What a year 2021 turned out to be. It was marked by contrasts—a tug of war between the desire for normalcy and the gravity of crisis. This back-and-forth was apparent in nearly all facets of social life, the economy, and markets. Breakthrough vaccinations were followed by deadly new variants of COVID-19, while sharply rising interest rates during the first quarter were followed by surprising declines over the rest of the year. In a similar pattern, strong gains for value stocks in early 2021 were followed by stronger returns for growth stocks for the remainder of the year.

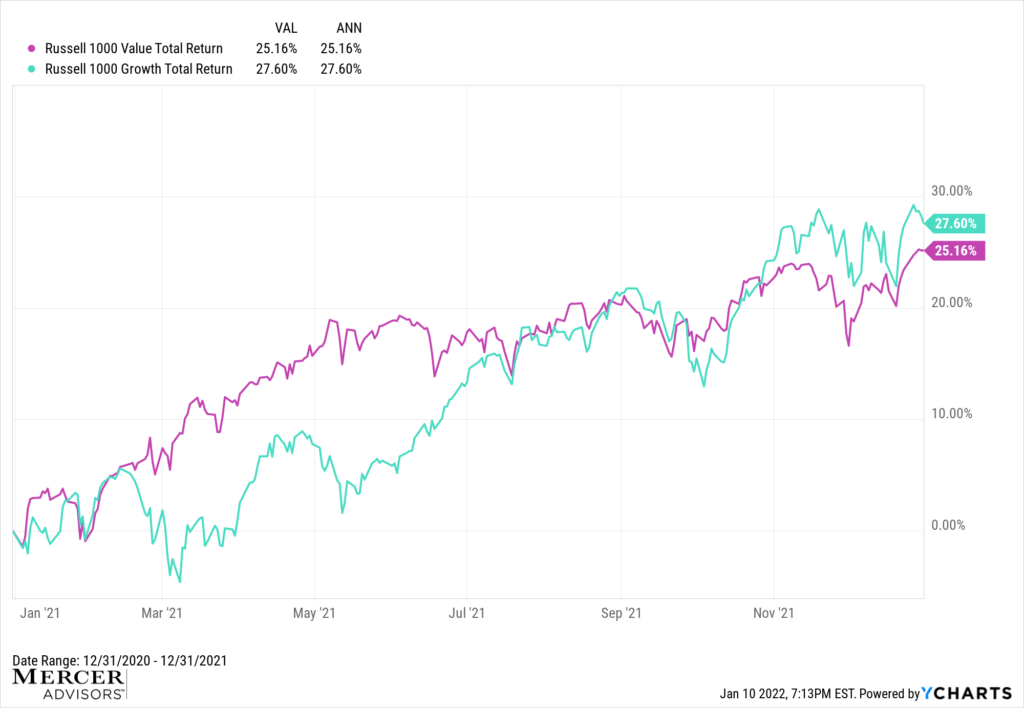

Many of these trends persisted as 2021 drew to a close. The omicron variant still threatens to delay or even halt the economic reopening. Interest rates finished December lower than where they started on November 3, when the Fed announced its decision to begin winding down bond purchases. And despite persistent inflation and the promise of higher interest rates, growth stocks outperformed value stocks by 2.4% for the year—a legendary comeback considering value had outperformed growth stocks by over 10% in the first quarter alone. [1]

Financial Market Overview

Global equity markets delivered strong returns last year, with the MSCI All-Country World Index returning an eye-popping 19% for the year. In the U.S., earnings growth recovered dramatically from 2020’s precipitous declines and subsequently propelled the S&P 500 Index to a 28.7% return for the year. Energy, financials, and real estate—the worst performing sectors of 2020—were the three best performers in 2021. Outside the U.S., developed equity markets similarly delivered strong returns with the MSCI World ex USA Index returning 13.2% for the year. However, emerging markets lagged their developed market counterparts with the MSCI Emerging Markets Index returning -2.2% for the year.

