider that inflation data is lagged—meaning by the time it hits the presses it’s already many weeks old (e.g., June’s hot CPI report hadn’t fully accounted for the impact of the Fed’s aggressive rate hikes on May 6) — the same will be true of July’s CPI report in that it won’t have fully accounted for the Fed’s eye-popping 0.75% rate hike on June 15. Therefore, while the Fed’s current policy approach may ultimately bludgeon inflation into submission, in doing so it significantly increases the likelihood of recession (the proverbial “hard landing” that the Fed hopes to avoid). In fact, the Atlanta Fed now believes the U.S. economy to already be in recession.3

The second possible outcome is that Fed changes course in some way—not necessarily by cutting rates but by slowing or lowering future rate hikes. There are, after all, growing signs that the economy is slowing—a rising trade deficit, declining home sales, growing business inventories, and record low consumer confidence. A significant decline in the Federal deficit over the past six months is also contributing significantly to a slowing economy4—the deficit has declined 80% YTD relative to the same period for 2021 and the government posted its largest monthly surplus ever in May 2022. To be fair, there are still signs the economy is growing— unemployment remains near record lows, consumer spending remains strong (ironic given such low consumer sentiment), and the Purchasing Managers’ Index (PMI) stood at 51.4 (a reading over 50 indicates expansion).5 Therefore, forecasting the odds of a recession is a game of probabilities, not certainties. But given the increased probability of recession—which economists estimate to be in the 50% range presently (the odds of a recession in any given year are about 15%)—there is a strong possibility in our view that the Fed changes course at some point later this year.

Implications for investors

Whether the U.S. economy tips into recession remains to be seen. Given such a high degree of uncertainty, it helps to step back and take stock of what we know and don’t know.

First, if the economy tips into recession, we don’t know how severe or long-lasting it would be. There is no reason to think it would be deeper or longer than average. Unlike 2008, the U.S. banking sector today is not overleveraged and is, in fact, well-capitalized. Similarly, unlike March 2020, the pandemic has largely subsided, at least outside China and other emerging markets. But we know from history that since 1946 the average recession has lasted an average of 10 months and that the average expansion has lasted for over five years.6 To quote JP Morgan’s David Kelly, we still live in a “world of short winters and long summers”.7

Second, we don’t know when the bear market will end but we do know that bear markets, defined as a decline of 20% or more, are normal. There have been 26 bear markets in the S&P 500 Index since 1926—about one every 4 years—lasting an average of 9.6 months.8 If you’re keeping track, the market last peaked on January 3, 2022—meaning today’s bear market is approximately 6 months old.

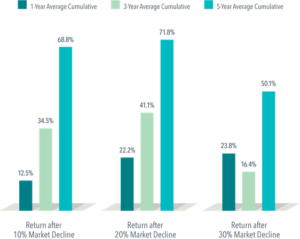

Finally, we don’t know when the economy or bear market will hit bottom. However, we do know from history that the market is forward-looking and tends to lead the economy. Said differently, markets tend to bottom before the economy does. Consequently, attempting to time markets in anticipation of an economic recession—which is only identified in hindsight using data that is weeks or even months old—is not a good idea. Despite 12 recessions and 12 bear markets since 1947, the S&P 500 Index has returned 12.57% annually.9 Further, markets have historically posted exceptionally strong returns in the wake of bear markets. Since 1926, stocks returned an average of 22.2% in the first year following a 20% decline—and a cumulative return of 71.8% after five years.10 The takeaway is that it’s far better for investors to be strategically well-positioned to benefit from long summers than to try to tactically trade around short winters.

Exhibit A: Market returns have been strong in the wake of bear markets. Source: Fama/French Total U.S. Market Research Index Returns, July 1926 – December 20212

Home » Insights » Market Commentary » Implications for Fed Policy and Investors

Implications for Fed Policy and Investors

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Summary

This is a three-part series about why we’re experiencing inflation now and how it can be mitigated.

Part III: Implications for Fed Policy and Investors

Implications for interest rates and GDP growth

Given inflation is a global phenomenon, with a myriad of global and domestic contributing factors, the Fed’s ability to tame inflation through rate hikes and quantitative tightening (“QT”) is limited. The Fed largely influences demand; it cannot miraculously increase supply—but it can heavily influence demand by constraining credit (via rate hikes). And since so many of today’s inflationary pressures can be attributed to supply side constraints—COVID-shutdowns in China, limited refinery capacity, and the war in Ukraine’s impact on food and energy prices—it’s quite possible that the Fed’s policy actions will be less effective than it thinks.