On the fixed-income front, markets, in anticipation of higher rates, delivered mixed returns for the year. In the investment-grade space, the Barclays U.S. Aggregate Index and Barclays Global Aggregate Index returned -1.54% and -4.71%, respectively. In contrast, high-yield bonds, due to their equity-like characteristics and relatively shorter durations (owing to their higher yields), delivered respectable returns with the Barclays U.S. High Yield Index (1-5Y), returning 5.96% for the year—a rare bright spot in the fixed-income space.[2]

Exhibit A: U.S. large growth stocks staged a legendary comeback after posting anemic returns in Q1.[3]

The Economy in the Year Ahead

By many measures, the economy appears to be on relatively stable footing as we’ve started 2022. GDP growth remains strong, unemployment is falling, consumer spending is healthy, and U.S. household finances appear in good shape. But there are significant challenges ahead, and three major themes will ultimately dictate the course of the economy in 2022:

- COVID-19: New variants are likely to continue arising and weigh episodically on consumer and business confidence, employment, and the broader the economy.

- Inflation: Price inflation was 6.9% over the past 12 months, the highest it’s been in decades. [4] Keep in mind that averages can obscure important details. For example, prices for energy and used vehicles were up a staggering 33.3% and 31.4%, respectively. Many of us have witnessed this firsthand at the gas pump. In contrast, other categories, such as shelter and medical care, were up a more moderate 3.4% and 2.1%, respectively. The consensus estimate is for inflation to average 3.5% over 2022, a welcome respite from current levels, as it subsides due to normalization of supply chains, higher interest rates, and slowing GDP growth. [5]

- The Fed: In response to rising inflationary pressures—specifically mounting evidence that current inflation was likely less transitory than originally predicted the government announced its decision to begin tapering bond purchases, as its bond-buying program would end by March 2022; it also forecast three rate hikes in 2022. This is a significant departure from the Fed’s previous messaging where they indicated a very low probability of rate hikes in 2022; in fact, this time last year the Fed suggested it likely wouldn’t raise rates until mid-2023. Current members of the Federal Open Market Committee tend to be in favor of lower interest rates. Yet the Fed is also very aware of the risks high inflation presents to the economy. We expect the Fed to take a cautious approach to monetary policy—perhaps with two rate hikes of 0.25% each.

Market Outlook 2022

Ongoing uncertainty around the pandemic, declining fiscal stimulus, rising interest rates, and inflation—combined with already-high valuations—will all present challenges in the year ahead. Broad diversification is by far the best approach to dealing with such uncertainty, so let’s look at our expectations for a range of asset classes and the important role each might play in portfolio allocations through 2022.

Stocks can defy assumptions

Investors shouldn’t automatically assume that negative returns await us after the strong gains in global stock markets over the past three years. Markets often go on to post strong, even double-digit, returns for many years in a row.[6] Since 1926, the S&P 500 has averaged 13.9% annually in years following new market highs.[7] This could very well be the case for 2022 given the expectation of positive sales and earnings growth for S&P 500 companies. Analysts project a 2022 earnings growth of 9.4% and revenue growth of 7.6%.[8] Why are these good things? Because stock prices are ultimately a function of sales and earnings; higher sales typically mean higher earnings and higher earnings typically mean higher stock prices.

What about interest rates?

Rising interest rates will likely prove to be the greatest headwind facing stocks in 2022. However, it’s not a law of physics that stocks automatically decline as rates rise. For example, interest rates rose in 2021, yet stocks still went on to post strong gains. Evidence suggests stocks correlate positively to rising interest rates until rates reach 4%. Therefore, we could very well see stocks, especially value stocks and financials, continue to rise along with interest rates.

What about valuations?

The S&P 500 Index finished 2021 with a forward price-to-earnings ratio of 21.2 times next year’s earnings (that means the price of the stock was, on average, 21.2 times that of its 2022 earnings estimate). While it’s true that market valuations remain elevated, the fact remains that they began to come down in 2021 due to strong earnings growth; valuations subsequently finished the year 7.6% lower (from about 23 times earnings at the end of 2020 to 21.3 times by the end of 2021). Continued earnings growth in 2022 could also help bring down valuations further.