There are two possible outcomes implied by this view. First, the Fed could very well continue its current course of action, a conclusion that’s reinforced by the recent hawkish tone of several FOMC board members, including Chair Jerome Powell. Yet there are several problems with the Fed’s current approach. As we’ve shown, food and energy prices are significant drivers of today’s high inflation and the Fed has no control over COVID-shutdowns in China, global refinery capacity, or the war in Ukraine. In addition, it’s not very “data-dependent”, as the Fed so often claims is a requisite for how it approaches policy decisions. For example, there are some signs that inflation is beginning to cool—core inflation appears to have peaked in March and commodity prices, after peaking on June 9, have since fallen 11%.1 Forward inflation expectations have all come down recently and the 5-year forward inflation expected rate now stands at 2.3%−within easy striking distance of the Fed’s 2% average long-term target inflation rate.2 When we consider that inflation data is lagged—meaning by the time it hits the presses it’s already many weeks old (e.g., June’s hot CPI report hadn’t fully accounted for the impact of the Fed’s aggressive rate hikes on May 6) — the same will be true of July’s CPI report in that it won’t have fully accounted for the Fed’s eye-popping 0.75% rate hike on June 15. Therefore, while the Fed’s current policy approach may ultimately bludgeon inflation into submission, in doing so it significantly increases the likelihood of recession (the proverbial “hard landing” that the Fed hopes to avoid). In fact, the Atlanta Fed now believes the U.S. economy to already be in recession.3

The second possible outcome is that Fed changes course in some way—not necessarily by cutting rates but by slowing or lowering future rate hikes. There are, after all, growing signs that the economy is slowing—a rising trade deficit, declining home sales, growing business inventories, and record low consumer confidence. A significant decline in the Federal deficit over the past six months is also contributing significantly to a slowing economy4—the deficit has declined 80% YTD relative to the same period for 2021 and the government posted its largest monthly surplus ever in May 2022. To be fair, there are still signs the economy is growing— unemployment remains near record lows, consumer spending remains strong (ironic given such low consumer sentiment), and the Purchasing Managers’ Index (PMI) stood at 51.4 (a reading over 50 indicates expansion).5 Therefore, forecasting the odds of a recession is a game of probabilities, not certainties. But given the increased probability of recession—which economists estimate to be in the 50% range presently (the odds of a recession in any given year are about 15%)—there is a strong possibility in our view that the Fed changes course at some point later this year.

Implications for investors

Whether the U.S. economy tips into recession remains to be seen. Given such a high degree of uncertainty, it helps to step back and take stock of what we know and don’t know.

First, if the economy tips into recession, we don’t know how severe or long-lasting it would be. There is no reason to think it would be deeper or longer than average. Unlike 2008, the U.S. banking sector today is not overleveraged and is, in fact, well-capitalized. Similarly, unlike March 2020, the pandemic has largely subsided, at least outside China and other emerging markets. But we know from history that since 1946 the average recession has lasted an average of 10 months and that the average expansion has lasted for over five years.6 To quote JP Morgan’s David Kelly, we still live in a “world of short winters and long summers”.7

Second, we don’t know when the bear market will end but we do know that bear markets, defined as a decline of 20% or more, are normal. There have been 26 bear markets in the S&P 500 Index since 1926—about one every 4 years—lasting an average of 9.6 months.8 If you’re keeping track, the market last peaked on January 3, 2022—meaning today’s bear market is approximately 6 months old.

Finally, we don’t know when the economy or bear market will hit bottom. However, we do know from history that the market is forward-looking and tends to lead the economy. Said differently, markets tend to bottom before the economy does. Consequently, attempting to time markets in anticipation of an economic recession—which is only identified in hindsight using data that is weeks or even months old—is not a good idea. Despite 12 recessions and 12 bear markets since 1947, the S&P 500 Index has returned 12.57% annually.9 Further, markets have historically posted exceptionally strong returns in the wake of bear markets. Since 1926, stocks returned an average of 22.2% in the first year following a 20% decline—and a cumulative return of 71.8% after five years.10 The takeaway is that it’s far better for investors to be strategically well-positioned to benefit from long summers than to try to tactically trade around short winters.

Exhibit A: Market returns have been strong in the wake of bear markets. Source: Fama/French Total U.S. Market Research Index Returns, July 1926 – December 20212

1 Bloomberg Commodity Index as quoted by David Kelly in “Notes on the Week Ahead”, JP Morgan Asset Management, June 28, 2022.

2 Source: YCharts, Inc. Data as of June, 29, 2022.

3 “Atlanta Fed GDP tracker shows the US economy is likely in a recession”, CNBC, July 1, 2022

4 Source: Federal Reserve Bank of St. Louis, FRED; Congressional Budget Office

5 See: JP Morgan “Guide to the Markets”, June 27, 2022, slide 50.

6 “Recession Risks & Investment Implications”, JP Morgan Notes on the Week Ahead by David Kelly, June 22, 2022.

7 Ibid.

8 Source: Hartford Funds, “10 Things You Should Know About Bear Markets”

9 Source: FactSet, Inc. Rolling 1-year returns since 1947. Analysis of 906 rolling 1-year periods using monthly returns data for the period January 1947 – June 2022.

10 “History Shows That Stock Gains Can Add Up after Big Declines”, Dimensional Fund Advisors, June 2022. Data is the Fama/French Total US Market Research Index, July 1926 – December 2021.

Hiring an Estate Planning Attorney: When Does it Make Sense?

Notice 2024-35: Relief With Respect to Certain RMDs

The Hidden Hazards of Inheriting an IRA: Why Beneficiaries may Face More Harm than Good

Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Diversification does not ensure a profit or guarantee against loss. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark. Indexes are not available for direct investment.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.