Value stocks have been undervalued

When we break out the broader market between value and growth stocks, we see that the market’s growthiest stocks trade at twice the valuation of their value stock counterparts—a forward P/E of 30.6x earnings versus 15.77x earnings for value stocks. In other words, value stocks currently trade at about a 50% discount relative to growth stocks.[9] By some measures, value stocks today have never been so “undervalued” relative to growth stocks. With an expected return of nearly 7% annually over the next 10 years (versus about 5.2% for U.S. stocks overall),[10] U.S. value stocks may be poised to reclaim the mantle of market leadership, especially if interest rates begin to rise. The last time value outperformed growth was in 2016,[11] when the Fed began to raise rates for the first time since the global financial crisis of 2008-2009. Having a permanent allocation to the least expensive stocks in the market makes good strategic sense. Since 1926, value stocks have outperformed growth stocks in 59% of rolling 1-year periods and 81% of the time in rolling 10-year periods.[12]

Non-U.S. stocks—a critical building block

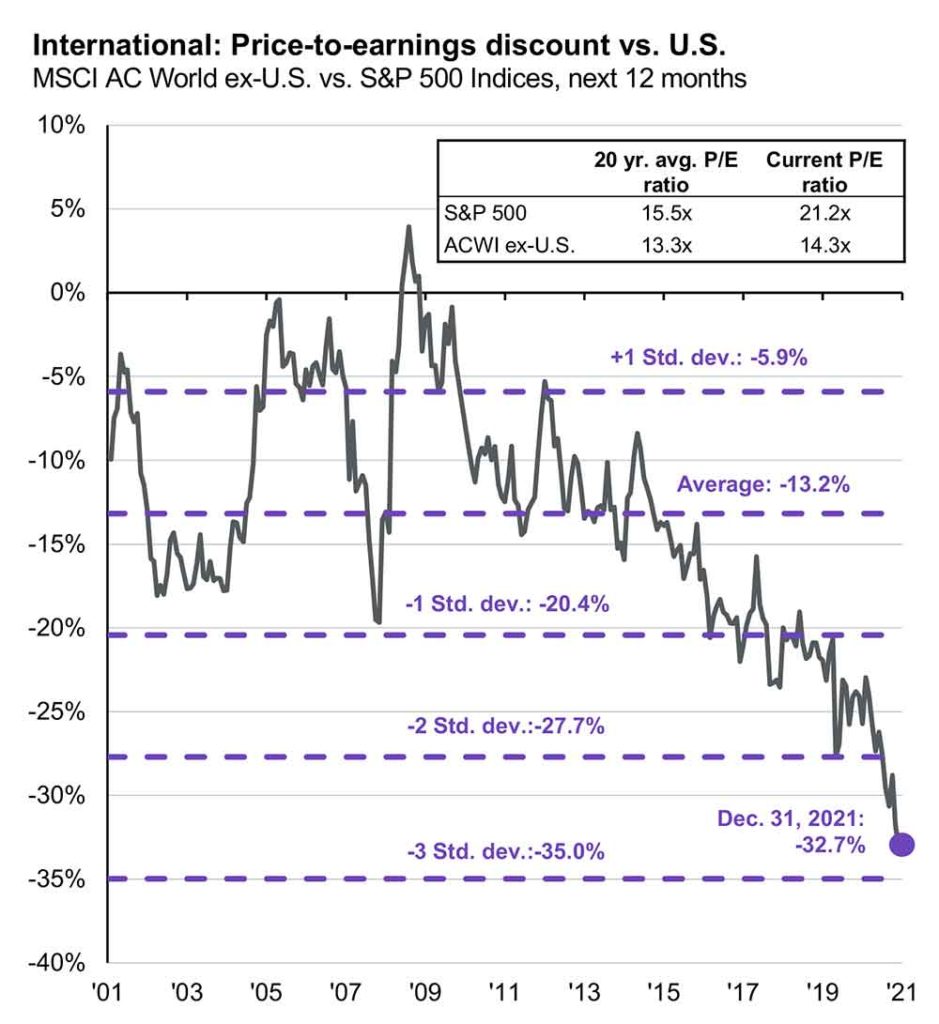

With expected returns of nearly 8% and 9% for developed and emerging market stocks,[13] respectively, it’s no wonder non-U.S. stocks continue to be critical building blocks of any globally diversified portfolio. However, many investors have come to question the wisdom of global diversification as U.S. stocks outperformed their non-U.S. counterparts over the past decade. Remember that this hasn’t always been the case. Not only have non-U.S. stocks exhibited relatively low correlations to U.S. stocks over the past 30 years (0.47 for emerging market stocks and 0.77 for developed market stocks)[14], but they also have higher expected returns due to the estimated 33% discount. Specifically, non-U.S. stocks currently trade at 14.3x next year’s earnings versus 21.2x for S&P 500 companies (see Exhibit B). Further, for those investors in search of income, non-U.S. stocks currently offer higher dividend yields than U.S. companies—nearly twice as much as a traditional dividend-oriented U.S. stock portfolio.[15]

Exhibit B: Valuations of non-U.S. stocks are at historic discounts relative to US stocks. [16]

Bonds as a ballast

With interest rates expected to rise in the year ahead, many investors have begun to question the wisdom of owning bonds at all. However, the purpose of bonds is to act as a ballast against market volatility. We continue to advocate for the inclusion of short-term, high-quality fixed income in globally diversified portfolios out of an abundance of humility and caution. Interest rates are notoriously difficult to predict. They might rise early in the year only to decline the second half, similar to what we witnessed in 2021. We could, for example, see the pandemic take an ugly turn or see a major geopolitical crisis somewhere in the world that brings the global economy to a screeching halt. For any number of reasons, the economy could dip into an unforeseen recession (they’re all unforeseen until they aren’t) and rates could subsequently end up staying lower for longer. Also, high quality bonds are one of the best ways to diversify portfolios that are heavily tilted towards equities. For example, the U.S. Aggregate Bond Index has a correlation of virtually zero to U.S. stocks.[17] That’s powerful diversification, especially in light of high market valuations.

The Case for Private Credit

For those investors who meet the SEC’s qualification requirements, the addition of private investments to diversified portfolios of public securities can often reduce risk and increase long-term expected returns. Theses “alternative” assets range from venture capital and private equity, to hedge funds and real estate. Given today’s low yield environment, investors in search of income might wish to consider adding a small allocation to the private credit. With yields currently in the 7-8% range, private credit funds currently offer higher yields than those available from most publicly traded fixed-income funds.

Private credit is a form of non-bank lending in which the debt is not issued or traded on any public market exchange. Private credit funds often extend credit directly to private companies or invest in other private funds that do the same. Funds typically earn returns through loan origination fees, interest payments, and pre-payment fees. Private credit funds also take on a certain amount of leverage to help increase returns (they borrow additional capital at rates that are less than the rates at which they lend). However, in doing so they also assume greater risk in the event of default by the fund’s borrowers.

Moving beyond public markets often provides a range of benefits, as well as posing added risks. Private investments are almost always characterized by a relative lack of liquidity, a lack of transparency, and the use of leverage. But their relative lack of correlation to publicly traded asset classes is a powerful argument in favor of adding alternatives to portfolios.

Correlation as a concept

We’ve mentioned correlation throughout this article, and will again over the year, so let’s take a moment to explain this concept. When two assets have a correlation to one another of less than 1, combining the two together in a portfolio creates a new portfolio that has less risk than either of them on a standalone basis. For example, private credit currently has a correlation of about 0.63 to U.S. stocks and only 0.20 to U.S. investment grade corporate bonds.[18] Correlation measures diversification power, and our advisors use this metric to help reduce the overall risk in an investment portfolio.

Takeaways for 2022 and Beyond

These imperatives may be timeless, but given the upheavals of the past year, and the uncertainties of the year ahead, it’s an especially critical juncture for investors to take a deep breath and hold steady in the following three ways.

Discipline matters

The path forward will likely be a bumpy one. Keeping things in perspective, remaining patient, and sticking to our long-term financial plan should pay big dividends over time. One great way to maintain discipline in volatile markets is to engage with your trusted advisors to revisit how and why you’re invested the way that you are.

Keep a long-term perspective

There’s no evidence that years of high stock returns are followed by years of negative returns. Further, there continue to be good values in many asset classes, including U.S. value stocks and non-U.S. stocks generally. For those investors who continue to hold onto yesterday’s big winners, I would remind us that those investments with the highest returns over the past few years are also typically the most highly overvalued. Losses in “work from home” (WFH) stocks that had been all the rage—such as ARK Innovation ETF (ARKK: -24.02%), Zoom (ZM: -45.5%), and Peloton (PTON: -76.43%)—remind us of the dangers of fad-based investing.[19]

Humility is healthy

In a world full of hubris, humility is a high-returning, non-correlated asset class that can greatly reduce both the probability and impact of negative events on our lives. We diversify portfolios not because of what we expect but because of what we don’t. None of us are clairvoyant. No one knows for sure what will happen with inflation, what path the pandemic will take, or what interest rates will do over the next 12 months. The future is always unknowable and both the economy and financial markets are infinitely complex. We should avoid simple solutions or soundbites that promise high risk-free returns.

Start the year by reconfirming your commitment to maintain a global investment portfolio that’s highly diversified across and within asset classes. It should be informed by your need, capacity, and desire for risk; crafted in close partnership with your trusted advisors and designed to achieve your long-term goals and objectives with a high probability of success.

We always encourage conversation with your Mercer Advisors advisor, whether it’s prompted by curiosity or concern. Know that we put our own advice into practice by cultivating a company-wide culture of discipline, humility, and perspective. You can always rely on our support to keep on course amid whatever winds may blow in the year ahead.

Home » Insights » Market Commentary » 2021 Market Review & 2022 Outlook

2021 Market Review & 2022 Outlook

Donald Calcagni, MBA, MST, CFP®, AIF®

Chief Investment Officer

Summary

The economy appears to be on relatively stable footing as we enter 2022. But ongoing uncertainty around the pandemic, declining fiscal stimulus, rising interest rates, and inflation—combined with already high valuations—will all present challenges to varying degrees in the year ahead.

What a year 2021 turned out to be. It was marked by contrasts—a tug of war between the desire for normalcy and the gravity of crisis. This back-and-forth was apparent in nearly all facets of social life, the economy, and markets. Breakthrough vaccinations were followed by deadly new variants of COVID-19, while sharply rising interest rates during the first quarter were followed by surprising declines over the rest of the year. In a similar pattern, strong gains for value stocks in early 2021 were followed by stronger returns for growth stocks for the remainder of the year.

Many of these trends persisted as 2021 drew to a close. The omicron variant still threatens to delay or even halt the economic reopening. Interest rates finished December lower than where they started on November 3, when the Fed announced its decision to begin winding down bond purchases. And despite persistent inflation and the promise of higher interest rates, growth stocks outperformed value stocks by 2.4% for the year—a legendary comeback considering value had outperformed growth stocks by over 10% in the first quarter alone. [1]

Financial Market Overview

Global equity markets delivered strong returns last year, with the MSCI All-Country World Index returning an eye-popping 19% for the year. In the U.S., earnings growth recovered dramatically from 2020’s precipitous declines and subsequently propelled the S&P 500 Index to a 28.7% return for the year. Energy, financials, and real estate—the worst performing sectors of 2020—were the three best performers in 2021. Outside the U.S., developed equity markets similarly delivered strong returns with the MSCI World ex USA Index returning 13.2% for the year. However, emerging markets lagged their developed market counterparts with the MSCI Emerging Markets Index returning -2.2% for the year.

On the fixed-income front, markets, in anticipation of higher rates, delivered mixed returns for the year. In the investment-grade space, the Barclays U.S. Aggregate Index and Barclays Global Aggregate Index returned -1.54% and -4.71%, respectively. In contrast, high-yield bonds, due to their equity-like characteristics and relatively shorter durations (owing to their higher yields), delivered respectable returns with the Barclays U.S. High Yield Index (1-5Y), returning 5.96% for the year—a rare bright spot in the fixed-income space.[2]

Exhibit A: U.S. large growth stocks staged a legendary comeback after posting anemic returns in Q1.[3]

The Economy in the Year Ahead

By many measures, the economy appears to be on relatively stable footing as we’ve started 2022. GDP growth remains strong, unemployment is falling, consumer spending is healthy, and U.S. household finances appear in good shape. But there are significant challenges ahead, and three major themes will ultimately dictate the course of the economy in 2022:

Market Outlook 2022

Ongoing uncertainty around the pandemic, declining fiscal stimulus, rising interest rates, and inflation—combined with already-high valuations—will all present challenges in the year ahead. Broad diversification is by far the best approach to dealing with such uncertainty, so let’s look at our expectations for a range of asset classes and the important role each might play in portfolio allocations through 2022.

Stocks can defy assumptions

Investors shouldn’t automatically assume that negative returns await us after the strong gains in global stock markets over the past three years. Markets often go on to post strong, even double-digit, returns for many years in a row.[6] Since 1926, the S&P 500 has averaged 13.9% annually in years following new market highs.[7] This could very well be the case for 2022 given the expectation of positive sales and earnings growth for S&P 500 companies. Analysts project a 2022 earnings growth of 9.4% and revenue growth of 7.6%.[8] Why are these good things? Because stock prices are ultimately a function of sales and earnings; higher sales typically mean higher earnings and higher earnings typically mean higher stock prices.

What about interest rates?

Rising interest rates will likely prove to be the greatest headwind facing stocks in 2022. However, it’s not a law of physics that stocks automatically decline as rates rise. For example, interest rates rose in 2021, yet stocks still went on to post strong gains. Evidence suggests stocks correlate positively to rising interest rates until rates reach 4%. Therefore, we could very well see stocks, especially value stocks and financials, continue to rise along with interest rates.

What about valuations?

The S&P 500 Index finished 2021 with a forward price-to-earnings ratio of 21.2 times next year’s earnings (that means the price of the stock was, on average, 21.2 times that of its 2022 earnings estimate). While it’s true that market valuations remain elevated, the fact remains that they began to come down in 2021 due to strong earnings growth; valuations subsequently finished the year 7.6% lower (from about 23 times earnings at the end of 2020 to 21.3 times by the end of 2021). Continued earnings growth in 2022 could also help bring down valuations further.

Value stocks have been undervalued

When we break out the broader market between value and growth stocks, we see that the market’s growthiest stocks trade at twice the valuation of their value stock counterparts—a forward P/E of 30.6x earnings versus 15.77x earnings for value stocks. In other words, value stocks currently trade at about a 50% discount relative to growth stocks.[9] By some measures, value stocks today have never been so “undervalued” relative to growth stocks. With an expected return of nearly 7% annually over the next 10 years (versus about 5.2% for U.S. stocks overall),[10] U.S. value stocks may be poised to reclaim the mantle of market leadership, especially if interest rates begin to rise. The last time value outperformed growth was in 2016,[11] when the Fed began to raise rates for the first time since the global financial crisis of 2008-2009. Having a permanent allocation to the least expensive stocks in the market makes good strategic sense. Since 1926, value stocks have outperformed growth stocks in 59% of rolling 1-year periods and 81% of the time in rolling 10-year periods.[12]

Non-U.S. stocks—a critical building block

With expected returns of nearly 8% and 9% for developed and emerging market stocks,[13] respectively, it’s no wonder non-U.S. stocks continue to be critical building blocks of any globally diversified portfolio. However, many investors have come to question the wisdom of global diversification as U.S. stocks outperformed their non-U.S. counterparts over the past decade. Remember that this hasn’t always been the case. Not only have non-U.S. stocks exhibited relatively low correlations to U.S. stocks over the past 30 years (0.47 for emerging market stocks and 0.77 for developed market stocks)[14], but they also have higher expected returns due to the estimated 33% discount. Specifically, non-U.S. stocks currently trade at 14.3x next year’s earnings versus 21.2x for S&P 500 companies (see Exhibit B). Further, for those investors in search of income, non-U.S. stocks currently offer higher dividend yields than U.S. companies—nearly twice as much as a traditional dividend-oriented U.S. stock portfolio.[15]

Exhibit B: Valuations of non-U.S. stocks are at historic discounts relative to US stocks. [16]

Bonds as a ballast

With interest rates expected to rise in the year ahead, many investors have begun to question the wisdom of owning bonds at all. However, the purpose of bonds is to act as a ballast against market volatility. We continue to advocate for the inclusion of short-term, high-quality fixed income in globally diversified portfolios out of an abundance of humility and caution. Interest rates are notoriously difficult to predict. They might rise early in the year only to decline the second half, similar to what we witnessed in 2021. We could, for example, see the pandemic take an ugly turn or see a major geopolitical crisis somewhere in the world that brings the global economy to a screeching halt. For any number of reasons, the economy could dip into an unforeseen recession (they’re all unforeseen until they aren’t) and rates could subsequently end up staying lower for longer. Also, high quality bonds are one of the best ways to diversify portfolios that are heavily tilted towards equities. For example, the U.S. Aggregate Bond Index has a correlation of virtually zero to U.S. stocks.[17] That’s powerful diversification, especially in light of high market valuations.

The Case for Private Credit

For those investors who meet the SEC’s qualification requirements, the addition of private investments to diversified portfolios of public securities can often reduce risk and increase long-term expected returns. Theses “alternative” assets range from venture capital and private equity, to hedge funds and real estate. Given today’s low yield environment, investors in search of income might wish to consider adding a small allocation to the private credit. With yields currently in the 7-8% range, private credit funds currently offer higher yields than those available from most publicly traded fixed-income funds.

Private credit is a form of non-bank lending in which the debt is not issued or traded on any public market exchange. Private credit funds often extend credit directly to private companies or invest in other private funds that do the same. Funds typically earn returns through loan origination fees, interest payments, and pre-payment fees. Private credit funds also take on a certain amount of leverage to help increase returns (they borrow additional capital at rates that are less than the rates at which they lend). However, in doing so they also assume greater risk in the event of default by the fund’s borrowers.

Moving beyond public markets often provides a range of benefits, as well as posing added risks. Private investments are almost always characterized by a relative lack of liquidity, a lack of transparency, and the use of leverage. But their relative lack of correlation to publicly traded asset classes is a powerful argument in favor of adding alternatives to portfolios.

Correlation as a concept

We’ve mentioned correlation throughout this article, and will again over the year, so let’s take a moment to explain this concept. When two assets have a correlation to one another of less than 1, combining the two together in a portfolio creates a new portfolio that has less risk than either of them on a standalone basis. For example, private credit currently has a correlation of about 0.63 to U.S. stocks and only 0.20 to U.S. investment grade corporate bonds.[18] Correlation measures diversification power, and our advisors use this metric to help reduce the overall risk in an investment portfolio.

Takeaways for 2022 and Beyond

These imperatives may be timeless, but given the upheavals of the past year, and the uncertainties of the year ahead, it’s an especially critical juncture for investors to take a deep breath and hold steady in the following three ways.

Discipline matters

The path forward will likely be a bumpy one. Keeping things in perspective, remaining patient, and sticking to our long-term financial plan should pay big dividends over time. One great way to maintain discipline in volatile markets is to engage with your trusted advisors to revisit how and why you’re invested the way that you are.

Keep a long-term perspective

There’s no evidence that years of high stock returns are followed by years of negative returns. Further, there continue to be good values in many asset classes, including U.S. value stocks and non-U.S. stocks generally. For those investors who continue to hold onto yesterday’s big winners, I would remind us that those investments with the highest returns over the past few years are also typically the most highly overvalued. Losses in “work from home” (WFH) stocks that had been all the rage—such as ARK Innovation ETF (ARKK: -24.02%), Zoom (ZM: -45.5%), and Peloton (PTON: -76.43%)—remind us of the dangers of fad-based investing.[19]

Humility is healthy

In a world full of hubris, humility is a high-returning, non-correlated asset class that can greatly reduce both the probability and impact of negative events on our lives. We diversify portfolios not because of what we expect but because of what we don’t. None of us are clairvoyant. No one knows for sure what will happen with inflation, what path the pandemic will take, or what interest rates will do over the next 12 months. The future is always unknowable and both the economy and financial markets are infinitely complex. We should avoid simple solutions or soundbites that promise high risk-free returns.

Start the year by reconfirming your commitment to maintain a global investment portfolio that’s highly diversified across and within asset classes. It should be informed by your need, capacity, and desire for risk; crafted in close partnership with your trusted advisors and designed to achieve your long-term goals and objectives with a high probability of success.

We always encourage conversation with your Mercer Advisors advisor, whether it’s prompted by curiosity or concern. Know that we put our own advice into practice by cultivating a company-wide culture of discipline, humility, and perspective. You can always rely on our support to keep on course amid whatever winds may blow in the year ahead.

[1] FactSet, Inc.

[2] FactSet, Inc.

[3] YCharts, Inc.

[4] U.S. Bureau of Labor Statistics

[5] FactSet, Inc.

[6] For a discussion of valuations and subsequent year returns, see Dimensional Fund Advisors’ “Market Review 2021: A Recovery Amid Challenges” at https://www.dimensional.com/us-en/insights/market-review-2021-a-recovery-amid-challenges

[7] Source: Dimensional Fund Advisors, Inc.

[8] FactSet Earnings Insight, January 7, 2022.

[9] JP Morgan, Guide to the Markets, December 31, 2021, slide 10.

[10] “2022 Long-Term Capital Market Assumptions”, JP Morgan Asset Management, p.126

[11] Source: FactSet, Inc. In 2016, the Russell 1000 Value returned 17.34% versus 7.08% for the Russell 1000 Growth.

[12] Dimensional Fund Advisors, Inc. Value is Fama/French US Value Research Index; Growth is Fama/French US Growth Research Index. There are 1,015 overlapping 10-year periods, 1,075 overlapping 5-year periods, and 1,123 overlapping 1-year periods.

Fama/French US Value Research Index: Provided by Fama/French from CRSP securities data. Includes the lower 30% in price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and Nasdaq equivalents since 1973).

Fama/French US Growth Research Index: Provided by Fama/French from CRSP securities data. Includes the higher 30% in price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and Nasdaq equivalents since 1973).

[13] “2022 Long-Term Capital Market Assumptions”, JP Morgan Asset Management, p.126

[14] Calculations performed by Mercer Advisors using data from FactSet, Inc.

[15] See JP Morgan, Guide to the Markets, December 31, 2021, slide 10.

[16] Source: FactSet, MSCI, Standard & Poor’s, J.P. Morgan Asset Management.

Guide to the Markets – U.S. Data are as of December 31, 2021.

[17] “2022 Long-Term Capital Market Assumptions”, JP Morgan Asset Management, p.126

[18] “2022 Long-Term Capital Market Assumptions”, JP Morgan Asset Management, p.126

[19] YCharts, Inc.

Hiring an Estate Planning Attorney: When Does it Make Sense?

Notice 2024-35: Relief With Respect to Certain RMDs

The Hidden Hazards of Inheriting an IRA: Why Beneficiaries may Face More Harm than Good

Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. Mercer Global Advisors Inc. (“Mercer Advisors”) is registered as an investment advisor with the SEC. The firm only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy or product made reference to directly or indirectly, will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may materially alter the performance and results of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark. Diversification does not ensure a profit or guarantee against loss. Foreign investing involves special risks due to factors such as increased volatility, currency fluctuation and political uncertainties. Investing in emerging markets can be riskier than investing in well-established foreign markets. Alternative investments are subject to greater risks than those associated with traditional investments and are not suitable for all investors. Indices are not available for direct investment.

This document may contain forward-looking statements including statements regarding our intent, belief or current expectations with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Mercer Advisors’ control.